The Pudgy Penguins franchise is soaring in mainstream visibility — but its token isn’t feeling the love.

Pudgy Party Game Launch

Pudgy Party Game Launch

New battle royale game “Pudgy Party” launched on iOS & Android.

50,000+ downloads on Google Play.

50,000+ downloads on Google Play.

Cracked the Top 10 most downloaded games on Apple’s App Store.

Cracked the Top 10 most downloaded games on Apple’s App Store.

Token Price Action

Token Price Action

$PENGU fell ~4% on Friday, despite the game’s strong debut.

Over the past 30 days, the token is down 20%+ (CoinMarketCap).

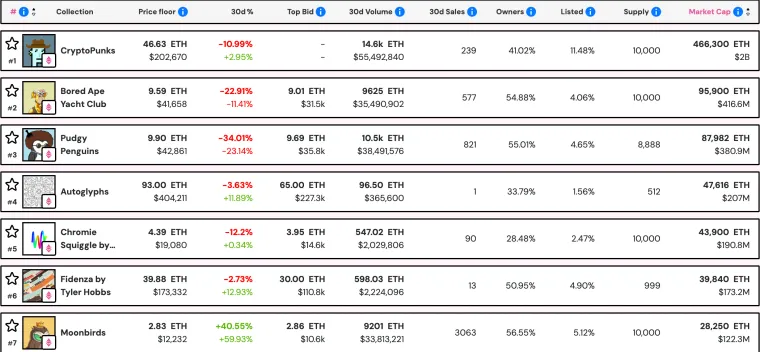

Reflects wider NFT market slump → Bored Ape Yacht Club (–11%), Doodles (double-digit drop).

Cultural Appeal vs. Market Reality

Cultural Appeal vs. Market Reality

Pudgy Penguins has become a cross-over brand:

NFTs + trading cards + plush toys + video games.

Strong resonance beyond Web3 → kids, collectors, and mainstream gamers.

Yet token value remains tied to NFT market cycles and broader ETH price action.

The NFT Market Backdrop

The NFT Market Backdrop

ETH dropped from $4,957 ATH → $4,397, dragging NFT valuations lower.

NFT market cap:

$9.3B in early August → now $7.4B.

Exception: CryptoPunks +3% in August, showing relative resilience among blue chips.

🧩 The Takeaway

Pudgy Penguins may be winning the mainstream adoption game, but token holders are feeling the sting of the broader NFT downturn.

Question: Does Pudgy’s cultural brand expansion make $PENGU a long-term play — or will it always remain chained to ETH’s price swings and NFT market sentiment?

Question: Does Pudgy’s cultural brand expansion make $PENGU a long-term play — or will it always remain chained to ETH’s price swings and NFT market sentiment?

️ What Is a Pump-and-Dump?

️ What Is a Pump-and-Dump? In some cases, insiders net 100%–2000% profits in a single event.

In some cases, insiders net 100%–2000% profits in a single event. ️ Why It Works in Web3

️ Why It Works in Web3 Spotting a Pump Before It’s Too Late

Spotting a Pump Before It’s Too Late Ignore unsolicited DMs → if someone pitches a “sure thing,” it isn’t.

Ignore unsolicited DMs → if someone pitches a “sure thing,” it isn’t.

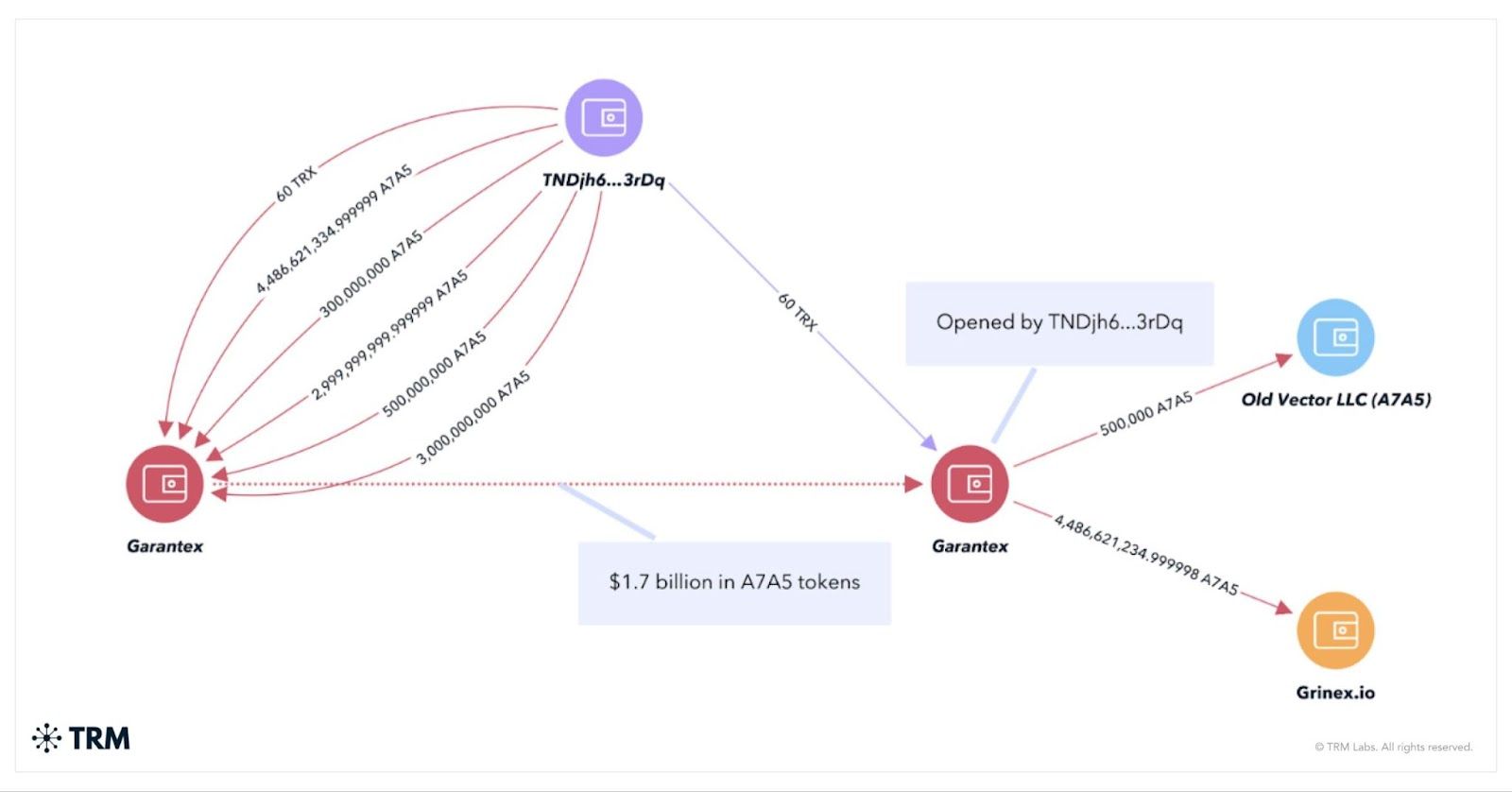

Enforcement & Seizures

Enforcement & Seizures Rising Physical Threats

Rising Physical Threats

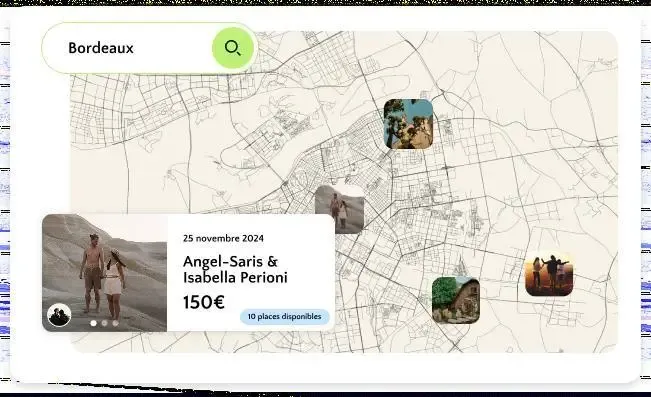

Redeemability in Practice

Redeemability in Practice

️ How It Works

️ How It Works

The Offer: Up to $1.5 Billion Over 6 Years

The Offer: Up to $1.5 Billion Over 6 Years Who Meta Did Hire

Who Meta Did Hire ️ Building Meta’s Superintelligence Lab

️ Building Meta’s Superintelligence Lab