El Salvador has quietly redistributed its Bitcoin reserves into 14 separate wallet addresses — a move its Bitcoin Office says is aimed at reducing potential risks from future quantum computing attacks.

🪙 What Changed

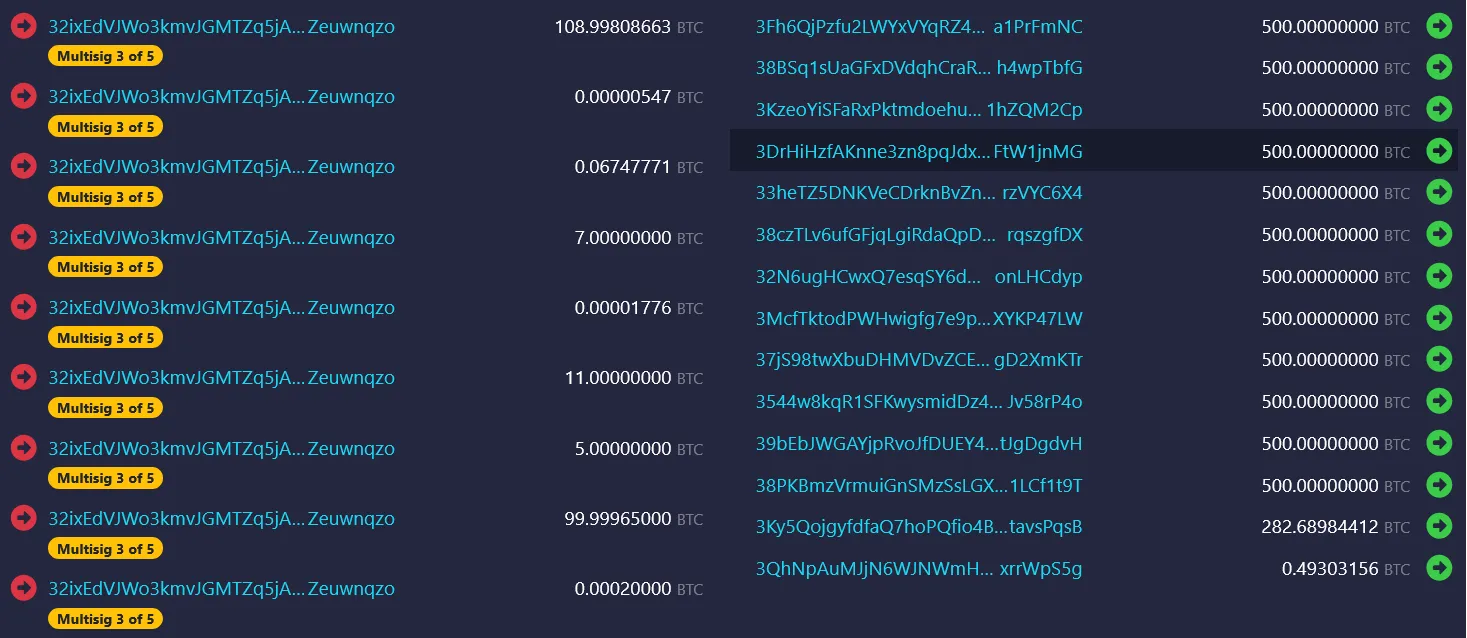

El Salvador previously held 6,274 BTC (~$678M) in a single address.

El Salvador previously held 6,274 BTC (~$678M) in a single address.

On Friday, those funds were split into 14 new wallets, each capped at 500 BTC.

The Bitcoin Office explained: once funds are spent, their public keys are revealed, making them theoretically vulnerable to quantum cracking down the line.

Why Quantum Matters (Eventually)

Why Quantum Matters (Eventually)

Project Eleven estimates 6M+ BTC (~$650B) could be at risk if elliptic curve cryptography (ECC) were broken.

But for now, the risk is low: no quantum computer has cracked even a 3-bit key, far from Bitcoin’s 256-bit standard.

Michael Saylor (MicroStrategy) dismissed the panic in June:

“If quantum becomes real, Bitcoin just upgrades — like Microsoft, Google, or the US government do with software.”

IMF Tensions Still in Play

IMF Tensions Still in Play

An IMF report in July claimed El Salvador hasn’t bought new BTC since February, raising doubts over its official narrative.

Bukele’s Bitcoin Office continues to post about ongoing purchases, but hasn’t directly addressed IMF claims.

El Salvador previously secured a $1.4B IMF funding package in late 2024, conditional on scaling back Bitcoin initiatives — a source of ongoing friction.

🧩 The Takeaway

El Salvador’s quantum-proofing move may be more about optics than urgent necessity, but it highlights:

Nation-states now treating Bitcoin custody with sovereign-level security strategies.

Nation-states now treating Bitcoin custody with sovereign-level security strategies.

Quantum remains a future concern, not an immediate threat.

Quantum remains a future concern, not an immediate threat.

IMF disputes suggest El Salvador’s Bitcoin experiment is still politically and financially contested.

IMF disputes suggest El Salvador’s Bitcoin experiment is still politically and financially contested.

Do you think El Salvador’s move is forward-thinking risk management, or just a symbolic flex to signal long-term conviction in BTC?

Do you think El Salvador’s move is forward-thinking risk management, or just a symbolic flex to signal long-term conviction in BTC?

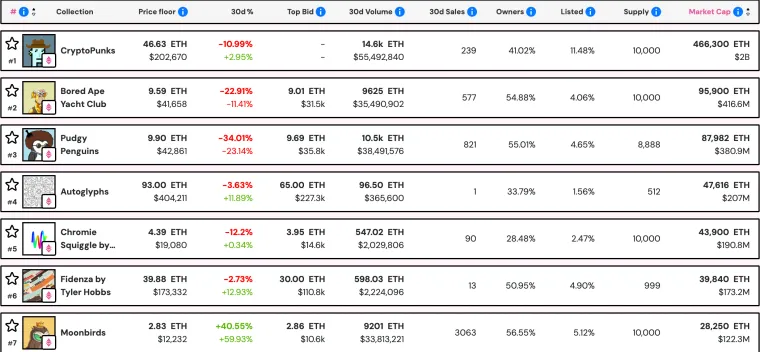

Pudgy Party Game Launch

Pudgy Party Game Launch 50,000+ downloads on Google Play.

50,000+ downloads on Google Play. Cracked the Top 10 most downloaded games on Apple’s App Store.

Cracked the Top 10 most downloaded games on Apple’s App Store. The NFT Market Backdrop

The NFT Market Backdrop

What’s Happening

What’s Happening ️ Why So Slow?

️ Why So Slow? What’s Next

What’s Next

Who’s Leading?

Who’s Leading? The Rise of Dogecoin Treasury Companies

The Rise of Dogecoin Treasury Companies ️ Bear case: DOGE remains a memecoin with limited adoption, making a $200M treasury play highly speculative.

️ Bear case: DOGE remains a memecoin with limited adoption, making a $200M treasury play highly speculative.

Risks

Risks

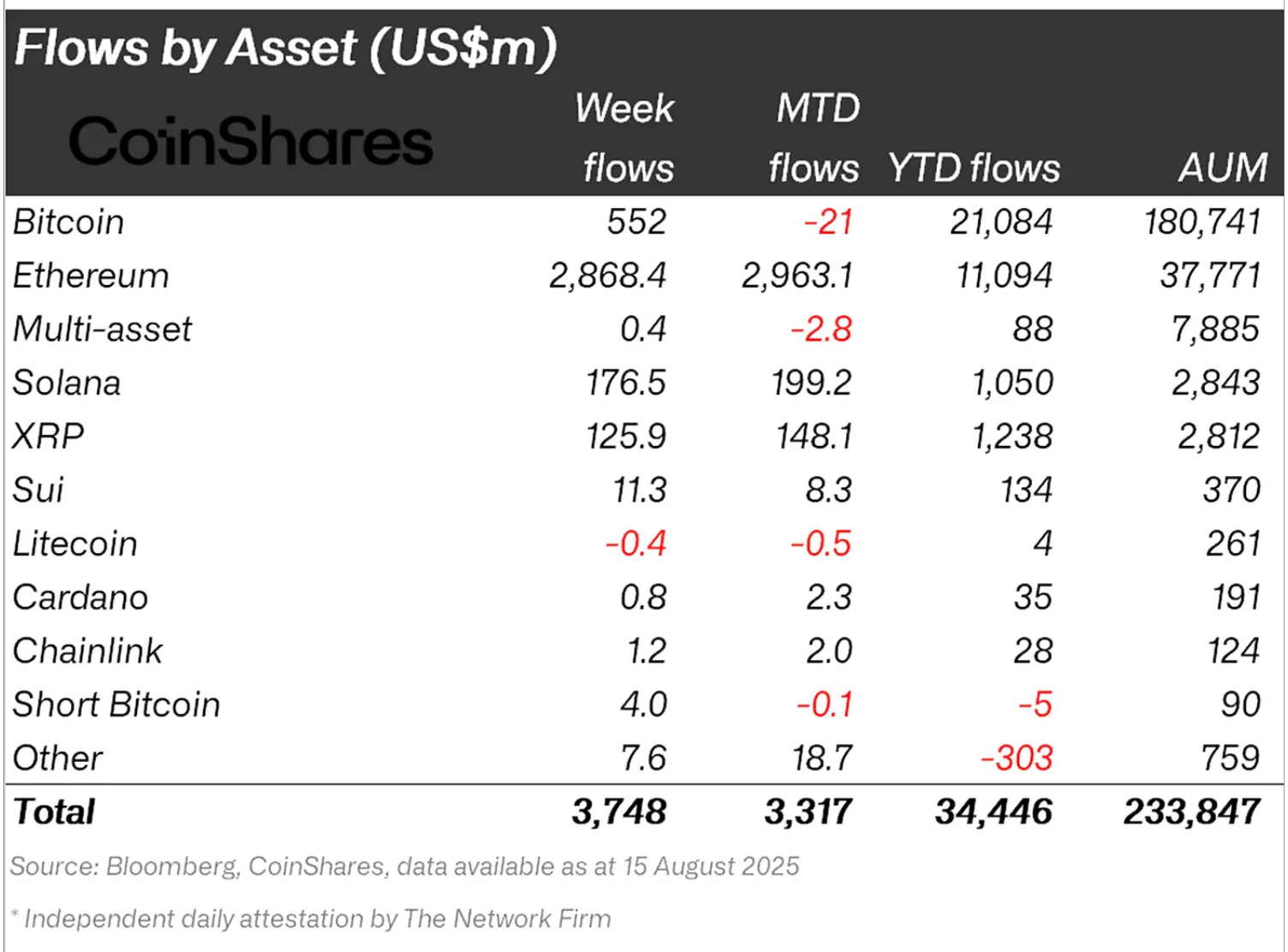

ETF & Treasury Inflows Surge

ETF & Treasury Inflows Surge Ethereum Roadmap: Inflection Point

Ethereum Roadmap: Inflection Point

Smart contracts remain active → tokens still transferable.

Smart contracts remain active → tokens still transferable. No new issuance or redemption → tokens on these chains become “unsupported.”

No new issuance or redemption → tokens on these chains become “unsupported.” Why It Matters

Why It Matters Stablecoins in the Big Picture

Stablecoins in the Big Picture

Hey Traders, in tomorrow's trading session we are monitoring USDCAD for a buying opportunity around 1.40250 zone, USDCAD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.40250 support and resistance area.

Hey Traders, in tomorrow's trading session we are monitoring USDCAD for a buying opportunity around 1.40250 zone, USDCAD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.40250 support and resistance area.

Bitcoin slips to $108,489, hitting multiweek lows after Wall Street’s open.

Bitcoin slips to $108,489, hitting multiweek lows after Wall Street’s open. Heavy whale selling on Binance sparks fresh downside.

Heavy whale selling on Binance sparks fresh downside. Nearly $540M liquidated across crypto in 24 hours.

Nearly $540M liquidated across crypto in 24 hours. Whale Selling Drags BTC Lower

Whale Selling Drags BTC Lower

→ U.S.-listed ETH ETFs saw nearly $288M in a single day, lifting total AUM above $12B.

→ U.S.-listed ETH ETFs saw nearly $288M in a single day, lifting total AUM above $12B. → Firms like BitMine, SharpLink, and BTCS have loaded up, pushing on-chain corporate holdings near $30B.

→ Firms like BitMine, SharpLink, and BTCS have loaded up, pushing on-chain corporate holdings near $30B.