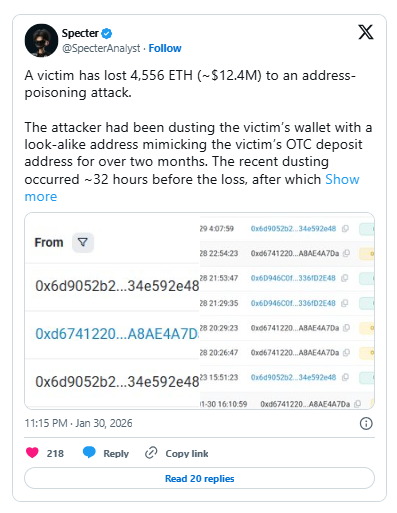

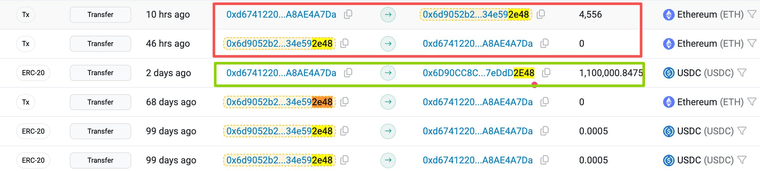

Hackers can craft look-alike Ethereum addresses and manipulate wallet histories to steal millions. In the latest case, an investor lost 4,556 ETH (~$12.4M) after copying a fraudulent address from their recent transactions.

Wallet interfaces that truncate addresses make this easier, hiding the middle characters. Institutional investors are urged to whitelist addresses and verify all high-value transfers carefully.