Boost your earnings legally with allowances and tax-free income:

Personal allowance: Earn up to £12,570 tax-free

Rent-a-room relief: Up to £7,500 tax-free rental income

Trading/property allowance: Up to £1,000 tax-free

Savings: Cash ISAs (£20,000), Premium Bonds, personal savings allowance

Even small adjustments can save hundreds—or thousands—annually.

To the global crypto community:

To the global crypto community:

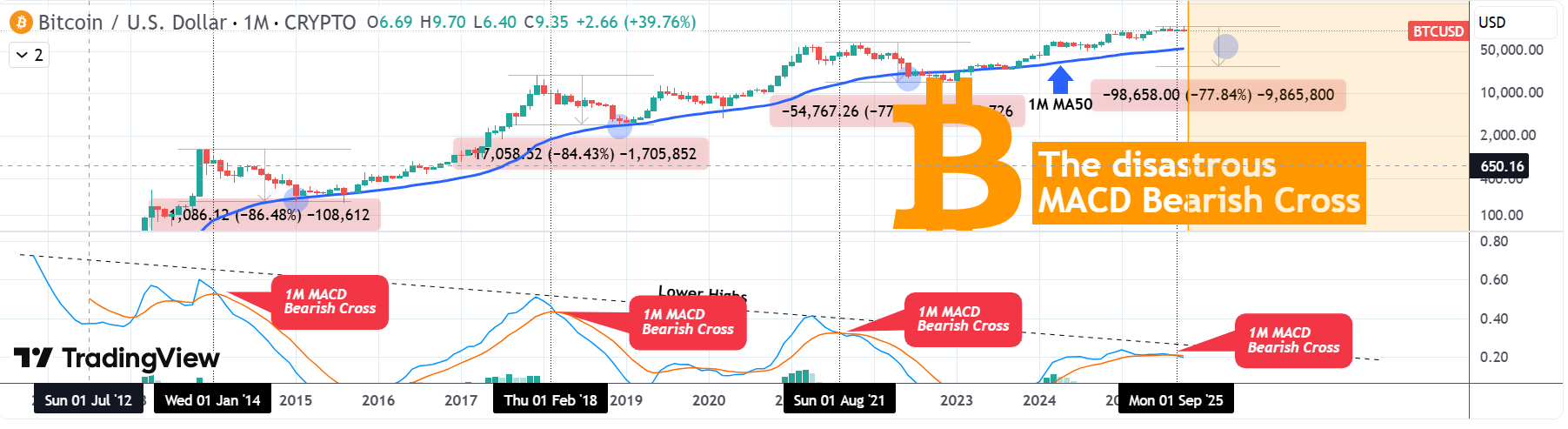

Bitcoin (BTCUSD) is on the verge of establishing an LMACD Bearish Cross on the 1M time-frame, which for better reliability needs to close the current 1M candle (October) to confirm it.

Bitcoin (BTCUSD) is on the verge of establishing an LMACD Bearish Cross on the 1M time-frame, which for better reliability needs to close the current 1M candle (October) to confirm it. #ETH 1H chart is showing signs of a Double Bottom forming a potential reversal structure.

#ETH 1H chart is showing signs of a Double Bottom forming a potential reversal structure.

Why This Matters:

Why This Matters: What This Could Mean:

What This Could Mean:

Hello everyone,

Hello everyone,

How to Stay Safe:

How to Stay Safe: As blockchain sleuth @tayvano_ put it:

As blockchain sleuth @tayvano_ put it: ️

️

The Stakes Are Real:

The Stakes Are Real: What’s Happening:

What’s Happening: Impact on Hackers:

Impact on Hackers: Why It Matters:

Why It Matters: