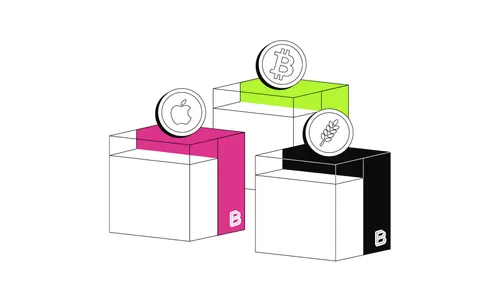

PoR is a starting point, but real trust needs:

1️⃣ Solvency proof – assets ≥ full liabilities (Merkle or zero-knowledge proofs help).

2️⃣ Operational controls – key management, access permissions, incident response, custody workflows.

3️⃣ Liquidity & encumbrance transparency – can assets be converted to cash during a run?

4️⃣ Governance & disclosure – custody frameworks, conflict management, consistent reporting.

PoR helps, but accountability, solvency, and control are what users actually need.

PoR helps, but accountability, solvency, and control are what users actually need.

️ Regulators, like the PCAOB, caution against over-reliance on PoR as proof an exchange can meet obligations.

️ Regulators, like the PCAOB, caution against over-reliance on PoR as proof an exchange can meet obligations.

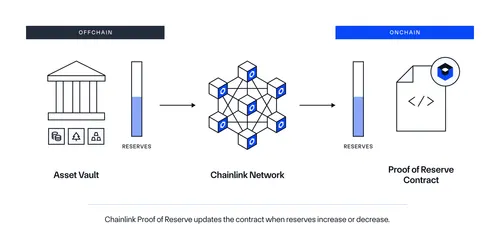

It demonstrates that assets exist at a specific point in time.

It demonstrates that assets exist at a specific point in time. It doesn’t guarantee solvency, liquidity, or risk management—so withdrawals can still be delayed in a crisis.

It doesn’t guarantee solvency, liquidity, or risk management—so withdrawals can still be delayed in a crisis.

Xu: “Long-term trust in crypto cannot be built on short-term yield games or marketing that obscures risk.”

Xu: “Long-term trust in crypto cannot be built on short-term yield games or marketing that obscures risk.”

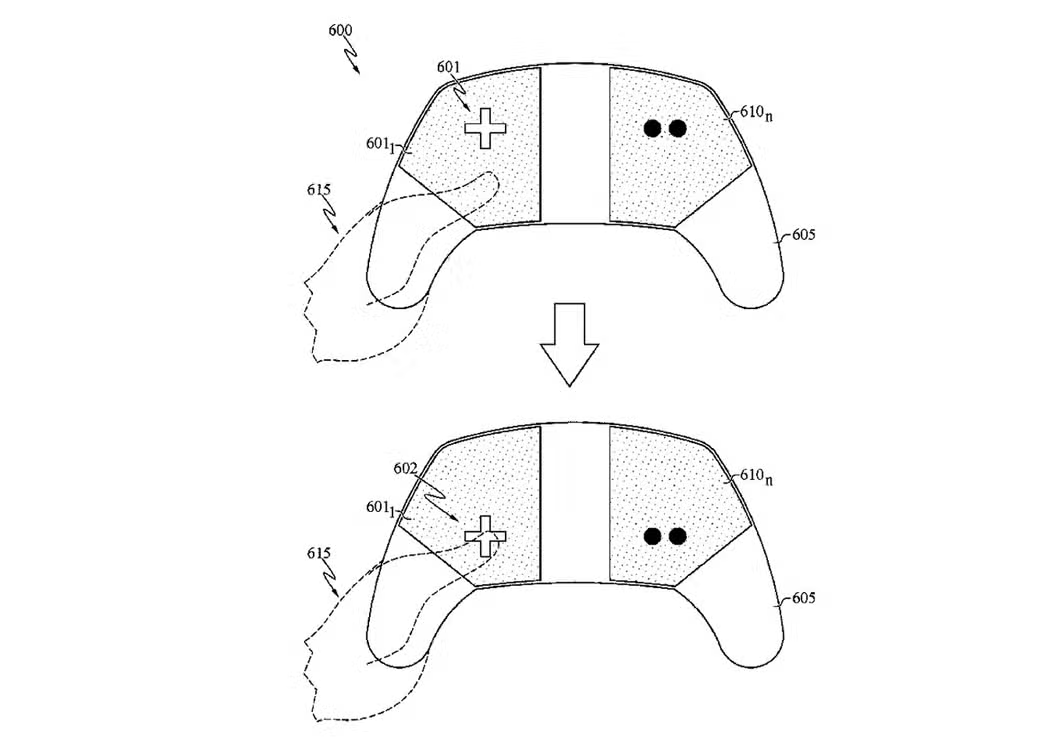

The future of controllers may be less about buttons and more about customizable, adaptive input.

The future of controllers may be less about buttons and more about customizable, adaptive input.

Note: Patents don’t always become products, but this shows where gamepad innovation is heading.

Note: Patents don’t always become products, but this shows where gamepad innovation is heading.