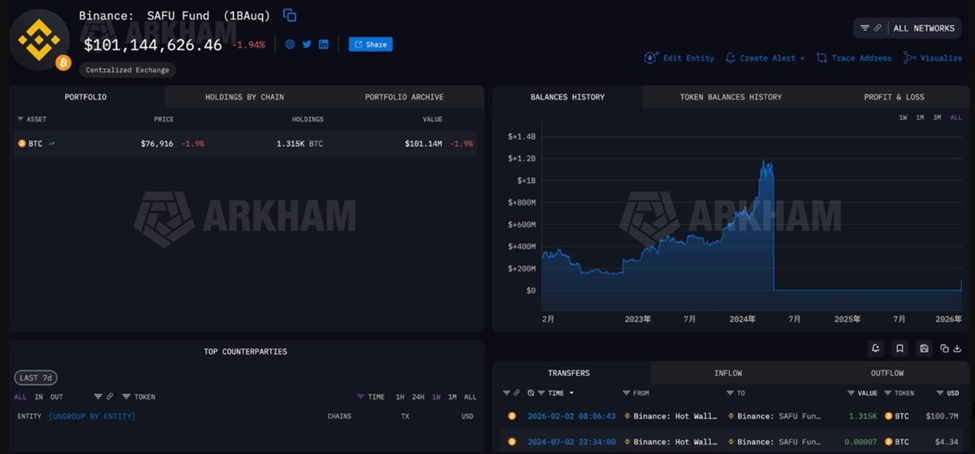

Binance’s first SAFU Bitcoin purchase arrives amid broader signs of accumulation from large market players.

On-chain activity suggests the SAFU address is preparing for further transfers, often a precursor to additional purchases. At the same time, other signals of confidence are emerging. Strategy executive chair Michael Saylor recently posted a cryptic “More Orange” message, widely interpreted as a hint at another Bitcoin acquisition.

Meanwhile, data from CryptoQuant shows that whales have continued accumulating BTC throughout the recent market pullback. Taken together, these moves are reinforcing the idea that deep-pocketed players may be stepping in to stabilize Bitcoin organically.

With hundreds of millions in SAFU conversions still ahead, Binance has positioned itself as one of the most influential buyers in the current market cycle.