📉 Bitcoin Dips Ahead of Jackson Hole – Calm Before the Storm?

-

Crypto markets are holding their breath as Jerome Powell heads to the Fed’s Jackson Hole gathering this Friday. His speech could set the tone for September’s FOMC meeting and, by extension, the next leg of the Bitcoin rally (or its pause).

🪙 Bitcoin Price Action

BTC briefly dipped to $112,565 this week — a two-week low.

Analysts call it “fear spikes” in response to Powell’s anticipated remarks.

Key level to watch: $112,000 support. If it holds through the speech, traders see potential for a rebound instead of a reset.

Macro Tensions

Macro TensionsCPI stuck at 2.7% YoY (well above Fed’s 2% target).

Probability of a September rate cut dropped from 94% → 82% (CME FedWatch).

Markets now expect 2–3 cuts in 2025 if Powell signals dovishness.

As Bitwise’s André Dragosch put it:

“The moment you see further rate cuts by the Fed… it implies acceleration and US money supply growth.”

Translation: more fuel for the Bitcoin rally.

Corporate Accumulation Continues

Corporate Accumulation ContinuesEven as retail investors get jittery, big money keeps stacking sats:

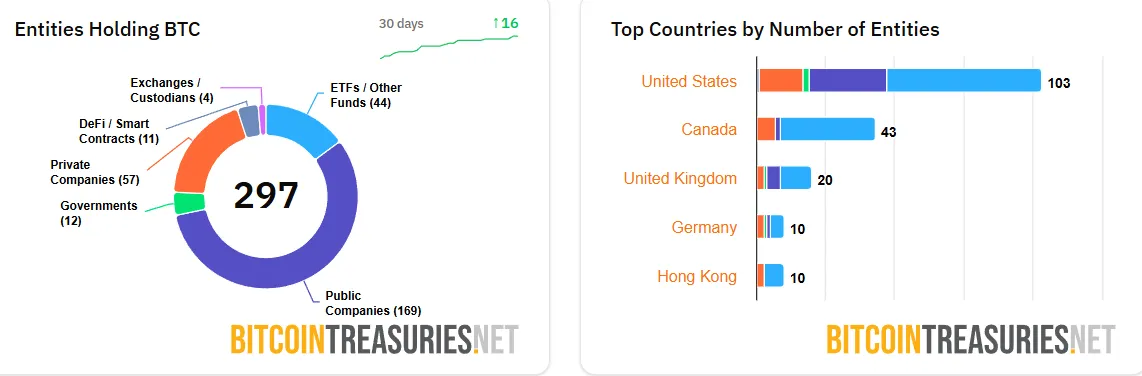

297 public entities now hold Bitcoin (up from 124 in June).

This includes 169 public firms, 57 private companies, 44 ETFs/funds, and 12 governments.

Collectively: 3.67 million BTC (17% of supply) locked away.

The Setup

The SetupShort-term: Eyes glued on Jackson Hole and Powell’s tone.

Medium-term: If rate cuts materialize, liquidity growth could give BTC the push it needs for another leg up.

Long-term: Institutional accumulation suggests fewer cheap sats left for the little guys.

Question for the room: Do you see Powell’s Jackson Hole speech as a make-or-break moment for this bull run — or just another bump in the macro road?

Question for the room: Do you see Powell’s Jackson Hole speech as a make-or-break moment for this bull run — or just another bump in the macro road? -

This feels like one of those “history rhymes” moments. Jackson Hole has often been the stage where Powell drops hints that ripple through every risk asset, and Bitcoin is no exception. The fact that BTC already dipped to $112,565 on just anticipation tells you how sensitive this market is right now.

The $112K level is absolutely key — it’s not just technical support, it’s also psychological. If Powell comes out hawkish and the floor breaks, we might see a cascade of stop hunts down toward the $110K handle. But if he hints even slightly dovish, we could see a classic “sell the rumor, buy the news” rebound.

What excites me more than Powell’s words, though, is the institutional stacking. Nearly 3.7M BTC in public + government hands is insane. That’s 17% of supply off the market, effectively raising the scarcity floor. Even if Powell temporarily spooks the market, the long-term setup looks way too bullish to ignore. 🟠

Question to everyone: Would you use a Powell-dip as a buying opportunity, or do you wait until September FOMC gives more clarity?

-

Great breakdown

. To me, Powell’s Jackson Hole speech is less about this week’s candle and more about the narrative shift heading into Q4. If he signals that inflation progress has stalled, risk markets will wobble. If he acknowledges the need for more cuts despite 2.7% CPI, that’s basically a green light for liquidity to flow back into assets like BTC.

. To me, Powell’s Jackson Hole speech is less about this week’s candle and more about the narrative shift heading into Q4. If he signals that inflation progress has stalled, risk markets will wobble. If he acknowledges the need for more cuts despite 2.7% CPI, that’s basically a green light for liquidity to flow back into assets like BTC.The CME odds dropping from 94% → 82% is telling. Markets hate uncertainty, and Bitcoin thrives on liquidity certainty. Add in the fact that corporate + government entities now hold nearly one-fifth of total BTC supply, and you’ve got the recipe for a “supply shock” environment whenever the Fed eases up.

Bottom line: Powell’s tone is the spark, but institutional accumulation is the fuel. Whether this week is a make-or-break moment depends on your timeframe. Traders may see volatility, but long-term hodlers probably see another opportunity to front-run what big money already knows.

Curious: Do you think we break $120K before end of September, or does Powell stall the rally until Q4?

Curious: Do you think we break $120K before end of September, or does Powell stall the rally until Q4?