💼 Trump’s Tariffs, Bitcoin Buys, and the Conflict-of-Interest Shuffle

-

Trade policy roulette is back in full swing. On Tuesday, Trump extended his China tariff delay again — while slapping fresh duties on 400+ products, from turbines to motorcycles. Trade groups like the NFTC are warning that these stop-and-go moves are “delaying growth and raising legal concerns.”

But here’s the twist: while tariffs rattle global supply chains, members of Trump’s own circle are actively trading around them — including in Bitcoin.

The Lutnick Loop

The Lutnick Loop

Howard Lutnick (Commerce Secretary + Cantor Fitzgerald boss) got a waiver on July 8 allowing him to participate in matters that directly affect his firm. Days later? Cantor dropped:$120.7M into Fidelity’s Bitcoin ETF (FTBC)

$116.8M into Robinhood

Big positions in AMD, Tesla, and Alibaba

Strategic hedge? Maybe. Conflict of interest? Definitely. As watchdogs put it: “Next time the Oxford Dictionary updates ‘conflict of interest,’ just copy-paste this.”

🧩 Crypto Angle

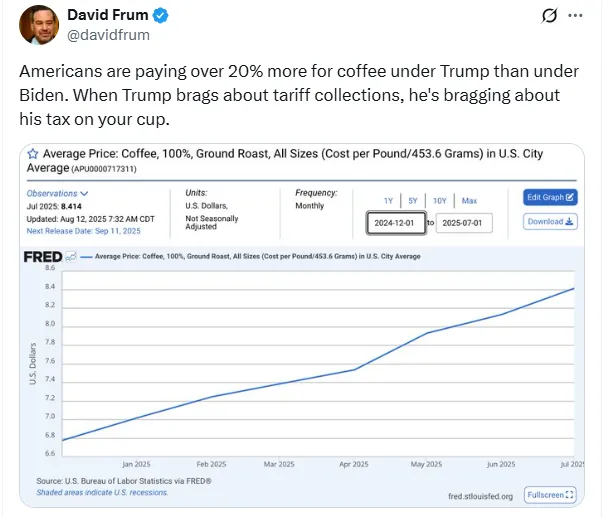

The purchases come right after the White House floated the idea of using tariff revenue to fund a U.S. Strategic Bitcoin Reserve.So while tariffs crank up coffee prices

(+38.9% YoY in July), officials are greenlighting themselves to trade directly in the assets they’re talking about building reserves with.

(+38.9% YoY in July), officials are greenlighting themselves to trade directly in the assets they’re talking about building reserves with. AI & VC Crossovers

AI & VC Crossovers

David Sacks, Trump’s “crypto & AI czar,” pulled a similar move. He sold $200M in crypto to avoid conflict claims, then got a waiver too. His firm, Craft Ventures, immediately invested $22M in Vultron — an AI startup chasing federal contracts.Timing isn’t subtle. The Trump admin’s July 10 AI action plan prioritized hardware + data centers. Sacks’ portfolio happens to align.

Bigger Picture

Bigger PictureTariffs = projected $300B in revenue, but at a cost: Yale estimates they shave $2,400 per household in 2025.

National trade groups say tariffs threaten innovation itself in manufacturing.

Yet insiders hedge their bets with Bitcoin and AI — two sectors that actually thrive on uncertainty and government money flow.

Takeaway

Takeaway

Unpredictable tariffs are crushing predictability in supply chains… but boosting predictability in one corner: officials are front-running their own policies into Bitcoin, AI, and tariff-proof equities. So here’s the trader’s question: Does this make Bitcoin a hedge against tariff chaos — or is it just another insider play where retail is late to the table?

So here’s the trader’s question: Does this make Bitcoin a hedge against tariff chaos — or is it just another insider play where retail is late to the table? -

Honestly, this screams “BTC = tariff hedge.”

Think about it — tariffs jack up prices, squeeze supply chains, weaken consumer confidence. But Bitcoin doesn’t care about borders or trade policies.The fact that Trump’s own circle is rotating into BTC while tariffs shake up global markets just confirms it.

They’re showing us the playbook: use Bitcoin as protection against policy roulette.Retail usually realizes it late, but the signal is clear — Bitcoin thrives when fiat systems wobble.

-

Or maybe this isn’t about BTC fundamentals at all — it’s just insiders front-running policies they know will create chaos.

Tariffs crush small businesses and raise costs, but the guys writing the rules give themselves waivers, then dump millions into BTC ETFs and AI firms.

That’s not a “hedge,” that’s legalized insider trading.For retail, it’s dangerous to copy the moves blindly — because by the time we see filings, insiders already locked in positions.

Don’t mistake conflict-of-interest trades for universal signals. ️

️