bitwise lately been cool

kevin1

Posts

-

Bitwise Expands Crypto ETF Offerings -

Whale’s Multisig Wallet Drained in $40M Crypto Attackis there any info on which multisig wallet is it?

-

OpenAI Expands ChatGPT With Third-Party Appsnow thats interesting

-

Pickle Robot Taps Former Tesla Exec as First CFOpickle rick + pickle robot

-

ETHGas Raises $12M to Launch Ethereum Blockspace Tradingeth is losing its position as an number two coin to solana. just see

-

Crypto isn't drowning come onwell, after this winter i think it will sink

-

What is going on??when you short it goes up

when you long it goes down -

Brazil’s B3 Prepares Tokenized Markets for 2026Hmm, interesting… so basically I could be buying stocks on B3 without ever touching the traditional exchange? If they make it seamless, I can see a lot of people just not even realizing they’re trading tokenized assets. Curious how they’ll handle the stablecoin part though hope it’s not another volatile mess.

-

Chai 2 Signals a Leap in Custom Antibody Design

Chai’s latest model, Chai 2, is showing major improvements in de novo antibody design, meaning it can create custom antibodies from scratch rather than tweaking existing ones. CEO Josh Meier says the models can design molecules with real drug-like properties and tackle previously unreachable targets—marking a meaningful step toward AI-designed medicines moving from theory to practice.

-

Why Investors Are Betting Big on AI-Driven Drug Design

Chai Discovery is building foundation AI models purpose-built for drug discovery, aiming to predict how biochemical molecules interact and can be reprogrammed for new therapies. Its goal: create a “computer-aided design suite” for molecules, dramatically shortening drug development timelines. Investors see AI as a faster, more scalable path to discovering treatments that traditional methods struggle to reach.

-

OpenAI-Backed Chai Discovery Hits $1.3B Valuation

Chai Discovery, a biotech startup backed by OpenAI, raised $130M in Series B funding, pushing its valuation to $1.3 billion. The round was led by General Catalyst and Oak HC/FT, with participation from Menlo Ventures, Thrive Capital, SV Angel, and others. With total funding now above $225M, Chai is emerging as a major player at the intersection of AI and drug discovery.

-

Disney Tests AI While Warning Google

The OpenAI deal gives Disney a controlled way to experiment with generative AI and its IP, while keeping future options open. Iger made it clear Disney isn’t trying to block technological change—it wants to shape it. Notably, the same day the OpenAI deal was announced, Disney sent a cease-and-desist to Google over alleged copyright infringement, signaling a sharp line between licensed AI use and unapproved data scraping.

-

Disney’s OpenAI Deal Has a Clock on It

Disney’s partnership with OpenAI isn’t a long-term lock-in. According to CEO Bob Iger, the three-year agreement includes only one year of exclusivity. After that, Disney is free to license its characters to other AI companies. For now, OpenAI’s Sora is the only AI platform legally allowed to generate content using Disney, Marvel, Pixar, and Star Wars characters—but the competitive window opens fast.

-

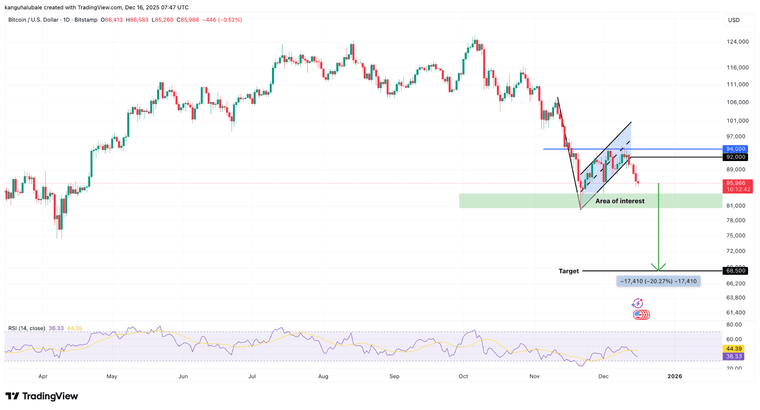

Bitcoin Risks Drop Toward $68,500

Bitcoin’s technical structure weakened after losing the 50-week moving average and breaking below $92,000, confirming a bearish flag pattern. Analysts warn that failure to hold the $83,800–$80,500 support zone could send BTC toward $68,500, aligning with the 200-week moving average. -

Whales Add Downside Pressure

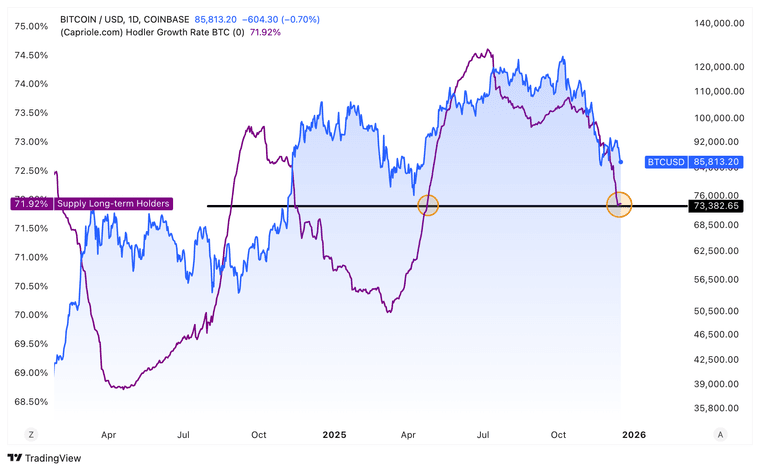

BTC/USD daily chart. Source: Cointelegraph/TradingViewCryptoQuant data shows LTH supply has fallen by 761,000 BTC over the past month, while whales sold roughly $2.78 billion worth of BTC during the same period. This sustained distribution suggests rising fear of further downside and reinforces near-term bearish momentum.

-

LTH Selling Mirrors Previous Cycle Peaks

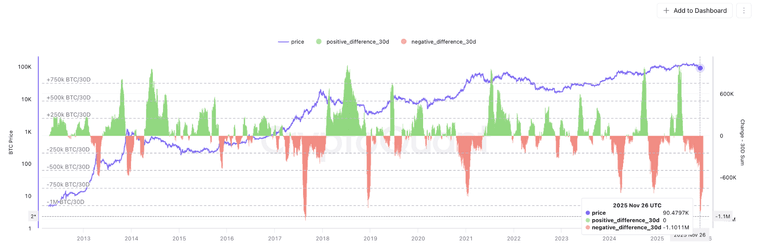

Bitcoin 30-day rolling LTH supply change. Source: CryptoQuantHistorically, sharp declines in long-term holder supply tend to appear during late-cycle or retail-driven phases. Similar patterns occurred in 2017 and 2021, when LTHs distributed into strength near market tops. Recent data shows a 1.1M BTC drop in 30 days, the second-largest decline on record.

-

Bitcoin Long-Term Holders Cut Exposure

Bitcoin long-term holder supply, %. Source: Capriole InvestmentsBitcoin long-term holders (LTHs) have continued trimming their positions, pushing their share of BTC supply down to 71.9%, the lowest level since April. Glassnode data shows LTH holdings fell from 14.8M BTC in July to 14.3M BTC in December, signaling growing caution among seasoned investors.

-

Regulated Stablecoins Expand Across Southeast Asia

StraitsX operates under Singapore’s Monetary Authority (MAS) stablecoin framework, with both XSGD and XUSD acknowledged as compliant with upcoming regulations. The expansion follows a recent exploratory agreement with Grab to integrate stablecoin payments into everyday transactions across Southeast Asia, pending regulatory approval.

-

XSGD and XUSD Surpass $18B in Onchain Volume

XSGD and XUSD have processed more than $18 billion in combined onchain transaction volume across multiple blockchains. XSGD currently has a market cap of $13 million, while XUSD stands at $52 million, with both stablecoins already active on networks including Ethereum, Polygon, Avalanche, and BNB Smart Chain.

-

Stablecoins Target AI and Digital Commerce Use Cases

StraitsX said the Solana expansion is designed to support rising demand from digital commerce platforms and AI-native applications. Solana has increasingly become a hub for x402-based payments, a standard that enables automated transactions between software agents, aligning with StraitsX’s programmable payment ambitions.