Crypto Calls in Short Format with Mihai Iacob

-

Solana (SOLUSDT) – Bulls Hold the Channel

Solana (SOLUSDT) – Bulls Hold the ChannelAfter the drop from 300 to under 100, Solana reversed strongly and now trades inside an ascending channel.

The 200 zone acted as perfect support, triggering a 15% bounce.As long as price stays above 215, momentum remains bullish.

Next target for buyers: 260, the channel top and November high.

Support: 200 / 215

Resistance: 260

Bias: Bullish

-

AVAX – Retest Before the Next Move Up

After breaking above the $26.60 resistance, AVAX rallied to $36.60 in a strong bullish leg.

Now, the price is pulling back to retest the broken level — a confluence support with the rising trendline from June.This area could offer a great buying opportunity, with a potential 1:4 risk/reward setup.

I’m looking to buy and target the next bullish continuation.

-

UDSUSDT – Correction Before the Next Pump

After reaching nearly $3, UDSUSDT entered a normal correction following its strong rally from the $1 support.

Now, the price is consolidating, and the $1.15 zone stands as key support.A new upward leg could start from this area, with the main target at $3 — or even higher if momentum continues.

-

BTC – Bulls Still in Control

BTC made a new ATH as expected, followed by a brief correction.

Price reversed from above 120K, and the daily candle shows strong buying pressure with a long lower wick — possibly forming a continuation Pin Bar.As long as 118K holds, the structure stays bullish and buying dips remains the plan toward 140K–150K.

-

AVAX – Retest Before the Next Move Up

After breaking above the $26.60 resistance, AVAX rallied to $36.60 in a strong bullish leg.

Now, the price is pulling back to retest the broken level — a confluence support with the rising trendline from June.This area could offer a great buying opportunity, with a potential 1:4 risk/reward setup.

I’m looking to buy and target the next bullish continuation.

-

Solana – Wait for Confirmation, Not Hope

As I mentioned in yesterday’s crypto post, I’m still bullish long-term, but we need to trade what we see, not what we wish for.

Friday’s sell-off pushed Solana below key support and the channel bottom — a bearish signal.

After the drop, price recovered to touch the $200 psychological level, but the structure remains weak.Only a clear stabilization above $200–210 would turn the short-term outlook bullish again.

Until then, it’s wiser to wait for confirmation — markets punish overconfidence.Patience first, profits later.

-

Bitcoin – Rebound or Real Recovery?

As mentioned yesterday, I’d like to stay bullish, but the overconfidence in the market keeps me cautious.

BTC bounced from key support and recovered part of the drop, yet this looks more like a technical rebound, not real buying pressure.

Only a break above 118K–120K would confirm strength.

If BTC falls back under 110K, another leg down becomes likely.Still waiting for confirmation before conviction.

-

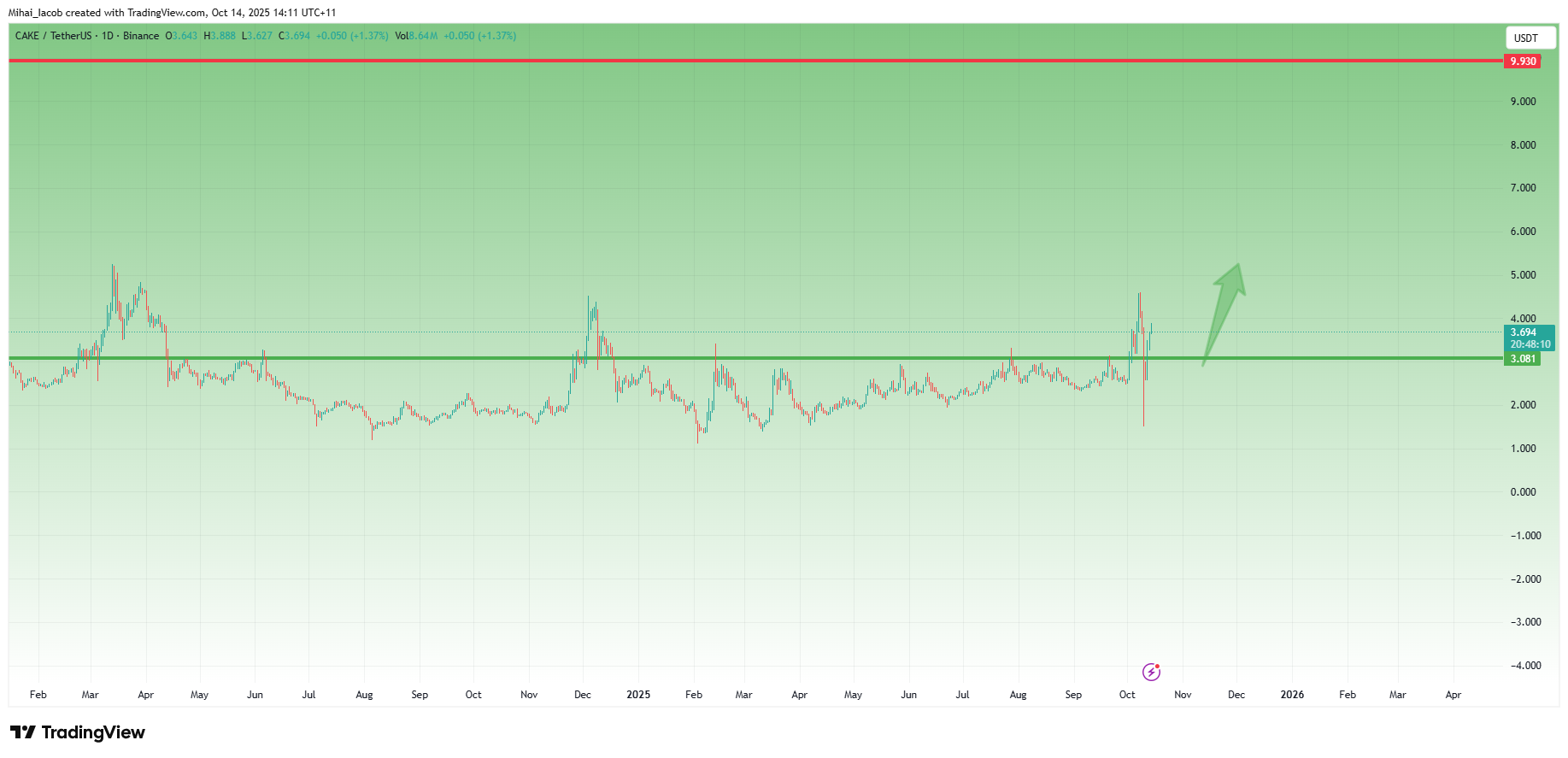

CAKE — Bulls Still in the Game

In my previous analysis, I mentioned that CAKE could rise to 5 USD after breaking above a 1.5-year accumulation range.

The coin reached 4.5 USD, then dropped sharply during Friday’s liquidation — but unlike many others, it quickly recovered above support, showing strong bulls.As long as 3 USD holds, the outlook remains bullish, with 5 USD still the medium-term target.

Plan: Buy dips near 3 USD.

-

LINK – Back in the Game

Chainlink briefly lost the 18.50 support and dropped below $10, but quickly recovered, reclaiming that key zone and re-entering the bullish flag from late August.

No clear buy signal yet — but a break above 21.50 could confirm a new leg toward $30.

Let the market confirm it.

-

ETH: Looking strong

Despite the crypto crash, ETH has moved very technically.

The break below $4,300 sent it down to $3,500, but a rebound above $3,850 pushed the price back to the $4,300 resistance.After another pullback, ETH found support again at $3,850 and quickly bounced to $4,100.

The chart now shows an ascending triangle with resistance at $4,300 — a breakout could send ETH toward $4,900–$5,000.I’m looking to buy dips below $4,000, with a 1:3–1:4 risk-reward setup.

-

Chainlink briefly lost the 18.50 support and dropped below $10, but quickly recovered, reclaiming that key zone and re-entering the bullish flag from late August.

No clear buy signal yet — but a break above 21.50 could confirm a new leg toward $30.

Let the market confirm it.

-

First target → ATH retest.

Extended target → $4+ on this leg up.

As long as $2.70 holds, the setup remains constructive.

#XRP #Crypto #Trading #Altcoins

#XRP #Crypto #Trading #Altcoins -

Chainlink briefly lost the 18.50 support and dropped below $10, but quickly recovered, reclaiming that key zone and re-entering the bullish flag from late August.

No clear buy signal yet — but a break above 21.50 could confirm a new leg toward $30.

Let the market confirm it.

-

Very solid analysis If $2.70 keeps holding as strong support, XRP breaking $3 could trigger serious momentum — $4+ retest definitely on the table

-

As mentioned yesterday, I’d like to stay bullish, but the overconfidence in the market keeps me cautious.

BTC bounced from key support and recovered part of the drop, yet this looks more like a technical rebound, not real buying pressure.

Only a break above 118K–120K would confirm strength.

If BTC falls back under 110K, another leg down becomes likely.Still waiting for confirmation before conviction.

-

First target → ATH retest.

Extended target → $4+ on this leg up.

As long as $2.70 holds, the setup remains constructive.

#XRP #Crypto #Trading #Altcoins

#XRP #Crypto #Trading #Altcoins -

Chainlink briefly lost the 18.50 support and dropped below $10, but quickly recovered, reclaiming that key zone and re-entering the bullish flag from late August.

No clear buy signal yet — but a break above 21.50 could confirm a new leg toward $30.

Let the market confirm it.

-

First target → ATH retest.

Extended target → $4+ on this leg up.

As long as $2.70 holds, the setup remains constructive.

#XRP #Crypto #Trading #Altcoins

#XRP #Crypto #Trading #Altcoins