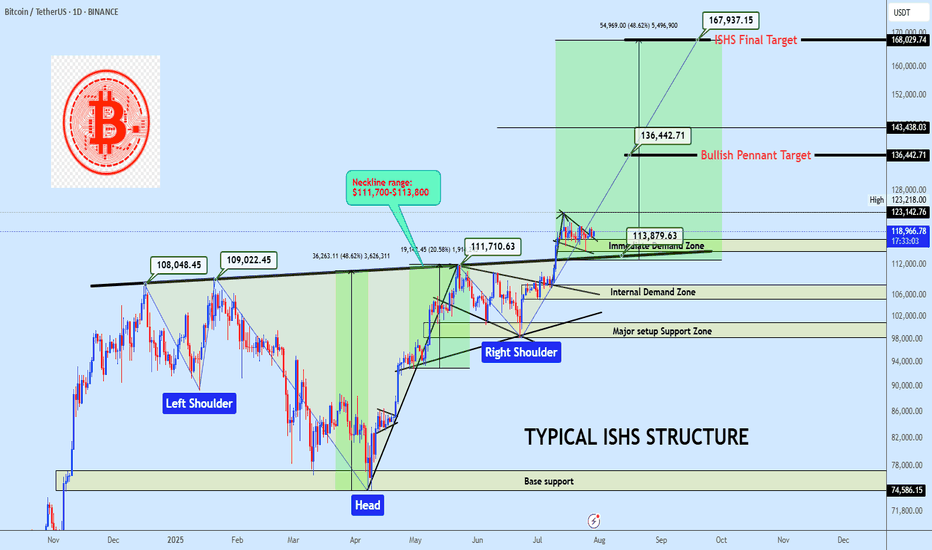

Bitcoin is sideways right now and is moving in a very tight and narrow range. All the action has been happening between $117,000 and $120,000 based on candle close since 11-July. This is bullish, think about it.

Bitcoin hits a new all-time high and next thing you know it turns sideways very close to resistance. The only drop was short-lived and everything sold was quickly bought. Why is Bitcoin consolidating so close to resistance? It is preparing to move ahead.

What happens when Bitcoin moves forward after so much recovery? Everything experiences a positive cycle. This is a very strong signal.

This chart allows for more whipsaw as you know nothing else is possible in a trading range. We predict the pattern to resolve bullish, but there can be swings to either side. A swing down just as it happened 25-July. A swing up just as it happened 14-July. This is always possible but the end result won't change. Bitcoin will continue sideways but when the sideways period is over, you will not see a move toward $110,000 or $100,000. The break of the trading range will confirm the advance toward $135,000 next month. Bitcoin is likely to continue in the same mode. While Bitcoin consolidates the new advance, the altcoins grow. In this way the entire market continues to recover and grow month after month after month.

Name Your Altcoin

Leave a comment with your favorite altcoin trading pair and I will do an analysis for you. I will reply in the comments section. Make sure to include any questions you might have beforehand.

If you see a comment with a pair you like, boost and reply so these can be done first.

Thanks a lot for your continued support.

' like'

' like'

& Share it with your friends; thanks, and Trade safe.

& Share it with your friends; thanks, and Trade safe.

Key claims from Musk & xAI:

Key claims from Musk & xAI: Why this matters:

Why this matters: Background:

Background: Market takeaway:

Market takeaway:

$33 Becomes $118: Here’s What Happened

$33 Becomes $118: Here’s What Happened Growth Is Real — But So Is Volatility

Growth Is Real — But So Is Volatility Who Uses Figma and Why It Matters

Who Uses Figma and Why It Matters Figma, the Bitcoin Holder

Figma, the Bitcoin Holder Should You Buy the Stock Now?

Should You Buy the Stock Now? Bottom Line

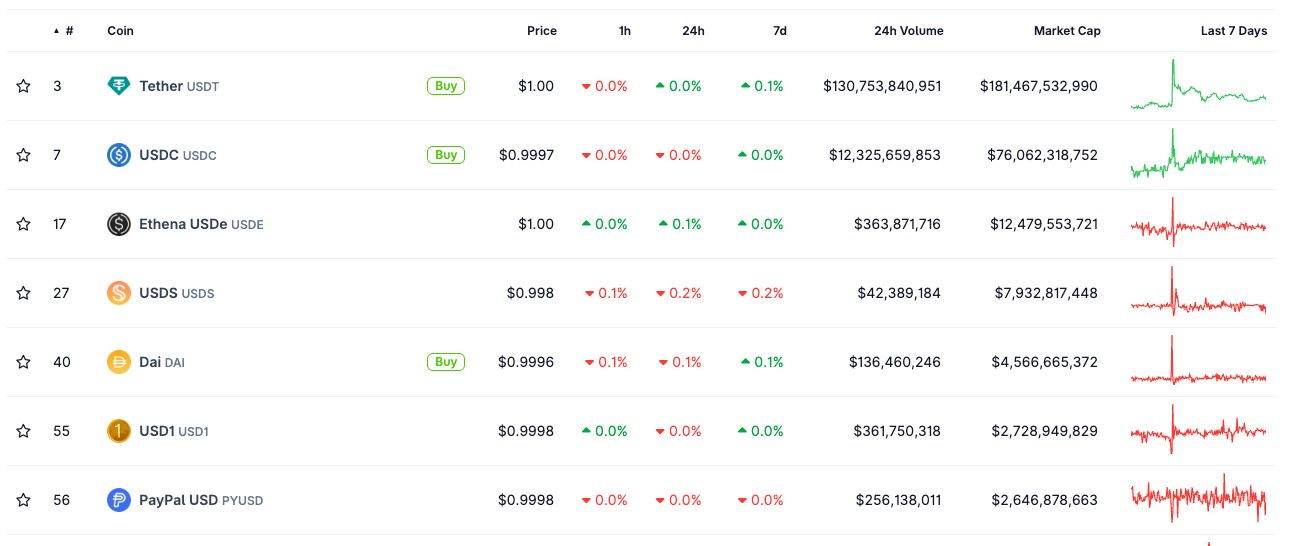

Bottom Line Analysts forecast that regulated banks like Erebor could capture up to 25% of the US stablecoin market by late 2026. Integration of insured-bank infrastructure with blockchain could accelerate institutional adoption and payments testing.

Analysts forecast that regulated banks like Erebor could capture up to 25% of the US stablecoin market by late 2026. Integration of insured-bank infrastructure with blockchain could accelerate institutional adoption and payments testing.

Uncover crypto-linked tax evasion.

Uncover crypto-linked tax evasion. Secure more tax revenue while encouraging a “culture of honest payment.”

Secure more tax revenue while encouraging a “culture of honest payment.” South Korea legalized crypto seizure from tax delinquents in 2021.

South Korea legalized crypto seizure from tax delinquents in 2021. Question for the community:

Question for the community:

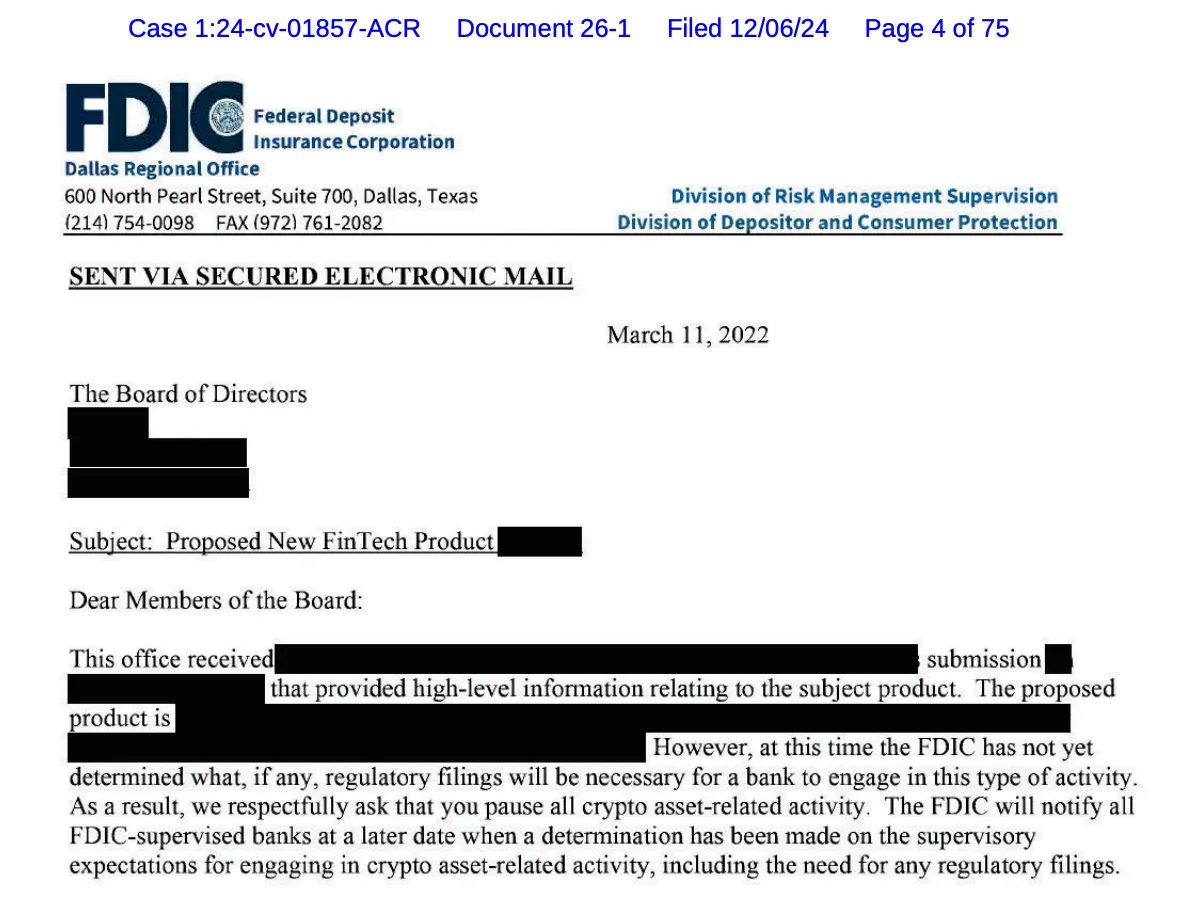

️ Investigate potential violations of antitrust and fair lending laws

️ Investigate potential violations of antitrust and fair lending laws This comes amid growing claims that U.S. regulators during the Biden era used "Operation Choke Point 2.0" tactics to quietly push banks to cut off crypto access — especially after the FTX collapse.

This comes amid growing claims that U.S. regulators during the Biden era used "Operation Choke Point 2.0" tactics to quietly push banks to cut off crypto access — especially after the FTX collapse. The probe will also include alleged “political debanking” of conservative Americans — banks allegedly canceling services based on political affiliation.

The probe will also include alleged “political debanking” of conservative Americans — banks allegedly canceling services based on political affiliation. ️ Will this executive order help restore neutrality in finance — or just escalate political and crypto tensions even further?

️ Will this executive order help restore neutrality in finance — or just escalate political and crypto tensions even further? What do YOU think?

What do YOU think? Overreach — let banks decide

Overreach — let banks decide

$167,000

$167,000 Below $105,000

Below $105,000 Let us know your thoughts in the comment section, and feel free to tag your preferred altcoins for analysis.

Let us know your thoughts in the comment section, and feel free to tag your preferred altcoins for analysis.

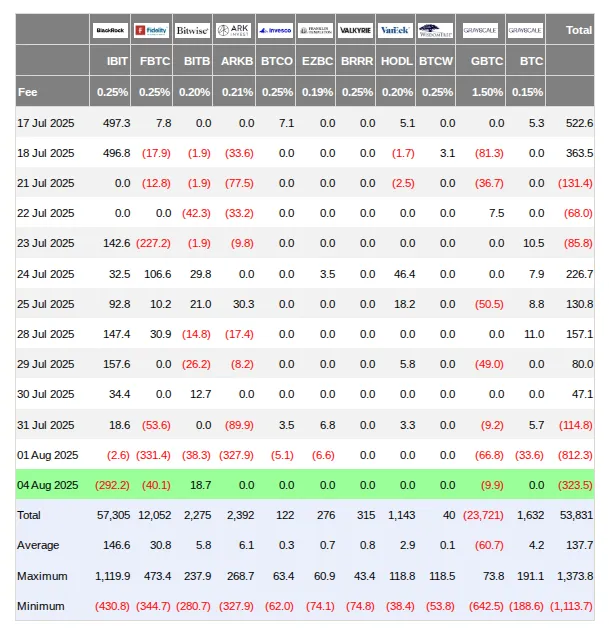

Would you follow treasuries or ETFs here?

Would you follow treasuries or ETFs here?

Plans to purchase $500M–$1B in crypto, kicking off with BTC, ETH, and other top assets.

Plans to purchase $500M–$1B in crypto, kicking off with BTC, ETH, and other top assets. ️ EAI Vehicle Chain → tokenized vehicle sales + crypto-based deposits (cars on-chain

️ EAI Vehicle Chain → tokenized vehicle sales + crypto-based deposits (cars on-chain  What do you think—will tokenized Teslas, Rivians, and Faradays be the next big crypto use case, or is this just EV drama wrapped in a crypto bow?

What do you think—will tokenized Teslas, Rivians, and Faradays be the next big crypto use case, or is this just EV drama wrapped in a crypto bow?

3387 Rejection

3387 Rejection Support – 3281

Support – 3281