chainsniff

Posts

-

If you held the McChicken for the past 5 years, you would have outperformed Ethereum. -

somehow price will be back

-

Nomura bets on long-term crypto adoption despite near-term volatility

Nomura’s crypto push reflects a broader shift among Japanese financial institutions positioning for long-term digital asset adoption. Through Laser Digital, the firm has secured licenses in Dubai, launched tokenized investment products, and most recently applied for a U.S. trust bank charter.

Executives say the infrastructure buildout is designed to meet future institutional demand, even as near-term trading results fluctuate. Industry data suggests over half of institutional investors plan to allocate to digital assets within three years. For traditional brokerages facing pressure on legacy revenues, Nomura’s approach signals a belief that crypto infrastructure — not speculative trading — will define the next phase of growth.

-

Losses repeat as Nomura separates crypto trading from infrastructure buildout

Laser Digital’s recent losses are not an isolated incident. Nomura previously reported that the crypto unit dragged down European results in mid-2025, yet the firm continued expanding its regulatory footprint rather than pulling back.

Nomura appears to be running a two-track crypto strategy: actively managing and reducing proprietary trading exposure while accelerating infrastructure and licensing efforts. While trading losses have triggered tighter controls, investments in regulated platforms, custody services, and institutional products have continued uninterrupted. Executives emphasized that short-term volatility is being addressed through risk management, not by abandoning the firm’s broader digital asset strategy.

-

Nomura tightens crypto risk after losses, but pushes ahead in the U.S.

Japan’s largest brokerage, Nomura, disclosed on Jan. 30 that its crypto subsidiary Laser Digital posted losses in the October–December quarter, prompting the firm to reduce cryptocurrency positions and tighten risk controls. The losses weighed on Nomura’s European operations.Just days earlier, however, Laser Digital applied for a U.S. national trust bank charter with the Office of the Comptroller of the Currency. The move would allow the firm to offer crypto custody, trading, and staking services to institutional clients. Nomura executives framed the actions as complementary, signaling stricter short-term risk management alongside continued long-term expansion into regulated digital asset markets.

-

CrossCurve offers 10% bounty as legal action looms

CrossCurve CEO Boris Povar has offered a bounty of up to 10% for the return of funds taken in the recent $3 million exploit. In a public appeal, Povar shared 10 wallet addresses that allegedly received stolen tokens and asked for their return within 72 hours.

He said the company does not believe the incident was necessarily malicious and hopes for cooperation. However, Povar warned that if no contact is made within the deadline, CrossCurve will pursue legal action, work with law enforcement, and coordinate with other crypto projects to freeze assets linked to the attack.

-

Flaw allowed spoofed messages to unlock CrossCurve tokens

Security analysts say the CrossCurve exploit stemmed from a critical validation failure in one of its smart contracts. According to Defimon Alerts, attackers were able to spoof cross-chain messages that bypassed gateway checks and triggered token unlocks.

The flaw reportedly allowed anyone to call a function known as expressExecute on the ReceiverAxelar contract, enabling unauthorized withdrawals through the PortalV2 system. As news of the exploit spread, Curve Finance — a partner of CrossCurve — warned users who allocated votes to CrossCurve pools to review their positions and consider removing exposure, emphasizing the risks of interacting with third-party protocols.

-

CrossCurve confirms $3M cross-chain bridge exploit

Crypto protocol CrossCurve has confirmed its cross-chain bridge was attacked, with roughly $3 million reportedly stolen across multiple blockchain networks. The company said late Sunday that the incident involved exploitation of a vulnerability in one of its smart contracts.

CrossCurve urged users to immediately pause all interactions with the protocol while an investigation is underway. Blockchain security firm Decurity, via its Defimon Alerts account, reported that the exploit affected several networks and allowed unauthorized access to locked tokens. The incident adds to a growing list of cross-chain bridge attacks, a sector that has repeatedly been targeted due to complex smart contract designs.

-

Beyond stablecoins, Tether expands into gold, AI, and global investments

Tether’s ambitions now extend well beyond digital dollars. The company holds roughly 140 tons of gold — worth about $24 billion — and has expanded products like Tether Gold, which allows users to transact with tokenized physical gold. Ardoino says Tether is buying one to two tons of gold weekly, positioning itself as a major private holder.

At the same time, Tether is investing heavily in AI, robotics, agriculture, satellites, and infrastructure, including its decentralized AI platform Qvac. Ardoino describes the strategy as building long-term stability for hundreds of millions of users, likening Tether’s evolution to that of a sovereign wealth fund focused on financial inclusion.

-

Ardoino defends Tether amid scrutiny, touts law enforcement cooperation

Facing long-standing criticism over illicit use, Tether CEO Paolo Ardoino argues the company is now more transparent and cooperative than ever. He says Tether works with nearly 300 law enforcement agencies across more than 60 countries, including the FBI and Secret Service, and follows U.S. sanctions rules.

According to Ardoino, Tether has frozen roughly $3.5 billion in tokens linked mostly to hacks and scams, including $225 million tied to a major “pig-butchering” fraud scheme in 2023. He contends that blockchain-based dollars are easier to monitor than cash, calling USDT a superior tool for combating financial crime despite ongoing skepticism from critics and ratings agencies.

-

Tether CEO launches media blitz as company unveils U.S.-regulated stablecoin

Tether CEO Paolo Ardoino has stepped into the media spotlight this week, speaking with outlets including Reuters, Bloomberg, Fortune, and TechCrunch — a notable shift for a company long criticized for operating in regulatory gray zones. The timing aligns with Tether’s launch of USAT, a U.S.-regulated stablecoin issued through Anchorage Digital Bank.

USAT is Tether’s first product designed to comply with new federal rules and directly compete with Circle’s USDC, as competition in the stablecoin space intensifies with new entrants like Fidelity. Once portrayed as opaque and offshore, Tether is now engaging with U.S. regulators, law enforcement, and policymakers as it seeks mainstream acceptance.

-

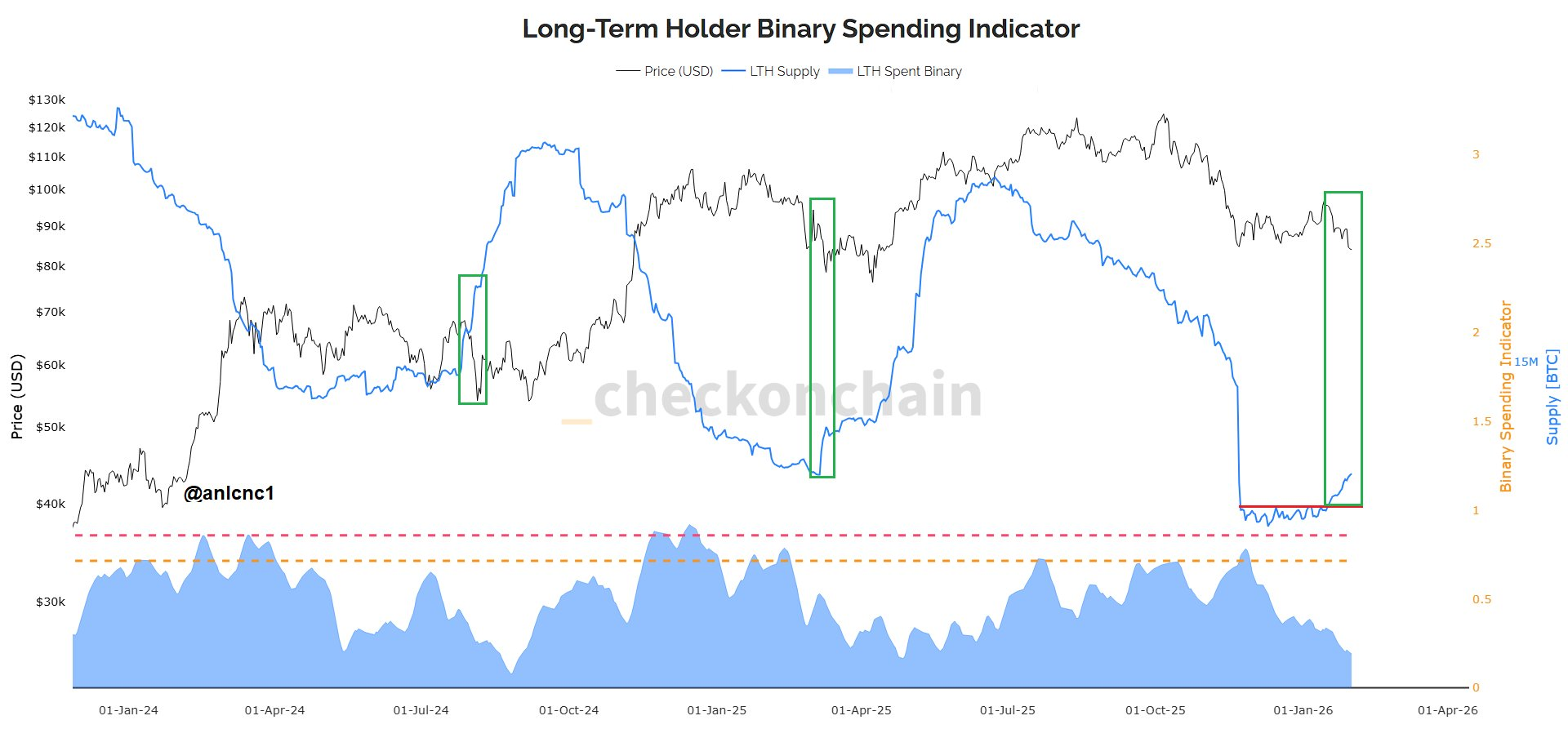

Long-term Bitcoin holders quietly rebuild during January sell-off

Despite Bitcoin’s sharp pullback in January, on-chain data suggests long-term holders are accumulating rather than exiting the market. The supply held by entities that have owned Bitcoin for more than 155 days began recovering during the sell-off, signaling renewed conviction among patient investors.

At the same time, the Long-Term Holder Spent Binary indicator continued to decline, showing reduced selling pressure from experienced holders. In previous market cycles, similar patterns have appeared near durable Bitcoin bottoms. Analysts note that after the April 2025 lows, long-term accumulation preceded a sharp rebound of roughly 60%, suggesting current behavior may be laying the groundwork for future gains.

-

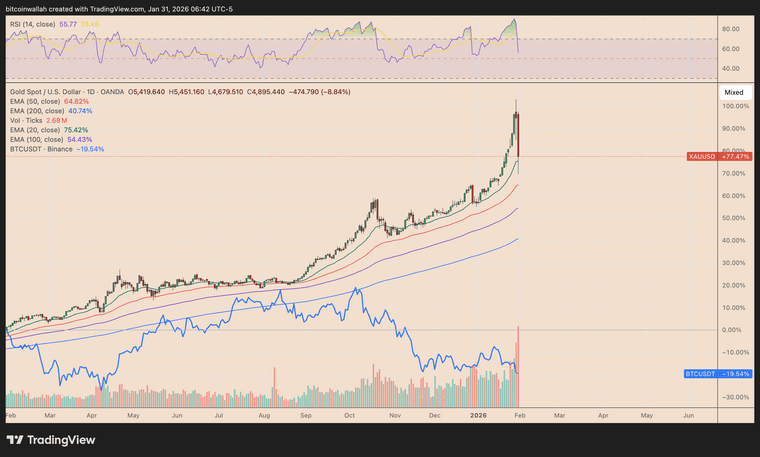

Analysts divided on whether gold profits will rotate into Bitcoin

While some analysts expect capital to rotate from gold into Bitcoin in the coming months, others caution that such a shift may take longer than investors expect. Gold prices have surged over the past year, while Bitcoin is down roughly 18% over the same period.

Bitwise Europe’s head of research André Dragosch and Swyftx lead analyst Pav Hundal believe rotation into Bitcoin could begin as early as February or March. However, analyst Benjamin Cowen pushed back, warning that Bitcoin may continue underperforming both stocks and precious metals in the near term. He argued that expectations of a rapid, large-scale move out of gold and silver into Bitcoin could prove premature.

-

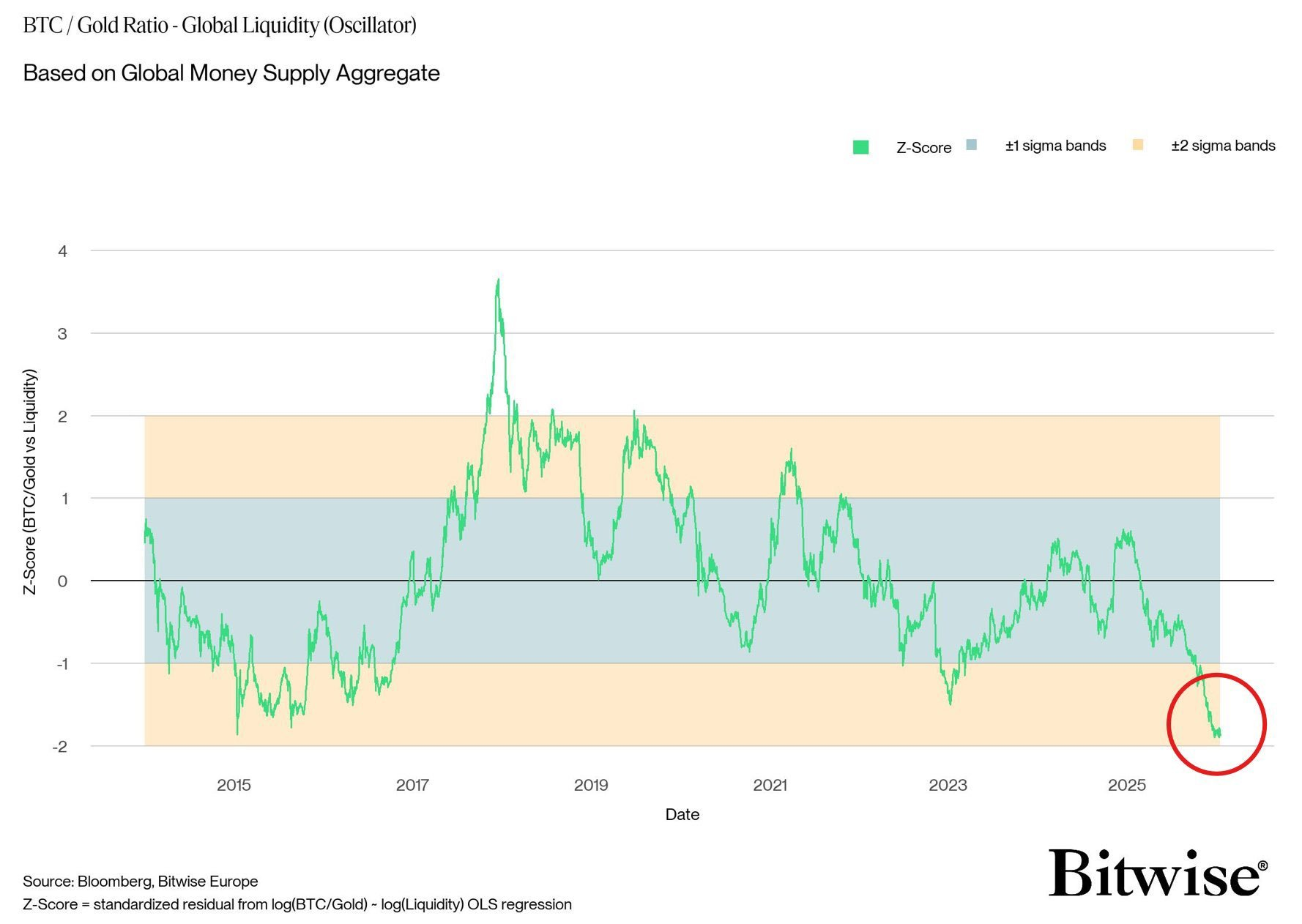

Bitcoin hits record low versus gold, analysts see rare buying signal

Bitcoin has fallen to a record low against gold, a level analysts say has historically marked major long-term buying opportunities. According to data from Bitwise Europe, Bitcoin’s value relative to gold — adjusted for global money supply — dropped into an extreme zone previously seen near major market bottoms.

The last time the BTC-to-gold indicator reached similar levels was in 2015, shortly before Bitcoin entered a historic bull run that delivered gains of more than 11,000% over the following two years. Analyst Michaël van de Poppe said the current setup represents “a better opportunity to be buying Bitcoin than 2017,” echoing views that BTC may be deeply undervalued versus gold.

-

Market sentiment weakens as macro fears hit crypto

Crypto market sentiment has fallen to a six-week low following heightened macro uncertainty and a broad sell-off across risk assets. The downturn followed U.S. President Donald Trump’s nomination of former Federal Reserve governor Kevin Warsh to replace Jerome Powell as Fed chair.

While Warsh has spoken favorably about Bitcoin, he is viewed as a more hawkish candidate, signaling tighter monetary policy and an exit from quantitative easing. Gold and silver fell sharply after the announcement, while the S&P 500 declined 0.43%.

Meanwhile, the Crypto Fear & Greed Index dropped to 14 out of 100, as former Binance CEO Changpeng Zhao expressed reduced confidence in the idea of a near-term Bitcoin supercycle.

-

Bitcoin dip briefly pushes Strategy below cost basis

Bitcoin’s sharp decline over the weekend temporarily pushed the cryptocurrency below Strategy’s average cost basis, marking a rare moment where the company’s long-term holdings dipped into unrealized losses.

Bitcoin fell from a high of $87,970 to as low as $75,892, slipping below Strategy’s estimated cost basis of $76,040 before rebounding above that level. Despite the short-lived dip, Strategy has remained largely profitable on its Bitcoin holdings over the past five years, aided by early purchases and long-term price appreciation.

Strategy’s largest Bitcoin acquisition this year came on Jan. 20, when it purchased 22,305 BTC, further cementing its position as the dominant Bitcoin treasury company.

-

Strategy hints at new Bitcoin buy after weekend sell-off

Strategy co-founder and executive chairman Michael Saylor has hinted that the company may have added to its Bitcoin holdings following a sharp market pullback over the weekend. Bitcoin fell more than 13%, briefly pushing Strategy’s massive BTC position into the red.

Saylor posted “More Orange” on X on Sunday, alongside a chart tracking Strategy’s Bitcoin purchases since August 2020 — a post he has historically used to signal new or upcoming buys. If confirmed, it would mark Strategy’s fifth Bitcoin purchase this year.

The firm remains the world’s largest corporate Bitcoin holder, managing more than 712,000 BTC valued at roughly $55 billion.

-

Binance coin, bullish lower low —Relief rally target updated

As we look into the big three, I want to show how a bullish rally is still possible by mentioning just a small detail on the BNB (Binance Coin) daily chart. Let's see if you can agree.A bullish lower low, how?

The low 21-November 2025 was $790. The lower low 31-January 2026 was $750, a difference of only 5% after 71 days of range trading. To me, this looks like a stop-loss hunt event. A stop-loss hunt move is a bullish development once it is over.

It can also happen that we are witnessing a bearish continuation and this bearish move is just early.

The RSI is now moving within the oversold (weak) zone and trading volume is low on the drop. There is potential for a reversal in the coming days.

The chart signals and market conditions still support a relief rally, a lower high compared mid-October 2025 followed by a strong bearish wave.

The numbers have been updated on the chart. The main target for the next move sits around $1,136.

Thank you for reading.

-

Bitcoin Is in the Wave 3 of the Bear Cycle

Bitcoin Bear Market Comparison (2021–2022 vs 2025–2026)

Based on structural similarity with the 2021–2022 bear market, Bitcoin in 2026 is most likely positioned in Wave 3-3 of the Elliott Wave bear cycle.

After the cycle top, Bitcoin completed:

• Wave 1: Initial breakdown

• Wave 2: Bear market rally within a rising corrective channelThat channel has now failed, marking the start of Wave 3, the main bear market leg.

Wave 3-3 is typically the most aggressive phase:

• Fast downside acceleration

• Rising volatility and volume

• Rapid failure of support levelsThis suggests the market is not at the bottom. Historically, the true bear market low forms only after Wave 5, not during Wave 3.

Any near-term rebound should be viewed as a counter-trend bounce, not a trend reversal.

-

Alphabet Stock: Ascending Triangle Signals Next Move

• Strong bullish trend (Higher Highs & Higher Lows)

• After a sharp rally, price is consolidating

• Current pattern: Ascending Triangle (Bullish Continuation)

• Moving Average is acting as dynamic supportKey Levels

• Major Resistance: 345 – 350

• Next Resistance: 365 – 375

• Near Support: 320 – 318

• Structural Support: 300Bullish Scenario

Trigger:

• Daily close above 340

• Confirmed breakout above triangle resistanceTargets:

- 350

- 365

- 380

Stop Loss (Long):

Stop Loss (Long):

• Aggressive: 318

• Conservative: 300Bearish / Pullback Scenario

If:

• Rejection from 345

• Breakdown below triangle supportTargets:

- 318

- 300

Stop Loss (Short):

Stop Loss (Short):

• Above 350Fundamental Analysis (Brief)

• Alphabet remains one of the strongest AI-driven tech giants

• Growth drivers:

• AI & Gemini ecosystem

• Cloud expansion (Google Cloud)

• Advertising resilience

• Valuation is still reasonable vs mega-cap peers

• Long-term bias: Bullish