A new survey from Dragonfly Capital reveals that average salaries in crypto firms dropped 18% to $144,000, and token grants fell 75%. Meanwhile, founder salaries rose 37% to roughly $197,000, highlighting a widening gap between executives and regular employees.

cryptoenthusiast

Posts

-

Crypto Salaries Tighten While Founder Pay Climbs -

💵 How to Make Money with Stablecoins (Without Wild Price Swings)

Most people think “crypto” means price swings, sleepless nights, and staring at red charts. But what if you could earn passive income with crypto—without the risk of your portfolio turning into a rollercoaster?

That’s where stablecoins come in.

These dollar-pegged assets (like USDC, USDT, and DAI) don’t moon or crash—they stay close to $1. But don’t let the lack of price movement fool you… there are real ways to make money with stablecoins in 2025.

Let’s break them down:

Earn Yield Through DeFi Lending

Earn Yield Through DeFi Lending

Platforms like Aave, Compound, and Spark let you lend out your stablecoins and earn interest.

How it works: You supply USDC or USDT to a lending pool. Borrowers take loans (often overcollateralized) and pay interest. Returns: 3–8% APY depending on demand and platform. Risks: Smart contract bugs, platform insolvency. Stick with audited platforms and consider diversifying. CeFi Savings Accounts (Centralized Lending)

CeFi Savings Accounts (Centralized Lending)

If you’re not ready to dive into DeFi, centralized platforms like Binance Earn, OKX Savings, or Kraken offer fixed or flexible stablecoin savings.

Returns: Typically 3–6% APY. Perks: Easier to use, often insured or secured by large exchanges. Watch out for: Lock-in periods and withdrawal restrictions. Provide Liquidity in Stablecoin Pools

Provide Liquidity in Stablecoin Pools

Platforms like Curve Finance or Balancer offer liquidity pools with low volatility and decent fees.

Example: USDC/DAI/USDT pool on Curve Earn from: Trading fees + bonus rewards in governance tokens Bonus: Yields can reach 10–15% when boosted Pro tip: Use auto-compounders like Yearn, Beefy, or Pendle to optimize returns. Cross-Border Payments & Remittance

Cross-Border Payments & Remittance

In some countries, stablecoins are the financial lifeline.

Freelancers and remote workers: Accept stablecoins for services. Fast, global, and inflation-resistant. Arbitrage opportunities: Sometimes, stablecoins trade at a premium in high-inflation countries. Tools: Use platforms like Bitwage, Request Finance, or Circle for invoicing and payouts.- 🧾 Real-World Asset (RWA) Yield Farms

Stablecoins are being used in tokenized real estate, treasury bills, and private credit markets.

Platforms: Ondo Finance, Maple, Backed, Centrifuge Returns: 5–10% from tokenized U.S. treasuries or invoice factoring Regulated? Increasingly so—especially after the GENIUS Act in the U.S. ️ Delta-Neutral Strategies for Yield

️ Delta-Neutral Strategies for Yield

Want to earn without betting on price? Try delta-neutral yield farming.

How: Provide USDC as collateral → borrow volatile asset → farm rewards while hedged Advanced strategy: Use platforms like Lyra, Ribbon, or UXD Protocol Potential: 10–20% returns, but requires careful position management Earn Stablecoins by Working

Earn Stablecoins by Working

Freelance platforms like:

CryptoTask LaborX DeworkLet you get paid directly in USDC, DAI or USDT. No bank fees, no currency conversion—just clean, global payments.

Final Thoughts

Final ThoughtsStablecoins are more than just a safe haven during bear markets—they’re a gateway to sustainable income in crypto.

🔄 You won’t 10x overnight, but you can build a reliable yield engine that compounds over time—without needing to chase pumps or time tops.So… what’s your favorite way to put stablecoins to work?

Drop your tools, yields, and tips below!

Drop your tools, yields, and tips below!Disclaimer: Always do your own research and assess platform risk before depositing funds.

-

🟩 Crypto Market Wrap-Up: Bitcoin Tightens, Stablecoins Surge, and Tokenized Stocks Explode | July Recap 📈

July is closing out strong for crypto—and if you’re watching on-chain trends and regulatory progress, there’s a lot to be bullish about.

Here’s what’s been moving markets and shaping the next big wave:

Bitcoin Reserves Hit Multi-Year Lows — Supply Shock Incoming?

Bitcoin Reserves Hit Multi-Year Lows — Supply Shock Incoming?Bitcoin exchange reserves dropped another 2% this month, pushing the total down 14% since January. That’s not just a stat—it’s a strong signal.

📉 Less BTC on exchanges = more long-term holders = less available supply = potential price squeeze.In fact, this is the first time since 2018 that less than 15% of BTC’s supply is sitting on centralized exchanges. Analysts are warning: a supply shock might be brewing.

Crypto Chief noted:

“We’ve never seen such a big divergence between OTC/exchange balances and price.” ️ Regulators Step Up — US Congress Passes 3 Crypto Bills

️ Regulators Step Up — US Congress Passes 3 Crypto BillsThe U.S. House passed three major crypto bills in July. The GENIUS Act, now signed into law by President Trump, establishes clear rules for stablecoins—setting the stage for real institutional adoption.

Even though it didn’t allow issuers to pay interest (sorry Coinbase), it added $4B in new stablecoin market cap in just one month. That brings the total market cap to $250B+.

🟢 Monthly active stablecoin addresses also jumped 20%+ to over 38 million.

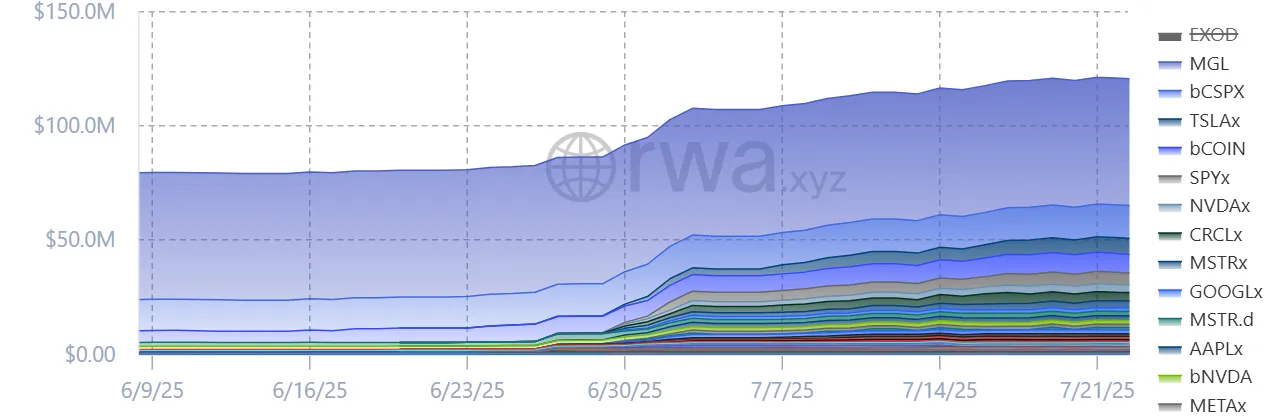

🪙 Real-World Assets (RWAs) Onchain Pass $25 Billion

It’s not just stablecoins seeing inflows. RWAs—think tokenized treasuries, private credit, and stocks—continue booming:

Tokenized stocks grew 15% in July, hitting $400M in value Robinhood announced plans to roll out tokenized stock trading RWA wallet activity is up nearly 700% this monthBut it’s not all smooth sailing. Legal questions are growing around tokenized equity that lacks actual ownership rights. Regulators are watching.

️ US States & Global Watchdogs Get to Work

️ US States & Global Watchdogs Get to Work🟨 Three U.S. states passed their own crypto laws in July:

Missouri now regulates crypto ATMs and declares metals-backed digital currencies legal tender. New Hampshire launched a study on stablecoin/RWA regulation. Oregon now treats unclaimed crypto as abandoned after 3 years.🟥 Meanwhile, Arizona vetoed a bill that would’ve let the state hold seized crypto in reserve. (Too bad.)

Global Momentum:

Global Momentum:Bybit, OKX & CoinShares all gained MiCA licenses in Europe. Bitstamp got the green light in Singapore. Ripple and Circle are chasing full U.S. banking licenses. Deutsche Bank’s AllUnity project received approval to issue a euro stablecoin. Why This Matters:

Why This Matters:From record-low BTC supply to booming RWAs and clearer regulation, we’re seeing the building blocks of the next bull wave slot into place.

Stablecoins are growing. Institutions are finally getting the green light. On-chain assets are diversifying. And exchange BTC balances? Just… evaporating.

Whether you're stacking, staking, trading, or building—July set the tone for a high-volatility, high-potential second half of 2025.

Are you positioning yourself for it? Let's talk strategy.

️

️ -

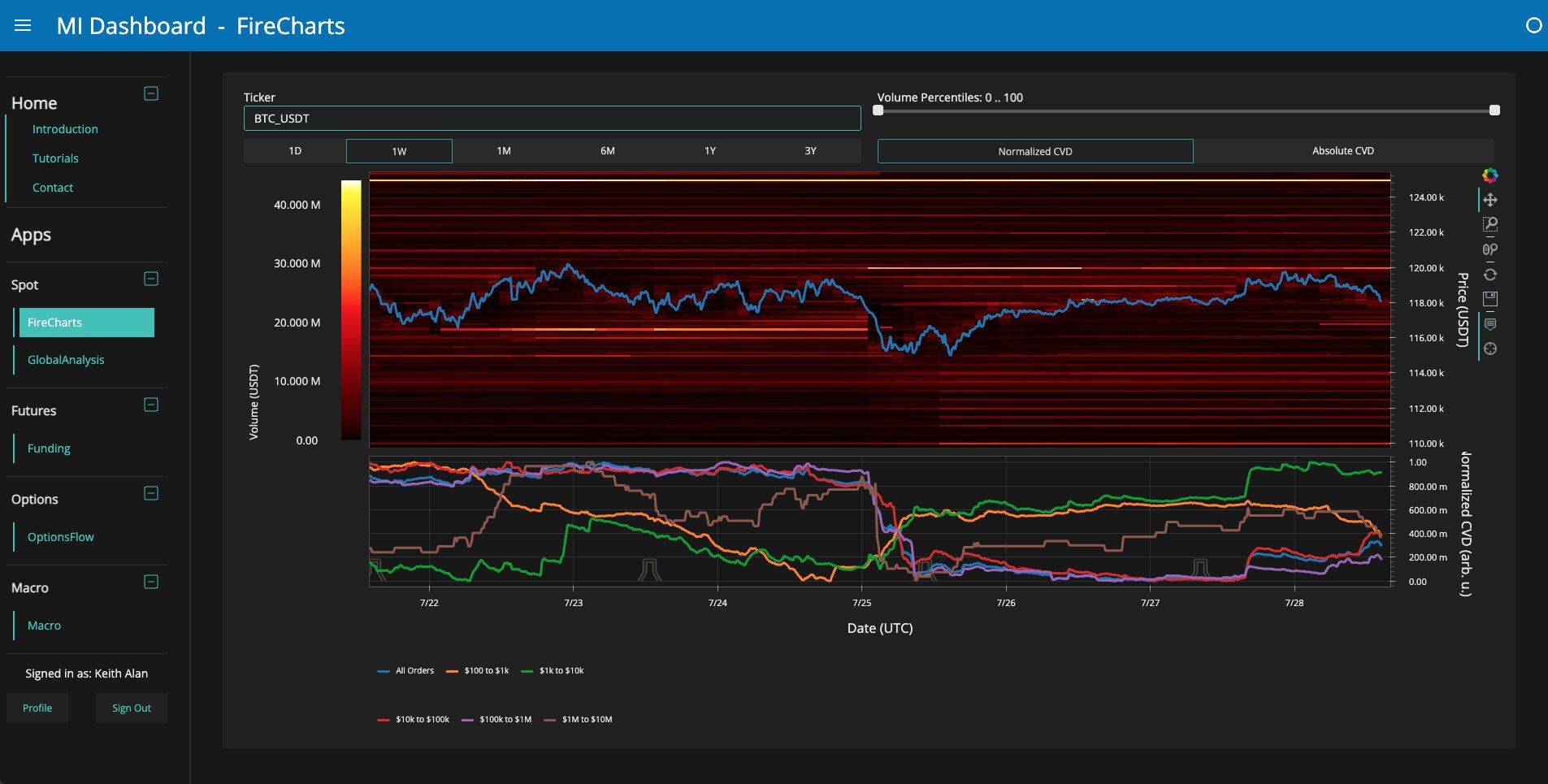

🔍 Bitcoin Bulls on the Brink? $120K Rejected, Eyes on $110K and Below 🐻📉

Bitcoin just pulled a fake-out.

After flirting with $119K earlier today, BTC failed to hold the $120K resistance and has now slipped below $117,500 — back under the daily open. Some traders are bracing for a sharp move downward. So… are we about to dive into the “C wave”?

Bearish signs are stacking up:

Bearish signs are stacking up:Whales are distributing at local highs — this is creating headwinds for further price movement. Momentum is slowing and several popular traders are now openly discussing targets in the $110K–$108K range. $116,750 is a key level to watch — if it breaks, we could be staring down the barrel of a sub-$110K leg.As Material Indicators put it:

“If $116,750 doesn't hold, the $110k range may come into focus quickly.” Meanwhile, Credible Crypto warns of a clean triple tap forming, and trader Roman is eyeing $108K. But it's not all doom and gloom... yet:

But it's not all doom and gloom... yet:Despite the dip, CryptoQuant says we’re not seeing massive profit-taking on-chain. That’s a bullish divergence from typical local tops.

🧠 Their key takeaways:

No major profit realization spike in Net Realized Profit/Loss (NRPL) — suggesting investors are still confident. Short-term holder cost bases at ~$115.7K and ~$105K may act as strong support zones if we correct further. Improving U.S. economic data (JOLTS + Consumer Confidence) is creating a “risk-on” environment for assets like BTC. TL;DR:

TL;DR:🟥 Bears in control for now; rejection at $120K could drag us to $111K or lower 🟩 Bulls still have hope — no mass exits, and support zones are holding 📉 Next 48 hours are crucial: if $116.7K fails, we might test $110K fast 📆 FOMC + White House crypto policy release could shift sentiment midweekAre you hedging, DCA’ing, or waiting for blood on the charts?

Let’s hear your playbook. ️

️ -

Dollar Weakness Fuels the Trade

The US Dollar Index (DXY) shows why the debasement trade is gaining steam:

Down 12% in 2025, from 110 in Jan → 96.3 in Sept.

Deficits, soaring debt & loose policy keep real yields suppressed.

Analysts expect the trend to define the next decade.

-

🎮 Tom Talk x MZZC Global: Powering the Next Wave of Web3 Gaming 🌍

Web3 gaming platform Tom Talk has announced a strategic alliance with MZZC Global Foundation, a Singapore-based crypto investment fund + DeFi trading platform. The move marks a major step in Tom Talk’s mission to scale its Talk-to-Earn ecosystem worldwide.

Why It Matters

Why It MattersFunding Boost → MZZC Global is injecting multi-million-dollar support to accelerate Tom Talk’s network expansion and game development.

DeFi Synergy → By merging Tom Talk’s blockchain-powered gaming with MZZC’s DeFi platform, users will gain access to play + earn + invest opportunities within one ecosystem.

Massive Audience Reach → MZZC Global boasts millions of users across Singapore, Korea, Japan, and Asia. Tom Talk aims to onboard ~10% of that base (~30M gamers) into Web3.

What This Unlocks

What This UnlocksGlobal Growth → Tom Talk strengthens its presence in major markets with MZZC’s financial and network backing.

Sustainable GameFi → The partnership promises rewarding, transparent, and fair gaming incentives, addressing some of the issues that plagued earlier GameFi experiments.

Interoperability in Action → Web3 platforms are increasingly joining forces across niches (gaming, DeFi, NFTs) to build more flexible and scalable ecosystems.

The Bigger Picture

The Bigger PictureWeb3 gaming has struggled with hype cycles, churn, and sustainability.

Partnerships like Tom Talk ✕ MZZC hint at the next phase: gaming platforms backed by real funding, integrated with DeFi, and targeted at mass adoption.

If Tom Talk can convert even a fraction of MZZC’s user base, it could become one of the largest Web3 gaming communities in Asia.

Community Question:

Community Question:

Is this the formula Web3 gaming needs — GameFi + DeFi + investment fund muscle — or will it face the same pitfalls that sank earlier projects? -

🎮 Fortnite On-Chain? Coinbase’s Jesse Pollak vs. GameFi Skeptics

Coinbase’s Jesse Pollak (head of Base L2) stirred Crypto Twitter after suggesting Fortnite’s in-game economy could be “10x better onchain.”

His argument:

For companies → open economies = anyone can build on them.

For companies → open economies = anyone can build on them. For players → true asset ownership + free market pricing.

For players → true asset ownership + free market pricing. For everyone → global access + lower platform fees.

For everyone → global access + lower platform fees.Sounds bullish, right? Not everyone agreed.

️ The Pushback

️ The PushbackJohn Wang (ex-Immutable) wasn’t buying it:

Roblox already gives devs near-infinite APIs & analytics.

Web2 systems still offer better UX + higher retention tools.

Lower fees ≠ better business if the player experience suffers.

Pollak countered:

On-chain APIs are more expressive & powerful.

Permissioned systems can still exist on-chain if needed.

But critics kept pointing to the elephant in the room: GameFi’s track record is rough.

🪦 The Ghosts of GameFi Past

Axie Infinity collapsed → unsustainable tokenomics + security failures.

60% of blockchain gamers churn within 30 days.

Many projects built Ponzi-like “earn first, fun later” models that imploded once hype faded.

Meanwhile, Web2 titans (Roblox, Fortnite, Ubisoft) continue to dominate without tokens, proving fun > speculation.

Can On-Chain Gaming Still Work?

Can On-Chain Gaming Still Work? Composable economies + open APIs could unlock innovation.

Composable economies + open APIs could unlock innovation. Partnerships (Immutable + Ubisoft) hint at hybrid Web2–Web3 futures.

Partnerships (Immutable + Ubisoft) hint at hybrid Web2–Web3 futures. UX, retention, and speculative models still cripple most projects.

UX, retention, and speculative models still cripple most projects.GameFi’s market cap is $13.2B — not dead, but limping.

Pollak’s vision is bold, but the skeptics currently have stronger receipts. The sector needs a killer game with real product–market fit before the “10x better onchain” claim sticks.

Question for you: Would you actually play a Fortnite-style game on-chain if it meant real asset ownership… or would you stick to Web2 where the fun (and smoother UX) still dominates?

Question for you: Would you actually play a Fortnite-style game on-chain if it meant real asset ownership… or would you stick to Web2 where the fun (and smoother UX) still dominates? -

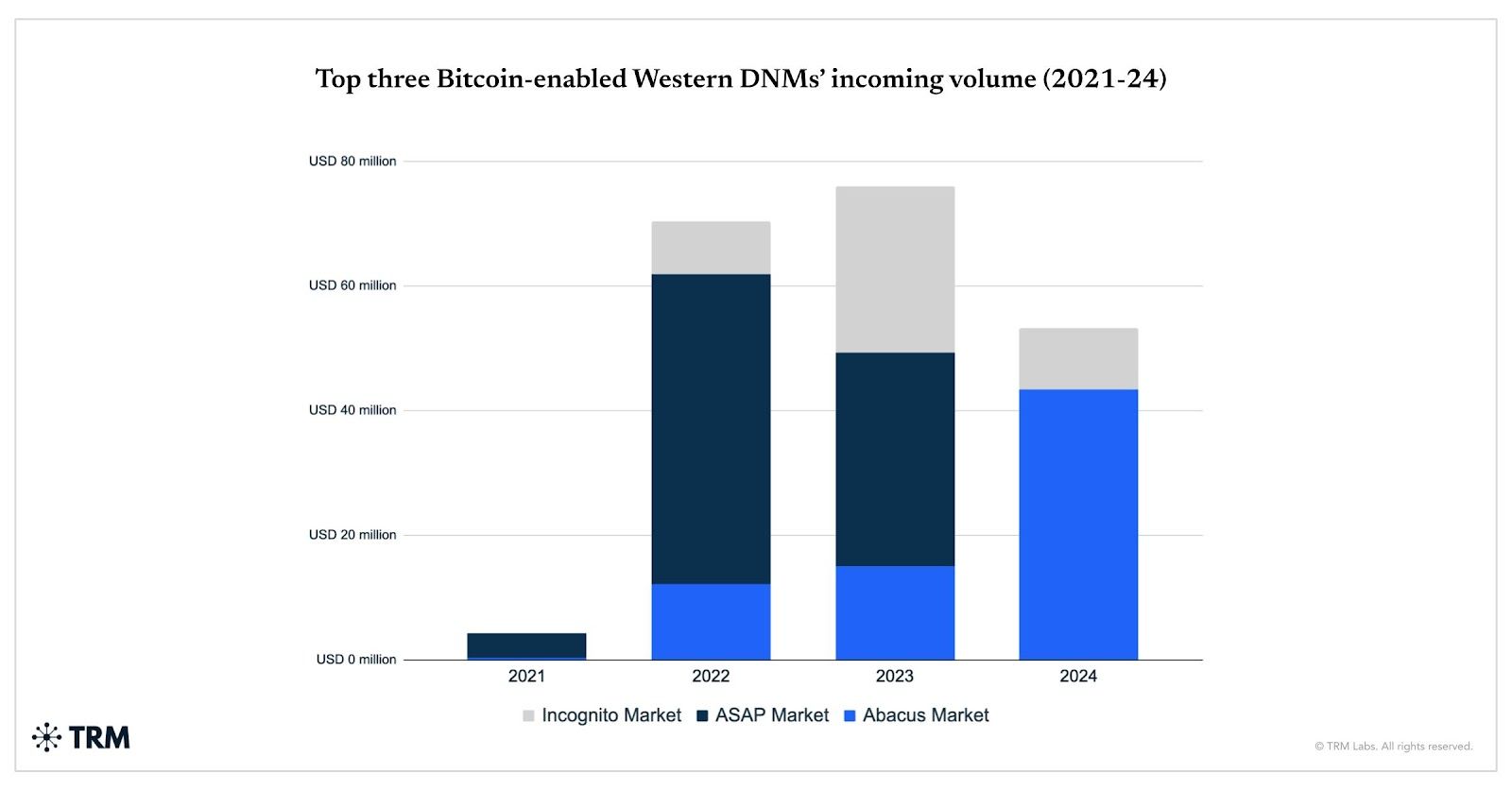

💸 Bitcoin Darknet Giant Abacus Market Disappears — $300M+ Exit Scam Suspected

The world’s biggest Bitcoin-powered darknet marketplace, Abacus Market, has gone dark — and investigators say it looks like the operators pulled off a classic exit scam, vanishing with users’ funds. What happened?

What happened?Abacus handled ~70% of the Bitcoin-enabled Western darknet trade in 2024. After its clearnet and dark web portals went offline, blockchain intelligence firm TRM Labs concluded the admins “likely shut down operations and disappeared with the money.” The site had recently hit record volume — $6.3M in June sales — after rival Archetyp Market was seized by Europol in mid-June. The telltale signs:

The telltale signs:Late June: Withdrawal delays spark user panic. Admin “Vito” blames server strain + DDoS attacks. Deposits plunge from $230K/day to just $13K/day by early July. TRM: “Behavior matched known exit scam patterns.” What Abacus sold:

What Abacus sold:

Stimulants, psychedelics, unlicensed pharmaceuticals — all paid via Bitcoin or Monero.

Central deposit wallets held user balances until withdrawn — perfect for a sudden, clean getaway. By the numbers:

By the numbers:4 years in operation Nearly $100M in confirmed Bitcoin sales (actual total likely $300M–$400M when counting Monero transactions) Volume share jumped after ASAP Market closed in July 2023 and Incognito Market was seized in March 2024. Why shut down at the top?

Why shut down at the top?Law enforcement focus rises as a marketplace dominates volume, listings, and reputation. Operators may have preferred profit + freedom over continuing risk, especially after seeing Archetyp’s takedown. History shows many darknet market admins exit rich and uncaught — from Agora’s voluntary shutdown to Evolution’s $12M rug pull. Other theory:

Other theory:

TRM says law enforcement could already control the site and be silently gathering evidence. But Dread forum insiders close to Abacus doubt that’s the case. -

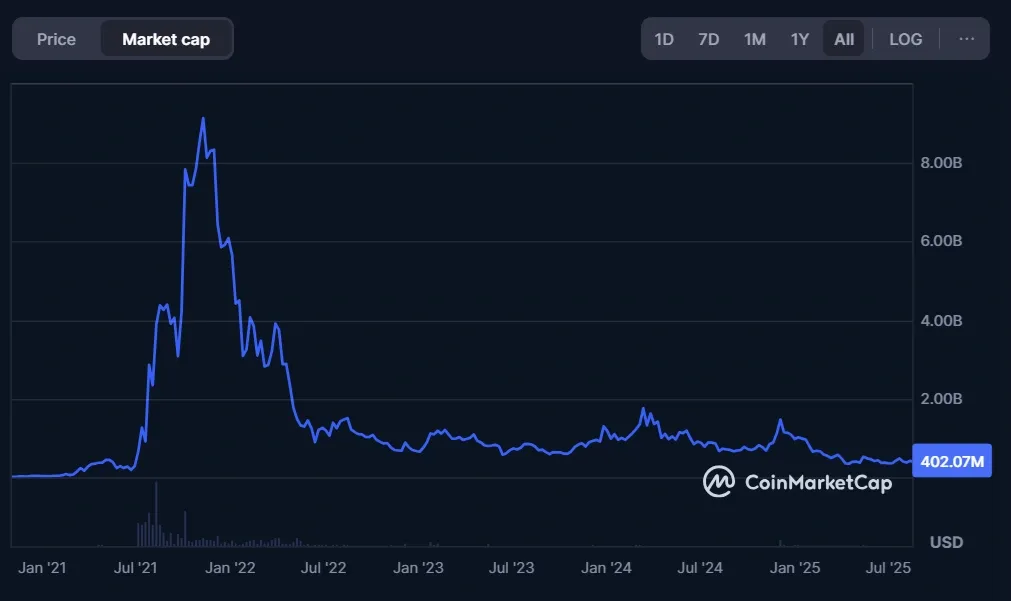

🔗 Tron Finally Lands in MetaMask — What It Means for TRX & Beyond

After years of being one of the top 10 blockchains without native support, Tron (TRX) is officially joining MetaMask.

The move makes Tron just the third non-Ethereum chain integrated into MetaMask since its 2016 launch, following Solana (May 2024), BNB Smart Chain, and Sei.

Why This Matters

Why This MattersMassive distribution: MetaMask remains one of the most widely used self-custodial wallets globally. Tron suddenly gains exposure to millions of users and dApps without needing “add network” workarounds.

Asian market bridge: MetaMask’s Angel Gonzalez-Capizzi specifically highlighted Tron’s dominance in Asia. This could be a regional on-ramp moment where users accustomed to TRC-20 USDT get deeper into MetaMask’s multi-chain world.

Future synergy: MetaMask is experimenting with a Mastercard-backed self-custody crypto card. If Tron’s ecosystem connects there, it could supercharge retail adoption.

️ Behind the Integration

️ Behind the IntegrationIntegrating a new chain isn’t just a checkbox. MetaMask says the decision depends on:

Security audits

️

️Technical readiness

️

️User demand

Tron passed those gates in 2025 — finally giving it a seat at MetaMask’s main table.

️ Politics, Regulation & Momentum

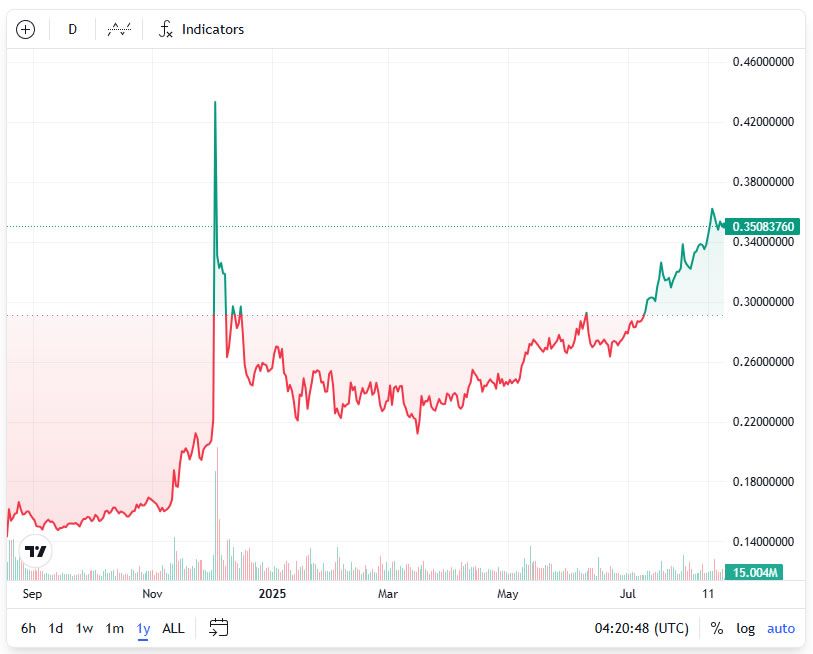

️ Politics, Regulation & MomentumTron has been riding the post–US election wave, with TRX up 166% after November and briefly hitting a new ATH of $0.43 in December 2024.

Clearer US regulatory signals have made it easier for big wallets and infra providers to greenlight networks like Tron.

Despite political chatter (and even Trump-family name-drops

), MetaMask insists the integration was “product and security driven,” not political.

), MetaMask insists the integration was “product and security driven,” not political. TRX Price Action

TRX Price ActionYTD: +37%

Currently: $0.347

Long-term: Tron has outpaced its 2021 highs while many alts are still lagging.

Big Picture

Big PictureTron’s integration isn’t just cosmetic. It signals:

Growing recognition of non-EVM ecosystems (Solana, now Tron).

Rising institutional and retail appetite for multi-chain liquidity hubs.

The possibility that Tron’s dominance in stablecoin transfer volume (USDT) could spill into new DeFi and payment rails once embedded in MetaMask.

Question for the room: Do you think Tron’s MetaMask integration is a game-changer for adoption — or just a long-overdue checkmark that won’t move the needle much?

Question for the room: Do you think Tron’s MetaMask integration is a game-changer for adoption — or just a long-overdue checkmark that won’t move the needle much? -

The NFT Industry Shifts Strategy as Sales and Platforms Retreatthe space isn’t dead, it’s just way smaller than everyone pretended it was

-

⏱️ Deep Tech vs. 52-Hour Workweek

South Korea’s 52-hour weekly limit is challenging for startups in semiconductors, AI, and quantum computing, where R&D workloads are uneven and deadlines unpredictable.

Experts suggest flexible monthly averages and differentiated rules for deep tech, allowing bursts of intensive work while staying within legal limits. Globally, South Korea sits between stricter EU rules and more flexible regimes in the U.S., Singapore, and China.

#StartupCulture #DeepTech #WorkweekLimits #GlobalWorkforces

-

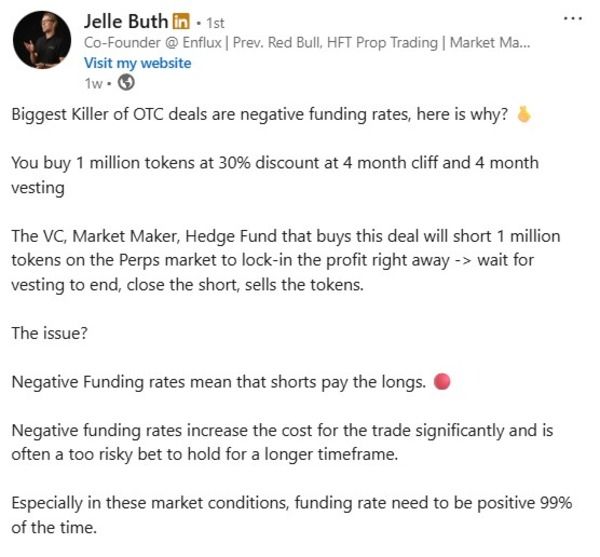

🏦 OTC Token Deals: Why Funds Lock in 100%+ APY While Retail Eats the Risk

Behind the scenes, crypto funds and market makers are printing double-digit returns through over-the-counter (OTC) token deals — while retail traders get stuck with the volatility and sell pressure.

Here’s how the game works

The Mechanics of an OTC Deal

The Mechanics of an OTC DealA VC or fund buys tokens at a 30% discount with a 3–4 month vesting.

To hedge, they short the same amount in perpetual futures markets.

When tokens unlock, the discount + hedge guarantees a profit — often 60–120% annualized, no matter where the token price goes.

“I would never want to be retail again,” says Jelle Buth, co-founder of market maker Enflux (which also plays this game).

Why Retail Gets Wrecked

Why Retail Gets WreckedProjects announce “$X million raised” but rarely disclose that the raise included discounted tokens with short vesting.

When unlocks hit, selling pressure crushes spot markets.

Retail traders are effectively trading blind against insiders holding stacks they got cheap.

Douglas Colkitt (Fogo):

“If you’re trading a token and don’t know there’s a pile of discounted paper waiting to dump, you’re just trading blind.”

Isn’t This Just TradFi Playbook?

Isn’t This Just TradFi Playbook?Yes — it mirrors convertible bond arbitrage in equities, except with zero disclosure.

In TradFi: filings + restrictions.

In crypto: no filings, no transparency, just insiders farming yield.

Lawyer Yuriy Brisov:

“It’s not illegal, but equities live inside a wall of disclosure rules. In crypto, projects can quietly structure deals however they want.”

The Catch for Funds

The Catch for FundsThese aren’t 100% free lunches:

Funding fees on perps eat into profits if shorts are expensive.

Opportunity cost → capital locked in vesting could be deployed elsewhere.

Still, when returns annualize to ~90% APY, the math usually works. Why OTC Persists

Why OTC PersistsProjects → Get instant liquidity without nuking token price.

Funds → Get predictable yield instead of long, illiquid equity bets.

Retail → Left guessing when unlocks and hedges distort price action.

Buth:

“Many VCs don’t bother with pre-seed anymore. They’d rather take liquid token deals with 60–80% APY than wait years for an equity exit.”

Can Retail Ever Play?

Can Retail Ever Play?Some fundraising platforms now list OTC deals publicly, letting retail buy into what used to be insider-only rounds.

But transparency is still thin. Token unlock schedules, discounts, and hedges remain hidden drivers of price.

Best defense for retail: assume hidden sell pressure exists and trade accordingly.

Big Picture

Big PictureOTC deals aren’t going away. They’re too profitable for funds and too convenient for projects.

For retail, the only winning move is awareness: know when you’re up against discounted stacks and adapt your strategy before you get dumped on. What’s your take?

What’s your take?Should OTC deals for tokens require mandatory disclosure, like in TradFi?

Or is this just the natural free market at work — insiders play the game, and retail has to wise up?

-

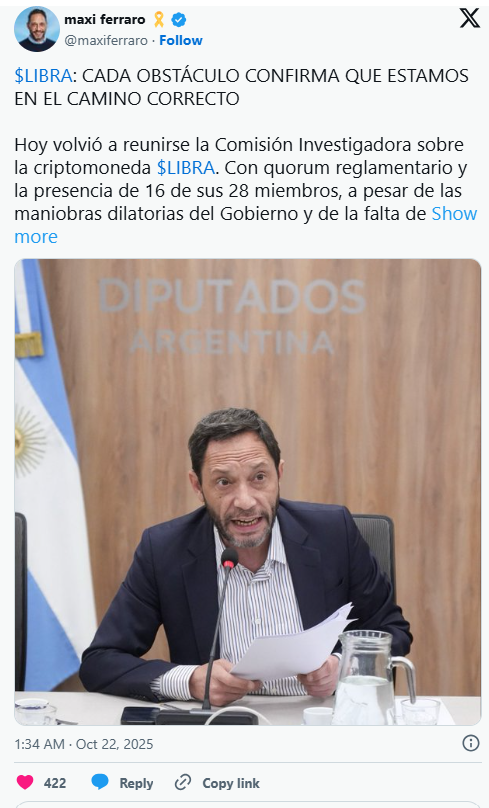

⚠️ President Milei Under Scrutiny

Official data contradicts Milei’s claim that only “single-digit” Argentinians were affected by LIBRA. Ripio reports 1,358 domestic investors, not 5.

The congressional committee has summoned Milei, his sister Karina, Novelli, and Terrones Godoy to testify. Non-compliance could trigger law enforcement action.

#LIBRAScandal #CryptoFraud #Argentina #Milei

-

CZ Denies Trump Family Ties After Surprise Pardon

Binance co-founder Changpeng Zhao (CZ) said he was “surprised” by his presidential pardon from Donald Trump, denying any business links with the Trump family.

CZ told Fox News he never met Trump and only briefly saw Eric Trump at a crypto event. He added he “didn’t know if or when” the pardon would happen, saying, “Then it happened one day.” -

Aerospace Defense = Big Money

Stoke Space raised $510M in Series D, signaling defense-focused aerospace is the new gold rush, not just commercial launches.

Stoke Space raised $510M in Series D, signaling defense-focused aerospace is the new gold rush, not just commercial launches.Geopolitical demand and government programs (e.g., Pentagon’s Golden Dome) are driving multi-billion-dollar contracts.

How to profit: Invest in aerospace startups pivoting to defense tech, or funds focused on national-security innovations.

️ Lesson: Follow government tailwinds, not just consumer hype, for long-term gains.

️ Lesson: Follow government tailwinds, not just consumer hype, for long-term gains. -

Trading Volume for IN Spikes After Upbit Listing

Following its Upbit listing, IN’s daily trading volume jumped 171.6%. The exchange confirmed support for the Ethereum network and urged users to verify the contract address before deposits or withdrawals. -

⚠️ Blurring the Lines Between Gambling & Finance

Experts are raising red flags about DraftKings’ move:Jason Mikula warns of convergence between finance and gambling

Gambling’s addictive nature could impact ordinary fans

Legalized sports betting integrated with institutional investing may have societal and economic consequences

As prediction markets grow, responsible use and regulatory oversight will be key.

#CryptoRisk #FinanceMeetsGambling #PredictionMarkets #ResponsibleGaming -

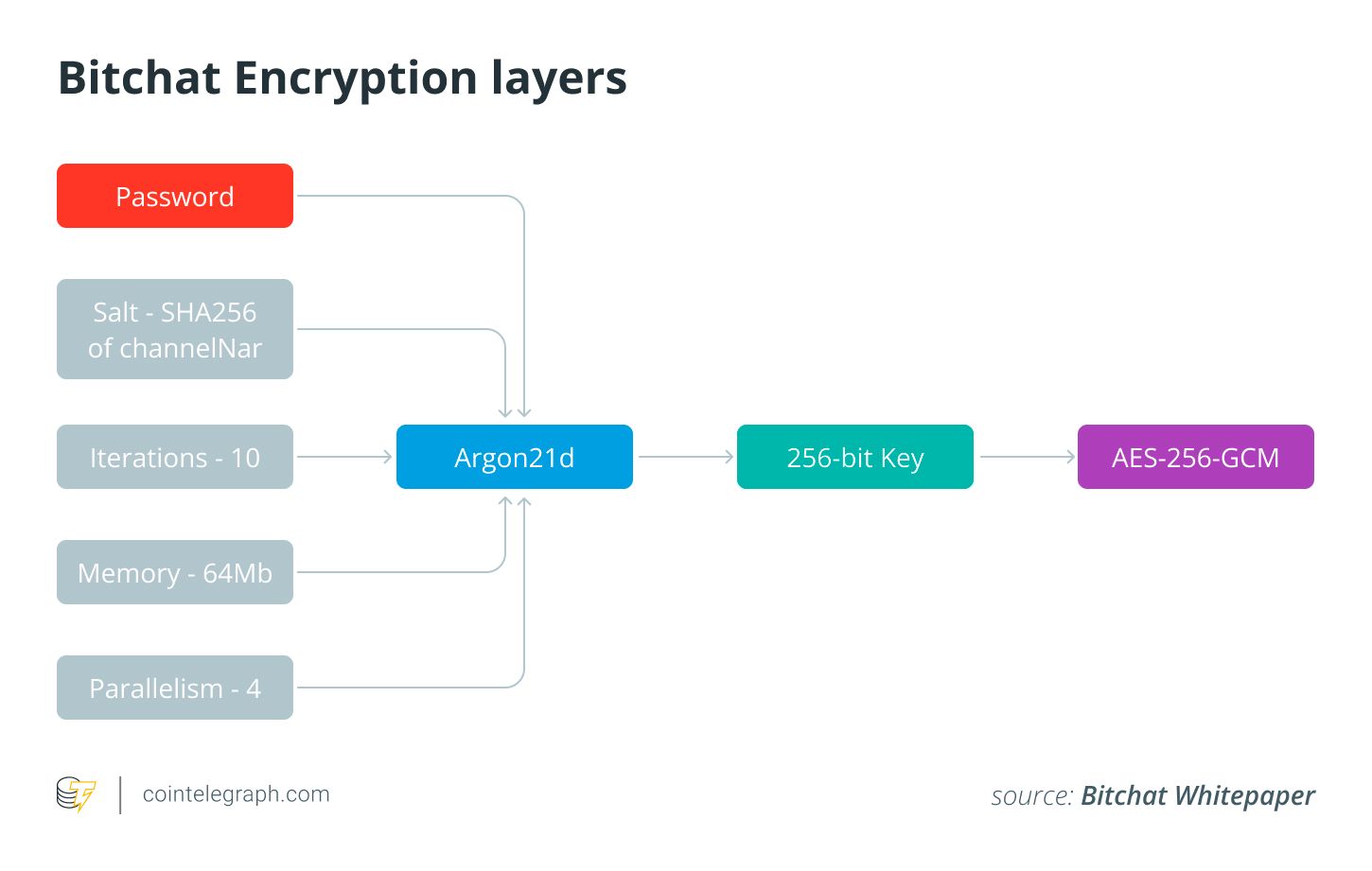

How to Use Bitchat — The Decentralized Messaging App That Works Without Internet

Bitchat isn’t your average messenger. Built for privacy, resilience, and total independence from telecom networks, it uses Bluetooth mesh networking to connect people — even if there’s no internet or cell signal.

Here’s what you need to know to get started and why it matters.

Getting Started

Getting StartedAvailability:

iOS: Only via Apple’s TestFlight (beta version is currently full). Android: An unofficial community build is available on GitHub as an APK. You’ll need to sideload it (download from GitHub and install from your browser).Setup:

No phone number, no email, no personal details. The app automatically assigns you a nickname (like anon1234) — you can change it later. Once open, Bitchat scans for nearby peers via Bluetooth mesh.Using Bitchat:

The interface feels a bit like old-school IRC chat rooms. Messages hop across devices until they reach their destination — no central server involved. Emergency wipe: Triple-tap to instantly clear all local data. Real-World Use Cases

Real-World Use CasesBitchat is not just for privacy enthusiasts — it can be a lifeline:

Disaster Coordination In hurricanes, earthquakes, or blackouts, mesh networks can keep communities and responders connected when cell towers fail. Events & Protests At crowded festivals or rallies where mobile networks jam, Bitchat can run group chats and announcements across the entire venue without internet. Censorship Resistance In regions with restricted internet, messages can be stored locally and sync whenever one device briefly connects to Wi-Fi, spreading across the mesh. Rural Community Links Villages or remote communities can maintain direct comms without needing centralized infrastructure. Did you know? Apps like Bridgefy saw a 4,000% usage spike during the Hong Kong protests thanks to their offline, peer-to-peer messaging power.

Did you know? Apps like Bridgefy saw a 4,000% usage spike during the Hong Kong protests thanks to their offline, peer-to-peer messaging power.

Why Mesh Networks Matter

Why Mesh Networks MatterResilient: No single point of failure. Private: Fully encrypted, no central logs. Censorship-proof: Can’t be shut down like a server-based platform. Global Potential: From Starlink’s satellite mesh to Google Nest’s home mesh, the concept is already growing. ️ What to Keep in Mind

️ What to Keep in MindMesh range is limited — works best in dense areas or events. Messages typically expire after 12 hours on a device. Because of privacy-by-design, law enforcement can’t trace messages, which raises policy debates.Bottom line:

Bitchat isn’t just another chat app — it’s a peek into the future of decentralized communication. Whether you’re at a music festival, in a rural village, or facing an internet blackout, it gives you the power to stay connected without permission from ISPs, governments, or Big Tech. -

Bybit Expands Regulatory Footprint

Bybit has now secured licensing in Austria, India, Dubai (VARA non-operational license), and the UAE SCA, marking a major step in its global expansion despite past setbacks, including a $1.4 billion Ether hack in February. -

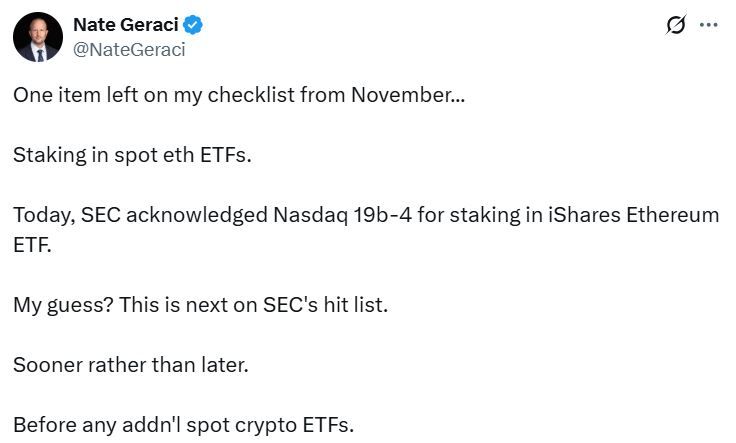

🧠 ETH Staking Approval Could Supercharge Spot ETFs – Here's Why Institutions Are Watching Closely 🧠

It looks like Ethereum might be on the edge of a massive institutional unlock.

The SEC recently acknowledged Nasdaq’s request to add staking functionality to BlackRock’s iShares Ethereum ETF — and if it gets approved, we could be entering a new era for ETH-based ETFs.

What does this mean?

What does this mean?

According to Markus Thielen from 10x Research, staking could reshape the market dynamics entirely. Here’s how:Spot Ether ETFs currently offer around 7% annualized return when arbitraging against futures. Add staking rewards (~3%) into the mix, and you’re looking at 10% unleveraged yield. With 2–3x leverage, some institutions could target 20–30% annualized returns on a relatively low-risk basis trade.Now that’s alpha.

Why institutions will care

Why institutions will care

Ryan McMillin (Merkle Tree Capital) notes that yield is everything for institutions like pension funds. They want predictable income — not just moonshots. And ETH staking offers: Steady returns

Steady returns

Diversification from Bitcoin (ETH as stablecoin & DeFi infrastructure)

Diversification from Bitcoin (ETH as stablecoin & DeFi infrastructure)

Exposure to an asset with real network activity and revenue

Exposure to an asset with real network activity and revenueA 3–5% yield + growth potential? ETH is shaping up as the first real “yield + upside” play in the crypto ETF space.

🧩 More liquidity, more onchain action

Kronos Research CEO Hank Huang puts it simply: ETH ETFs with staking open up compliant, hands-off onchain yield access for big money.“This flips the switch on demand,” he said. “We’re about to see a wave of capital drive valuations higher across the Ethereum ecosystem.” TL;DR:

TL;DR:

If ETH spot ETFs get staking approved, we could see:A rush of institutional inflows Explosive demand for yield-bearing ETH exposure Deeper liquidity across DeFi and ETH derivatives A serious challenge to BTC’s ETF dominanceETH isn't just ultrasound money — it might be ultrasound yield soon, too.