Why a BitMine ETH sale could trigger historic market disruption

-

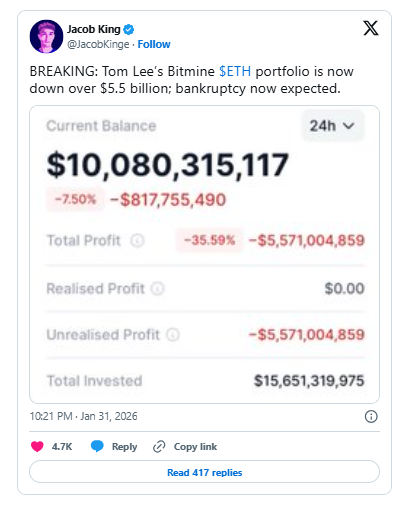

Analysts say a full liquidation of BitMine’s Ethereum holdings would likely overwhelm the market. Selling more than 4 million ETH — even gradually — would introduce supply far beyond what typical order books are built to absorb.Historical examples show that far smaller “whale” liquidations have caused 10–30% price drops within hours. In BitMine’s case, forced selling could push ETH down another 20–40%, according to market depth estimates. Slippage alone could reduce proceeds by billions, meaning BitMine might realize only $5–7 billion from assets currently marked near $10 billion.

As a result, selling is widely viewed as a last-resort option rather than a viable exit strategy.