Technical Analysis

Technical Analysis

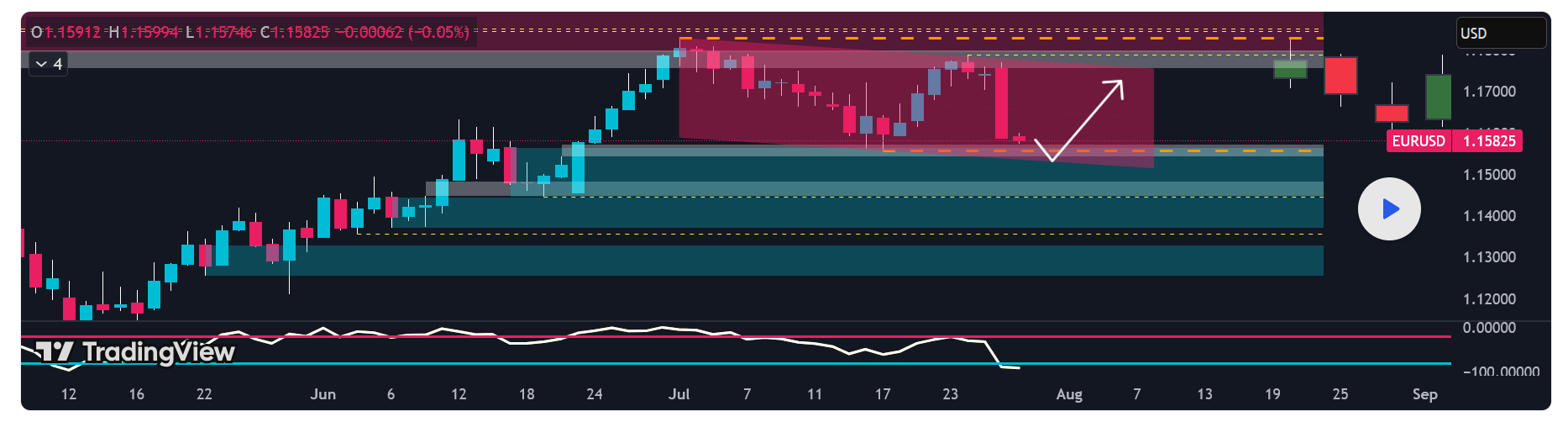

Price has decisively broken out of the descending channel highlighted in recent weeks. The weekly support zone between 1.1540 – 1.1580 is holding, triggering a significant technical reaction. The weekly RSI has entered oversold territory, suggesting a potential short-term reversal.

Key Support: 1.1530–1.1580 (currently reacting)

Key Resistance: 1.1720–1.1780 (inefficiency & supply zone)

Base Case: Potential rebound toward 1.1720–1.1750 before next structural decision

🧠 Sentiment Analysis

82% of retail traders are long, with an average entry at 1.1635

Only 18% are short, a clear minority

This extreme imbalance suggests downside pressure may persist to flush out weak long hands before a genuine reversal takes place.

COT (Commitment of Traders)

COT (Commitment of Traders)

USD Index:

Non-Commercials increased both long (+663) and short (+449) positions → uncertain stance but slight USD strengthening

EUR Futures:

Non-Commercials increased long (+6,284) and short (+8,990) positions, but net increase favors the bears

This shift signals a bearish turn in sentiment among large speculators, indicating short-term downward pressure.

Seasonality

Seasonality

In July, EUR/USD historically tends to rise, but:

This year’s price action is underperforming the seasonal pattern, showing relative weakness

August is historically flat to slightly bearish

Seasonality does not currently support a strong bullish continuation

Strategic Conclusion

Strategic Conclusion

Current Bias: Bearish-neutral (with short-term bullish bounce expected)

A technical rebound toward 1.1720–1.1750 is likely (liquidity void + RSI bounce + retail imbalance)

However, 1.1720–1.1750 is a key supply zone to monitor for fresh shorts, in line with:

Dollar-supportive COT data

Overcrowded long retail positioning

Weak seasonal context

🧭 Operational Plan:

Avoid holding longs above 1.1750 without macro confirmation

Monitor price action between 1.1720–1.1750 for potential short re-entry

Clean breakout above 1.1780 → shift bias to neutral/bullish

#trade #coin #crypto #USDT #BTC #trading

Will Ordinals + Runes sustain Bitcoin security, or is Taproot still a misstep?

Will Ordinals + Runes sustain Bitcoin security, or is Taproot still a misstep?

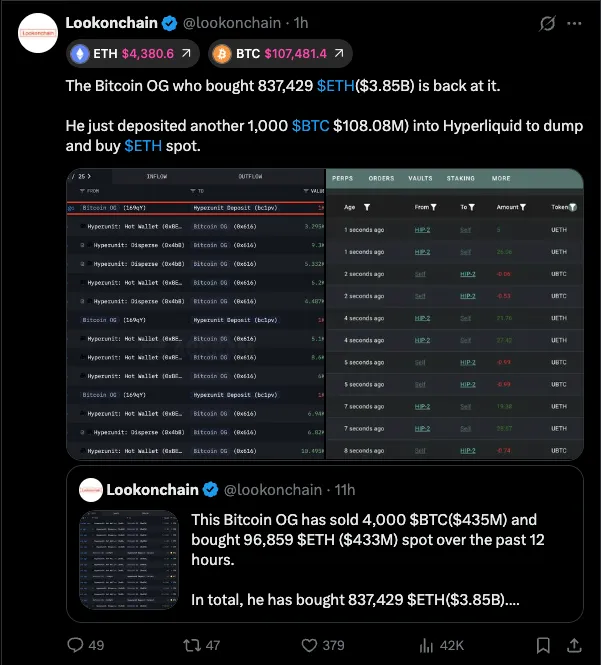

The market’s telling you: this isn’t 2021 déjà vu… it’s ETH 2.0 narrative season.

The market’s telling you: this isn’t 2021 déjà vu… it’s ETH 2.0 narrative season.

️ Short-Term Headwinds

️ Short-Term Headwinds ️ The Bigger Picture

️ The Bigger Picture Takeaway

Takeaway

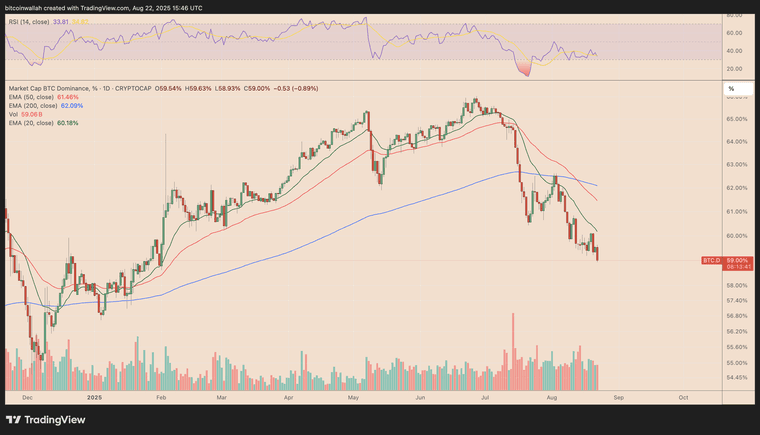

Why? Fed Chair Jerome Powell @ Jackson Hole hinted at rate cuts coming.

Why? Fed Chair Jerome Powell @ Jackson Hole hinted at rate cuts coming. ️

️ Market Takeaways

Market Takeaways

️ Coinbase is getting it from all sides:

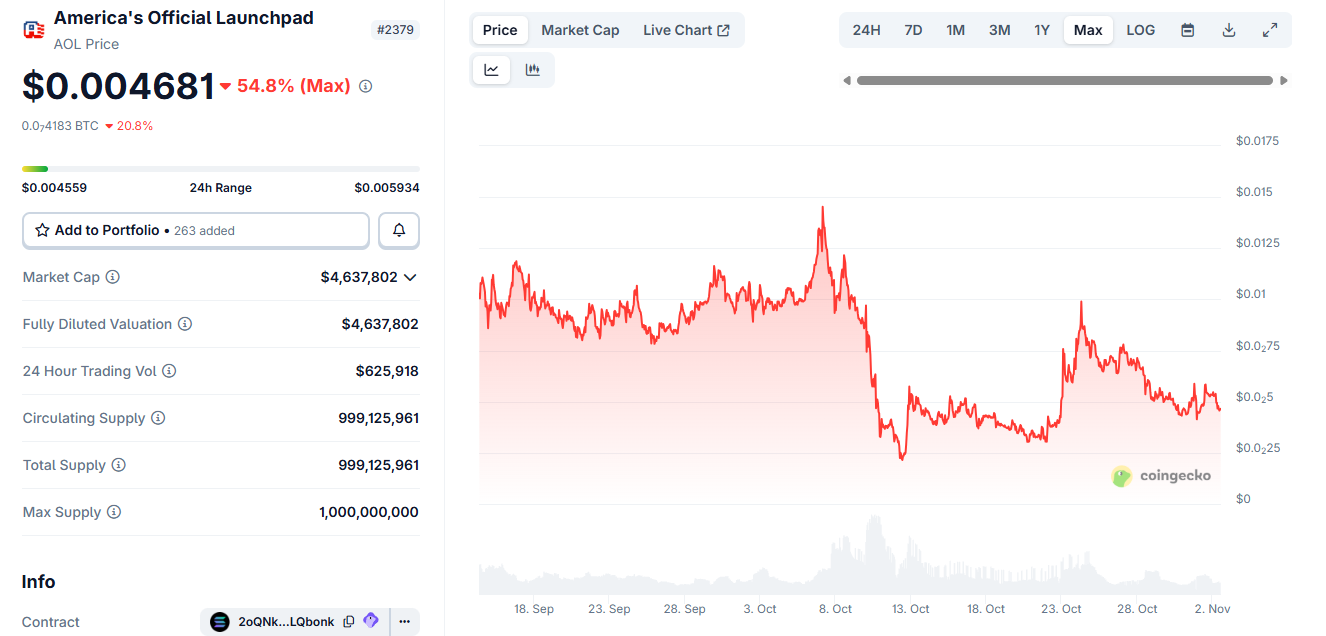

️ Coinbase is getting it from all sides: ️ Bakkt is accused of misleading investors about losing key clients (Webull + Bank of America), resulting in a 73% revenue collapse. Lawsuit seeks a jury trial.

️ Bakkt is accused of misleading investors about losing key clients (Webull + Bank of America), resulting in a 73% revenue collapse. Lawsuit seeks a jury trial. LIBRA — the memecoin tied to Argentine President Javier Milei — is under fire after its price pumped and dumped post-Milei endorsement. Investors are suing for manipulation and fraud.

LIBRA — the memecoin tied to Argentine President Javier Milei — is under fire after its price pumped and dumped post-Milei endorsement. Investors are suing for manipulation and fraud. Pump.fun, the memecoin launchpad, is facing a RICO lawsuit, accused of operating like a rigged slot machine, enabling billions in rug pulls with no actual products or projects behind the tokens.

Pump.fun, the memecoin launchpad, is facing a RICO lawsuit, accused of operating like a rigged slot machine, enabling billions in rug pulls with no actual products or projects behind the tokens. Nike is being sued for rug-pulling its RTFKT NFT platform, allegedly leaving collectors with worthless assets. Plaintiffs are seeking $5M+ in damages, accusing Nike of pushing unregistered securities.

Nike is being sued for rug-pulling its RTFKT NFT platform, allegedly leaving collectors with worthless assets. Plaintiffs are seeking $5M+ in damages, accusing Nike of pushing unregistered securities. Why it matters:

Why it matters: And if history is any guide, these cases will drag on for years — with massive reputational and financial consequences in play.

And if history is any guide, these cases will drag on for years — with massive reputational and financial consequences in play. Ethan’s Spiral

Ethan’s Spiral ️ The Shift

️ The Shift

What changed?

What changed? ️ Industry reactions:

️ Industry reactions: