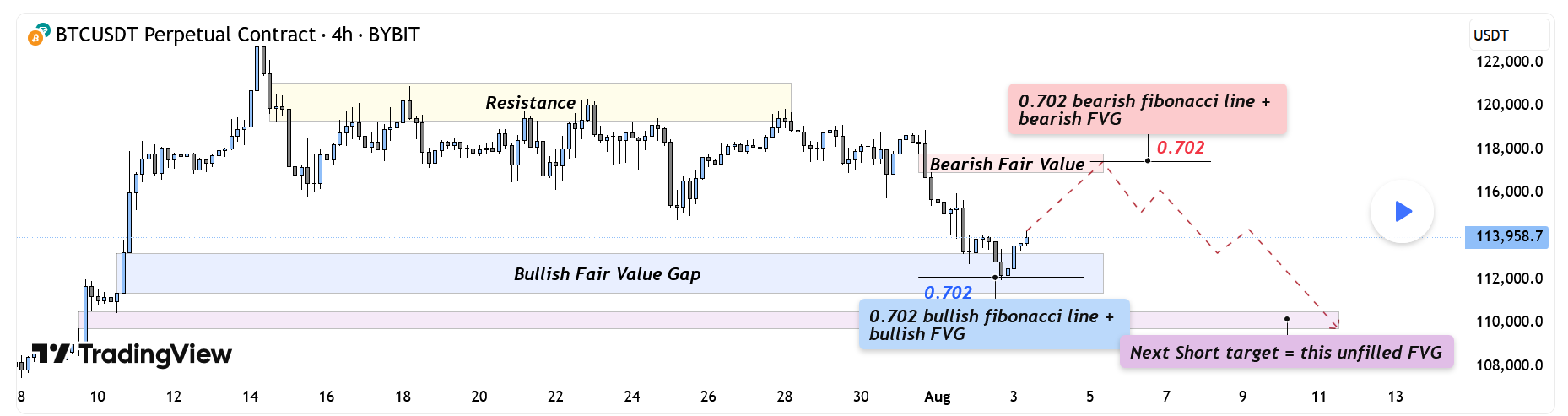

Hello traders! Let’s take a closer look at BTCUSD !

Recently, we’re seeing clear signs of a potential reversal after BTCUSD formed a double top pattern, and the EMA 34 and EMA 89 have crossed each other.

Breaking the support level around the previous key zone has strengthened the bearish momentum, potentially triggering a further decline towards the next support level near 103,500 USD.

However, I’m also watching for possible reversal signals at these support levels. If BTCUSD holds above 103,500 USD and forms a higher low, we may see the bulls make a comeback.

Key Levels to Watch:

Key Levels to Watch:

Resistance: 114,000 USD

Support: 103,500 USD

EMA Crossover: Strong Bearish Signal

Stay alert and be ready for potential market shifts! Will the bulls step in at 103,500 USD? Or will the bears continue to dominate?

Let me know your thoughts and happy trading!

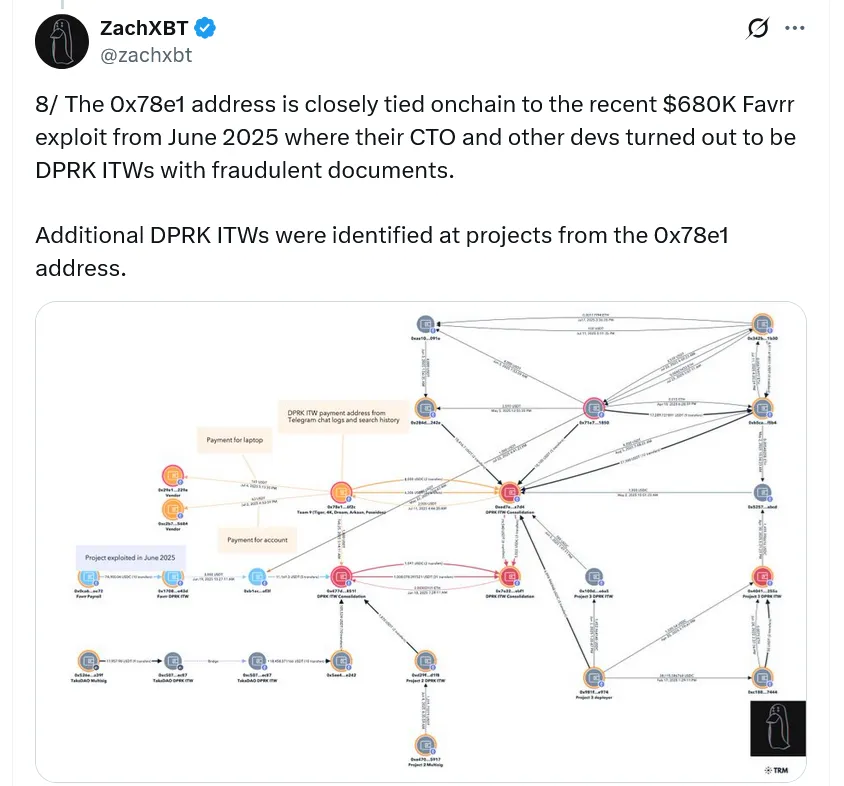

Elizabeth Warren) keep pointing fingers at crypto as the main villain in money laundering.

Elizabeth Warren) keep pointing fingers at crypto as the main villain in money laundering. What do you think — is crypto unfairly treated, or does the space still need stricter guardrails to avoid becoming the next $312B headline?

What do you think — is crypto unfairly treated, or does the space still need stricter guardrails to avoid becoming the next $312B headline?

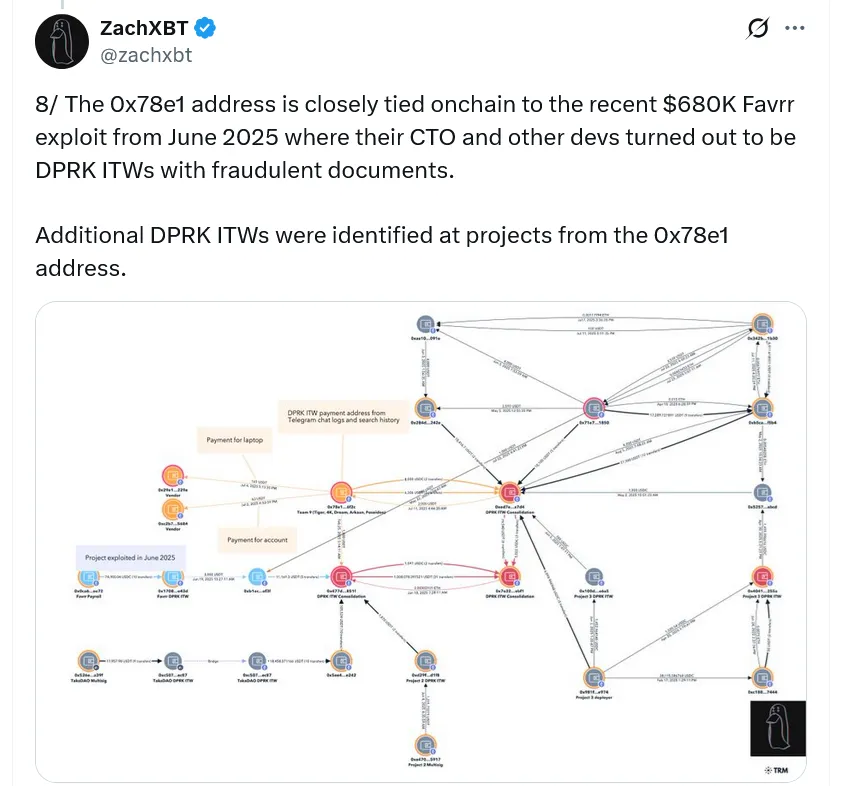

️ Key findings (via @zachxbt):

️ Key findings (via @zachxbt): Leaked docs show:

Leaked docs show: Takeaway for crypto orgs:

Takeaway for crypto orgs:

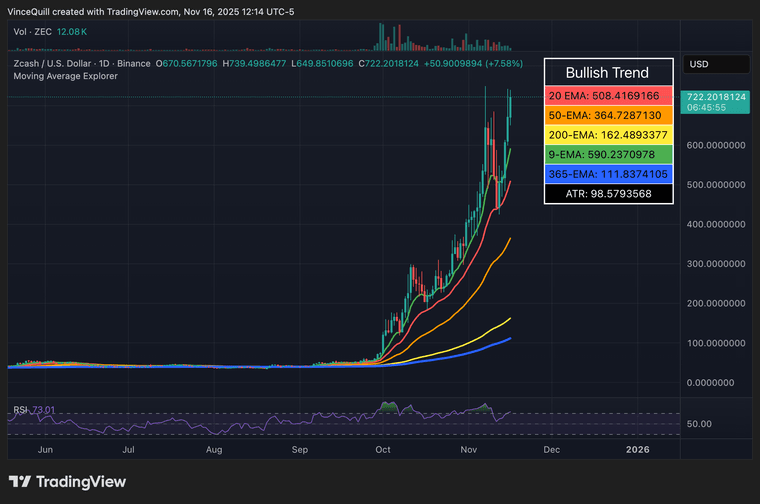

Zcash jumps past $700 after a low of $598, reigniting the Bitcoin vs. privacy coin debate. BTC maximalists call it a VC “pump and dump,” while ZEC supporters say it proves privacy is back in the spotlight.

Zcash jumps past $700 after a low of $598, reigniting the Bitcoin vs. privacy coin debate. BTC maximalists call it a VC “pump and dump,” while ZEC supporters say it proves privacy is back in the spotlight.

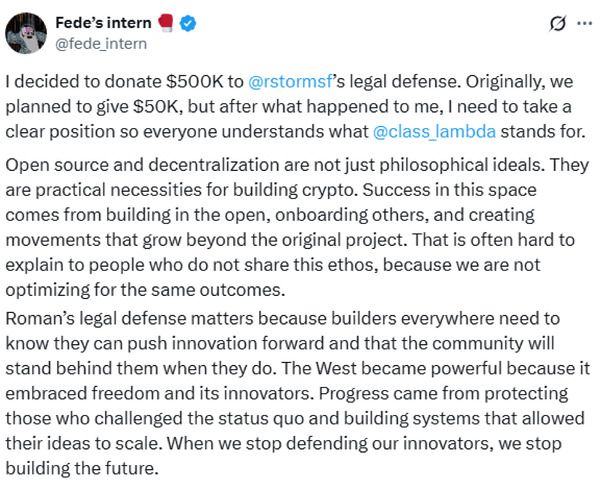

1. What makes Tornado Cash different from Silk Road?

1. What makes Tornado Cash different from Silk Road? ️ 2. Privacy vs. Security: An Old Fight, New Arena

️ 2. Privacy vs. Security: An Old Fight, New Arena 3. Legal Grey Zones: No “Crypto Privacy Law” Exists

3. Legal Grey Zones: No “Crypto Privacy Law” Exists 4. Global Policy Split

4. Global Policy Split 5. Why Classification Matters

5. Why Classification Matters Takeaway

Takeaway Question for the room: Is Storm’s conviction justice served, or does it cross the line into criminalizing code itself?

Question for the room: Is Storm’s conviction justice served, or does it cross the line into criminalizing code itself?

The Pump

The Pump The Dump

The Dump The Suspects

The Suspects Bubblemaps summed it up:

Bubblemaps summed it up: ️ The Pattern

️ The Pattern Crypto Detective’s Note:

Crypto Detective’s Note:

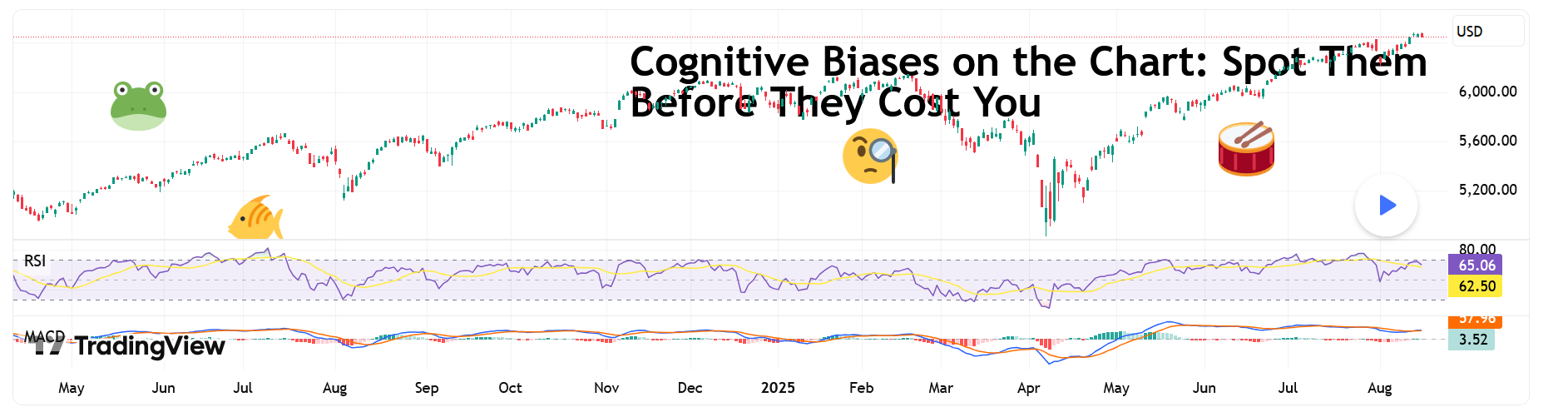

Anchoring Bias: Marrying a Trade

Anchoring Bias: Marrying a Trade Loss Aversion: Pain > Pleasure

Loss Aversion: Pain > Pleasure Confirmation Bias: The Echo Chamber Trade

Confirmation Bias: The Echo Chamber Trade Recency Bias: Yesterday = Forever

Recency Bias: Yesterday = Forever Gambler’s Fallacy: “I’m Due” Syndrome

Gambler’s Fallacy: “I’m Due” Syndrome Overconfidence Bias: I’m Smarter Than Them

Overconfidence Bias: I’m Smarter Than Them Herd Mentality: Everyone Can’t Be Wrong… Right?

Herd Mentality: Everyone Can’t Be Wrong… Right? The Meta-Bias: Thinking You Have None

The Meta-Bias: Thinking You Have None Final Word: Outsmarting Yourself

Final Word: Outsmarting Yourself

Who showed up in the roast?

Who showed up in the roast? Other Highlights

Other Highlights ️ Takeaway for Crypto Folks

️ Takeaway for Crypto Folks

Aerodrome closes MetaDEX02 with Slipstream V2, Autopilot, and UI improvements, moving toward MetaDEX03.

Aerodrome closes MetaDEX02 with Slipstream V2, Autopilot, and UI improvements, moving toward MetaDEX03.