bonk

Posts

-

to all the non believers lol -

Common Freelance Mistakes to Avoid

Starting out as a freelancer isn’t just about writing—it’s about strategy. Many new freelancers focus only on mainstream outlets, chase “perfect assignments,” or pour all their energy into cold pitching.

Experts say success comes from mixing big and small gigs, exploring non-traditional publications (universities, trade associations, specialty newsletters), and reconnecting with editors who already have assignments. Building relationships early is often more valuable than constant new pitches.

-

📉 Are the AI Trades Getting Tired?

AI has dominated market narratives for months — but some of the trend leaders are flashing fatigue signals.

Microsoft (MSFT)

Microsoft (MSFT)

Jumped on earnings (July 31) but couldn’t hold the highs. It’s been making lower highs since, and just broke the bottom of its triangle. Closed under the 21-day EMA for the first time since April. MACD rolling over too = short-term trend may be shifting negative. Palantir (PLTR)

Palantir (PLTR)

Classic “gap-and-fade.” Shot to new highs on big news… only to give it all back. Now it’s lower than the breakout day. Advanced Micro Devices (AMD)

Advanced Micro Devices (AMD)

Doubled since March, but weekly chart says stalling. $187.28 (April 2024 peak) acting like a ceiling. Options Heat

Options Heat

MSFT, PLTR, and AMD remain among the most active underliers in the options market — perfect battlegrounds for calls & puts depending on your read of the trend. Takeaway: AI names aren’t dead — but momentum is clearly pausing. For active traders, this is when risk/reward flips. Either you fade tired moves… or prepare for the next surprise squeeze.

Takeaway: AI names aren’t dead — but momentum is clearly pausing. For active traders, this is when risk/reward flips. Either you fade tired moves… or prepare for the next surprise squeeze. What’s your play here — short the “AI exhaustion,” or load up before the next leg higher?

What’s your play here — short the “AI exhaustion,” or load up before the next leg higher? -

Holiday Expedition Timeline Announced

No Man’s Sky players can look forward to a series of in-game events:

Beachhead (Nov. 7–18): Ancient Gek, Korvax, and Vy’keen lore returns, featuring a legendary weapon.

Titan (Nov. 19–Dec. 2): Explore new stars, worlds, and a unique living ship from a water world.

Relics (Dec. 3–16): Recreate ancient lifeforms with the Galactic Palaeology Society and unlock living stone appearance overrides.

Corvette (Dec. 17–30): Build your own corvette-class starship and earn the Mecha Mouse robotic companion.

Breach (Dec. 31–Jan. 13): Traverse a desolate universe, scavenge modules, and unlock Atlas-themed corvette modules.

Hello Games promises more content in development but has not revealed additional details.

-

Is the AI Trade Done for Now?

Are the AI Trades Getting Tired?

Are the AI Trades Getting Tired?AI has dominated market narratives for months — but some of the trend leaders are flashing fatigue signals.

Microsoft (MSFT)

Microsoft (MSFT)

Jumped on earnings (July 31) but couldn’t hold the highs. It’s been making lower highs since, and just broke the bottom of its triangle. Closed under the 21-day EMA for the first time since April. MACD rolling over too = short-term trend may be shifting negative. Palantir (PLTR)

Palantir (PLTR)

Classic “gap-and-fade.” Shot to new highs on big news… only to give it all back. Now it’s lower than the breakout day. Advanced Micro Devices (AMD)

Advanced Micro Devices (AMD)

Doubled since March, but weekly chart says stalling. $187.28 (April 2024 peak) acting like a ceiling. Options Heat

Options Heat

MSFT, PLTR, and AMD remain among the most active underliers in the options market — perfect battlegrounds for calls & puts depending on your read of the trend. Takeaway: AI names aren’t dead — but momentum is clearly pausing. For active traders, this is when risk/reward flips. Either you fade tired moves… or prepare for the next surprise squeeze.

Takeaway: AI names aren’t dead — but momentum is clearly pausing. For active traders, this is when risk/reward flips. Either you fade tired moves… or prepare for the next surprise squeeze. What’s your play here — short the “AI exhaustion,” or load up before the next leg higher?

What’s your play here — short the “AI exhaustion,” or load up before the next leg higher? -

Freelancing: The New Entry-Level Job

With entry-level roles disappearing, freelancing is becoming the go-to path for new graduates. Recent data shows entry-level hiring in the U.S. is down 23% since March 2020, leaving many college grads without a clear career on-ramp.

Freelancing allows young professionals to earn income, build skills, and gain real-world experience while bypassing a traditional, increasingly scarce entry-level job. Gen Z freelancers are turning to projects in AI, creative design, and business consulting, often working full-time hours and taking control of their careers.

-

📉 Bitcoin Slips Below $113K — Whales, Liquidity Games & Jackson Hole Jitters

Bitcoin couldn’t hold $113K at Wednesday’s Wall Street open, setting up another round of sell pressure right before the Fed’s Jackson Hole symposium.

What’s Happening

What’s HappeningBTC dropped under $113K, with $112.3K now the key level to watch (CoinGlass data).

Order books show bids sliding lower, hinting at possible whale games. Keith Alan calls it “Spoofy the Whale” — moving bids down to invite price down.

Major bid wall sits around $105K (“plunge protection”), raising questions of manipulation vs genuine liquidity.

Trader Sentiment

Trader SentimentDaan Crypto Trades: BTC has cleared liquidity pockets both ways for 6 weeks. Key levels = $120K cluster above & $112K support below.

TheKingfisher: Alts may bleed harder. A 5% BTC move = 10–30% altcoin drawdowns.

Rekt Capital: Silver lining — similar retraces happened in 2017 & 2021, both right before ATH breakouts. History rhymes?

Macro Catalyst: Powell @ Jackson Hole

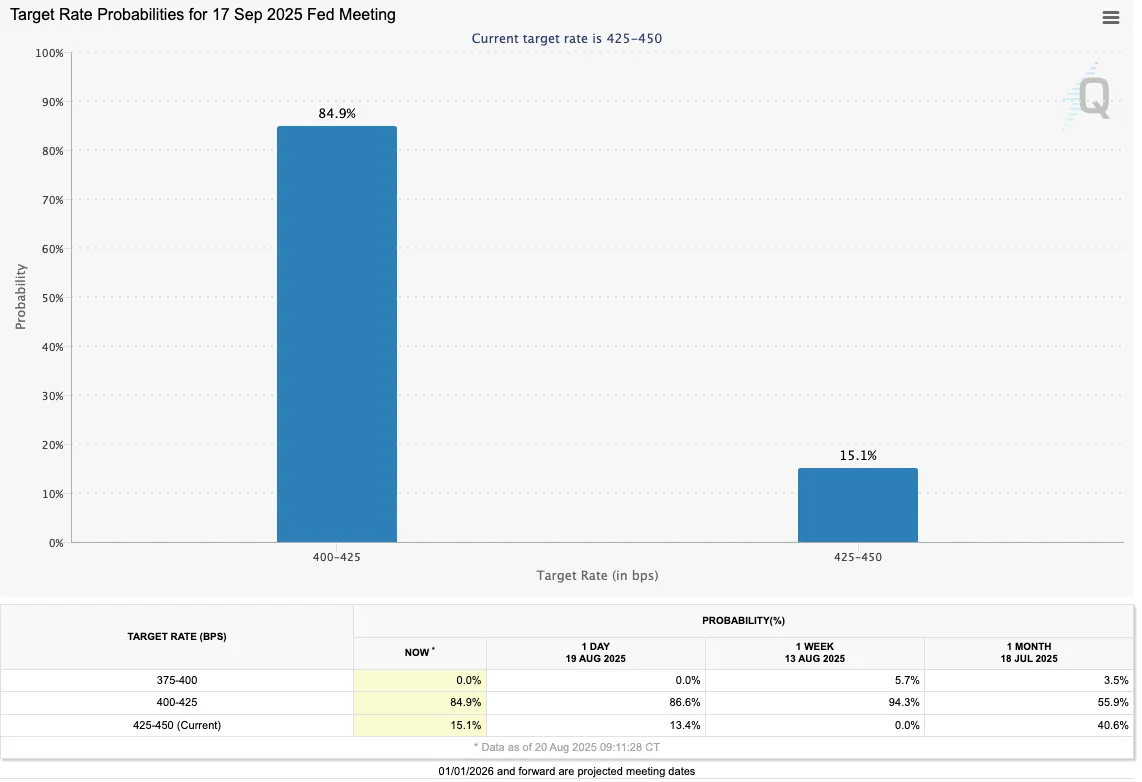

Macro Catalyst: Powell @ Jackson HoleFed Chair Jerome Powell speaks Friday. Markets price in an 80–95% chance of a September rate cut (25bps), but any shift in tone could spark volatility.

Stakes: inflation cooling vs labor risks rising. Traders are waiting for Powell’s words to either confirm a dovish path or slam on the brakes.

Takeaway for Traders

Takeaway for TradersWatch $112K (local low) & $120K (liquidity magnet) as near-term reversal zones.

Expect altcoin fragility if BTC bleeds further.

Jackson Hole = make-or-break event for September FOMC expectations. A dovish Powell could be the green light for the next BTC leg up; a hawkish one, another flush.

Question: Do you think this is a classic whale-driven shakeout before a breakout — or the start of a deeper retrace?

Question: Do you think this is a classic whale-driven shakeout before a breakout — or the start of a deeper retrace? -

💼 Trump’s Tariffs, Bitcoin Buys, and the Conflict-of-Interest Shuffle

Trade policy roulette is back in full swing. On Tuesday, Trump extended his China tariff delay again — while slapping fresh duties on 400+ products, from turbines to motorcycles. Trade groups like the NFTC are warning that these stop-and-go moves are “delaying growth and raising legal concerns.”

But here’s the twist: while tariffs rattle global supply chains, members of Trump’s own circle are actively trading around them — including in Bitcoin.

The Lutnick Loop

The Lutnick Loop

Howard Lutnick (Commerce Secretary + Cantor Fitzgerald boss) got a waiver on July 8 allowing him to participate in matters that directly affect his firm. Days later? Cantor dropped:$120.7M into Fidelity’s Bitcoin ETF (FTBC)

$116.8M into Robinhood

Big positions in AMD, Tesla, and Alibaba

Strategic hedge? Maybe. Conflict of interest? Definitely. As watchdogs put it: “Next time the Oxford Dictionary updates ‘conflict of interest,’ just copy-paste this.”

🧩 Crypto Angle

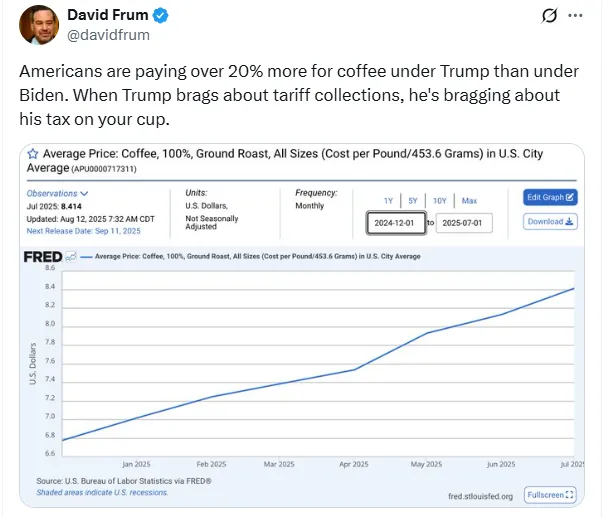

The purchases come right after the White House floated the idea of using tariff revenue to fund a U.S. Strategic Bitcoin Reserve.So while tariffs crank up coffee prices

(+38.9% YoY in July), officials are greenlighting themselves to trade directly in the assets they’re talking about building reserves with.

(+38.9% YoY in July), officials are greenlighting themselves to trade directly in the assets they’re talking about building reserves with. AI & VC Crossovers

AI & VC Crossovers

David Sacks, Trump’s “crypto & AI czar,” pulled a similar move. He sold $200M in crypto to avoid conflict claims, then got a waiver too. His firm, Craft Ventures, immediately invested $22M in Vultron — an AI startup chasing federal contracts.Timing isn’t subtle. The Trump admin’s July 10 AI action plan prioritized hardware + data centers. Sacks’ portfolio happens to align.

Bigger Picture

Bigger PictureTariffs = projected $300B in revenue, but at a cost: Yale estimates they shave $2,400 per household in 2025.

National trade groups say tariffs threaten innovation itself in manufacturing.

Yet insiders hedge their bets with Bitcoin and AI — two sectors that actually thrive on uncertainty and government money flow.

Takeaway

Takeaway

Unpredictable tariffs are crushing predictability in supply chains… but boosting predictability in one corner: officials are front-running their own policies into Bitcoin, AI, and tariff-proof equities. So here’s the trader’s question: Does this make Bitcoin a hedge against tariff chaos — or is it just another insider play where retail is late to the table?

So here’s the trader’s question: Does this make Bitcoin a hedge against tariff chaos — or is it just another insider play where retail is late to the table? -

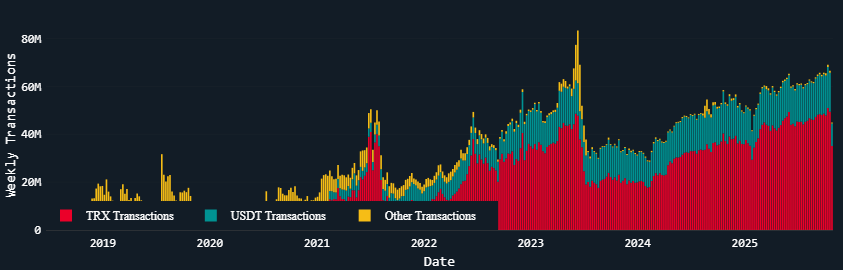

Tron Network Activity Hits Record High

The Tron blockchain just broke a major usage record.

According to TRONSCAN, Tron reached 5.7 million daily active addresses and 12.6 million daily transactions — the highest levels since June 2023.Analytics platform Nansen noted:

“No headlines. No hype. Just raw throughput.”

Tron’s growing activity signals expanding retail adoption, especially in developing regions.

-

Bitcoin - Huge drop will continue! Then a new ATH (buy here)

Bitcoin and mainly altcoins have been pumping in the recent weeks, so the important question is - will this trend continue, or is it over? My Elliott Wave analysis on Bitcoin suggests that we should see a correction to 105,000 USDT before another push to the upside. Why? I see a completed Impulse wave 12345 inside the rising wedge pattern, so this is a pretty bearish combo, to be honest. What's more, September is the worst-performing month for Bitcoin statistically, so that's also a problem. You probably don't want to be speculating on price increases during this period. I recommend buying in October and riding the bullish cycle until December 2025.Where should we buy BTC? When we take the Fibonacci retracement tool on the whole 12345 impulse wave, we have 105,386 - a strong Fibonacci 0.382 support. In confluence with the previous price action, there is a FVG (Fair Value GAP) between 103,399 and 104,622 on the daily candles. That's a pretty high-probability setup for buying BTC here, so thank me later!

What about alt season? We have seen a pretty strong uptrend on altcoins, but they also need to breathe, so expect a pullback as well. Of course, some altcoins will start pumping pretty much because we are in the alt season, but let's say the major altcoins in the TOP20.

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

-

TONUSDT

Hello Traders!

What are your thoughts on TONCOIN?

TON/USDT remains in a long-term ascending channel and is currently approaching a major resistance area. The price has respected the lower boundary of the channel and continued its upward trajectory.

If the resistance zone is broken in the coming attempts, it could open the path toward the next medium-term targets.

Until then, we expect price to consolidate below this key level with potential for a bullish breakout on renewed momentum.

Outlook: Bullish, as long as price holds within the ascending structure. A confirmed breakout above resistance will strengthen the bullish bias.

Don’t forget to like and share your thoughts in the comments! ️

️ -

🚨 Kanye’s YZY Token: Millionaire Snipers vs. Retail Bagholders

Nansen data shows the real winners of Kanye West’s Solana-based YZY launch weren’t fans — they were the snipers.

13 wallets walked away with over $1M each, netting a combined $24.5M as they dumped into the hype.

13 wallets walked away with over $1M each, netting a combined $24.5M as they dumped into the hype.

Price action: +1,400% in the first hour ($3 peak) → –74% in <24h (now ~$0.77).

Price action: +1,400% in the first hour ($3 peak) → –74% in <24h (now ~$0.77).

🧨 Out of the first 99 buyers, only 9 still hold any YZY.Not everyone struck gold:

Biggest loser = –$1.8M realized loss.

Another wallet down $1.2M.

One poor soul still holding an unrealized –$800K bag.

️ The Sniper Network

️ The Sniper Network

Bubblemaps says this wasn’t random. The same sniper who bagged Trump’s TRUMP token millions struck again — and appears tied to LIBRA insiders who drained $21M.“There’s an elite group of snipers who don’t compete but coordinate, making millions destroying charts.”

️ Pattern or Playbook?

️ Pattern or Playbook?

YZY isn’t the first celeb memecoin to follow this script:Haliey Welch’s HAWK: –90% in hours, insiders pocketed $3M.

Jenner, Lohan, Azalea, Kardashian — all linked to pump & dump scandals.

Arthur Hayes summed it up best:

“Oopsie… fam next time pls don’t let me trade shitters like YZY.”

Takeaway: Celebrity memecoins aren’t “onboarding tools” — they’re liquidity traps. The insiders snipe, retail bleeds, and charts get nuked.

Takeaway: Celebrity memecoins aren’t “onboarding tools” — they’re liquidity traps. The insiders snipe, retail bleeds, and charts get nuked. Question for you: Would you ever touch a celeb token — or is it pure exit liquidity with a fancy face on top?

Question for you: Would you ever touch a celeb token — or is it pure exit liquidity with a fancy face on top? -

SOLEUR: Trend in 4-H time frame The color levels are very accurate levels of support and resistance in different time frames.

The color levels are very accurate levels of support and resistance in different time frames.

A strong move requires a correction to major support and we have to wait for their reaction in these areas.

So, Please pay special attention to the accurate trends, colored levels, and you must know that SETUP is very sensitive.BEST,

bonk -

FTX Creditors Still Await Full Repayment

Nearly three years after FTX’s collapse, creditors are still waiting for full repayment. The exchange has so far reimbursed $7.8 billion to users, including a $1.2 billion payout in February, $5 billion in May, and a $1.6 billion September distribution, according to creditor representative Sunil on X.

The FTX estate says it has up to $16.5 billion in recovered assets, with plans to repay at least 98% of customers 118% of the value of their November 2022 account balances. Another $8.7 billion is expected to be distributed.

FTX’s bankruptcy, one of the largest in crypto history, triggered a wave of collapses across the industry and a deep bear market.

-

Pardon Sparks Concerns Over Crypto and Politics

The pardon has raised community fears about potential favoritism or conflicts of interest between political figures and crypto firms.

While the WLFI token benefitted immediately, the situation highlights the interconnected nature of US crypto ventures and political influence.

Experts warn such relationships could undermine public trust and reshape perceptions of governance in financial markets.

-

🚨 Kanye’s YZY Token: Millionaire Snipers vs. Retail Bagholders

Nansen data shows the real winners of Kanye West’s Solana-based YZY launch weren’t fans — they were the snipers. 13 wallets walked away with over $1M each, netting a combined $24.5M as they dumped into the hype.

13 wallets walked away with over $1M each, netting a combined $24.5M as they dumped into the hype.

Price action: +1,400% in the first hour ($3 peak) → –74% in <24h (now ~$0.77).

Price action: +1,400% in the first hour ($3 peak) → –74% in <24h (now ~$0.77).

🧨 Out of the first 99 buyers, only 9 still hold any YZY.Not everyone struck gold:

Biggest loser = –$1.8M realized loss.

Another wallet down $1.2M.

One poor soul still holding an unrealized –$800K bag.

️ The Sniper Network

️ The Sniper Network

Bubblemaps says this wasn’t random. The same sniper who bagged Trump’s TRUMP token millions struck again — and appears tied to LIBRA insiders who drained $21M.“There’s an elite group of snipers who don’t compete but coordinate, making millions destroying charts.”

️ Pattern or Playbook?

️ Pattern or Playbook?

YZY isn’t the first celeb memecoin to follow this script:Haliey Welch’s HAWK: –90% in hours, insiders pocketed $3M.

Jenner, Lohan, Azalea, Kardashian — all linked to pump & dump scandals.

Arthur Hayes summed it up best:

“Oopsie… fam next time pls don’t let me trade shitters like YZY.”

Takeaway: Celebrity memecoins aren’t “onboarding tools” — they’re liquidity traps. The insiders snipe, retail bleeds, and charts get nuked.

Takeaway: Celebrity memecoins aren’t “onboarding tools” — they’re liquidity traps. The insiders snipe, retail bleeds, and charts get nuked. Question for you: Would you ever touch a celeb token — or is it pure exit liquidity with a fancy face on top?

Question for you: Would you ever touch a celeb token — or is it pure exit liquidity with a fancy face on top? -

Advocacy Wins Shape Balanced Rules

Early AMLR drafts proposed harsh limits, including €1,000 caps on self-custody payments and extending AML obligations to DAOs, DeFi, and NFT platforms.

Thanks to industry advocacy, these restrictions were removed, allowing innovation to continue. Hansen warns, however, that MiCA–PSD2 overlaps could double compliance costs for stablecoin issuers by 2026, highlighting the need for careful regulatory alignment. -

What This Means for XRP Investors

2026 could be a turning point for XRP:

2026 could be a turning point for XRP:Asia: quick adoption via existing corridors.

Middle East: regulatory alignment and partnerships enable formal settlements.

Europe: slower rollout, but long-term scalability.

Key takeaway: Markets respond to evidence of actual usage, not just announcements.

Key takeaway: Markets respond to evidence of actual usage, not just announcements. -

Tron Becomes a Global Payments Hub for USDT

Tron continues to dominate USDT transfers, handling between 15–20 million Tether transactions per week — making USDT on Tron one of crypto’s most-used payment combinations.

Its low-cost, high-speed design makes it a popular choice in Africa, Asia, and South America, where many lack access to traditional banking.

Tether recently celebrated its 500 millionth user, a milestone its CEO called “the biggest financial inclusion achievement in history.”

-

Freelancing as a Career Launchpad

Freelancing offers more than income—it’s a crash course in entrepreneurship. Workers pitch clients, manage their time, and advocate for themselves, building resilience, creativity, and initiative.

For many, it’s a way to earn, learn, and grow while bypassing the bottleneck of traditional entry-level jobs. As Danielle Farage, a Gen Z freelancer, explains: “No one’s going to sell you like yourself.” In today’s economy, self-directed momentum may be the most valuable credential of all.