mendez

Posts

-

guys it's been an honor -

after buying every dip

-

Dont monkey around me!!

-

Bitcoin slips amid geopolitical tensions despite growing crypto adoption

Bitcoin’s price fell nearly 10% from January highs as geopolitical uncertainty rattled global markets, reinforcing BTC’s reputation as a risk-on asset.

After briefly approaching $97,000, Bitcoin retreated amid investor concerns tied to US President Donald Trump’s comments about acquiring Greenland, which sparked broader market unease. Analysts noted that cryptocurrencies offered little shelter during the sell-off.

The pullback came despite continued signs of crypto adoption. A January PayPal report found that four in 10 US merchants now accept crypto payments, with 84% believing digital assets will become mainstream within five years. Still, analysts say short-term price action remains sensitive to macro and political shocks.

-

Winter storm puts pressure on US Bitcoin miners as power grids strain

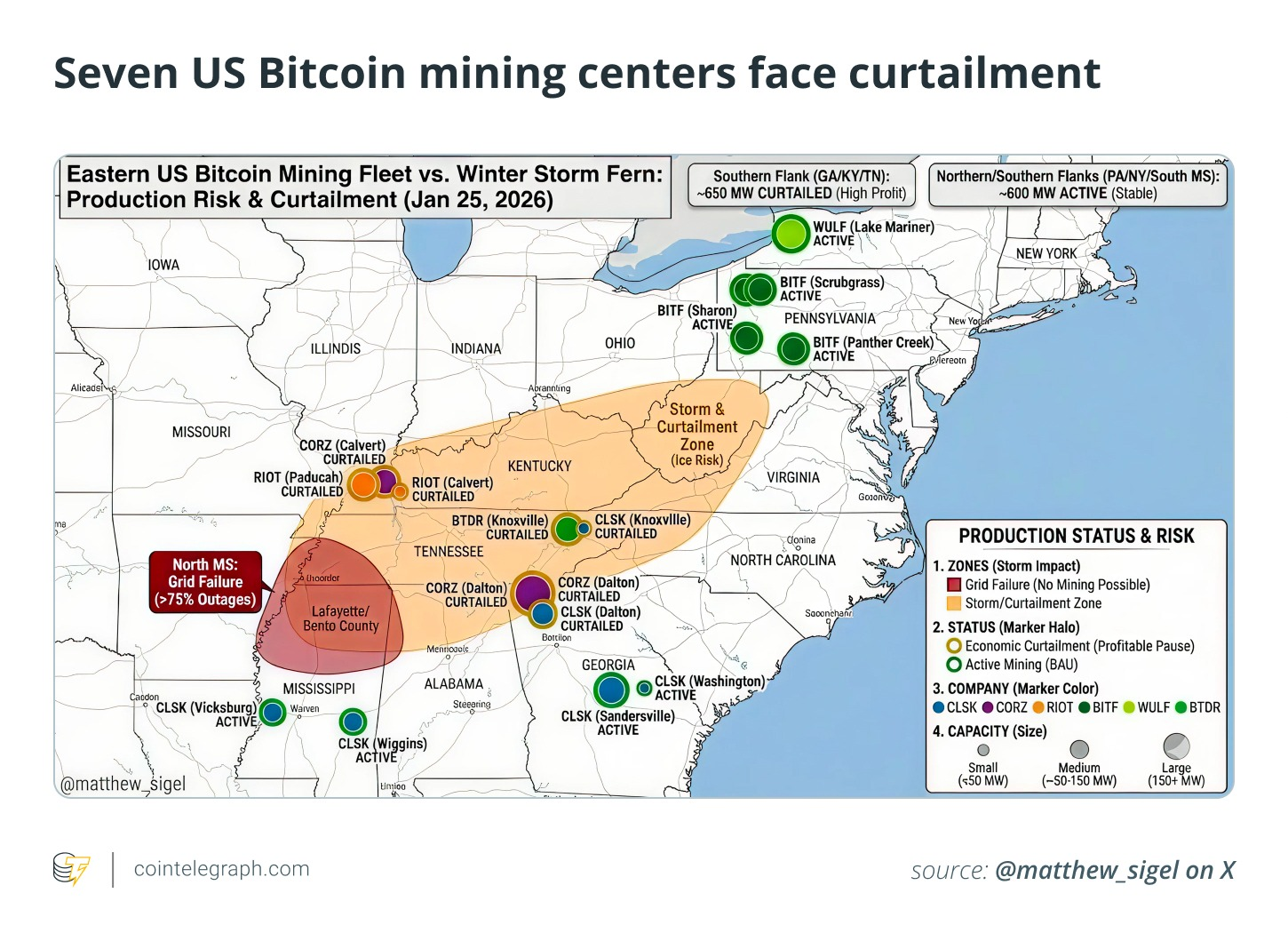

Seven major Bitcoin mining operations in the United States may temporarily scale back activity after severe winter storms strained power grids across the Southeast and South Central regions.

According to VanEck digital assets research head Matthew Sigel, mining sites operated by Riot, Core Scientific, CleanSpark, and Bitdeer are designed to reduce power consumption during grid stress through demand-response programs. While real-time curtailments have not been confirmed, the infrastructure is already in place to allow miners to shut down when electricity demand spikes.

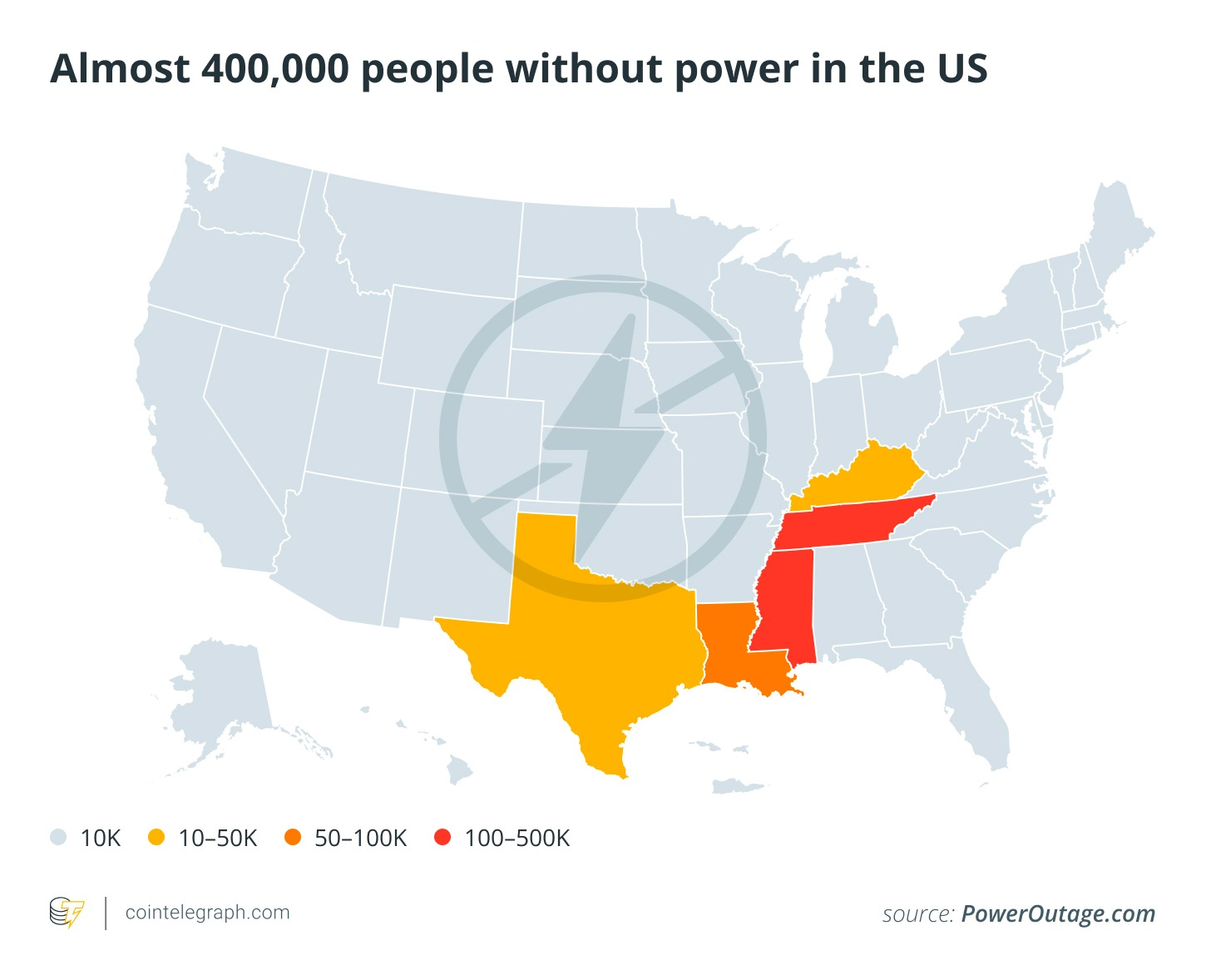

The storm left roughly 400,000 people without power across multiple states and has been linked to at least 20 deaths. Bitcoin miners increasingly operate in regions where they can stabilize grid demand by powering down during emergencies.

-

Solana and Ethereum see surge in active users as network upgrades pay off

Activity across major altcoin networks surged in January, with Solana and Ethereum both posting strong growth in daily active addresses.

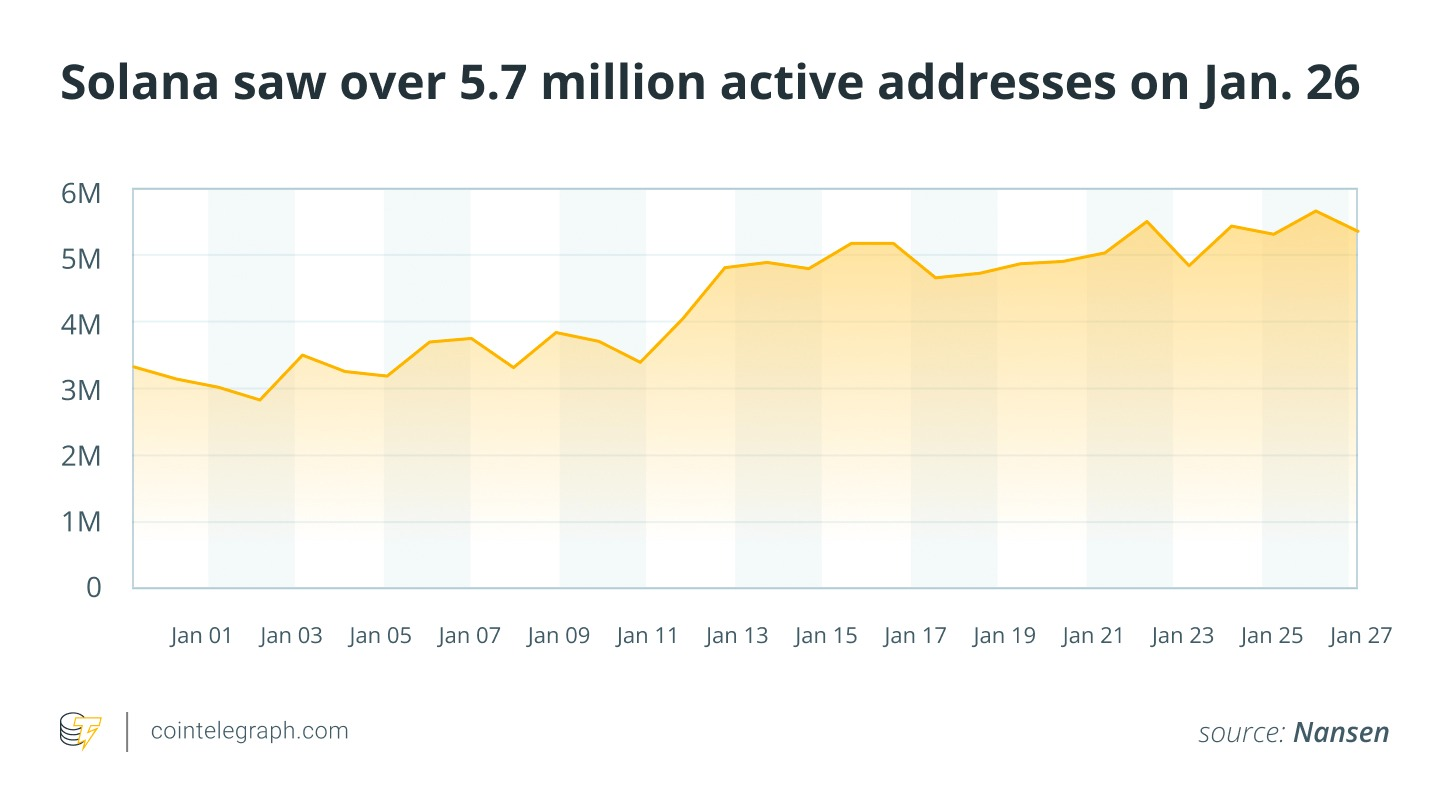

Solana recorded a 115% monthly increase in active addresses, regularly topping 5 million daily users in the second half of the month, according to Nansen data. The spike was driven largely by a memecoin launch frenzy tied to new AI-powered tooling and increased activity on token launchpad Bags, which also saw daily fees jump to $4.5 million on Jan. 16.

Ethereum also saw renewed momentum. After overtaking major layer-2 networks in December, Ethereum posted a 25% rise in daily active addresses in January following upgrades that expanded blob capacity and pushed average transaction fees below $0.01. Developers say the changes are part of broader efforts to future-proof the network.

-

SBF criticizes Biden and highlights GOP ties in political posts from prison

From federal prison, Sam Bankman-Fried has publicly rebuked President Joe Biden, accusing him of having “bungled crypto” through regulatory appointments, and contrasting that with praise for Donald Trump’s crypto stance.

Bankman-Fried’s recent comments online also applauded Trump’s international actions, calling the arrest of Venezuela’s Nicolás Maduro “smart, gutsy, and pro-democracy,” and framing Trump as favorable to digital assets.

The remarks come alongside his ongoing legal efforts: he appealed his conviction in late 2025 and continues to await a decision from the US Court of Appeals. While speculation about a presidential pardon persists, recent reporting indicates Trump currently has no plans to pardon Bankman-Fried.

-

Sam Bankman-Fried ramps up Trump praise from prison amid pardon talk

Disgraced FTX founder Sam Bankman-Fried has increased public praise for US President Donald Trump, while sharply criticizing former President Joe Biden, just days after ex-Alameda CEO Caroline Ellison was released from federal custody.

Bankman-Fried — serving a 25-year sentence for fraud and money-laundering tied to FTX’s 2022 collapse — took to social media to call Trump “right on crypto” and laud Trump’s handling of issues including the arrest of Nicolás Maduro.

The shift in tone has sparked speculation he may be positioning for leniency or a pardon, though betting markets currently put the chances of Trump issuing clemency before 2027 at around 17%

-

Utilities and contractors join HomeBoost’s energy-efficiency model

HomeBoost charges $99 for its home energy assessment—about one-quarter the cost of a typical in-person audit—but many customers pay far less thanks to utility partnerships.

Utilities including Central Hudson, Omaha Public Power District, and Avista now subsidize the service. In some cases, homeowners pay as little as $19, or nothing at all if they borrow the BoostBox from a public library.

The company is also expanding tools for professional energy auditors and testing features that connect homeowners directly with contractors. Tobaccowala says aligning consumers, utilities, and contractors around lower energy use could reduce bills while delivering meaningful climate benefits.

-

HomeBoost offers DIY alternative to traditional energy audits

HomeBoost, a startup featured in TechCrunch Disrupt 2025’s Startup Battlefield 200, is aiming to simplify home energy assessments with a do-it-yourself approach.

Customers receive a “BoostBox” containing an infrared camera, a blacklight, and access to an app that guides them through scanning their home. The tools help identify air leaks, insulation issues, and inefficient lighting.

The app then generates a personalized report recommending cost-effective upgrades and available rebates based on location. Founder Selina Tobaccowala says the process is faster, cheaper, and more transparent than traditional audits, which some homeowners feel are overly focused on selling expensive HVAC upgrades.

-

Former SurveyMonkey exec turns to home energy tech after family wake-up call

After selling her fitness startup Gixo, entrepreneur Selina Tobaccowala began looking for her next challenge in an unexpected place: her own home.

Her daughter had started leaving post-it notes reminding the family to turn off lights, sparking Tobaccowala’s interest in sustainability and climate solutions. Lacking a background in climate science or hardware, she leaned into what she knew best—consumer surveys.

After polling hundreds of people, Tobaccowala found a recurring pain point: homeowners wanted to lower utility bills but didn’t know where to start. That insight led her to co-found HomeBoost, a startup helping people assess and improve their home energy efficiency.

-

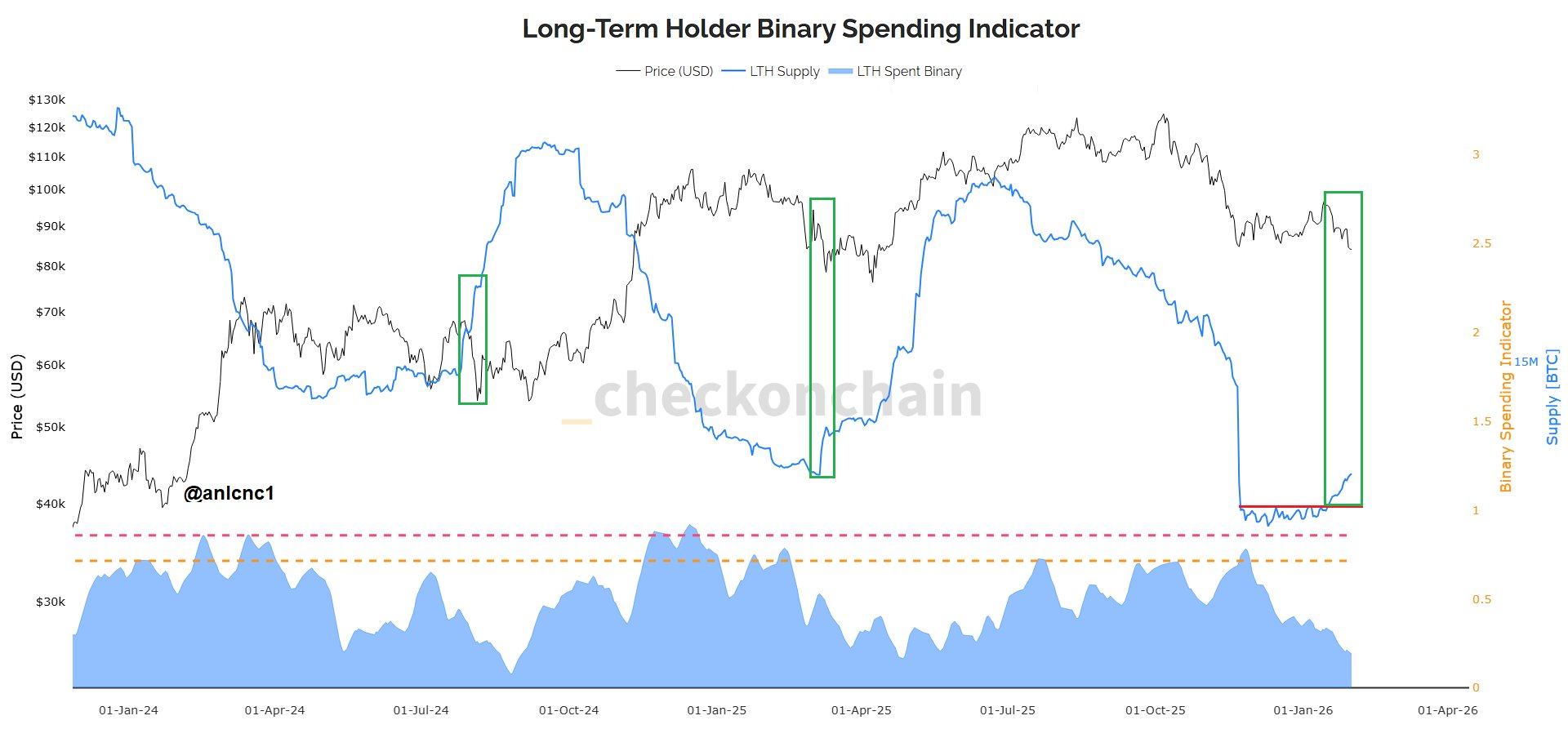

Long-term Bitcoin holders quietly rebuild positions

Despite January’s sharp Bitcoin sell-off, on-chain data suggests long-term holders are steadily accumulating.

Wallets holding BTC for more than 155 days began increasing supply during the downturn, while the Long-Term Holder Spent Binary indicator continued to decline. Historically, this combination has appeared near durable Bitcoin market bottoms.

A similar pattern followed the April 2025 lows, when long-term accumulation preceded a roughly 60% BTC rebound one month later.

Analysts say the January reset may be allowing patient investors to rebuild positions—often a key ingredient in forming a stronger foundation for future Bitcoin gains.

-

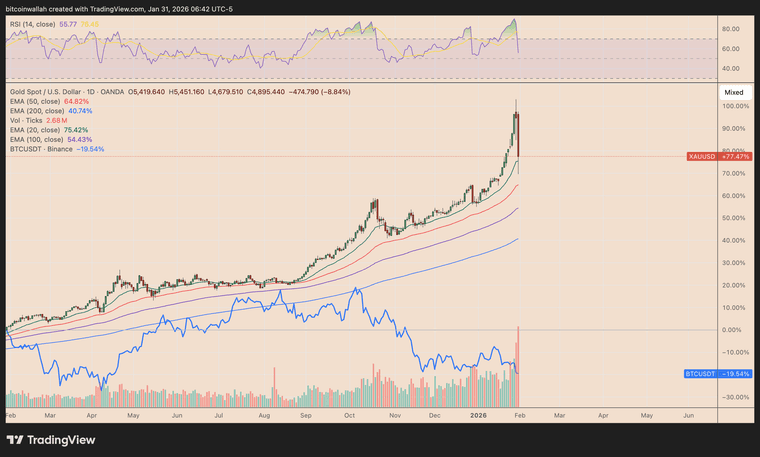

Gold surge clouds timing of Bitcoin rotation

While Bitcoin shows signs of extreme undervaluation versus gold, analysts warn that a rapid rotation is far from guaranteed.

Gold prices have doubled over the past year, while Bitcoin is down roughly 18% over the same period. This divergence has strengthened gold’s appeal as a hedge, with some institutions projecting continued gains. Citi expects silver to extend its rally, while RBC Capital Markets forecasts gold could reach $7,000 by the end of 2026.

Analyst Benjamin Cowen cautioned that Bitcoin may continue underperforming in the short term, arguing that hopes for a swift shift from precious metals into BTC may be premature.

-

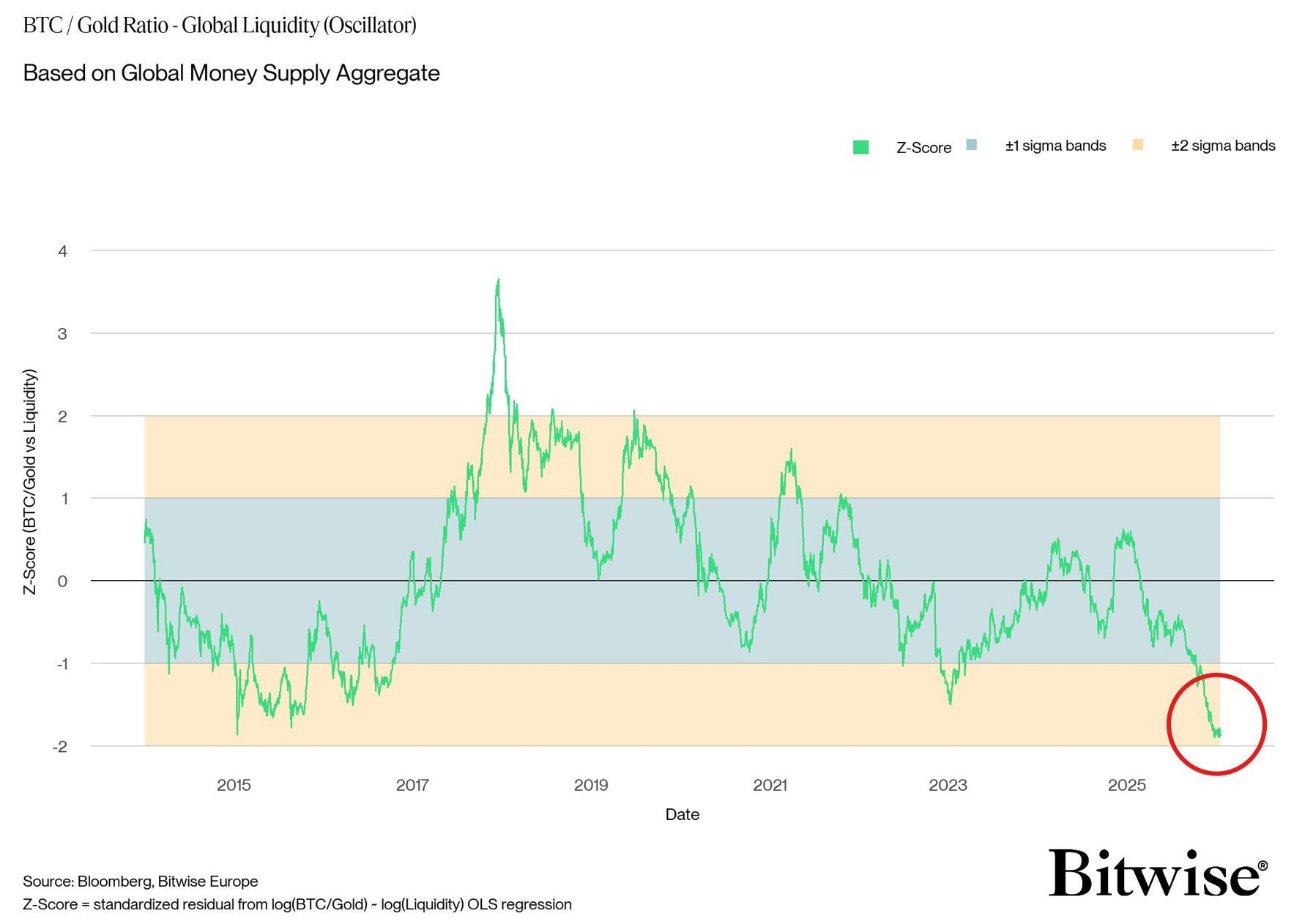

Bitcoin hits record low against gold, echoes past market bottoms

Bitcoin fell to a record low versus gold in January, a level analysts say has historically aligned with major BTC market bottoms.

Data from Bitwise Europe shows the BTC-to-gold ratio, adjusted for global money supply, has dropped into an extreme undervaluation zone. Similar conditions last appeared in 2015, shortly before Bitcoin entered its 2015–2017 bull market and rallied more than 11,000%.

Analyst Michaël van de Poppe called the current setup “a better opportunity to be buying Bitcoin than 2017,” fueling expectations that capital could rotate from gold into BTC later this year. Some analysts suggest this shift could begin as early as February or March.

-

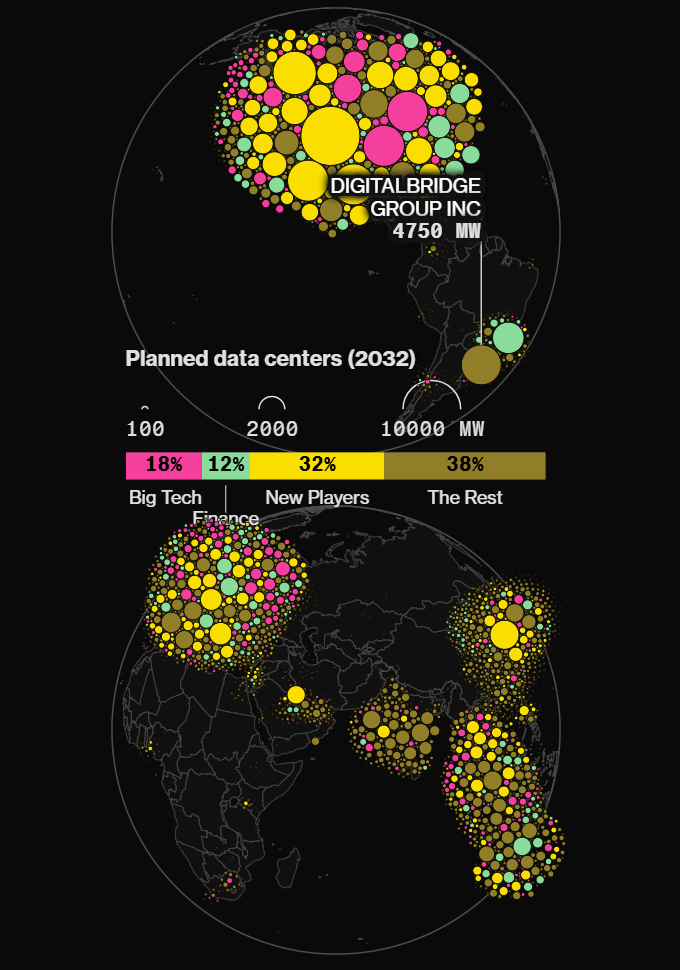

Crypto miners’ AI pivot faces familiar pressures

CoreWeave isn’t alone in moving from crypto mining to AI data centers. Firms like HIVE Digital, MARA Holdings, Hut 8, and TeraWulf have repurposed energy and compute infrastructure to support AI and high-performance workloads.

But AI data centers are beginning to face challenges once familiar to Bitcoin miners: community resistance tied to power consumption, grid strain, and land use.

Despite this, the market remains highly competitive. Bloomberg data shows thousands of new entrants building data centers, with Big Tech’s share of global computing capacity projected to fall below 18% by 2032.

If the trend holds, AI infrastructure—like crypto mining before it—may increasingly operate outside the direct control of Big Tech.

-

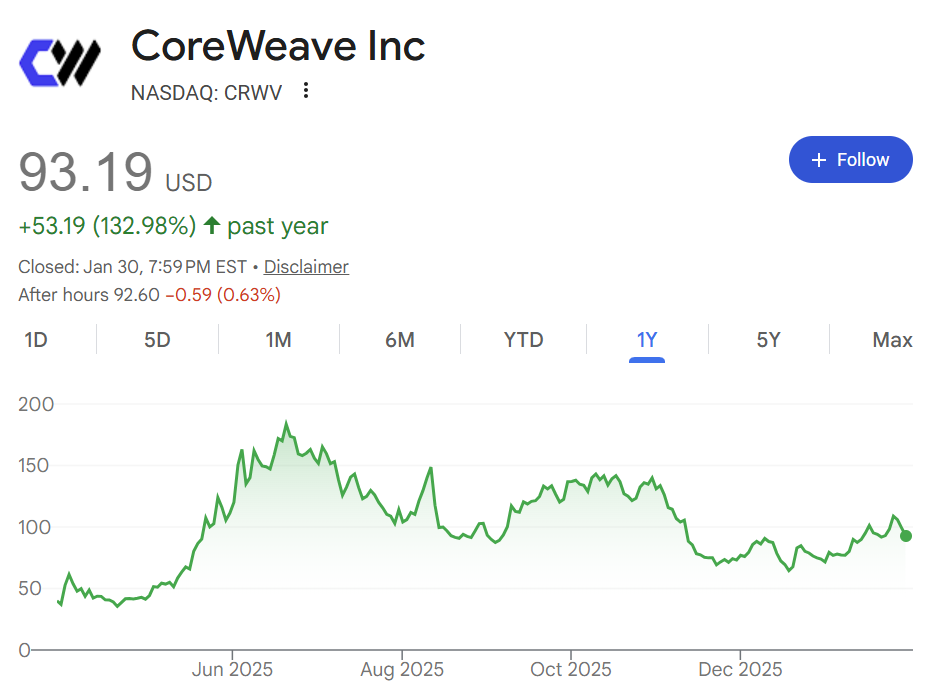

Nvidia backs CoreWeave as executives cash out

CoreWeave’s AI-focused transformation is now attracting both strategic partners and major liquidity events.

Nvidia’s $2 billion equity investment underscores CoreWeave’s role as a critical supplier of GPU infrastructure for AI workloads. Industry analysts say the deal strengthens CoreWeave’s position as a neutral alternative to hyperscale cloud providers.

The growth has also delivered windfalls internally. Since its IPO last March, CoreWeave executives have generated an estimated $1.6 billion in proceeds from stock sales, according to The Miner Mag.

The company’s trajectory highlights how early crypto-era infrastructure is now being monetized in the AI boom.

-

From crypto mines to AI machines — CoreWeave’s pivot pays off

CoreWeave’s evolution from a crypto-mining operator into a major AI infrastructure provider shows how computing assets are being repurposed across tech cycles.

After Ethereum moved away from proof-of-work, demand for GPU mining collapsed. According to The Miner Mag, companies like CoreWeave responded by redirecting GPUs toward AI training and high-performance computing as demand for compute surged.

CoreWeave began exiting crypto mining as early as 2019, shifting first into cloud services before fully repositioning as a GPU infrastructure provider for AI. That bet has paid off. Nvidia recently agreed to a $2 billion equity investment, cementing CoreWeave as one of the largest independent GPU operators outside Big Tech cloud giants.

-

Coinbase Launches Prediction Markets Across All 50 Statesbetting on politics and sports from the app is peak convenience, and peak chaos for dinner table arguments.

-

Coinbase Goes All-In on Prediction Marketscoinbase being a one-stop shop for crypto + bets feels like peak 2026 energy.

-

DeepMind’s Project Genie blends creativity and AI experimentationremixing worlds and exploring galleries makes this feel more like a toy than a tool right now, which is fine.