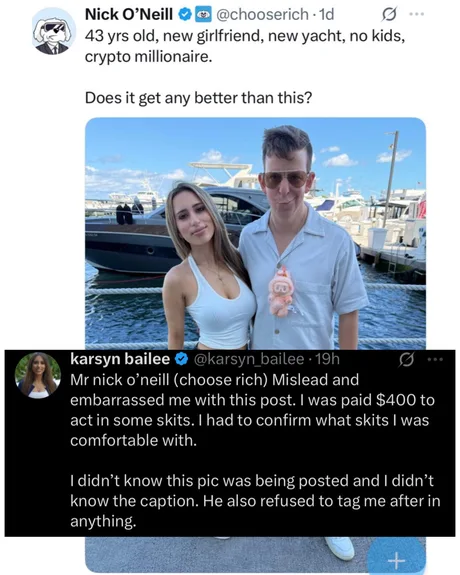

lingriiddd

Posts

-

bruh -

🇳🇱 Amdax Raises €20M to Launch Bitcoin Treasury on Euronext

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

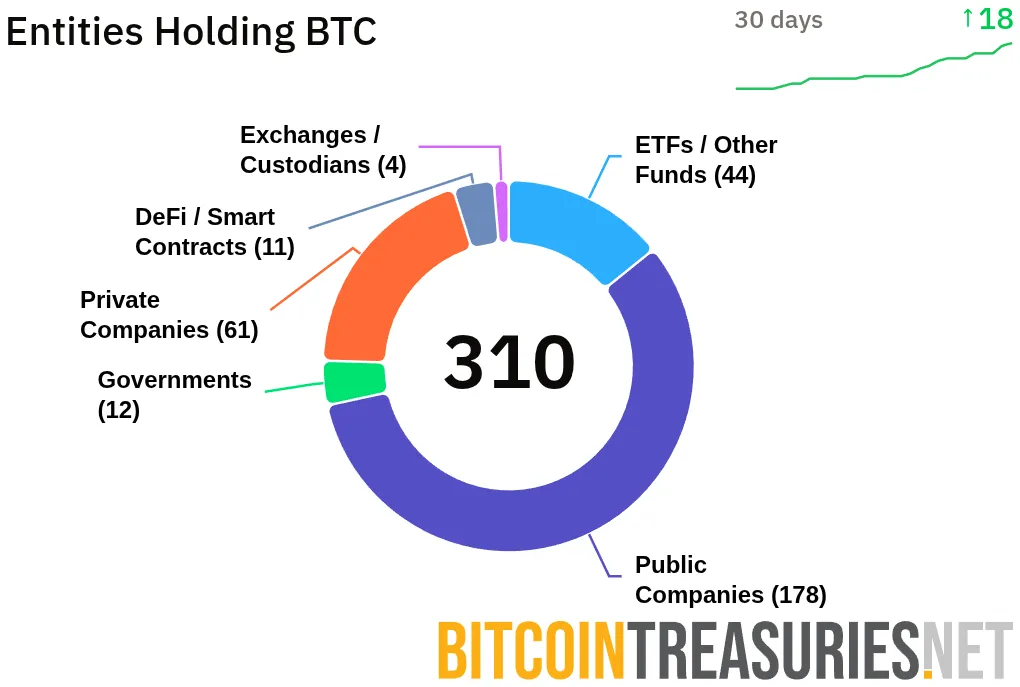

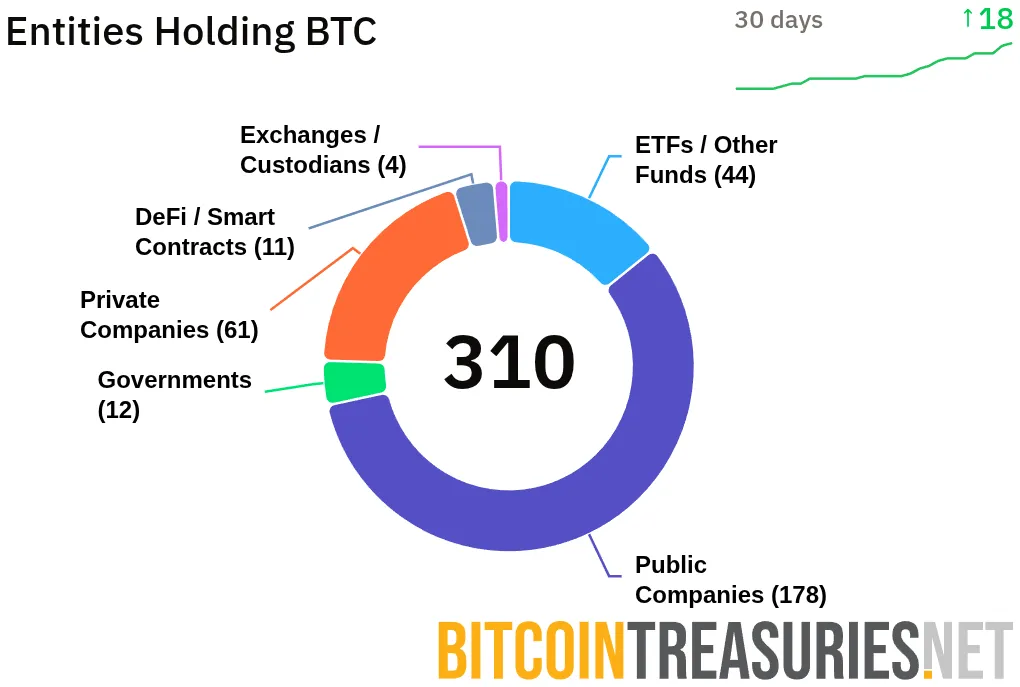

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands? -

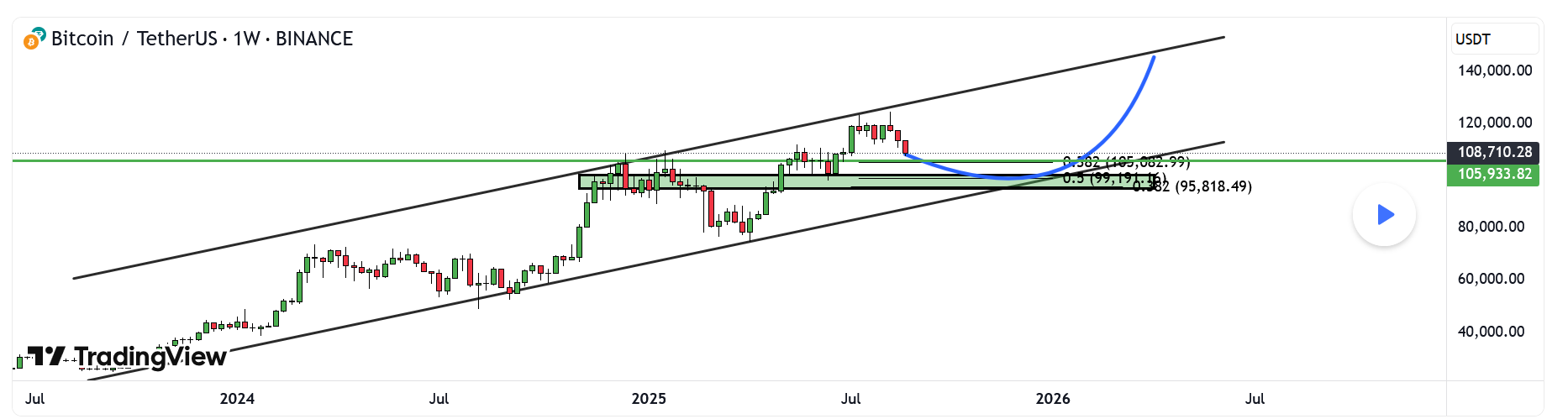

BTCUSDT

Hello Traders!

What are your thoughts on BITCOIN?

Bitcoin has entered a corrective phase after printing a new all-time high and reaching the top of its ascending channel.

This pullback is expected to extend towards the key support zones, and in a deeper scenario, it could test the bottom of the channel.

As long as Bitcoin holds above these support areas and reacts positively at the lower boundary of the channel, the broader outlook remains bullish, with potential for new all-time high

However, a decisive break below the channel’s bottom would invalidate the medium-term bullish scenario and raise the risk of a deeper correction.

The current correction may provide a valuable opportunity for medium- to long-term traders to re-enter the market.

Don’t forget to like and share your thoughts in the comments! ️

️ -

AXIS BANK

Multi-Timeframe (MTF) Analysis – AXIS BANK

Multi-Timeframe (MTF) Analysis – AXIS BANK

TF Zone Trend Logic Proximal Distal Avg

Yearly Demand UP Demand 867 616 742

Half-Yearly Demand UP BUFL 1151 814 983

Quarterly Demand UP BUFL 1151 814 983

Monthly Demand UP BUFL 970 814 892

Weekly Demand UP BUFL 945 814 880

Daily Demand UP DMIP BUFL 964 814 889

Intraday (60m–240m) Demand UP DMIP 964 814 889 HTF Average Zone: 1056 – 748

HTF Average Zone: 1056 – 748

MTF Average Zone: 960 – 814

MTF Average Zone: 960 – 814

ITF Average Zone: 964 – 814

ITF Average Zone: 964 – 814 Trading above 1135 (with bullish daily close) confirms strength and continuation of uptrend.

Trading above 1135 (with bullish daily close) confirms strength and continuation of uptrend. Trade Plan – AXIS BANK

Trade Plan – AXIS BANKEntry Price: 964

Stop Loss (SL): 814

Target: 1400

Last Swing High: 1250

Last Swing Low: 814

Capital & Risk-Reward

Capital & Risk-RewardQty to Buy: 5000

Investment Value: ₹4,820,000

Risk per Trade (SL 814): ₹750,000

Potential Reward (Target 1400): ₹2,180,000

Net Profit after Brokerage (0.49%): ₹2,156,373

Net Loss if SL Hit: ₹773,627

Risk-Reward Ratio (RR): ~2.79

ROI & Interest Impact

ROI & Interest ImpactCapital at Risk: ₹964,000

MTF Capital Required: ₹3,856,000

Estimated Duration to Target: 4 months

Interest Cost (9.69% p.a.): ₹122,843

Net Profit After Cost: ₹2,033,531

Real ROI (4 months): 211%

Key Notes for Execution

Key Notes for ExecutionEntry only if price sustains above 964 with volumes.

Major confirmation comes on daily close above 1135 (strong bullish trigger).

Partial booking possible near 1250 (last high); trail SL to cost after breakout.

Safe RR ~2.8 means the trade is attractive for positional holding.

-

🇳🇱 Amdax Raises €20M to Launch Bitcoin Treasury on Euronext

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands? -

Halls of Torment Updates

️ Halls of Torment is leveling up!

️ Halls of Torment is leveling up!Oct. 23: Game launches on Xbox Series X|S & PS5

Oct. 28: Free Bardcore update adds 20+ quests, 3 metal tracks, 6 new endgame artifacts, and the Bard character!

Plus, Boglands DLC brings new stage, 2 heroes, 6 artifacts & 50+ quests.

#HallsOfTorment #Roguelite #DarkFantasy #GameUpdate -

FBI Warns of Fake ‘Crypto Recovery Law Firms’ Targeting Scam Victims

The U.S. Federal Bureau of Investigation (FBI) has issued a fresh public service announcement warning victims of crypto scams about fraudulent “law firms” that claim they can recover stolen funds.

According to the bureau, these fictitious firms specifically target individuals who have already been scammed, putting them at risk of losing more money or compromising their personal information.

Key Red Flags

The FBI cautions against:

Accepting unsolicited help from anyone recommending a “crypto recovery law firm”

Paying a firm that demands cryptocurrency or prepaid gift cards as payment

Trusting law firms that contact you unexpectedly — especially if you haven’t reported the original scam to law enforcement

“Be cautious of law firms contacting you unexpectedly, especially if you have not reported the crime to any law enforcement or civil protection agencies,” the notice reads.

Part of a Larger Trend

This is the FBI’s third warning on the issue, following similar advisories in August 2023 and June 2024. It comes amid sobering statistics from blockchain security firm CertiK, which recorded $2.5 billion lost to hacks, exploits, and scams in just the first half of 2025.

While some exchanges and companies have successfully recovered stolen funds, many victims end up turning to third parties — making them prime targets for “double victimization” scams.

Law Enforcement and Crypto Seizures

The FBI is frequently involved in crypto-related fraud cases, seizures, and investigations. U.S. Treasury Secretary Scott Bessent has said that seized digital assets will go toward the national crypto and Bitcoin stockpile, once any victim compensation is addressed.

Recent examples include:

April 2025 – Dallas FBI seized $2.4 million in Bitcoin allegedly tied to a hacking group member

July 2025 – Federal lawsuit filed seeking government claim over the seized funds

Escalating Threats Against Crypto Holders

Beyond scams, some criminals have resorted to physical threats and kidnappings to steal digital assets. SatoshiLabs founder Alena Vranova estimates that at least one Bitcoiner a week worldwide is targeted in such incidents.

Bottom line: The FBI’s message is clear — if someone offers to recover stolen crypto for a fee, especially in crypto or gift cards, treat it as a scam. Victims should report incidents directly to law enforcement rather than relying on unsolicited “recovery” services.

-

Newbies, What's up?

-

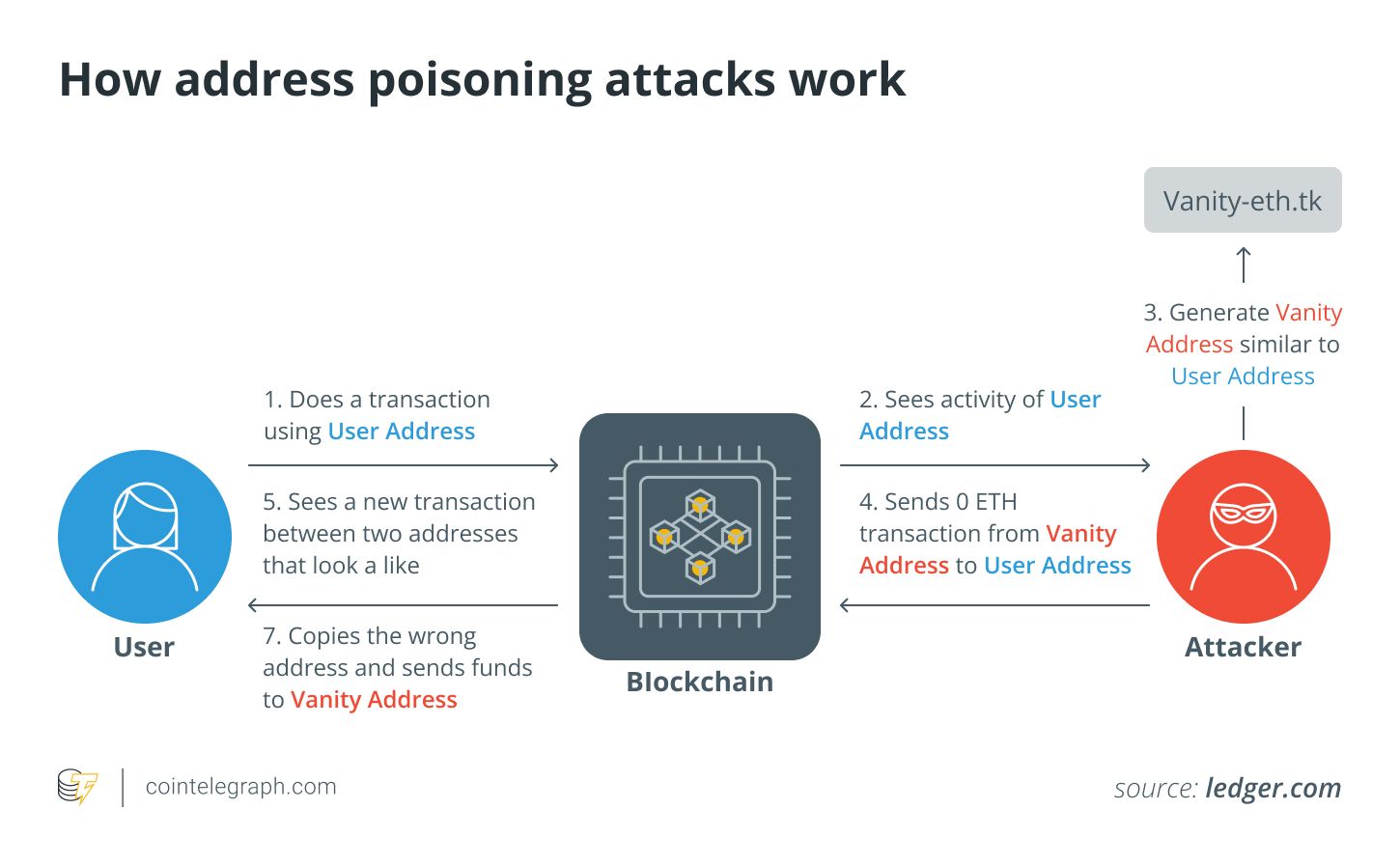

Crypto Address Poisoning Scams Steal $1.6M in a Week — Largest Spike This Year

Scammers using crypto address poisoning tactics netted more than $1.6 million from unsuspecting users this week — surpassing total losses for the entire month of March, according to alerts from ScamSniffer and Web3 Antivirus.

Million-Dollar Losses in Days

Friday: One victim lost 140 ETH (~$636,500) after sending funds to a lookalike address embedded in their wallet’s transaction history.

Sunday: Another victim lost $880,000 in USDT in a similar attack.

Other cases this week include individual losses of $80,000 and $62,000.

ScamSniffer says the $636K victim’s history was “full of poison address attacks,” making it “only a matter of time before the trap worked.”

How Address Poisoning Works

Address poisoning exploits human copy-paste habits:

Scammer sends a tiny transaction from an address that closely resembles a legitimate one.

The fake address appears in the victim’s transaction history.

When the victim later copies it for a payment, the funds are sent to the attacker.

“Poisoners send small transfers from addresses that mimic a real one, so copying from history becomes a trap,” said Web3 Antivirus.

Phishing Signatures Compound Losses

On top of address poisoning, scammers also stole $600,000+ this week through malicious signature requests — tricking victims into signing “approve,” “increaseAllowance,” and “permit” transactions.

Tuesday: One victim lost $165,000 in BLOCK and DOLO tokens after approving a malicious signature.

Security Warnings

Experts stress:

Never copy wallet addresses from transaction history — use an address book or whitelist.

Verify the full address before sending, not just the first/last characters.

Treat unsolicited signature requests as suspicious.

“We sound like a broken record, but it’s worth mentioning again,” wrote Web3 Antivirus.

Bottom line: Address poisoning is surging, and attackers are pairing it with phishing signatures to drain wallets faster. With over $1.6M stolen in under a week, this vector is now one of the most dangerous active scams in Web3.

-

High-Profile Crypto Case Could Reopen

If the appeals court rules in SBF’s favor, his case could be sent back for a new trial, reopening one of the most prominent fraud cases in cryptocurrency history. A decision from the Second Circuit is expected in the coming months, keeping the crypto community closely watching the outcome. -

🇨🇭 Satoshi Nakamoto Statue Recovered After Vandalism in Switzerland

The iconic statue honoring Satoshi Nakamoto, the mysterious creator of Bitcoin, has been recovered by the city of Lugano after being stolen and thrown into Lake Lugano over the weekend.

Originally unveiled in October 2024 by Italian artist Valentina Picozzi, the statue has become a global symbol of the Bitcoin movement. Crafted over 21 months, it was installed in the scenic Parco Ciani — only to be ripped from its base and tossed into the lake on Swiss National Day.

Originally unveiled in October 2024 by Italian artist Valentina Picozzi, the statue has become a global symbol of the Bitcoin movement. Crafted over 21 months, it was installed in the scenic Parco Ciani — only to be ripped from its base and tossed into the lake on Swiss National Day. Municipal workers found the statue in pieces, suggesting vandalism, not theft, as the motive. Satoshigallery, the art collective behind the installation, had offered a 0.1 BTC reward (~$11,000) for its safe return.

Municipal workers found the statue in pieces, suggesting vandalism, not theft, as the motive. Satoshigallery, the art collective behind the installation, had offered a 0.1 BTC reward (~$11,000) for its safe return. “You can steal our symbol, but you will never be able to steal our souls,” the collective said defiantly — adding that they still plan to place 21 statues globally, representing Bitcoin’s 21 million coin cap.

“You can steal our symbol, but you will never be able to steal our souls,” the collective said defiantly — adding that they still plan to place 21 statues globally, representing Bitcoin’s 21 million coin cap. The Bitcoin community responded with outrage and unity:

The Bitcoin community responded with outrage and unity:“Such a tasteless and stupid thing to do,” said Gabor Gurbacs. Tether CEO Paolo Ardoino replied with a ❤️ emoji. Some speculate the act was carried out by drunken revelers during Swiss National Day celebrations — but no suspects have been identified yet.

Some speculate the act was carried out by drunken revelers during Swiss National Day celebrations — but no suspects have been identified yet. Symbolism Lives On

Symbolism Lives On

The damage may be physical, but Bitcoin's ideals — decentralization, freedom, and innovation — remain untouchable. The statue will likely be restored, and its story now stands as a testament to the resilience of the crypto community. Stay tuned — there are 20 more Satoshi statues to go.

Stay tuned — there are 20 more Satoshi statues to go. -

FedEx shares rise premarket as cost-cutting helps results top expectations Shares of FedEx rose in premarket U.S. trading on Friday after the shipping group reported quarterly profit above Wall Street expectations and issued a full-year outlook that brackets analyst estimates.

Shares of FedEx rose in premarket U.S. trading on Friday after the shipping group reported quarterly profit above Wall Street expectations and issued a full-year outlook that brackets analyst estimates.Memphis-based FedEx was bolstered by a drive to bring down costs, which helped to counterbalance soft international volumes following the end of a tariff exemption for certain low-value products sent directly to consumers.

As part of a bid to slash expenses by $1 billion during its current fiscal year, FedEx has moved to shutter facilities, restructure divisions and park planes. The changes, along with indications of consumer resilience during a time of concern over tariff-fueled price hikes, gave lift to the company’s closely-monitored operating margin.

The company posted first-quarter earnings of $3.83 per share, beating analysts’ average forecast of $3.68, on revenue of $22.2 billion. That compared with consensus estimates of $21.69 billion.

For fiscal 2026, FedEx forecast earnings per share of $17.20 to $19.00, against Wall Street’s $18.25 estimate.

Excluding certain accounting and restructuring costs, earnings are expected at $14.20 to $16.00 per share.

The company projected revenue growth of 4% to 6% year-on-year and said it would keep capital spending at $4.5 billion, with emphasis on network optimization and automation.

FedEx cut its expected pension contributions to as much as $400 million from a prior $600 million, and kept its forecast for a 25% effective tax rate.

The guidance assumes no major shocks to the economy, fuel costs or trade flows.

-

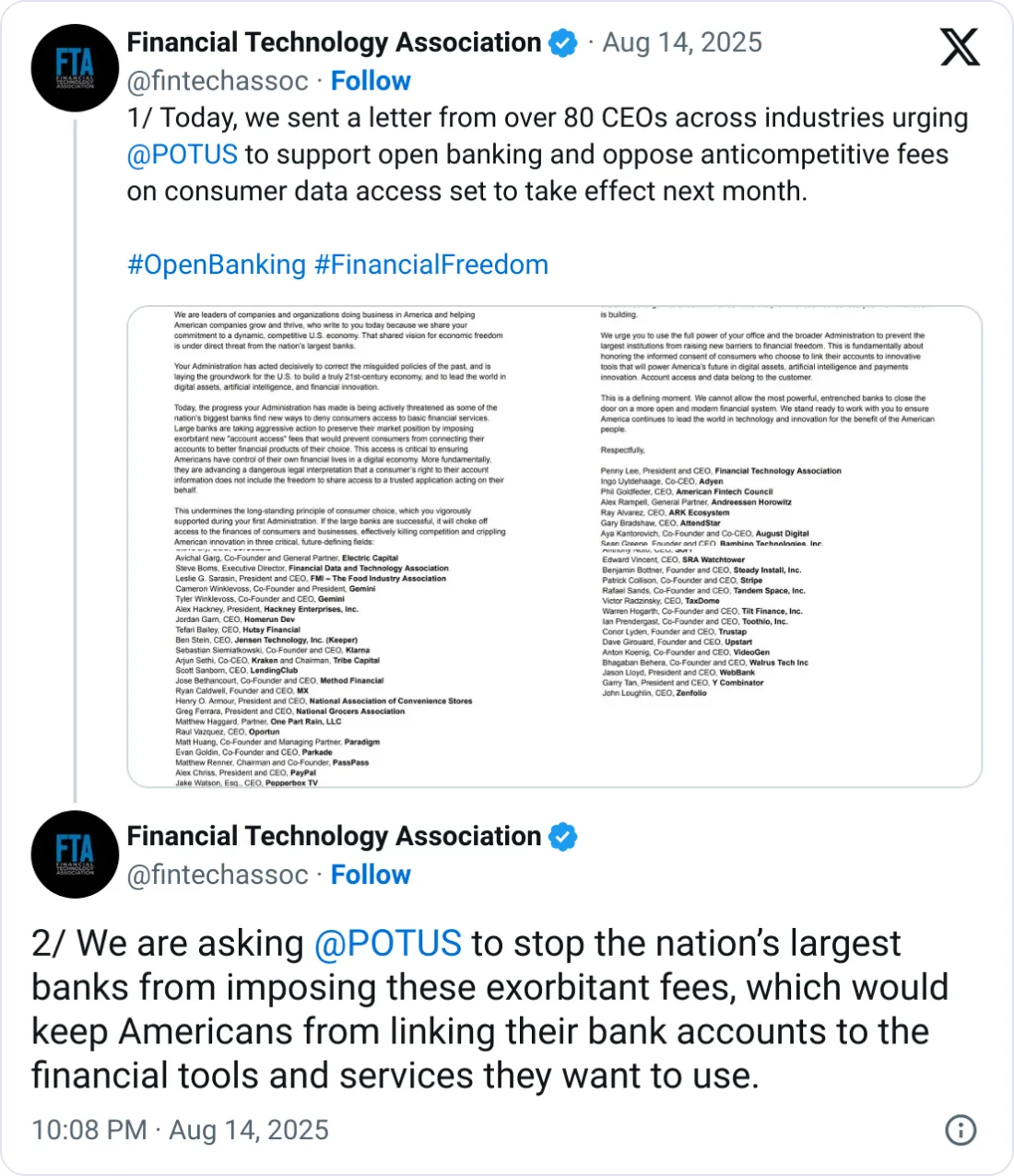

Crypto and Fintech Leaders Urge Trump to Block Bank Data Access Fees

More than 80 crypto and fintech executives are pressing U.S. President Donald Trump to stop banks from charging “account access” fees for sharing customer data, warning the move could undermine the nation’s competitive edge in digital finance.In a letter sent Wednesday, the group accused major banks of seeking to “preserve their market position” by imposing exorbitant new fees that would prevent consumers from connecting their accounts to alternative financial products.

Signatories include Gemini, Robinhood, the Crypto Council for Innovation, and the Blockchain Association. They claim the fees could cripple U.S. leadership in crypto, AI, and digital payments.

Background: Open Banking Rule in the Crosshairs

The dispute traces back to the Consumer Financial Protection Bureau’s open banking rule, finalized in October 2024 under former President Biden. The rule allows customers to share their bank data with fintechs at no cost.

Banks strongly opposed the rule and sued the regulator. Trump initially sided with banks to repeal it but reversed course in late July, leaving the rule in place temporarily under pressure from the crypto lobby. The administration says it will keep the rule while drafting a new version.

Why Crypto Firms Care

Crypto exchanges and platforms rely on seamless bank data access to link users’ bank accounts for fiat-to-crypto transfers. The letter warns that bank-imposed fees could:

Shut down innovative products

Undercut Trump’s stated goal of making the U.S. a “crypto superpower”

Push innovation offshore and weaken U.S. influence in digital assets

“America’s ability to lead in the responsible development of digital assets depends on safe, reliable on-ramps connecting our banking system to the new ecosystem,” the letter states.

Banking Sector Pushback

Banking groups, led by the American Bankers Association (ABA), blasted the letter, calling it an attempt to “undermine free markets and engage in government price fixing.”

The ABA argued that fintechs want to charge for their services while demanding that banks provide equivalent services for free, labeling it “a double standard”.

Banks also accused the signatories of being “middlemen” trying to profit from Biden-era policies and “free ride” on the investments banks have made in data security and consumer protection.

Wider Context: Crypto vs. Banks on Multiple Fronts

This clash comes amid broader tension between the banking and crypto industries. Just this week, banking groups urged Congress to close a perceived loophole allowing stablecoin issuers to pay yields via affiliates — a practice banks argue creates unfair competition.

Bottom line: The outcome of this battle over bank data fees could set the tone for U.S. open banking policy and shape the on-ramps between traditional finance and the crypto ecosystem. For Trump, it’s a political balancing act between supporting an industry that heavily backed his campaign and protecting the banking sector’s commercial interests.

-

Team Vitality Wins First S-Tier CS2 Trophy

On Oct. 12, 2025, Team Vitality clinched their first S-Tier Counter-Strike 2 trophy at ESL Pro League Season 22. They defeated Team Falcons 3-0 in the grand final with map scores of Inferno 13-10, Train 13-9, and Dust II 13-5. Vitality’s dominance was clear, ending the tournament with a statement victory.

-

Gold Falls Below $4,000

Gold (XAU) dipped under the $4,000 mark amid fading hopes for more Fed rate cuts. Support at $3,938 is critical—if it breaks, gold could fall to $3,886. A decisive 4-hour candlestick above $4,061 would be needed to make gold attractive for buyers again.

-

Goldman starts coverage on EU defense, aerospace: BAE, Airbus among top picks

Goldman Sachs has launched coverage of European defense and aerospace stocks, arguing that the two sectors are entering powerful investment cycles, albeit from different drivers.The bank highlights record demand for civil aircraft and a structural rearmament push in Europe, while emphasizing that investors must remain selective given high valuations.

In aerospace, Goldman sees aftermarket strength persisting as airlines continue to refleet. The analysts said the sector is still in a “harvest period” with pricing power underpinned by strong demand for maintenance, repair and overhaul and a large fleet of legacy engines.

Supply chain pressures are easing, with engines now the main bottleneck.

Airbus was initiated with a Buy rating and a €230 target. “We believe Airbus’ current valuation represents a compelling entry point, given the mid-term outlook,” analysts wrote.

Safran, Rolls-Royce and Melrose were also rated Buy, with the broker citing underestimated revenue growth for Safran , upside risk from civil aero margins and power systems at Rolls-Royce, and a cash-flow inflection at Melrose .

MTU Aero was initiated at Neutral, with Goldman judging its valuation as stretched versus peers.

Goldman added that with no major new aircraft programs expected before the late 2030s, the sector is increasingly being viewed as a “cash-return story,” with companies such as Safran, Rolls-Royce and Airbus well placed to boost dividends and buybacks.

On defense, Goldman argues Europe is experiencing its largest rearmament cycle since the Cold War. The shift is being driven not only by Russia’s invasion of Ukraine but also doubts over U.S. security guarantees.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

European NATO members are expected to reach ~3% of GDP in defense spending by 2030, up from 2% in 2025, with procurement taking a bigger share of budgets.“We are constructive on the sector, though high valuations demand a selective approach,” the analysts wrote.

“Geopolitics remains a key sector driver, and we believe announcements on the U.S. force posture in the Autumn could accelerate European defence spending intentions and act as a further catalyst for re-rating,” they added.

Goldman noted that spending is not evenly distributed, with Eastern and Nordic nations such as Poland and the Baltics already close to or above NATO’s 3.5% target, while Western economies like the U.K. and France face tighter fiscal constraints.

Germany, it said, has both the political will and fiscal headroom to drive transformative procurement.

Among defense names, BAE Systems is Goldman’s top pick, initiated at Buy with a 2,270p target, citing strong cash conversion and cross-domain capability.

Rheinmetall also received a Buy, with analysts highlighting its alignment to Europe’s capability gaps and German fiscal strength.

Leonardo and RENK were started at Neutral, while Thales and Dassault Aviation were rated Sell, reflecting concerns about cyber, digital and civil exposure at Thales and a cautious outlook for Dassault’s business jet segment.

Goldman added that venture capital-backed defense start-ups are injecting innovation in drones, electronic warfare and software, but large incumbents remain central.

In aerospace, it sees rising Asian demand and shareholder returns from cash-rich players as further support for the sector.

-

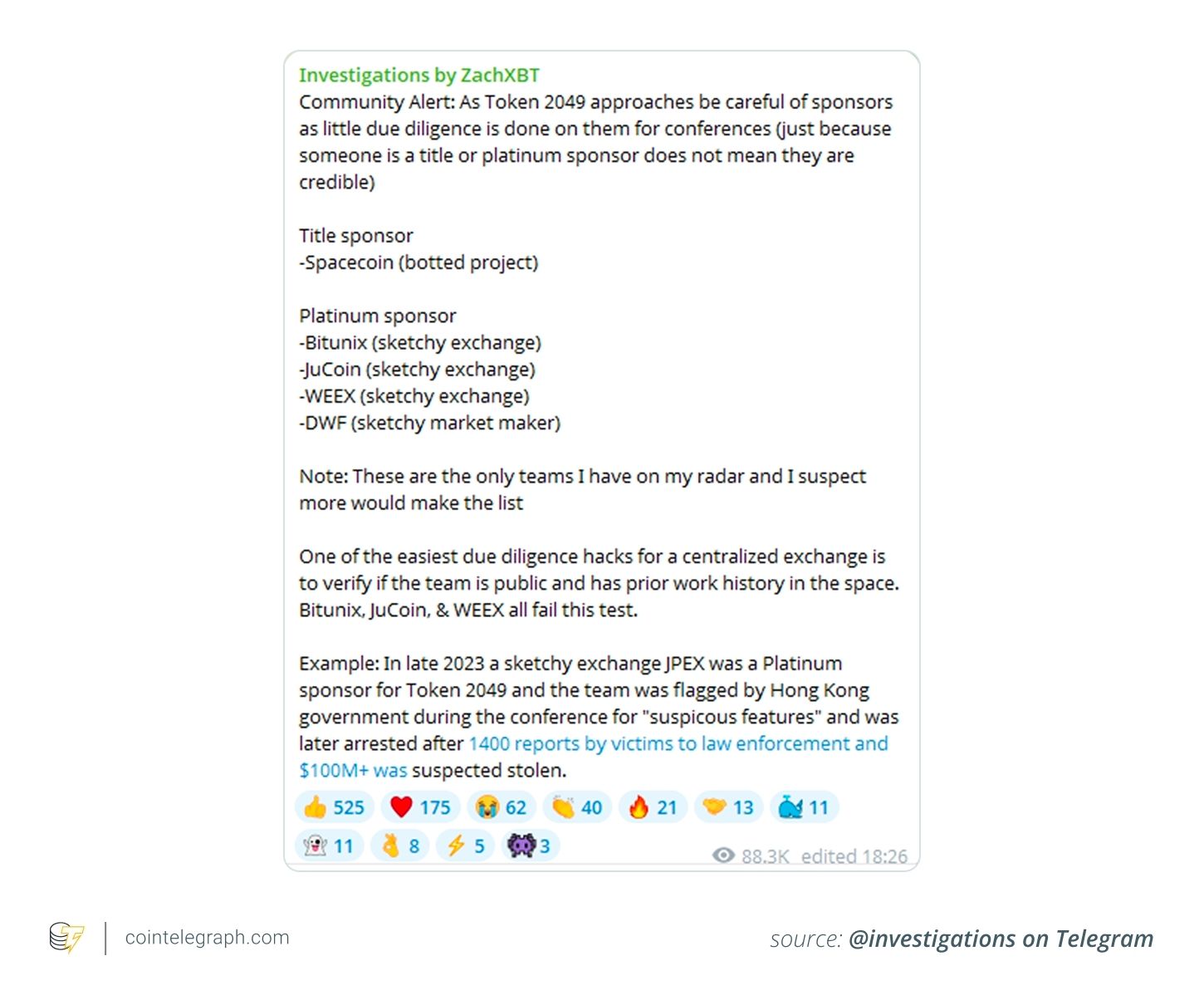

🚨 Big Stages, Bigger Scams? 5 Shady Crypto Projects That Got the Spotlight

Just because a crypto project has flashy sponsorships and throws massive parties doesn’t mean it’s legit.

️ Some of the shadiest coins in the game have strutted across major conferences, backed by millions in marketing — but offer little to no real value.

️ Some of the shadiest coins in the game have strutted across major conferences, backed by millions in marketing — but offer little to no real value. Here’s the warning: Sponsorship ≠ trustworthiness. According to on-chain investigator ZachXBT, several platinum sponsors at Token2049 — one of the biggest crypto events — had sketchy pasts or outright fraud allegations.

Here’s the warning: Sponsorship ≠ trustworthiness. According to on-chain investigator ZachXBT, several platinum sponsors at Token2049 — one of the biggest crypto events — had sketchy pasts or outright fraud allegations.Let’s unpack the red flags and name names.

️ Why Scammy Coins Survive

️ Why Scammy Coins SurviveDespite poor fundamentals, some tokens refuse to die — because:

They’re backed by speculative hype. They build cult-like communities. They manipulate liquidity for price control. They exploit influencer marketing and social media buzz.If it looks too good to be true, it probably is.

5 Shady Projects You Should Watch Out For

5 Shady Projects You Should Watch Out ForSpacecoin (SPACE) 🛰️ "Decentralized satellite internet for the world". Sounds cool, right? 🚩 No audit transparency, no satellite proof, and flagged as botted. 🧲 Still lives off hype, flashy booths, and wild promises. JuCoin 🪙 A rebranded exchange with a long history of pivots and questionable compliance. 🚩 No U.S. or EU licenses, despite aggressive token shilling. 🧲 Survives on promo campaigns and CeDeFi buzz. Weex 📉 A futures platform offering anonymous trading and high bonuses. 🚩 Unregulated, complaints of frozen accounts and sudden KYC blocks. 🧲 People still flock for the leverage, ignoring the risks. DWF 🧯 A "market maker" with accusations of wash trading and rug pulls (see: Vite Labs). 🚩 Operating across 60+ exchanges but little transparency. 🧲 Sponsorships give them credibility, not fundamentals. Bitunix 🏝️ Registered in Saint Vincent — red flag already. 🚩 Investigated in South Korea for serving customers illegally. 🧲 Lives off niche altcoin listings and speculative traders.🧨 Previous Big Scams That Bought the Spotlight

JPEX — Paid $70K for a premium sponsor slot at Token2049.

JPEX — Paid $70K for a premium sponsor slot at Token2049.

But after regulatory heat from Hong Kong, they vanished, froze withdrawals, and left over $127M in losses. HyperVerse — Lavish megayacht parties and celeb endorsements (Rick Ross, really?).

HyperVerse — Lavish megayacht parties and celeb endorsements (Rick Ross, really?).

But behind the scenes? A $1.89B Ponzi scheme. SEC charged key promoters.

️ How to Protect Yourself

️ How to Protect Yourself Research every project.

Research every project.Who’s behind it? Are they licensed or regulated? Any independent audits? Is the hype backed by real use cases? Watch for red flags like anonymous teams, only being listed on obscure exchanges, or insane promised returns. Bots can fake volume — don’t fall for it.

Watch for red flags like anonymous teams, only being listed on obscure exchanges, or insane promised returns. Bots can fake volume — don’t fall for it.Just because it made it to a conference stage or has a slick promo video doesn’t mean it’s safe. Crypto is still the Wild West — and sometimes, the loudest coins are the most dangerous.

Stay sharp. 🧠

-

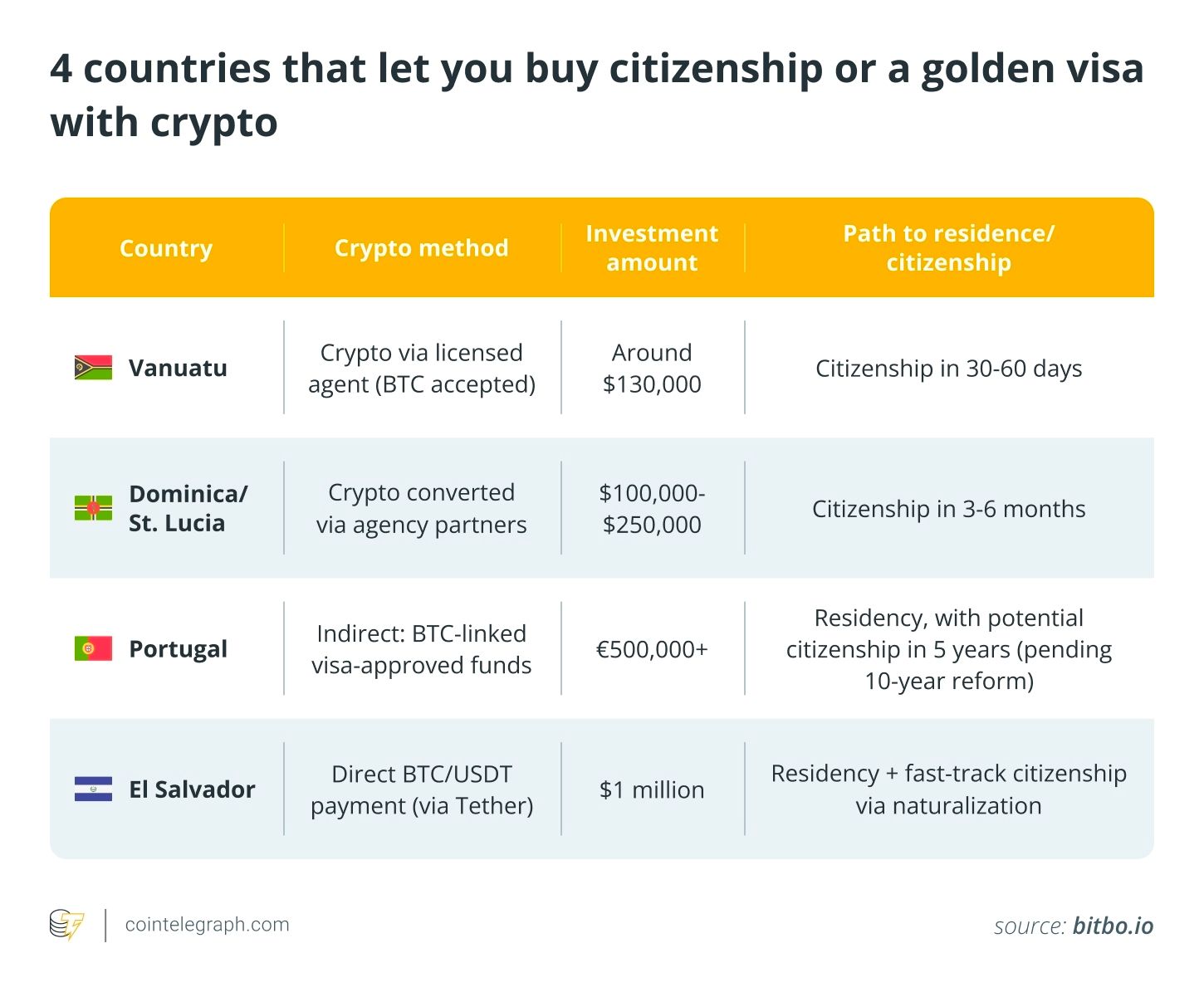

🌍 4 Countries Where You Can Buy Citizenship or Residency With Crypto (Yes, Really)

Have Bitcoin, Ether, or USDT burning a hole in your digital wallet? In 2025, that crypto could do more than moon your portfolio — it could literally get you a second passport or EU residency.Here are four countries where crypto can open the door to a new life abroad

Vanuatu: Fast Citizenship With Crypto (in 30–60 Days)

Vanuatu: Fast Citizenship With Crypto (in 30–60 Days)💰 Investment: From $130,000 🪙 Crypto accepted via agents (BTC, USDT, ETH) 🧾 No residency or language requirements 🛂 Visa-free access to 90+ countries 🏡 Fully remote processVanuatu offers one of the fastest citizenship programs in the world. Licensed agents accept crypto and convert it to fiat to handle your application. Ideal for crypto whales and digital nomads.

Dual citizenship allowed

Dual citizenship allowed

Tax-free: no income, capital gains or inheritance tax

Tax-free: no income, capital gains or inheritance tax

Dominica & Saint Lucia: Caribbean Passports With Crypto

Dominica & Saint Lucia: Caribbean Passports With Crypto💰 Investment: $200,000–$300,000 ⏱️ Processing time: 4–9 months 🪙 Crypto accepted via agencies (BTC, ETH, USDT) 🧾 No physical presence requiredWant palm trees, passport perks, and privacy? These islands offer strong passports and fast-track processes — and yes, crypto payments are welcome through trusted intermediaries.

Visa-free access to EU, UK, Singapore, and more

Visa-free access to EU, UK, Singapore, and more

Include your spouse, kids, and even parents

Include your spouse, kids, and even parents

️ Deep due diligence checks apply

️ Deep due diligence checks apply

Portugal: Golden Visa Fund With Crypto Exposure

Portugal: Golden Visa Fund With Crypto Exposure💰 Investment: ~€500,000 (via investment fund) ⏱️ Residency → Citizenship in 5–10 years 💻 Funds offer crypto exposure, but payment is in fiatPortugal’s golden visa doesn’t take BTC directly, but some investment funds are now crypto-themed. Think venture capital funds focused on blockchain startups or ETFs with Bitcoin exposure.

Live just 7 days/year to qualify

Live just 7 days/year to qualify

No language or job requirements

No language or job requirements

Tax-exempt on long-term crypto gains

Tax-exempt on long-term crypto gains

El Salvador: Full Citizenship With Bitcoin Only

El Salvador: Full Citizenship With Bitcoin Only💰 Investment: $1,000,000 in BTC or USDT 🕒 Timeline: 6 weeks to residency, citizenship within months 🌐 No fiat required — 100% crypto-nativeThis is the world’s first crypto-only residency program. Backed by Tether and the Salvadoran government, it’s a serious opportunity for wealthy Bitcoiners looking to make a statement — and a second home.

No physical stay required

No physical stay required

Application starts with a $999 deposit in BTC/USDT

Application starts with a $999 deposit in BTC/USDT

Supports education, infrastructure, and tech in El Salvador

Supports education, infrastructure, and tech in El Salvador

TL;DR — Crypto Passports at a Glance

Country Investment Timeline Crypto Accepted What You Get

Vanuatu $130K+ 1–2 months Yes (via agent) Full citizenship, remote process

Dominica $200K–$300K 4–9 months Yes (via agent) Caribbean passport

Portugal €500K (via fund) 5–10 years Indirect (fund-based) EU residency → citizenship

El Salvador $1M ~6 weeks Yes (direct BTC) Citizenship, no fiat needed🧭 Final Thoughts

These aren’t “buy a passport in 5 clicks” schemes. They’re legit national programs — just finally open to crypto.Whether you’re a Bitcoin OG, an Ethereum early bird, or just want freedom of movement, these countries are now bridging the gap between digital assets and real-world mobility.

Your crypto isn’t just wealth. It’s a gateway.

-

💶 ECB: Cash Isn’t Dead — It’s Here to Stay (Even With the Digital Euro Coming)

As the world races toward digital payments, the European Central Bank is hitting pause on any talk of cash extinction.

In a blog post this week, ECB Executive Board member Piero Cipollone made one thing clear:

“A digital euro will not replace cash — it will complement it.” Why it matters:

Why it matters:The digital euro is coming, but it won’t mean goodbye to coins and notes. The ECB wants to ensure payment autonomy for Europeans, offering choices: digital and physical. Cash is still crucial in times of crisis or tech outages, Cipollone added. "Consumers will have coins, notes, and digital euros — all with legal tender status," he said.

"Consumers will have coins, notes, and digital euros — all with legal tender status," he said.

🪙 What’s the ECB Building?The digital euro is a regulated central bank digital currency (CBDC), meant to:

Compete with private stablecoins Reduce reliance on dollar-backed tokens Future-proof Europe’s payments without handing the keys to Big Tech or foreign stablecoin issuersYet ironically, an ECB study in March showed most Europeans aren’t all that excited about it. When asked how they’d spend €10,000, people barely allocated anything to the digital euro.

Meanwhile, Stablecoins Are Surging

Meanwhile, Stablecoins Are SurgingThe ECB’s worry? Dollar-based stablecoins are growing fast and could take over Europe’s digital economy if regulation doesn’t keep up.

On that note, ECB adviser Jürgen Schaaf called for:

Stronger stablecoin regulation Euro-pegged digital alternatives And a unified European response to crypto’s riseTL;DR:

Cash isn’t going away. The ECB is building a digital euro — not to replace paper money, but to give Europeans more ways to pay.

Fiat, stablecoins, and CBDCs may soon all coexist — the question is who will control the rails. -

Regulation Supports the Transition

Regulators are creating frameworks for tokenized equity lending rather than blocking it. Europe’s blockchain sandboxes show live, compliant models that integrate KYC, whitelists, and zero-knowledge proofs. The message is clear: equity lending is moving onchain, and participants who delay risk losing efficiency, transparency, and market trust.