A lot of folks are still under the impression that Bitcoin = anonymous. Sorry to burst your bubble — but that’s not true.

Bitcoin is pseudonymous, meaning every transaction you make is permanently etched into the blockchain for all eternity. If someone ties your name to your wallet address… they can see everything you’ve ever done with it. Not exactly private, right?

Let’s break it down — and more importantly, let’s talk about what you can do to stay off the radar. 🧵

So… How Did We End Up Here?

So… How Did We End Up Here?

When Satoshi Nakamoto dropped the Bitcoin whitepaper, the idea was to create a decentralized, anonymous financial system. And while BTC removed the middlemen (banks), it didn’t quite nail the privacy part.

Why? Because all BTC transactions are public. All of them. Forever.

If someone knows your BTC address, they can plug it into a blockchain explorer and instantly see every coin that’s passed through your wallet. Add some KYC breadcrumbs, and boom — you’ve been de-anonymized.

🧠 Example? Sure.

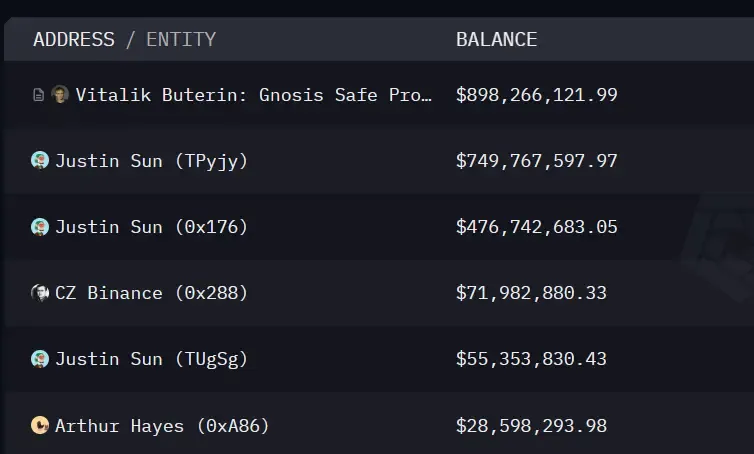

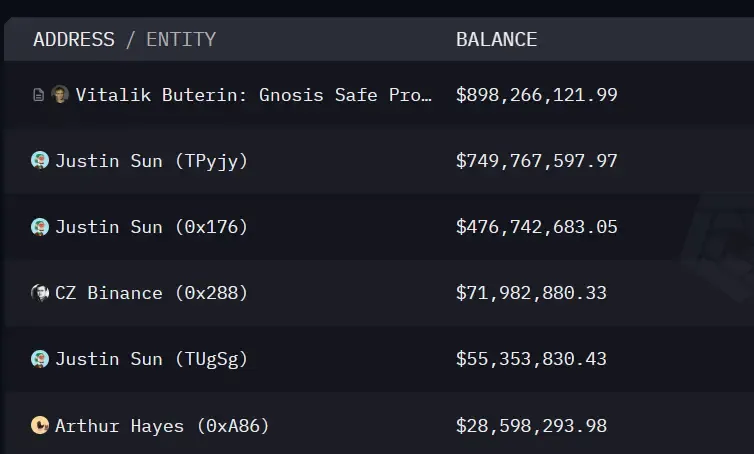

Let’s say Vitalik Buterin wants to send some ETH from one of his public wallets. Everyone watching Arkham, Nansen or DeBank will see it. Instantly. And yes, people do monitor his activity.

You can literally look up wallets of famous crypto whales and see their latest moves. Don’t believe it? Check out Arkham’s wallet explorer — it’s terrifyingly powerful.

The CEX Problem: KYC and Centralized Exposure

The CEX Problem: KYC and Centralized Exposure

Many users still prefer centralized exchanges (CEXs) because they’re packed with features — copy trading, staking, passive yield, you name it.

But what do you give up in return?

Convenience

Convenience

Privacy

Privacy

These platforms require full KYC, including passport scans, selfies, proof of address, sometimes even a DNA sample (ok, not yet). Once your info is stored, it's only a matter of time before a leak happens.

Take Binance, for example — yes, even the biggest names get hit. Their user KYC documents have leaked online in the past. It happens. And when it does, scammers are the first to pounce with phishing campaigns and social engineering attacks.

🧱 So What Can You Do?

If you’re serious about preserving your financial privacy, you have a few options:

Use non-custodial wallets with no KYC

Explore privacy coins (like Monero or Zcash)

Utilize peer-to-peer swaps or decentralized exchanges (DEXs)

Use services or protocols that support anonymous cross-chain swaps

And if you're moving BTC but want a cleaner, more private slate… consider swapping it into another asset through a privacy-respecting exchange before sending it where it needs to go.

TL;DR

TL;DR

Bitcoin is not anonymous — every transaction is public.

Once someone links your identity to your wallet, they see everything.

Centralized exchanges? Handy but risky — they know everything about you.

Privacy isn’t dead, but you have to work for it in crypto.

Use the tools. Stay sharp. Don’t doxx yourself by accident.

What are your go-to tools for crypto privacy in 2025?

Drop your favorite methods (or horror stories) below. Let’s crowdsource some wisdom.

Privacy, Please

Privacy, Please What’s on the Crypto Menu?

What’s on the Crypto Menu? Dubai’s Not Sleeping on This Either

Dubai’s Not Sleeping on This Either

1. Niche Down—Then Double Down

1. Niche Down—Then Double Down 2. Set Tiered Packages That Make Sense (to Crypto People)

2. Set Tiered Packages That Make Sense (to Crypto People) 3. Use Crypto Keywords to Game the Search

3. Use Crypto Keywords to Game the Search Bonus Hack: Build a Portfolio on Chain

Bonus Hack: Build a Portfolio on Chain

2. Secure It and Forget It (Kind Of)

2. Secure It and Forget It (Kind Of) 3. Educate Yourself

3. Educate Yourself

Why This Level Matters

Why This Level Matters

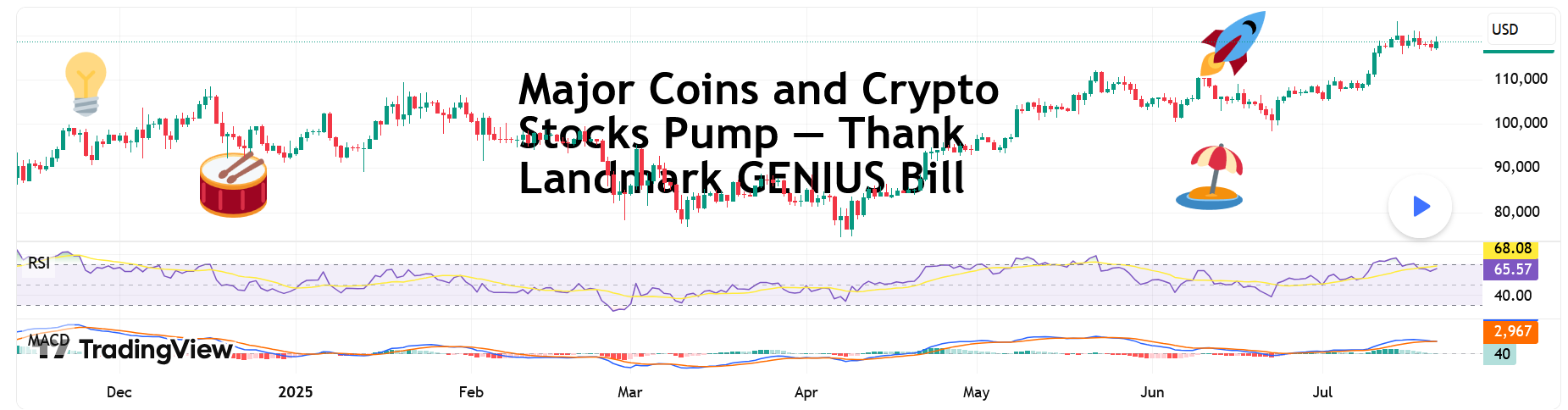

Robinhood: Meme Stock No More?

Robinhood: Meme Stock No More? XRP: Return of the Ripple?

XRP: Return of the Ripple? Ethereum: Quietly Eyeing $4,000

Ethereum: Quietly Eyeing $4,000 Washington, WAGMI?

Washington, WAGMI?

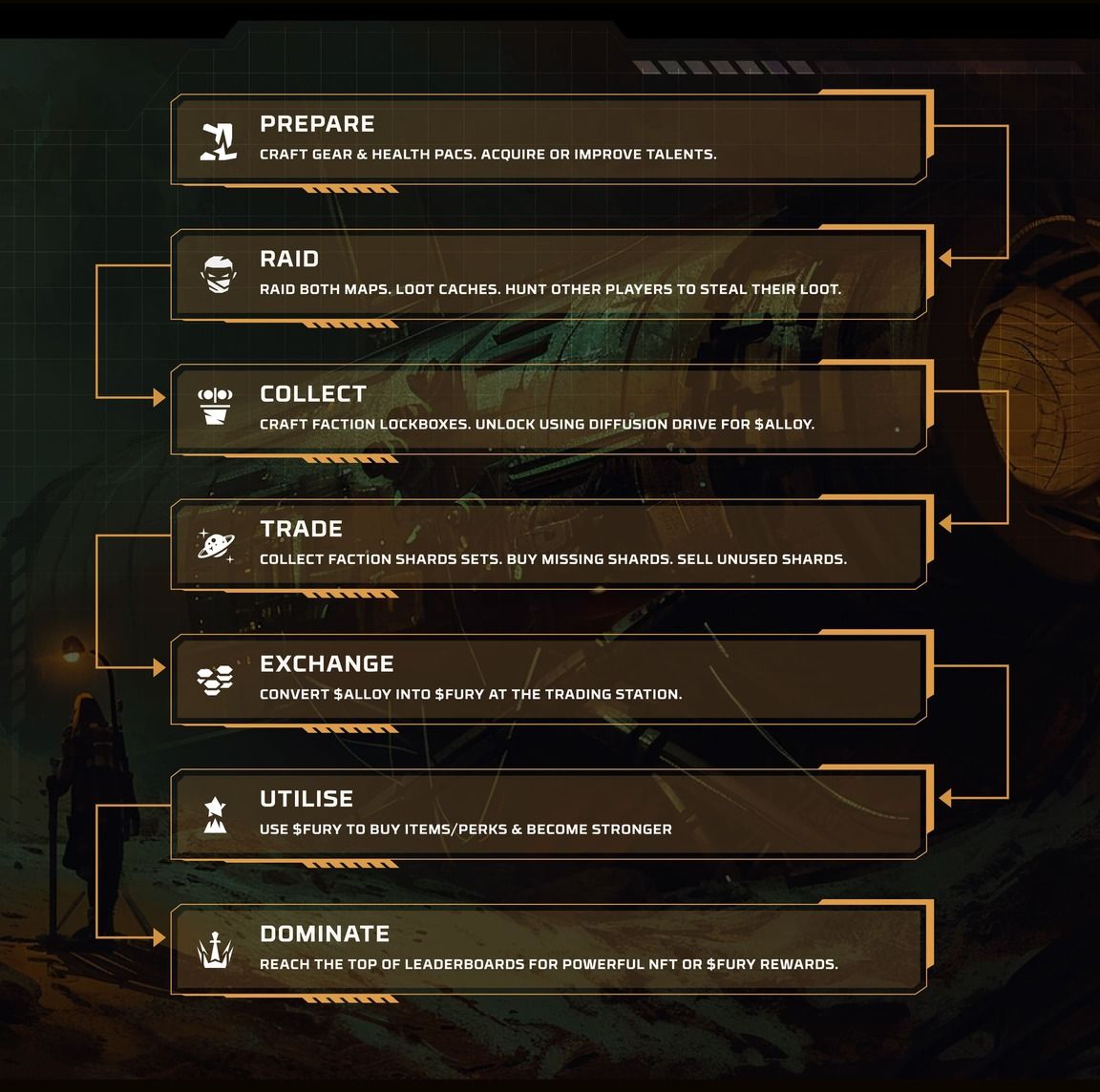

What Even Is ChronosWorlds?

What Even Is ChronosWorlds? PvE = Risk, Reward… & Regret

PvE = Risk, Reward… & Regret ️ PvP = Chaos Unleashed

️ PvP = Chaos Unleashed What’s in Early Access?

What’s in Early Access? Keep your eyes on Epic Games Store.

Keep your eyes on Epic Games Store.

Global Pay, Local Living:

Global Pay, Local Living: ️ Skills Over Degrees:

️ Skills Over Degrees: Decentralized Work Culture:

Decentralized Work Culture: The Rise of Peer-to-Peer Talent Marketplaces:

The Rise of Peer-to-Peer Talent Marketplaces:

WzrdBot: Smarter Trading on Autopilot

WzrdBot: Smarter Trading on Autopilot ️ Built Different: AI + Institutional-Grade Infrastructure

️ Built Different: AI + Institutional-Grade Infrastructure

Why It's Ending:

Why It's Ending: ️ What’s Next:

️ What’s Next:

), while Sinister Strike delivers solid guaranteed hits. Night Steal adds an energy steal edge for outplay potential.

), while Sinister Strike delivers solid guaranteed hits. Night Steal adds an energy steal edge for outplay potential. Combo Tip: Revenge Arrow → 2x Sinister Strike → Night Steal =

Combo Tip: Revenge Arrow → 2x Sinister Strike → Night Steal =  KO machine

KO machine Build #3: Nitro Leap | Death Mark | Sinister Strike | Night Steal

Build #3: Nitro Leap | Death Mark | Sinister Strike | Night Steal Bonus: Night Steal adds energy gain + extra utility if you’ve got the energy.

Bonus: Night Steal adds energy gain + extra utility if you’ve got the energy.

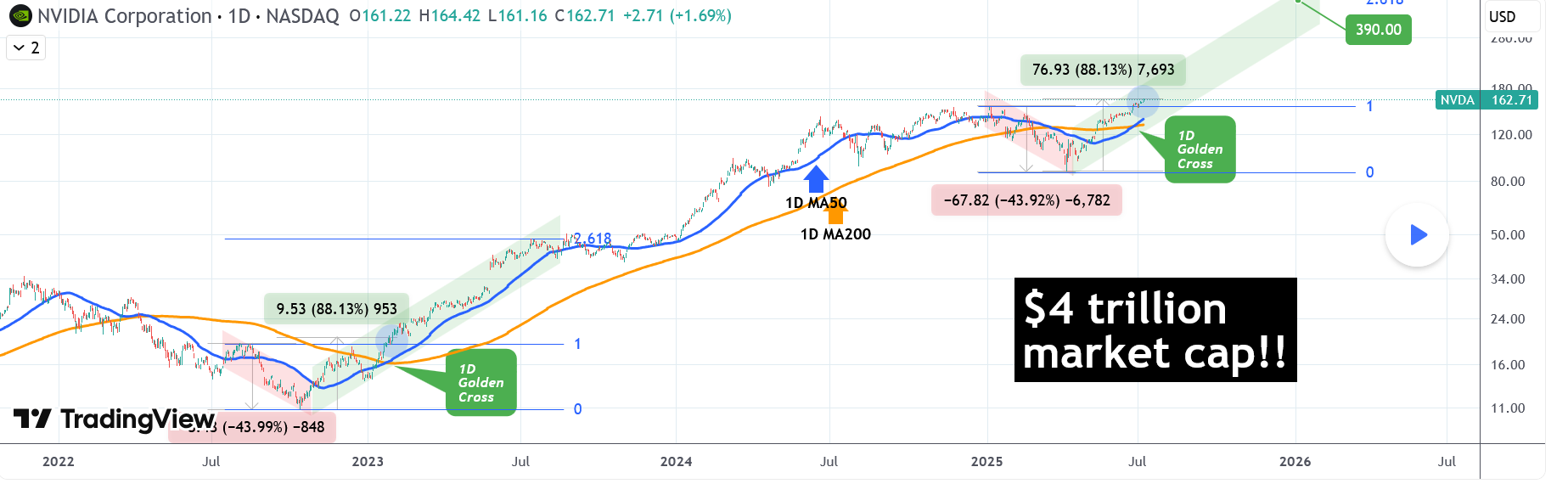

, FOLLOW

, FOLLOW  and COMMENT

and COMMENT  if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

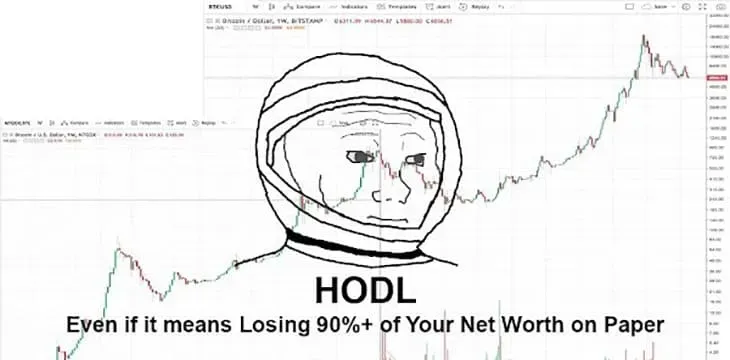

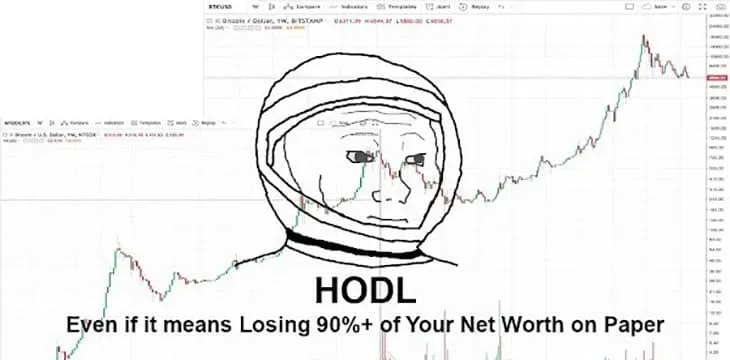

Hope: The Most Expensive Four-Letter Word

Hope: The Most Expensive Four-Letter Word

️ From Risk Management to Revenge Trading

️ From Risk Management to Revenge Trading ️ The Beauty of the Hard Stop

️ The Beauty of the Hard Stop ️ Small Losses Are the Cost of Doing Business

️ Small Losses Are the Cost of Doing Business ️ Finding Comfort in Discomfort

️ Finding Comfort in Discomfort Face the Fear, Keep the Account

Face the Fear, Keep the Account

️

️ , sold out in just 30 minutes, raking in a smooth $12 million.

, sold out in just 30 minutes, raking in a smooth $12 million. As of July 10, 2025, 10,000 Stars = roughly ₽16K–₽27K depending on how you paid.

As of July 10, 2025, 10,000 Stars = roughly ₽16K–₽27K depending on how you paid. ️ 24K digital cars? Snatched up in 60 seconds.

️ 24K digital cars? Snatched up in 60 seconds. In case you missed it, Snoop Dogg dropped a music video on July 9 featuring Telegram and the gift collection. The man’s been active since May 2025 when he launched his own Telegram channel.

In case you missed it, Snoop Dogg dropped a music video on July 9 featuring Telegram and the gift collection. The man’s been active since May 2025 when he launched his own Telegram channel. ️ Pavel Durov (Telegram founder) says NFT trading kicks off in 21 days:

️ Pavel Durov (Telegram founder) says NFT trading kicks off in 21 days: