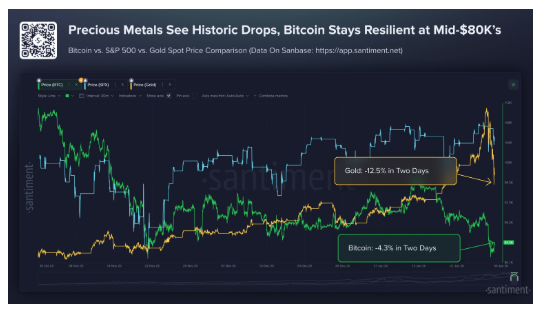

Bitcoin resilience raises questions after metals crash on Fed shift

-

Bitcoin’s ability to avoid a liquidation cascade during the recent collapse in gold and silver is fueling debate over its market role. The sell-off followed President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair, a move widely seen as signaling tighter monetary policy and support for a stronger U.S. dollar.

Analysts say heavily leveraged bets in precious metals were rapidly unwound, triggering sharp price declines. Bitcoin, which did not participate in the late-stage surge in metals, appeared less exposed to speculative excess. Some observers believe capital exiting gold and silver could rotate into digital assets, while others warn that prolonged liquidity tightening could still pressure Bitcoin in the weeks ahead.