all-time high after dual listings is a classic short-term pump scenario.

cryptohog

Posts

-

Dual Listings Fuel SENT Rally -

Sentient (SENT) Hits New All-Time Highai + crypto convergence is still sexy, just don’t get too attached to the candle chart.

-

Sentient’s Long-Term Outlooksentient popping on bithumb and upbit is hype city, but historically that’s usually a quick spike.

-

Prediction Markets Become Gen Z’s Crypto Playground$39k average salary and they’re still finding ways to bet on outcomes, resilient energy.

-

Gen Z Shifts Crypto Bets to Prediction Marketsseeing ripple vs swift still feels like old school vs new school, but gen z is quietly rewriting the playbook.

-

SWIFT vs Ripple — the same problem, different solutionpre-funded accounts are still a pain—blockchain rails just make the numbers feel less depressing.

-

Hogwarts Mystery Beyond Hogwarts update brings Quidditch, family quests, and new magical creaturesbeyond hogwarts exploring family stuff is surprisingly wholesome for a mobile game.

-

Harry Potter: Hogwarts Mystery adds Valentine’s Day magic for 2026secret admirer letters in a mobile harry potter game is exactly the energy i signed up for.

-

Rainbow Six Siege Teases Solid Snake Crossoverfirst crossover for r6? bet ubisoft’s lawyers are sweating over this one.

-

Google DeepMind opens Project Genie to AI Ultra subscribersletting users poke at it early feels smart, these systems need chaos to get better.

-

Meta bets on personal context to differentiate AI offeringsevery time zuck says “in a matter of months” i mentally add a year.

-

Meta to roll out new AI models and products in coming months$100b+ in capex with no concrete products named is a bold move.

-

everything was fun but i dont hold any

-

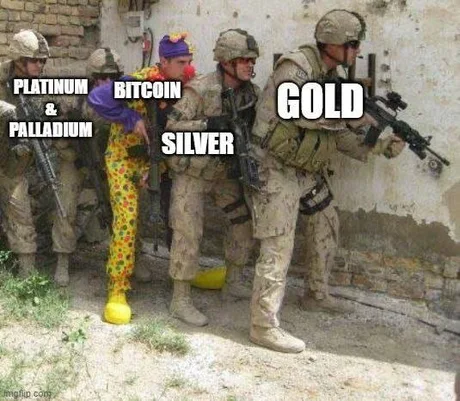

digital gold guys

-

we lost the house

-

ASIC’s Crypto Focus Comes as Enforcement and Licensing Plans Advance

ASIC’s emphasis on digital assets comes amid ongoing enforcement actions and proposed reforms to formally regulate crypto companies in Australia.

On Tuesday, a federal court ordered BPS Financial to pay 14 million Australian dollars ($9.3 million) over misleading claims and unlicensed conduct linked to its Qoin Wallet product. The case underscores ASIC’s focus on unlicensed crypto activity.

Meanwhile, Australia’s Treasury has proposed legislation requiring digital asset platforms to hold an Australian Financial Services Licence. If passed, the rules would bring crypto trading and custody firms under ASIC’s existing conduct, disclosure and risk management obligations.

-

Crypto Grouped With AI and Payments in ASIC’s 2026 Outlook

ASIC has placed crypto firms alongside AI-powered financial services and payment platforms in its latest outlook, warning that technology-enabled businesses are increasingly challenging existing regulatory frameworks.

The regulator cautioned that some companies may deliberately try to stay outside formal regulation by exploiting unclear boundaries, contributing to what it described as regulatory uncertainty. ASIC said ensuring clarity on licensing requirements and maintaining effective perimeter oversight will remain a key focus in 2026.

The approach suggests regulators are less concerned with the technology itself and more focused on how new financial services fit within Australia’s existing regulatory system.

-

ASIC Flags Crypto as a “Regulatory Perimeter” Risk for 2026

Australia’s financial regulator has signaled closer scrutiny of crypto firms in the year ahead, framing digital assets as a “regulatory perimeter” issue in its Key Issues Outlook 2026.

In the report published Tuesday, the Australian Securities and Investments Commission (ASIC) grouped digital assets with emerging sectors such as payments and AI-driven financial services. Rather than focusing on price volatility or adoption risks, ASIC highlighted structural concerns around businesses operating outside existing licensing, disclosure and conduct regimes.

The regulator said its priority for 2026 will be maintaining clarity around licensing boundaries and strengthening oversight where new financial services fall at the edges of current laws.

-

Clawdbot’s Full System Access Raises Crypto Security Concerns

Experts warn that Clawdbot’s deep system access makes it especially risky if improperly secured. Unlike many AI assistants, Clawdbot can read and write files, run shell commands, execute scripts, and control browsers on a user’s machine.

Archestra AI CEO Matvey Kukuy demonstrated the risk by extracting a private key via prompt injection in under five minutes. SlowMist urged users running Clawdbot to audit their setups immediately and apply strict IP whitelisting, warning that powerful AI agents require careful security controls.

-

Hundreds of Clawdbot Servers Found Publicly Accessible

Security researcher Jamieson O’Reilly says hundreds of Clawdbot control servers have been exposed online in recent days, allowing attackers to access credentials, chat histories, and command execution tools.

O’Reilly said he was able to locate the exposed instances within seconds using internet scanning tools by searching for the phrase “Clawdbot Control.” In some cases, attackers could send messages as users or execute commands remotely due to an authentication bypass tied to misconfigured reverse proxies.