ITER’s planned Bitcoin liquidation occurs amid heightened crypto regulation in Spain, including stricter tax reporting and disclosure requirements aligned with the EU’s MiCA framework.

By selling through authorized channels, the institute sets an example for transparent, compliant public-sector crypto transactions.

Novo Nordisk: A Healthy Pullback in a Long-Term Growth Story

Novo Nordisk: A Healthy Pullback in a Long-Term Growth Story 130 to around

130 to around  From Breakthrough Buzz to Market Reset

From Breakthrough Buzz to Market Reset The Bigger Picture

The Bigger Picture , riding steady innovation and strong global demand.

, riding steady innovation and strong global demand. A Discounted Opportunity?

A Discounted Opportunity? Strong fundamentals can lead to temporary overvaluation during hype cycles.

Strong fundamentals can lead to temporary overvaluation during hype cycles. Pullbacks are natural and healthy in long-term uptrends.

Pullbacks are natural and healthy in long-term uptrends. Quality companies often reward patience when bought during corrections.

Quality companies often reward patience when bought during corrections.

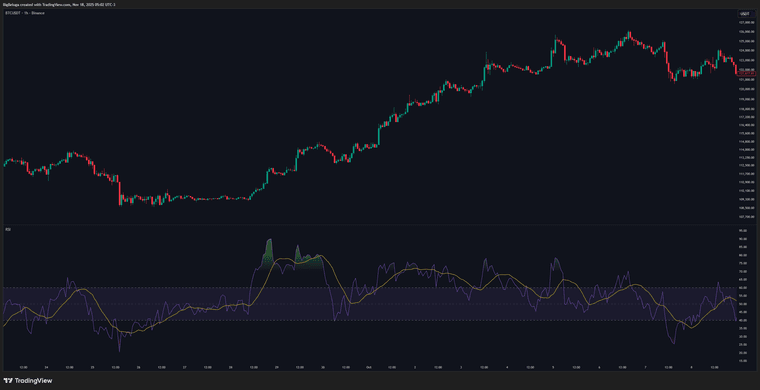

Mastering RSI: A Complete Guide to Momentum, Regimes, Reversals & Professional Signals

Mastering RSI: A Complete Guide to Momentum, Regimes, Reversals & Professional Signals

(Advanced)

(Advanced)