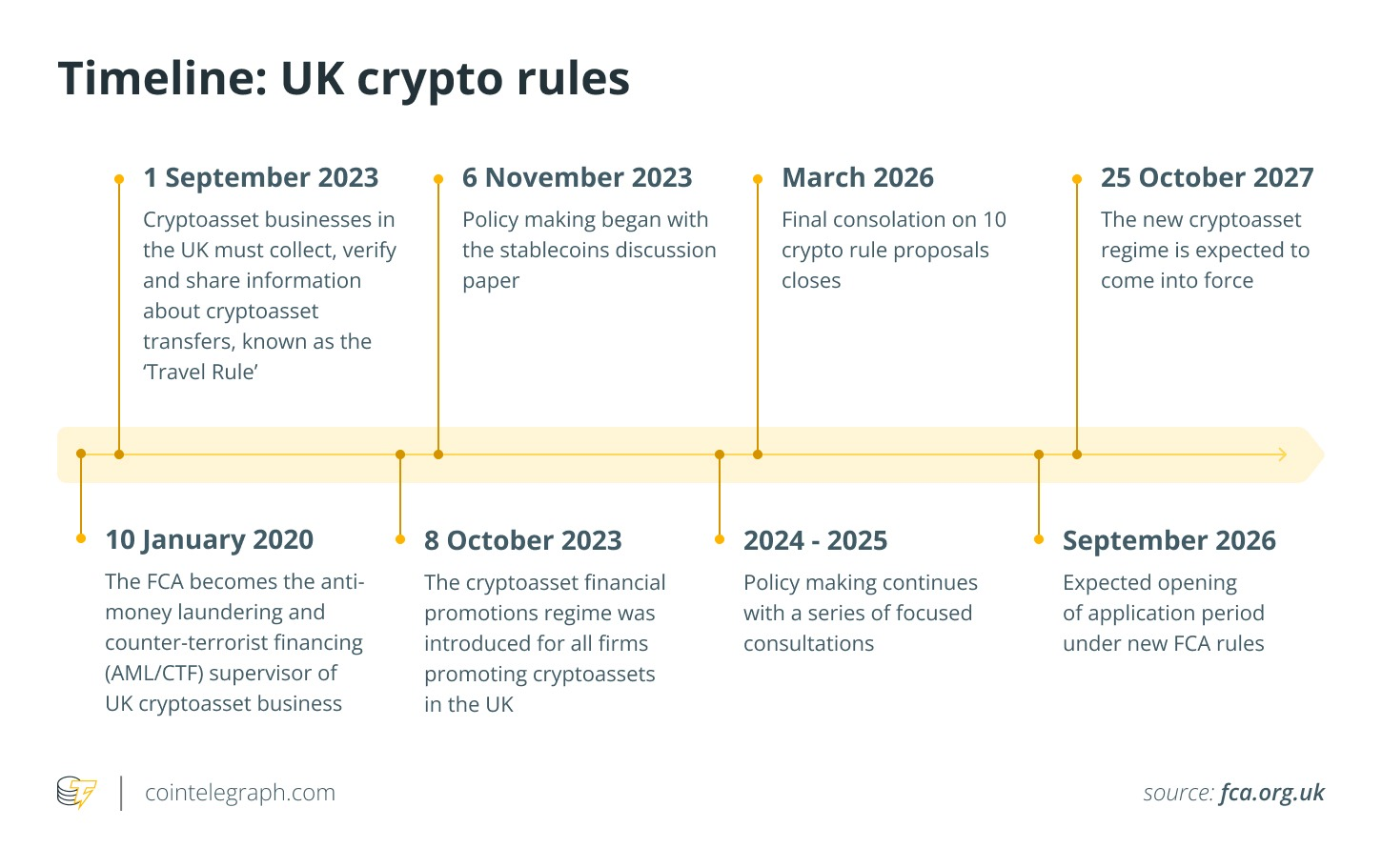

While SENT shows short-term momentum after Bithumb and Upbit listings, broader trends suggest caution. Only 1 of 87 tokens listed on Upbit in 2025 is trading green, and most Bithumb listings are down.

Still, with its vision of an open-source AGI network and utility-driven tokenomics, Sentient continues to attract attention, particularly among investors interested in AI and blockchain convergence.