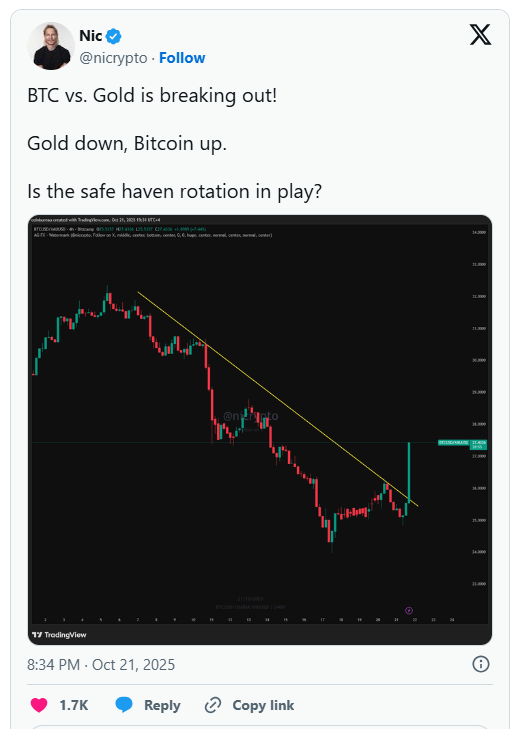

Federal Reserve Chair Jerome Powell suggested that rate cuts may come before year-end, signaling the end of the Fed’s balance sheet reduction program. Powell’s comments fueled optimism across digital asset markets, helping both Bitcoin and Ether ETFs rebound.

“An October rate cut will have markets taking flight, with crypto and ETFs seeing liquidity flow,” said Vincent Liu of Kronos Research. Even after a recent flash crash, crypto investment products remain resilient, with $48.7 billion in inflows for 2025, already surpassing last year’s total.

4-Hour Timeframe

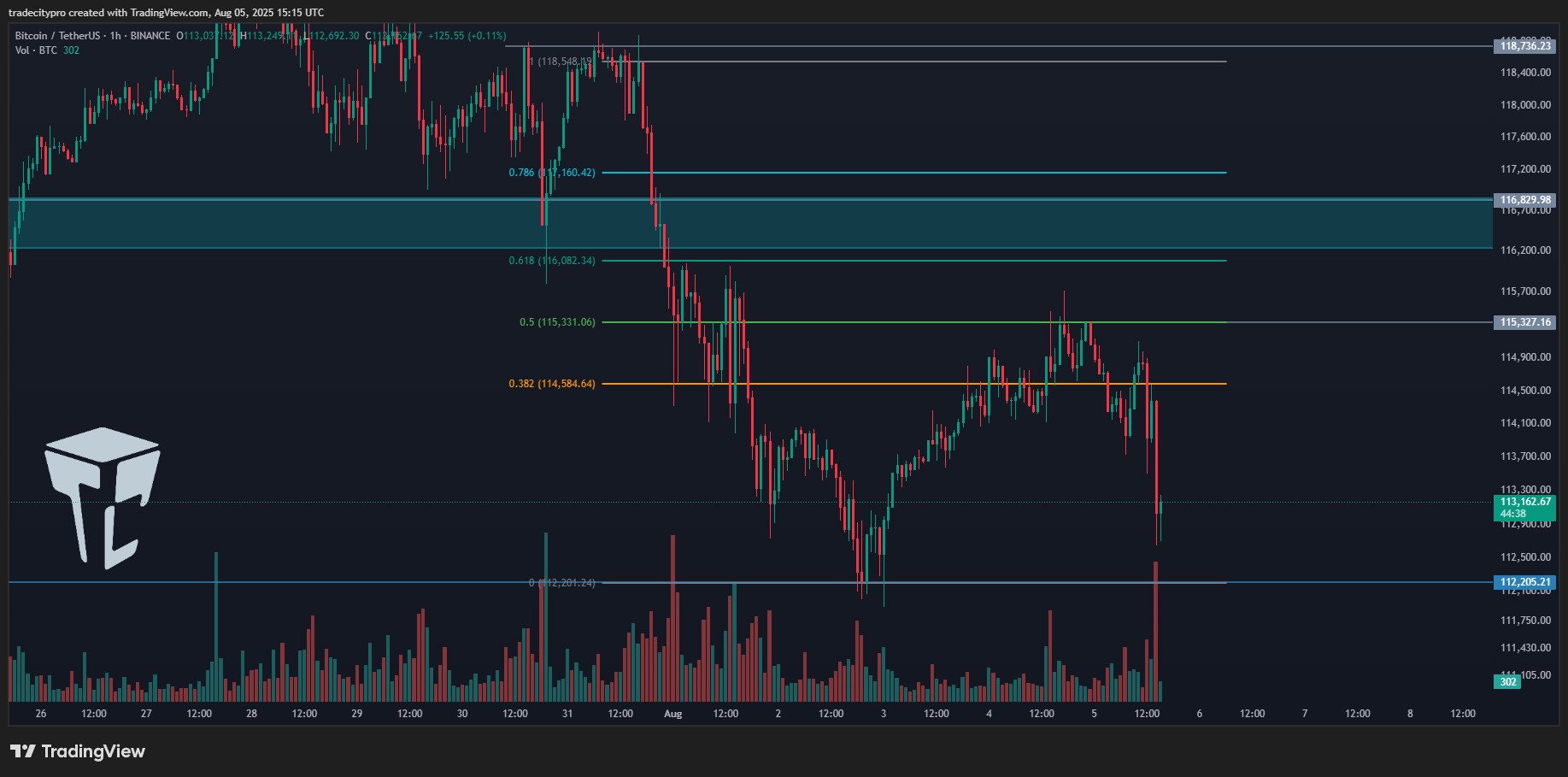

4-Hour Timeframe ️ I still won’t open any position on Bitcoin and am waiting for it to exit the box between 110000 and 116000. But if certain conditions occur in the market, I might open a position inside this box as well.

️ I still won’t open any position on Bitcoin and am waiting for it to exit the box between 110000 and 116000. But if certain conditions occur in the market, I might open a position inside this box as well. First of all, Bitcoin is still above the 111747 support, which is a very important support zone. As the price reaches it, there’s a chance it gets stuck there again.

First of all, Bitcoin is still above the 111747 support, which is a very important support zone. As the price reaches it, there’s a chance it gets stuck there again. On the other hand, seller strength is very high, and as you can see, the RSI has been rejected from the 50 ceiling, and a red engulfing candle with very high volume is forming — all of which indicate the power of sellers.

On the other hand, seller strength is very high, and as you can see, the RSI has been rejected from the 50 ceiling, and a red engulfing candle with very high volume is forming — all of which indicate the power of sellers. I still stand by my opinion that as long as the price is above 110000, I won’t open a short position. But for a long position, we can move to the 1-Hour timeframe to review the trigger that has formed.

I still stand by my opinion that as long as the price is above 110000, I won’t open a short position. But for a long position, we can move to the 1-Hour timeframe to review the trigger that has formed. Bitcoin in the HWC and MWC cycles has a very strong upward trend. Right now, in the LWC, it’s moving downward. So this Fibonacci drawn on the bearish leg doesn’t really mean much and won’t give us very strong and accurate resistances.

Bitcoin in the HWC and MWC cycles has a very strong upward trend. Right now, in the LWC, it’s moving downward. So this Fibonacci drawn on the bearish leg doesn’t really mean much and won’t give us very strong and accurate resistances. On the other hand, the LWC is moving against the higher cycles — meaning the higher cycles are stronger. That’s why shorting doesn’t make sense, since it’s against the main market cycle.

On the other hand, the LWC is moving against the higher cycles — meaning the higher cycles are stronger. That’s why shorting doesn’t make sense, since it’s against the main market cycle. But also, since LWC has gained downward momentum, long positions — if not set with wide stop-losses — will likely get stopped out, because this momentum may cause small downward legs that hit stop-losses.

But also, since LWC has gained downward momentum, long positions — if not set with wide stop-losses — will likely get stopped out, because this momentum may cause small downward legs that hit stop-losses. So opening a long position is also difficult right now, and that’s why I say it’s better to wait for the price to move out of the 110000 to 116000 range, and then enter a position more comfortably.

So opening a long position is also difficult right now, and that’s why I say it’s better to wait for the price to move out of the 110000 to 116000 range, and then enter a position more comfortably. If the price goes below 110000, we’ll receive the first sign of a trend reversal in the MWC, and then we can open short positions. And if it goes above 116000, LWC becomes bullish again and the continuation of the uptrend can begin.

If the price goes below 110000, we’ll receive the first sign of a trend reversal in the MWC, and then we can open short positions. And if it goes above 116000, LWC becomes bullish again and the continuation of the uptrend can begin. The trigger we have for a long position is 115327 — an important ceiling that overlaps with the 0.5 Fibonacci level and has been touched several times.

The trigger we have for a long position is 115327 — an important ceiling that overlaps with the 0.5 Fibonacci level and has been touched several times. ️ If we get another touch to this level, I myself will likely try to open a long position, and I think it’s a good entry point that’s worth the risk to anticipate a breakout of 116000.

️ If we get another touch to this level, I myself will likely try to open a long position, and I think it’s a good entry point that’s worth the risk to anticipate a breakout of 116000. Disclaimer

Disclaimer

High-Value Targets in the Crosshairs

High-Value Targets in the Crosshairs What’s Next?

What’s Next? ️ Takeaway

️ Takeaway

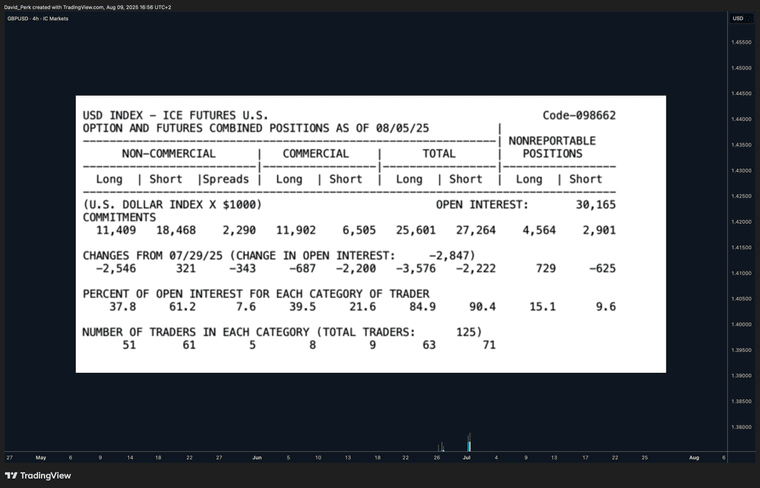

What Is COT Data?

What Is COT Data? The Main Market Participants

The Main Market Participants Which Report?

Which Report? Traders in Financial Futures (TFF) — covers forex, bonds, and indexes.

Traders in Financial Futures (TFF) — covers forex, bonds, and indexes.

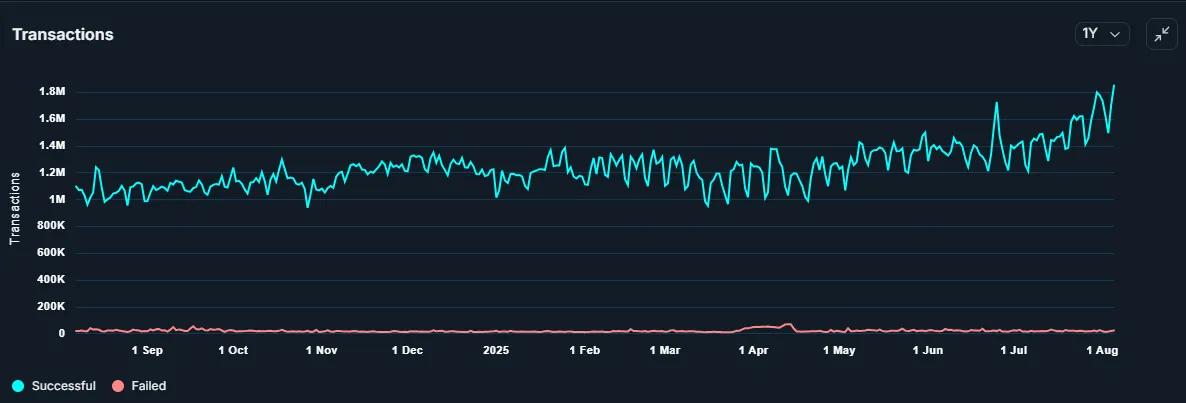

Migration Details

Migration Details Beta Gameplay: Limited but Functional

Beta Gameplay: Limited but Functional Mobile-First Transition

Mobile-First Transition Tokenomics Reset

Tokenomics Reset What’s Next

What’s Next

The Announcement

The Announcement CEO’s Take

CEO’s Take Custody & Oversight

Custody & Oversight

️ The Takeaway

️ The Takeaway

Reports From WLFI Holders

Reports From WLFI Holders ️ Rising Scam Activity

️ Rising Scam Activity

First Season: Dopameme Rush

First Season: Dopameme Rush

El Salvador treats it as legal tender.

El Salvador treats it as legal tender. Brazil lists BTC ETFs.

Brazil lists BTC ETFs. Trump now accepts BTC donations.

Trump now accepts BTC donations. Milei calls it “money returning to the people.”

Milei calls it “money returning to the people.”

Meanwhile, Open Interest = $79B (still frothy).

Meanwhile, Open Interest = $79B (still frothy).