The total cryptocurrency reported in 2024 exceeded $4 billion, including around $550 million in gains and $290 million in losses.

Authorities are preparing for stricter reporting: starting in 2026, crypto exchanges and custodians will provide third-party reporting to the tax office, helping to track ownership and taxable events more accurately.

️ Ripple Case Was the Turning Point

️ Ripple Case Was the Turning Point What This Means for You

What This Means for You 1. Clearer rules = more growth

1. Clearer rules = more growth 2. Easier path for tokenized assets & stablecoins

2. Easier path for tokenized assets & stablecoins 3. Banking custody rules may be next

3. Banking custody rules may be next ️ A Few Red Flags to Watch

️ A Few Red Flags to Watch

Skeptics: Point to political risk and past controversies — like the 70 billion CRO token burn cancellation earlier this year.

Skeptics: Point to political risk and past controversies — like the 70 billion CRO token burn cancellation earlier this year. What’s your call — bullish long-term momentum, or risky hype tied too closely to politics?

What’s your call — bullish long-term momentum, or risky hype tied too closely to politics?

Quantum Computing: FUD or Future Threat?

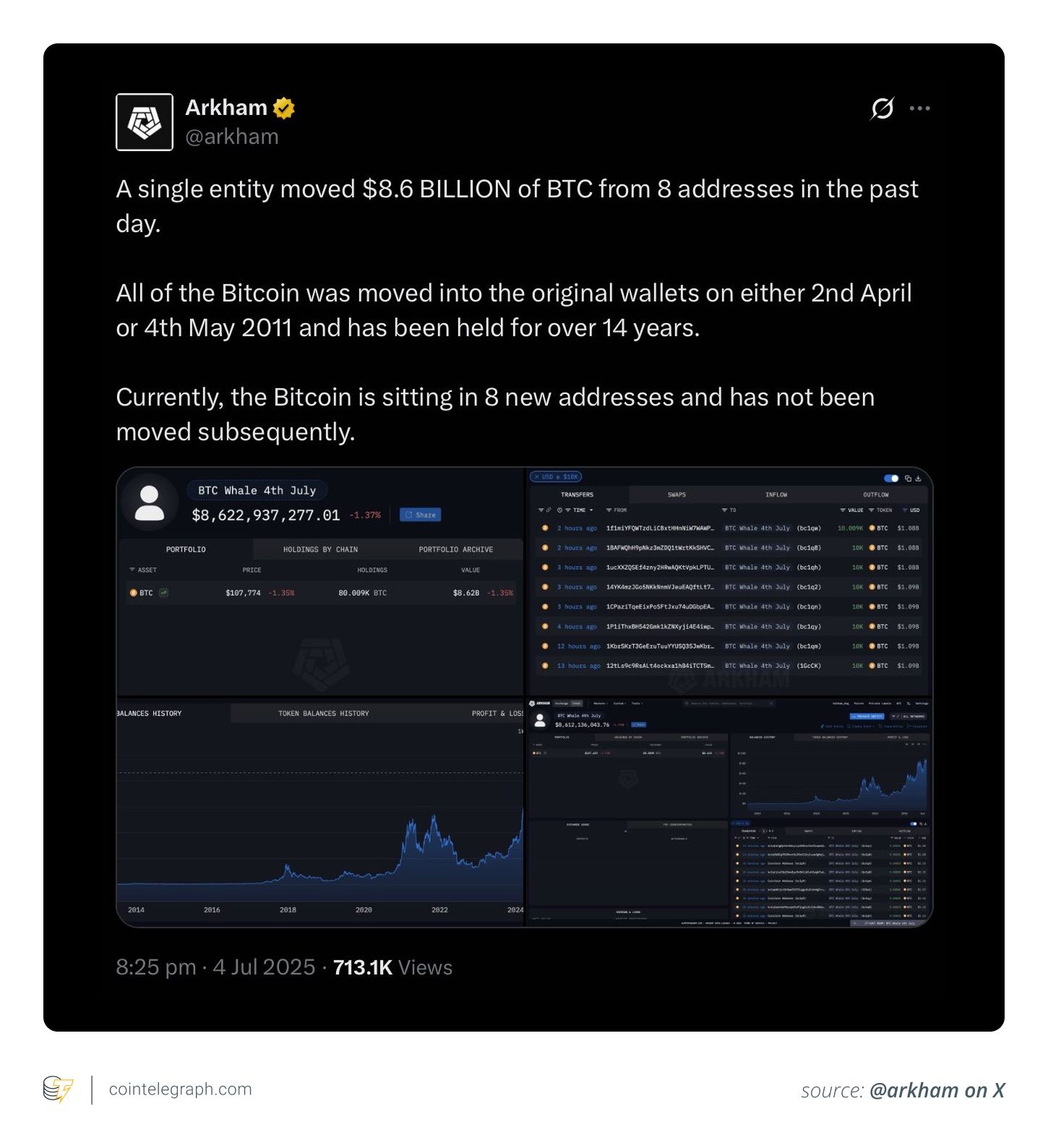

Quantum Computing: FUD or Future Threat? Whale Sold 9,000 BTC — and Bitcoin Dropped 5%

Whale Sold 9,000 BTC — and Bitcoin Dropped 5% ️

️ ️ Who Was It?

️ Who Was It?

Why Think of It as a Treasury?

Why Think of It as a Treasury? ️ Freelancer-Friendly DeFi Moves

️ Freelancer-Friendly DeFi Moves Thought Starter:

Thought Starter:

️ What Are the Stablecoin Wars?

️ What Are the Stablecoin Wars? Why Freelancers Should Care

Why Freelancers Should Care The Freelancer’s Playbook

The Freelancer’s Playbook

What do you think — in 5 years, will freelancers be mostly paid in USDC, USDT, or a government-backed CBDC?

What do you think — in 5 years, will freelancers be mostly paid in USDC, USDT, or a government-backed CBDC?

Only 5% of AI pilot programs produced quick, measurable revenue boosts (“millions in extra sales”).

Only 5% of AI pilot programs produced quick, measurable revenue boosts (“millions in extra sales”). For everyone else, there were no clear financial gains despite the investment.

For everyone else, there were no clear financial gains despite the investment. Takeaway: $30B+ later, AI isn’t a magic money printer. The companies winning are the ones that customize AI for their workflows and train people to use it — not the ones just buying licenses and hoping for miracles.

Takeaway: $30B+ later, AI isn’t a magic money printer. The companies winning are the ones that customize AI for their workflows and train people to use it — not the ones just buying licenses and hoping for miracles.

Shift in Momentum

Shift in Momentum

What’s New

What’s New Web3 bridge → Games like CS:GO and FIFA are in rotation, letting Web2 gamers earn Web3 rewards without friction.

Web3 bridge → Games like CS:GO and FIFA are in rotation, letting Web2 gamers earn Web3 rewards without friction. Bigger Picture

Bigger Picture