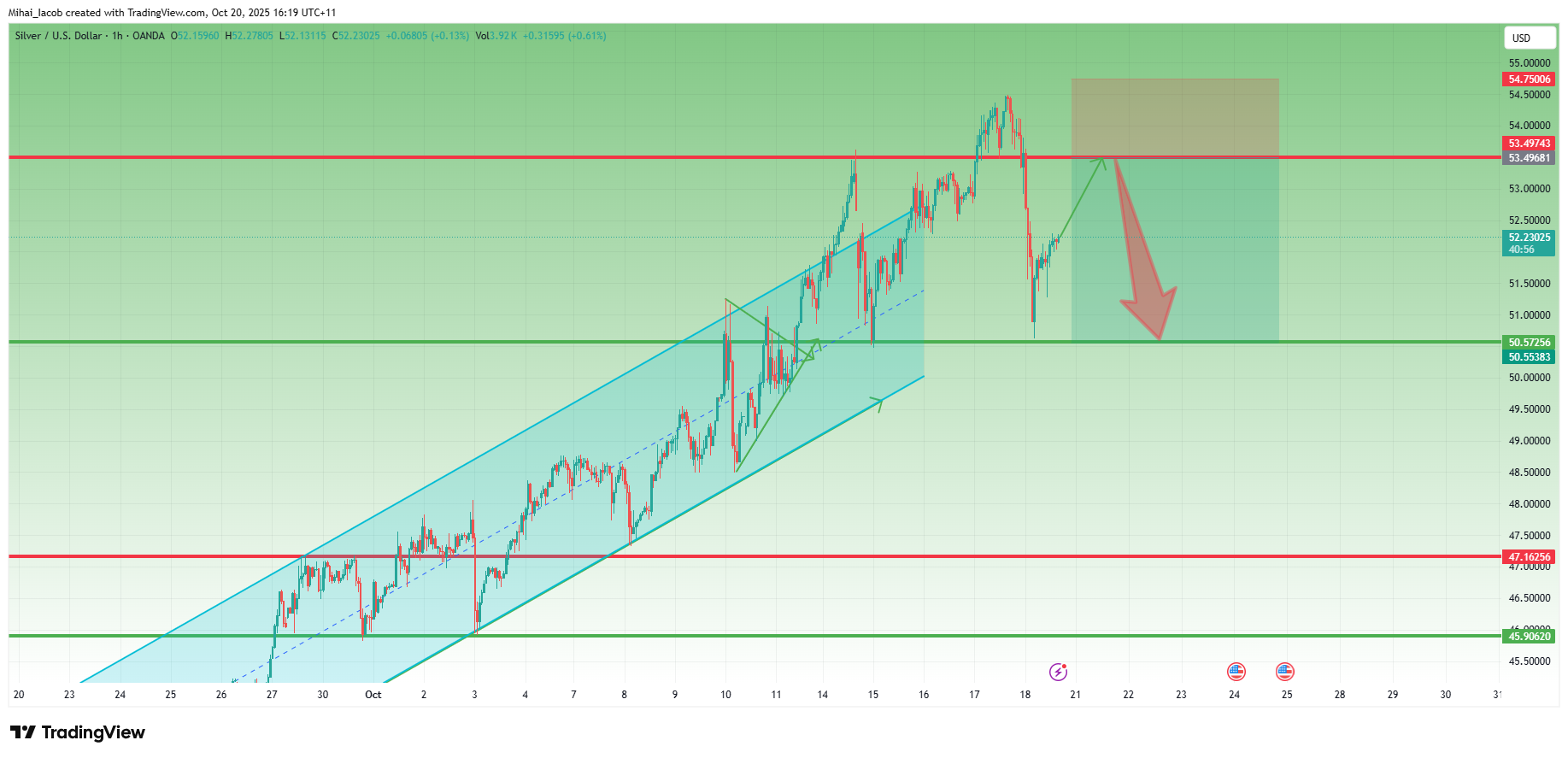

While Gold has been volatile, Silver’s drop has been even more spectacular — a breathtaking 9,000-pip decline in just 10 days, from the all-time high near 54.50 down to 45.50, a correction of roughly 20%.

But let’s not forget — the prior rally was just as extreme: from 37 to almost 55, a 50% surge.

This kind of price behavior is typical for Silver — sharp on both sides. Yet, compared to Gold, the recent structure shows a few key differences worth noting:

Key Observations

Key Observations

- Back Above the Ascending Trendline

After the recent low two days ago, Silver managed to climb back above the ascending trendline that started in late August — a strong early sign of stabilization. - Perfect 50% Retracement Support

The correction stopped exactly at the 50% Fibonacci retracement, perfectly aligned with a major horizontal support zone — a classic technical confluence. - Higher Low Confirmed

Unlike Gold, Silver printed a clear higher low last night, strengthening the case for a bullish recovery setup.

Outlook

Outlook

Putting it all together, Silver appears to have completed its correction and looks technically stronger than Gold at this stage.

If the current momentum continues, a new test above 50 seems increasingly likely in the coming sessions.

+550 pips

+550 pips -200 pips

-200 pips Break-even

Break-even