The new accusations against Justin Sun come amid ongoing political and regulatory attention. US lawmakers have criticized the SEC for pausing its prior case against Sun, citing his financial ties to Trump family ventures and suggesting potential influence on enforcement decisions.

Ten Ten, who claims detailed evidence of TRX price manipulation and insider profit-taking, has appealed for regulatory action and public distancing by political figures. Neither Sun nor Binance has commented on the latest claims, while TRON’s token remains largely stable at $0.2843, down 0.5% in 24 hours. Observers warn that substantiated allegations could prompt renewed investigations into TRON’s early trading practices and regulatory oversight.

️

️

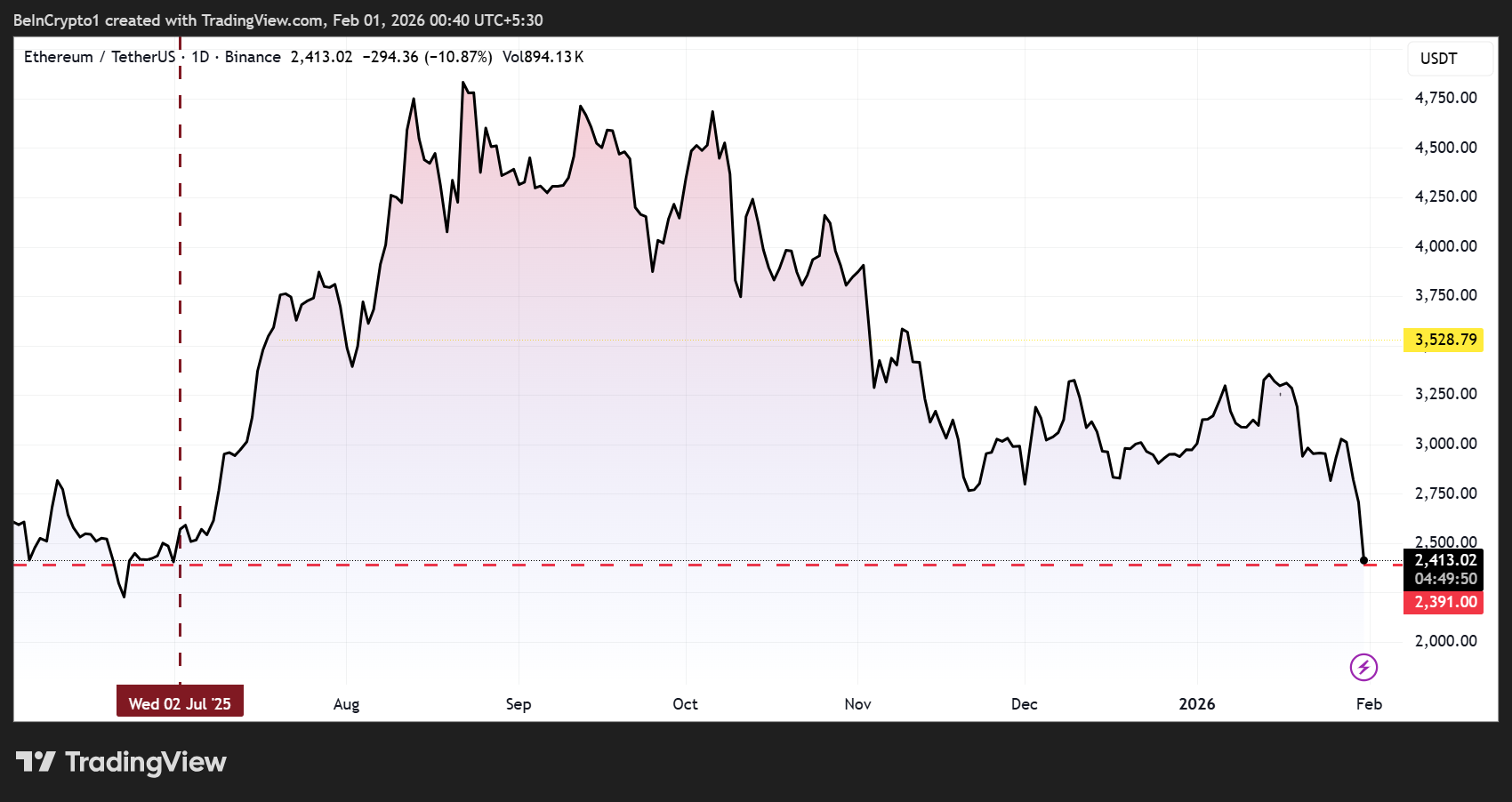

Scenario A: Continuation Lower (Primary)

Scenario A: Continuation Lower (Primary)