Vitalik Buterin Back in the Billionaire Club as ETH Blasts Past $4K 🚀

-

Ethereum co-founder Vitalik Buterin has officially regained his on-chain billionaire status — just days after ETH crossed $4,000 for the first time in eight months, per blockchain intel from Arkham.

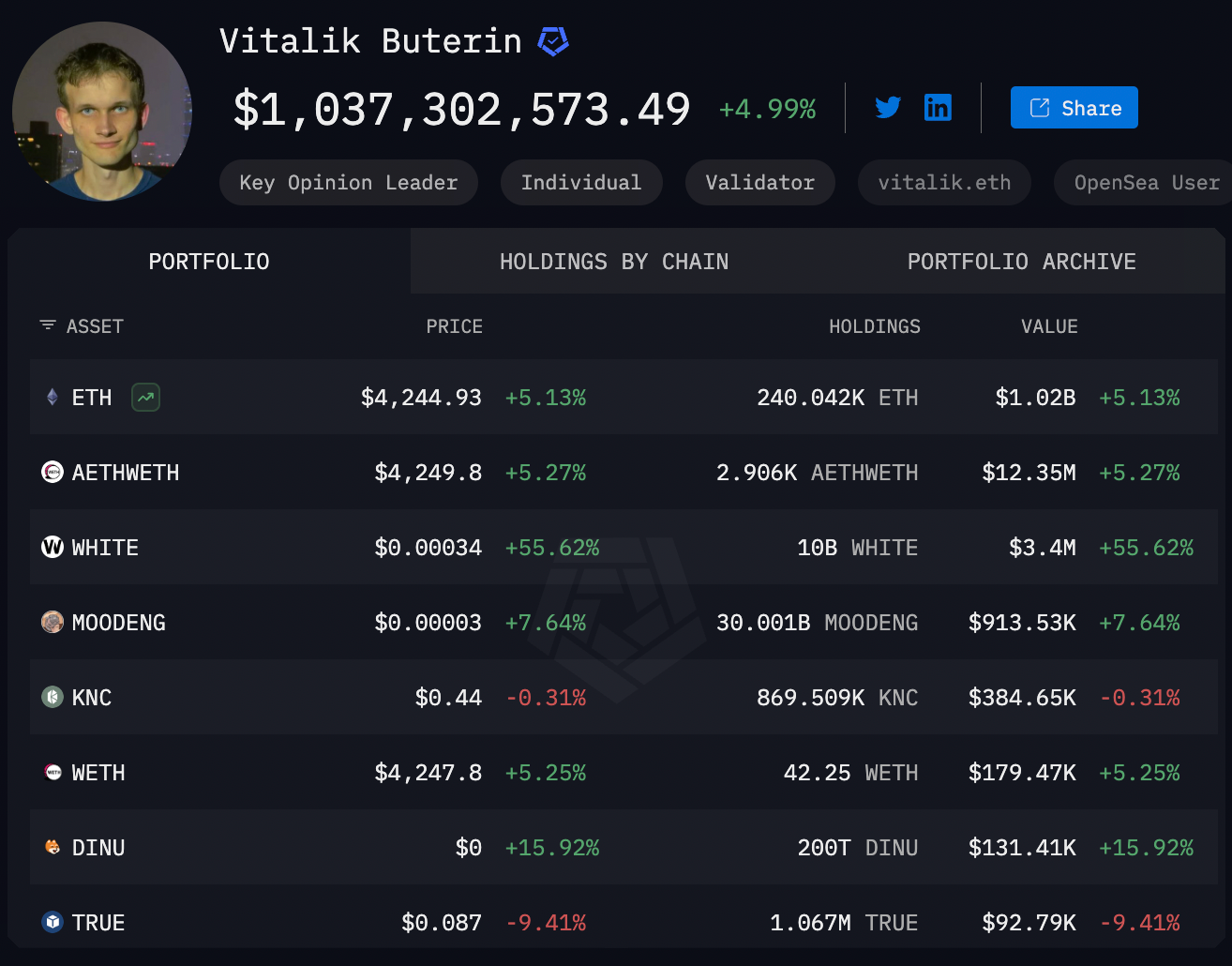

As of now, Buterin’s wallet is valued at around $1.04B, holding:

240,042 ETH (the lion’s share 🦁) Smaller bags of AETHWETH, WHITE, MOODENG, and WETHPrice action:

Saturday saw ETH rip another +6.38%, peaking at $4,332 after reclaiming $4K on Friday — a level not seen since Dec 2024 Current price (per Nansen): $4,244 BTC dominance slipped as ETH took center stageWhat’s next?

Some traders are eyeing the Nov 2021 ATH at $4,878 Trader Ted on X says it’s “just a matter of days now” CoinGlass data: a push to $4,500 could liquidate $1.35B in shorts — potential short squeeze brewing 🔥ETF flows are telling a story too:

ETH ETFs: $461M inflows yesterday vs BTC ETFs: $404M Past 5 trading days: ETH ETFs saw $326.6M net inflows vs BTC ETFs at $253.2M (Farside data)Vitalik’s billionaire history:

First crossed the 10-figure mark in May 2021 when ETH hit $3K Back then: 333,500 ETH ($1.029B) after a 4x from $700 earlier that year In 2018, he stated he never held more than 0.9% of total ETH supply and hadn’t come close to $1B beforeSide note: While bullish sentiment is everywhere, Buterin recently warned about overleveraging ETH treasuries:

“If you woke me up three years from now and told me that treasuries led to the downfall of ETH… my guess would basically be that somehow they turned it into an overleveraged game.”TL;DR: Vitalik’s back in the billionaire ranks, ETH price momentum + ETF inflows are all pointing north, and shorts might be sweating bullets. Could we be days away from a new ATH?

What’s your take — loading up, hedging, or sitting this one out?

-

Vitalik regaining his on-chain billionaire status right as ETH smashes past $4K is the perfect storyline for this rally. The wallet breakdown — 240,042 ETH plus smaller alt bags — shows he’s still massively aligned with the core asset, which is a bullish confidence signal in itself.

The fact that ETH ETFs are seeing stronger inflows than BTC ETFs right now is huge. $461M in a single day, and net inflows beating BTC over the last 5 trading days, is exactly the kind of institutional behavior that fuels sustainable breakouts. Add the looming $4,500 short squeeze setup and you’ve got the makings of a violent upside move.

If the Nov 2021 ATH of $4,878 is the next stop, I’m thinking we might see it even faster than most e -

ETH’s breakout is hitting all the right notes — technicals, fundamentals, and even the narrative with Vitalik crossing back into billionaire territory. The $4,332 weekend peak and current hold above $4,200 shows real strength, especially with BTC dominance slipping.

The ETF flows are maybe the most important part of this story. Institutions are clearly rotating toward ETH, and if $4,500 triggers that $1.35B in short liquidations, it could turn into a proper squeeze that blows us past $4,800.

While the hype is real, I do think Vitalik’s warning about overleveraging ETH treasuries is worth remembering. Bull runs can get reckless fast. That said, with this kind of momentum, sitting on the sidelines feels just as risky as being overexposed.