Hello everyone, let’s dive into how XAUUSD is moving!

Yesterday, just as we expected, gold made an impressive surge. The precious metal rocketed upwards from the 3321 USD range, hitting 3378 USD, gaining more than 500 pips in a short time.

So, what’s behind this move? The answer lies in the speech by Fed Chair Jerome Powell.

His remarks at the Jackson Hole symposium sent shockwaves through the market. Powell emphasized that the Fed might pause or even reduce interest rates soon due to concerns about the negative impact on the economy.

This has weakened the USD, providing an opportunity for gold (XAUUSD) to rise sharply. As the USD loses value, gold becomes a safe-haven for investors, pushing prices higher.

From a technical perspective, gold has overcome its previous downtrend, successfully conquering the 3370 USD peak. A trend correction could occur, but given the favorable environment, the upward trend still holds dominance. Watch for the 3400 USD level, as that’s our next target.

Do you agree with my analysis? Drop your thoughts in the comments and don’t forget to like the post—I’d really appreciate it!

Good luck!

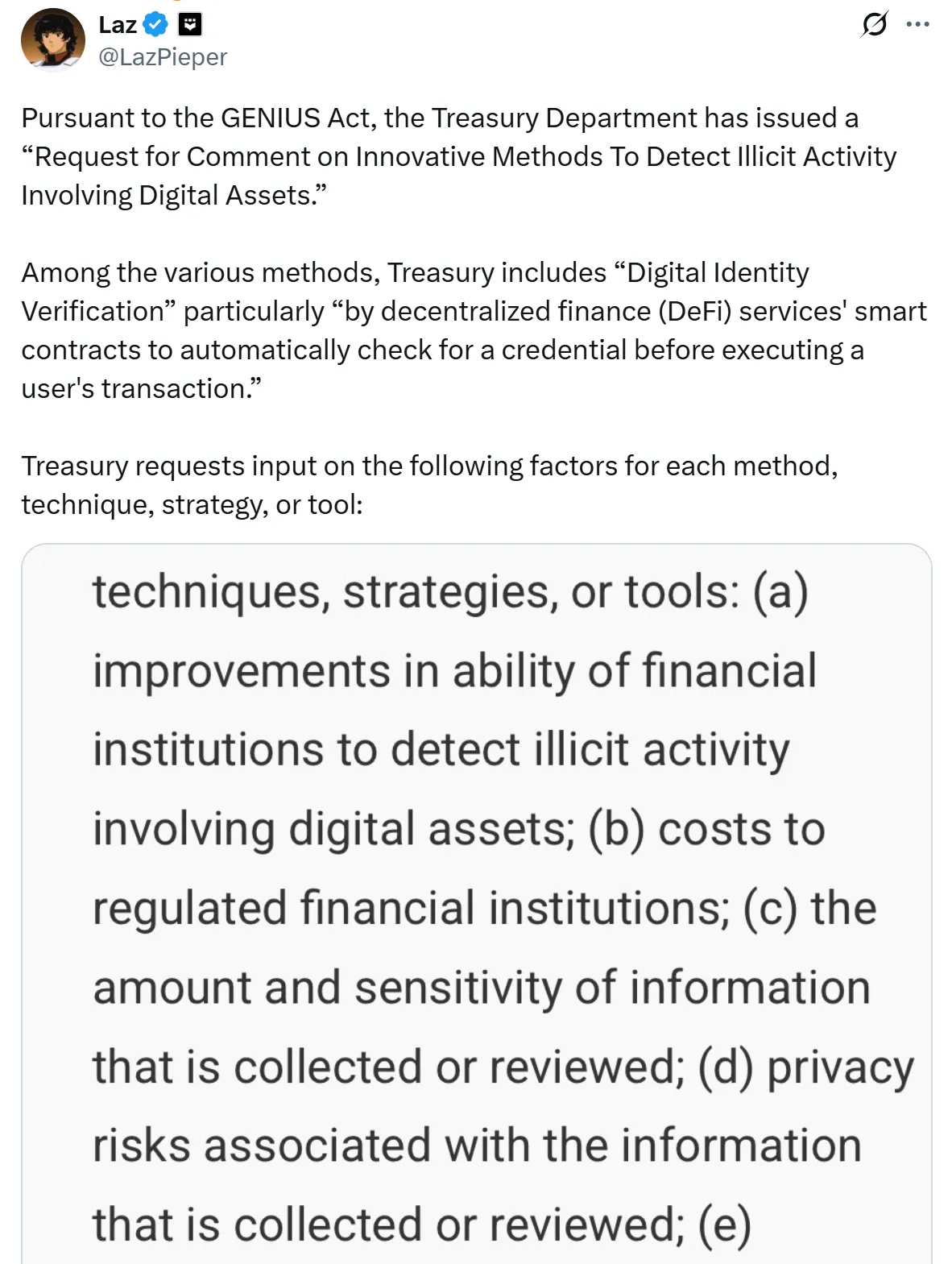

What’s Being Proposed

What’s Being Proposed Big Picture

Big Picture What do you think:

What do you think:

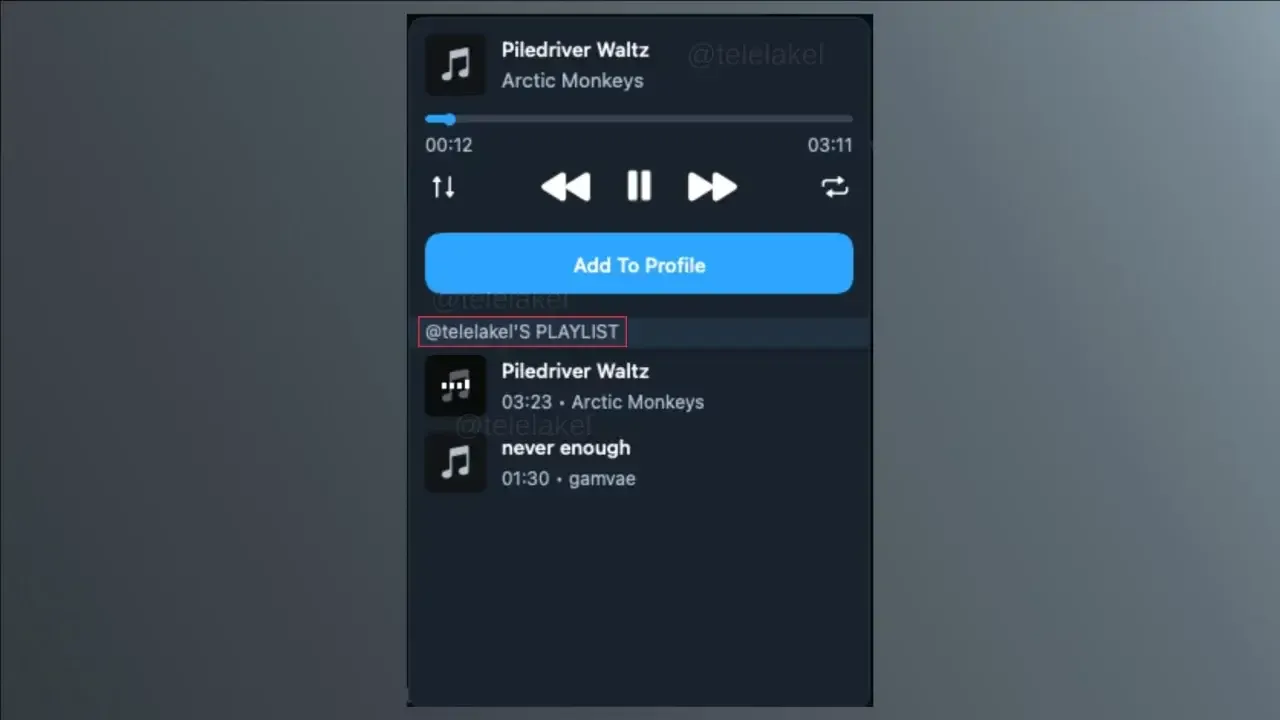

Music on Profiles

Music on Profiles ️ Custom Profile Tabs

️ Custom Profile Tabs ️ Dynamic Gift-Themed Wallpapers

️ Dynamic Gift-Themed Wallpapers Gift System Enhancements

Gift System Enhancements Sticker Mini-App

Sticker Mini-App Android Profile Redesign

Android Profile Redesign Takeaway

Takeaway

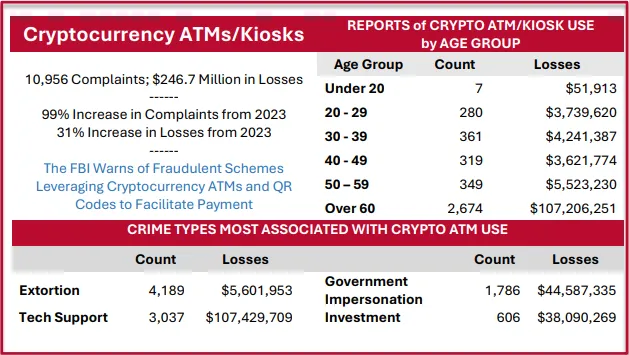

Local Bans & Hard Caps

Local Bans & Hard Caps Why Regulators Care

Why Regulators Care ️ The Bigger Picture

️ The Bigger Picture What’s Next?

What’s Next?

What Officials Are Saying

What Officials Are Saying Context: Fake

Context: Fake

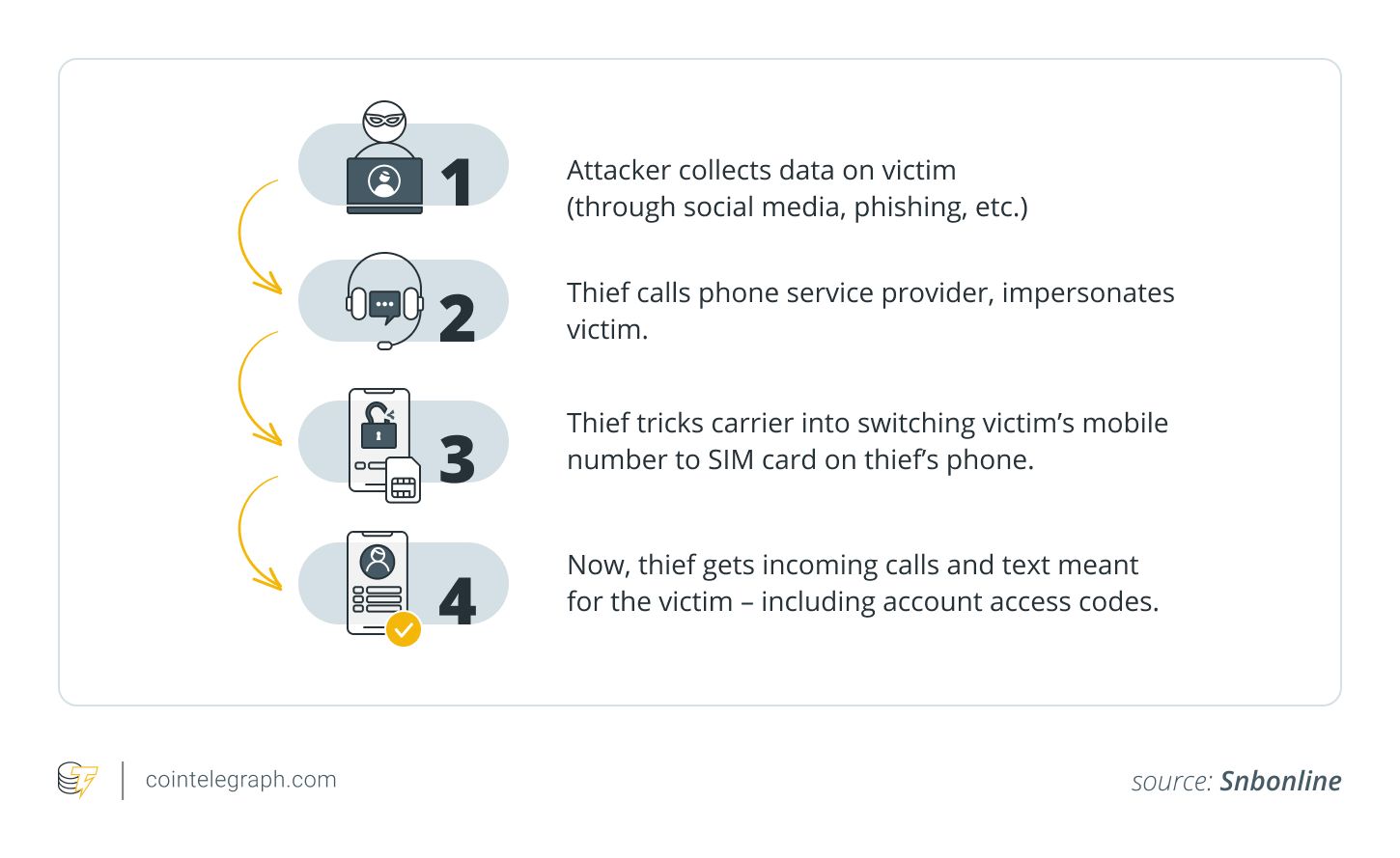

️ How SIM Swap Attacks Work

️ How SIM Swap Attacks Work ️ Protecting Yourself Against SIM Swaps

️ Protecting Yourself Against SIM Swaps

Key Highlights

Key Highlights Why It Matters

Why It Matters Question for the crowd:

Question for the crowd: