madtrader

Posts

-

waiting for the guys to buy the dip -

when ATH?

-

wait till for next pump

-

Global competition and regulatory shifts squeeze Indonesian exchanges

Indonesia’s crypto market has grown more competitive following a regulatory transition in early 2025 that moved oversight to OJK and expanded the number of licensed exchanges to 29. The increased competition has intensified margin pressure in a market already facing declining domestic volumes.At the same time, global players are moving in. Robinhood, Bybit, and Binance have all announced expansions or partnerships in Indonesia, bringing deeper capital and global infrastructure into the local market. Unlicensed platforms continue to add pressure, costing the country an estimated $70–110 million in lost tax revenue annually.

As regulators investigate recent consumer complaints, industry leaders are calling for stronger enforcement and closer collaboration to restore trust and stabilize the domestic crypto sector.

-

Indonesian traders favor overseas platforms as domestic volumes fall

Indonesia’s total crypto transaction value dropped to IDR 482.23 trillion (about $30 billion) in 2025, down sharply from IDR 650 trillion the previous year, according to OJK data. The regulator attributes the decline to traders increasingly using regional and global exchanges instead of local platforms.

Industry executives cite cost and efficiency as key drivers. Domestic exchanges face tax and compliance requirements that overseas platforms do not, even though foreign services remain accessible to Indonesian users through VPNs and local banking channels.

Users also report faster withdrawals and lower fees abroad, while lingering trust issues following past security incidents have further weakened confidence in local exchanges.

-

Most Indonesian crypto exchanges remain unprofitable despite user growth

Indonesia’s crypto user base has surpassed 20 million, but profitability remains elusive for most domestic exchanges. According to the Financial Services Authority (OJK), roughly 72% of licensed crypto exchanges in the country were still unprofitable at the end of 2025.

The figures highlight a structural imbalance in the market. While retail adoption continues to grow, a significant portion of trading activity is shifting to overseas platforms. As a result, local exchanges are competing for a shrinking share of domestic transaction volume.

Regulators say the challenge is not user demand, but where that demand is being served — a trend that raises concerns about the long-term viability of Indonesia’s licensed crypto ecosystem.

-

Banks warn stablecoins could drain trillions from deposits

Opposition from banks centers on one fear: deposits leaving the traditional financial system. Standard Chartered estimates that if the stablecoin market grows to $2 trillion, developed-market banks could lose up to $500 billion in deposits by 2028, with emerging markets facing losses approaching $1 trillion.Bank executives argue the risk is structural, not cyclical. Stablecoin reserves are largely held in Treasury bills rather than bank deposits, meaning money that exits the system is unlikely to return. Bank of America’s CEO has warned that as much as $6 trillion in US deposits could eventually migrate to stablecoins.

At the heart of the dispute is whether stablecoin-linked yield should be allowed—an issue now central to both regulatory negotiations and the crypto industry’s growing political clout.

-

White House steps in as crypto market structure bill stalls

As crypto money floods into politics, the industry’s top legislative priority remains stuck. The CLARITY Act, a sweeping bill aimed at defining digital asset market structure, was pulled from a Senate Banking Committee vote earlier this month after banks and crypto firms clashed over stablecoin rules.

Now, the White House is intervening directly. President Trump’s crypto policy council is convening executives from traditional finance and the crypto sector to negotiate a compromise, according to industry groups involved in the talks.

The move underscores the bill’s urgency for the administration, which campaigned heavily on crypto support and now faces pressure to deliver regulatory clarity amid rising political stakes.

-

Crypto industry amasses $193M war chest ahead of midterms

The cryptocurrency industry is entering the 2026 midterm cycle with unprecedented political firepower. Crypto-focused super PAC Fairshake disclosed it held $193 million at the end of 2025—nearly matching what it spent during the entire 2024 election cycle, with campaigns still months away.Major contributors include Ripple, Coinbase, and venture firm a16z, which together added tens of millions over the past year. Fairshake says the funds will be used to support pro-crypto candidates and oppose lawmakers seen as hostile to digital assets.

The scale of the war chest has shifted Washington’s calculus. With midterms ten months away, the industry’s political leverage is already shaping negotiations around stalled crypto legislation.

-

A growing divide in the race for general-purpose robotics

Physical Intelligence is part of a broader race to build general-purpose robotic intelligence, but its research-first approach contrasts sharply with competitors like Skild AI. While Physical Intelligence avoids near-term commercialization, Skild AI has already deployed its systems across security, warehouses, and manufacturing, generating tens of millions in revenue.

The divide reflects a deeper philosophical split in robotics. Skild argues that real-world deployment creates a data flywheel that accelerates progress, while Physical Intelligence believes resisting commercial pressure leads to better foundational intelligence.

Which strategy will prevail remains unclear and may take years to determine. For now, both approaches highlight the growing momentum — and high stakes — in the push to bring adaptable, intelligent robots into the real world.

-

Physical Intelligence raises over $1B with no rush to monetize

Two-year-old robotics startup Physical Intelligence has raised more than $1 billion from investors including Sequoia Capital, Khosla Ventures, and Thrive Capital, reaching a reported valuation of $5.6 billion. Despite the massive funding, the company offers investors no clear timeline for commercialization.

Co-founder and CEO Lachy Groom says the focus remains squarely on research rather than revenue. Most spending goes toward compute, not headcount, and the company operates with roughly 80 employees. Groom argues that prematurely chasing products could limit the company’s ability to build truly general robotic intelligence.

While the lack of a business roadmap might concern some investors, Groom says strong capitalization is essential to pursue long-term breakthroughs in a field where progress is expensive and uncertain.

-

Inside Physical Intelligence, where robots learn like ChatGPT

From the street, Physical Intelligence’s San Francisco headquarters is almost invisible, marked only by a subtly colored pi symbol on the door. Inside, however, the space is alive with activity. Robotic arms sit atop long wooden tables, attempting everyday tasks like folding clothes, turning shirts inside out, and peeling vegetables.

The startup, co-founded by UC Berkeley professor Sergey Levine, is building general-purpose robotic intelligence — an approach Levine describes as “ChatGPT, but for robots.” Data collected from robots operating in labs, kitchens, warehouses, and homes is used to train foundation models that can generalize across tasks and environments.

The hardware itself is intentionally inexpensive and unpolished. The company’s bet is that strong intelligence can compensate for weak hardware, allowing robots to master mundane tasks that once seemed out of reach.

-

Leverage reset and quantum fears shape cautious Bitcoin outlook

Bitcoin’s recent selloff liquidated approximately $860 million in leveraged long futures positions, suggesting many traders were caught offside. Despite this, overall BTC futures open interest has declined significantly compared to three months ago, indicating that excessive leverage has already been reduced.

Some analysts view this as a stabilizing factor, arguing that markets tend to be healthier after speculative leverage is flushed out. However, investor anxiety has also been fueled by longer-term concerns, including the potential impact of quantum computing on blockchain security.

While industry experts say such risks remain distant, derivatives data and stablecoin flows point to a cautious mood. Bitcoin’s ability to reclaim higher levels may depend on easing macro pressures and renewed confidence across global markets.

-

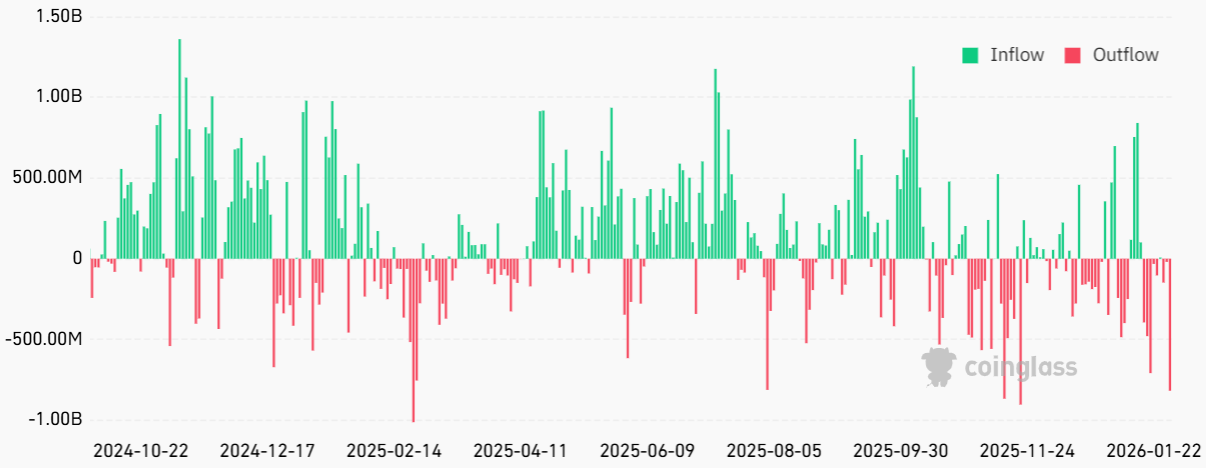

Bitcoin retests $81K as ETF outflows and gold moves weigh on sentiment

Bitcoin experienced a sharp 10% correction between Wednesday and Thursday, briefly retesting the $81,000 level for the first time in more than two months. The move came amid growing caution following significant outflows from US-listed spot Bitcoin ETFs.

Since Jan. 16, spot Bitcoin ETFs have recorded roughly $2.7 billion in net outflows, equivalent to about 2.3% of total assets under management. At the same time, gold prices fell sharply from recent all-time highs after posting strong gains over the past three months.

The combination has led traders to question the strength of Bitcoin’s $80,000 psychological support, with some suggesting institutional demand may be pausing as broader macro uncertainty drives risk aversion.

-

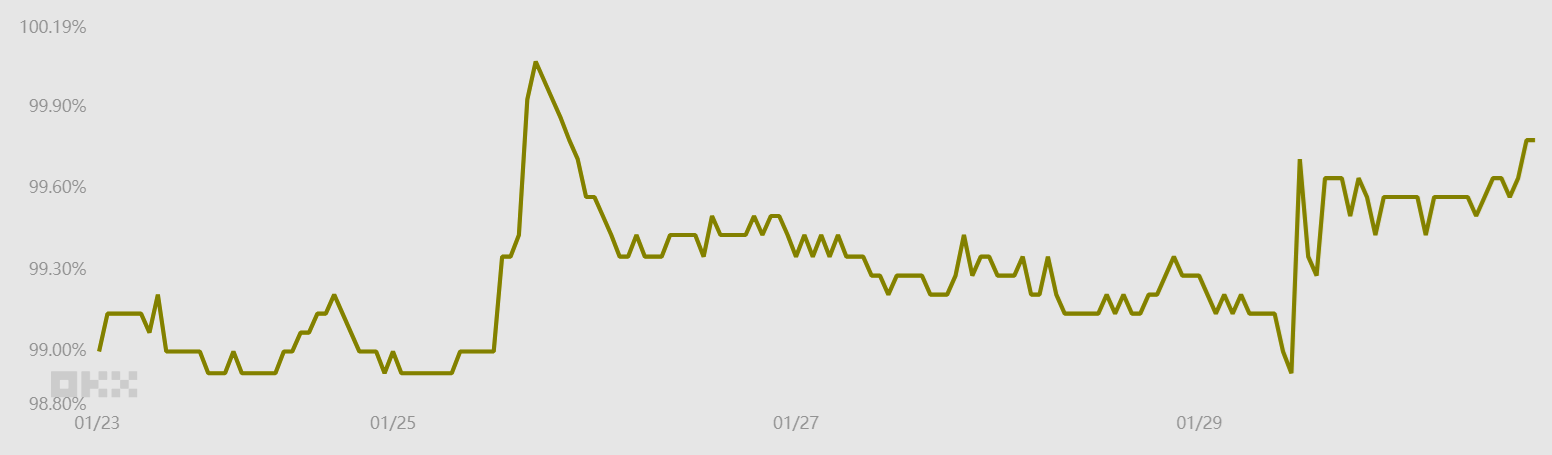

Bitcoin options signal highest fear in over a year

Bitcoin derivatives are flashing heightened fear, with options markets showing their most bearish sentiment in over a year. The BTC options delta skew surged to 17% on Friday, far above the level typically seen in neutral conditions, where put options trade at a modest premium to calls.

Such elevated skew levels suggest traders are aggressively hedging against further downside, often a sign of extreme caution. This shift follows a sharp selloff that pushed Bitcoin lower by double digits over the past two weeks, increasing volatility expectations among market makers.

Analysts note that while extreme fear can amplify short-term price swings, it has historically appeared near periods of market stress rather than sustained rallies. Bitcoin derivatives now reflect a market bracing for uncertainty rather than confident directional bets.

-

Industry leaders say crypto sentiment slump may be temporary

Despite the current downturn in market sentiment, some crypto industry leaders believe the pessimism may be short-lived. Crypto analyst Benjamin Cowen said expectations of a near-term rotation from traditional assets like gold and silver into Bitcoin are likely overestimated, suggesting patience may be required.

Meanwhile, Coinbase chief business officer Shan Aggarwal pointed to behind-the-scenes industry activity as a reason for optimism. In a post on X, Aggarwal noted that major financial institutions, including Mastercard, PayPal, American Express and JPMorgan, are actively hiring for crypto-related roles.

“Just a blip,” Aggarwal said, adding that early signals of long-term growth remain intact. Bitwise CEO Hunter Horsley echoed the sentiment, stating that the crypto sector is “hurtling toward the mainstream,” despite near-term volatility.

-

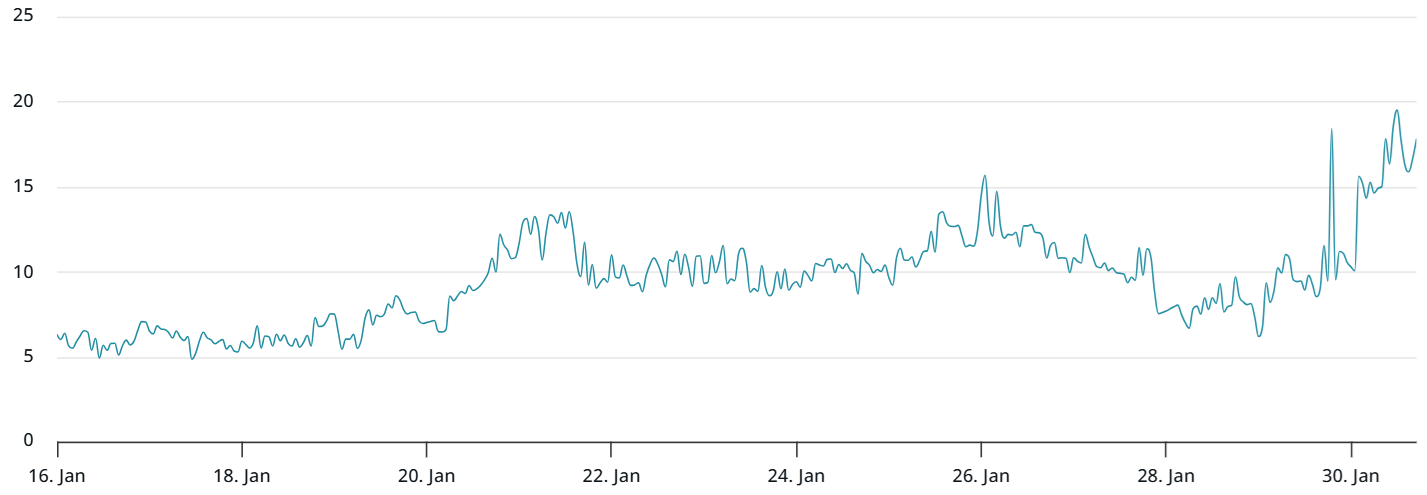

Extreme fear returns as Bitcoin and Ether extend weekly losses

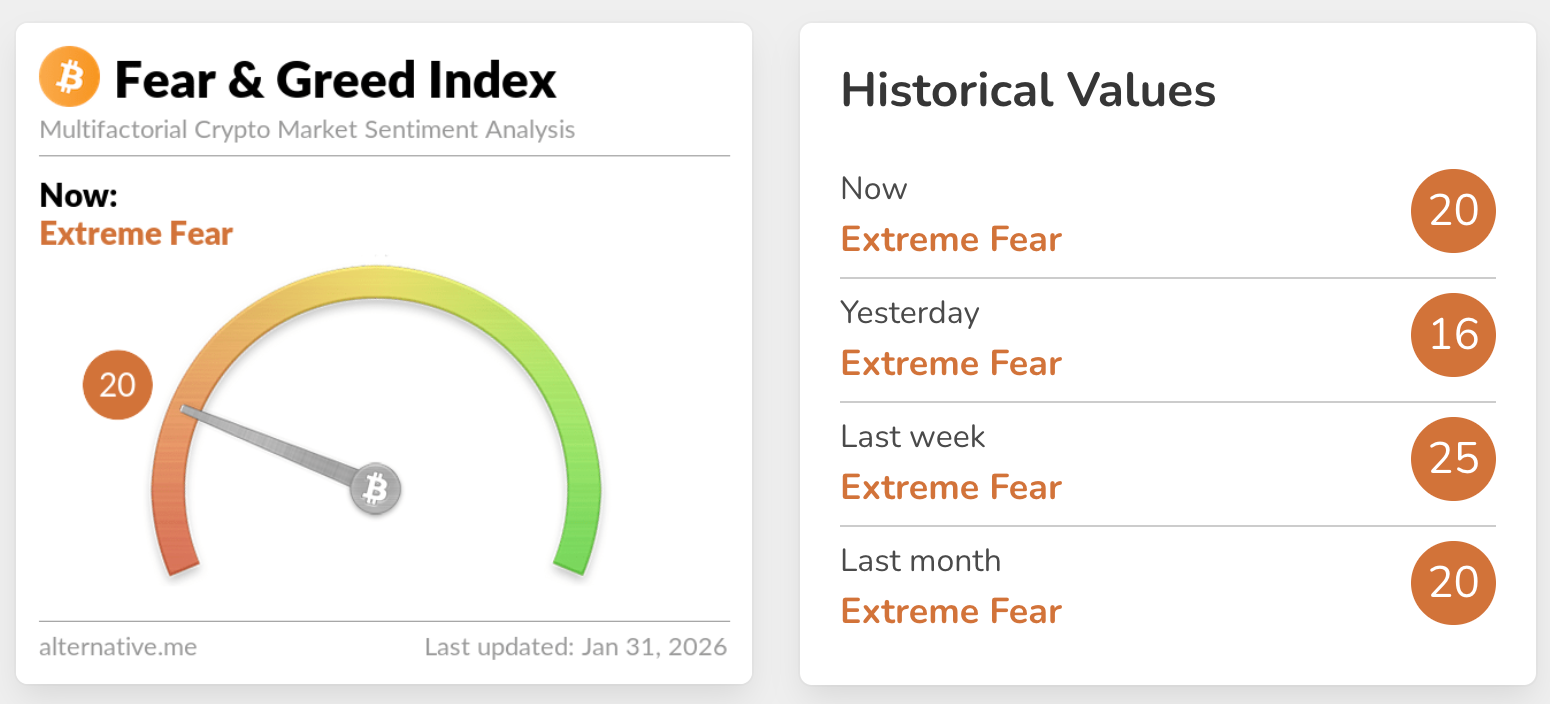

Investor caution has returned to the crypto market, with sentiment slipping back into “Extreme Fear” after a brief period of stabilization. The Crypto Fear & Greed Index moved into extreme fear territory on Thursday after remaining in “Fear” since January 20.

The shift comes amid notable price declines. Bitcoin has fallen nearly 7% over the past seven days, while Ether is down more than 9%, according to CoinMarketCap data. Bitcoin has also dropped over 4% in the past 30 days and continues to trade below the key $100,000 psychological level.

Bitcoin has not reclaimed that level since November 13, leading some analysts to question whether the market is entering a prolonged bearish phase. However, others argue that heightened fear could signal exhaustion rather than further downside.

-

Crypto sentiment hits year-low, flashing possible rebound signal

Crypto market sentiment has dropped to its lowest level of the year, a development that may hint at a potential rebound, according to crypto analytics platform Santiment.

In a report released Friday, Santiment said current sentiment data stands out as one of the few bullish indicators in an otherwise cautious market. The firm pointed to extreme negativity across social media, where bearish commentary now heavily outweighs bullish sentiment.

The Crypto Fear & Greed Index reflected this mood, posting an “Extreme Fear” score of 20 on Saturday. A day earlier, the index fell to 16 — its lowest reading in 2026 and the first time it reached that level since December 19.

Historically, Santiment noted, periods of intense fear have often preceded market reversals, as crypto prices tend to move against prevailing crowd expectations.

-

crypto be like

-

BTC to the MOOON