While everyone’s chasing the next memecoin or hyped layer-2, Litecoin — the OG silver to Bitcoin’s gold — is still quietly doing its thing… fast, cheap, and battle-tested.

But is there still money to be made with LTC in 2025? Short answer: yes, especially if you know how and where to look.

Let’s break it down.

🧬 What Makes Litecoin Different?

Launched in 2011 by former Google engineer Charlie Lee, Litecoin was designed to be a “lighter” version of Bitcoin:

⚡ Faster blocks — 2.5-minute block times vs. Bitcoin’s 10 minutes

💸 Low fees — typically less than $0.01 per transaction

🔒 Proof-of-Work security — uses Scrypt instead of SHA-256

🔄 Near-universal exchange support — available everywhere

It’s not fancy. It’s not flashy. But it works — and in crypto, that’s rare enough.

What’s New With LTC in 2025?

What’s New With LTC in 2025?

MimbleWimble Privacy Upgrade

MimbleWimble Privacy Upgrade

Litecoin quietly integrated MimbleWimble Extension Blocks (MWEB), allowing optional private transactions. This isn’t full-on anonymity, but it does help protect user balances and data.

Pro: Better privacy and scalability

Pro: Better privacy and scalability

Con: Some exchanges (esp. in Korea) delisted LTC due to privacy concerns

Con: Some exchanges (esp. in Korea) delisted LTC due to privacy concerns

LTC as a Payment Coin

LTC as a Payment Coin

From BitPay to Binance Pay to even some physical retailers, LTC is still one of the most-used cryptos for payments. With low fees and fast confirmations, it's perfect for day-to-day spending.

Halving 2023 Impact Still Playing Out

Halving 2023 Impact Still Playing Out

Litecoin’s last halving was in August 2023. Historically, LTC sees major price movement 6–12 months after a halving — and we’re right in that window.

How to Make Money with Litecoin in 2025

How to Make Money with Litecoin in 2025

- Hold (HODL)

LTC still tracks with BTC cycles. Some analysts see $150–$180 targets if Bitcoin re-tests its ATHs this year.

Current price: ~$80–$100 range

Potential upside? 2x–3x conservatively if market strength continues

- Trade the Range

Litecoin is known for clean technical patterns and mid-volatility swings. Great for range traders or swing traders.

Tip: Watch the $95–$105 zone for breakout or rejection opportunities

Bonus: Volume often spikes during Bitcoin dips

- Spend & Save With Rewards

Use LTC for payments through crypto cards or e-commerce platforms, and some services offer LTC cashback rewards.

💳 Try: Litecoin Foundation’s partnership card (via Unbanked or BitPay)

🛍️ Use on: Travala, Newegg, Overstock, and others

- Earn LTC via Freelance Gigs

Some platforms (like CryptoTask and LaborX) allow direct LTC payments for freelance or microtasks.

You can also accept LTC for digital goods, tutoring, design work — whatever your skill is.

🧠 Why LTC Still Matters

In a world full of hype coins, Litecoin remains:

✅ Reliable

✅ Easy to use

✅ Widely supported

✅ Surprisingly undervalued

It might not moon 1000% overnight, but it keeps showing up — and sometimes, consistency is the best alpha.

Final Thought

Final Thought

LTC isn't the loudest coin in the room — but that’s kind of the point. If you’re looking for a dependable, liquid, no-drama crypto that still has upside potential… don’t sleep on Litecoin.

Who's stacking silver? Drop your LTC thoughts below.

Disclaimer: Not financial advice. DYOR before investing.

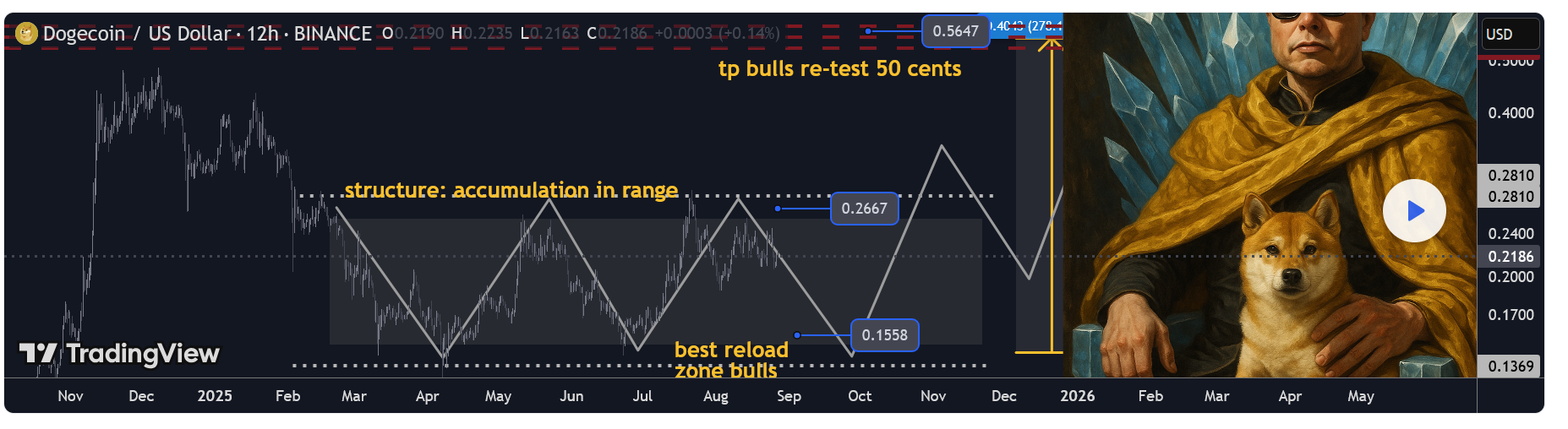

Dogecoin (DOGE) Market Update & Catalysts

Dogecoin (DOGE) Market Update & Catalysts Whale Accumulation & Trading Activity

Whale Accumulation & Trading Activity ETF Prospects & Institutional Tailwinds

ETF Prospects & Institutional Tailwinds Expanding Utility (DogeOS & DeFi)

Expanding Utility (DogeOS & DeFi) Key Positive Catalysts

Key Positive Catalysts Catalyst

Catalyst  Strong community + hype Keeps DOGE in the spotlight.

Strong community + hype Keeps DOGE in the spotlight. Summary

Summary

Pixel 10, 10 Pro & 10 Pro XL

Pixel 10, 10 Pro & 10 Pro XL

Pixel 10 Pro Fold

Pixel 10 Pro Fold My Take

My Take

Despite the rebrand and messaging change, Amazon insists it’s the “same mission”. A recent video highlights diverse users: students, farmers, remote workers, and first responders. Leo is now about scalability and flexibility, signaling Amazon’s move to compete more directly with SpaceX Starlink.

Despite the rebrand and messaging change, Amazon insists it’s the “same mission”. A recent video highlights diverse users: students, farmers, remote workers, and first responders. Leo is now about scalability and flexibility, signaling Amazon’s move to compete more directly with SpaceX Starlink.

Gaming journalism is navigating a turbulent landscape. Investor interest in esports has cooled, forcing media outlets to rely heavily on ad revenue and clicks.

Gaming journalism is navigating a turbulent landscape. Investor interest in esports has cooled, forcing media outlets to rely heavily on ad revenue and clicks.

Valuation check:

Valuation check:

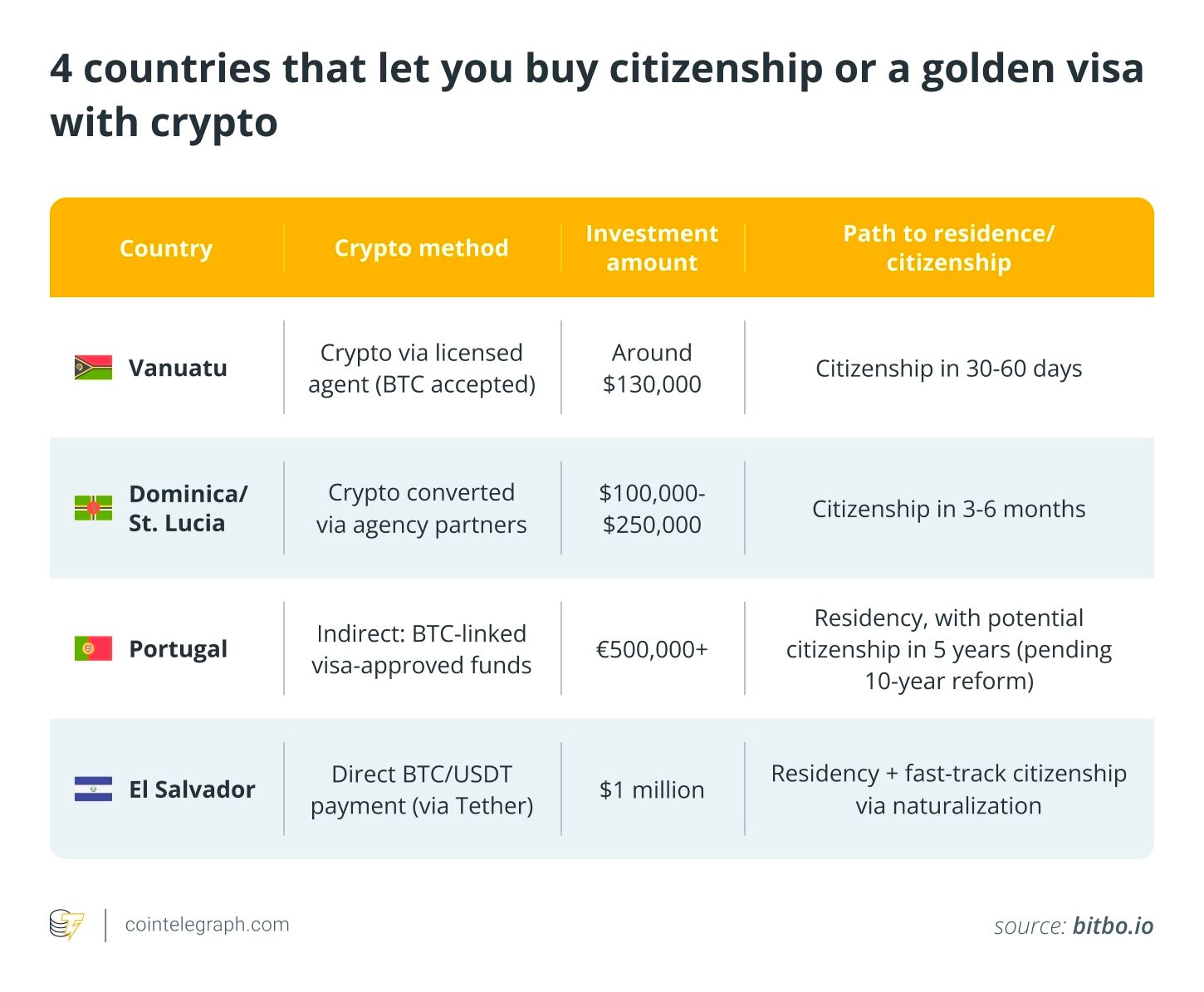

Vanuatu: Passport in Weeks

Vanuatu: Passport in Weeks Dominica & Saint Lucia: Caribbean in Crypto

Dominica & Saint Lucia: Caribbean in Crypto ️ Heads up: Caribbean CBI passports face stricter checks in some countries.

️ Heads up: Caribbean CBI passports face stricter checks in some countries. Portugal: Golden Visa with a Crypto Twist

Portugal: Golden Visa with a Crypto Twist El Salvador: Bitcoin Citizenship

El Salvador: Bitcoin Citizenship ️ The Big Picture

️ The Big Picture

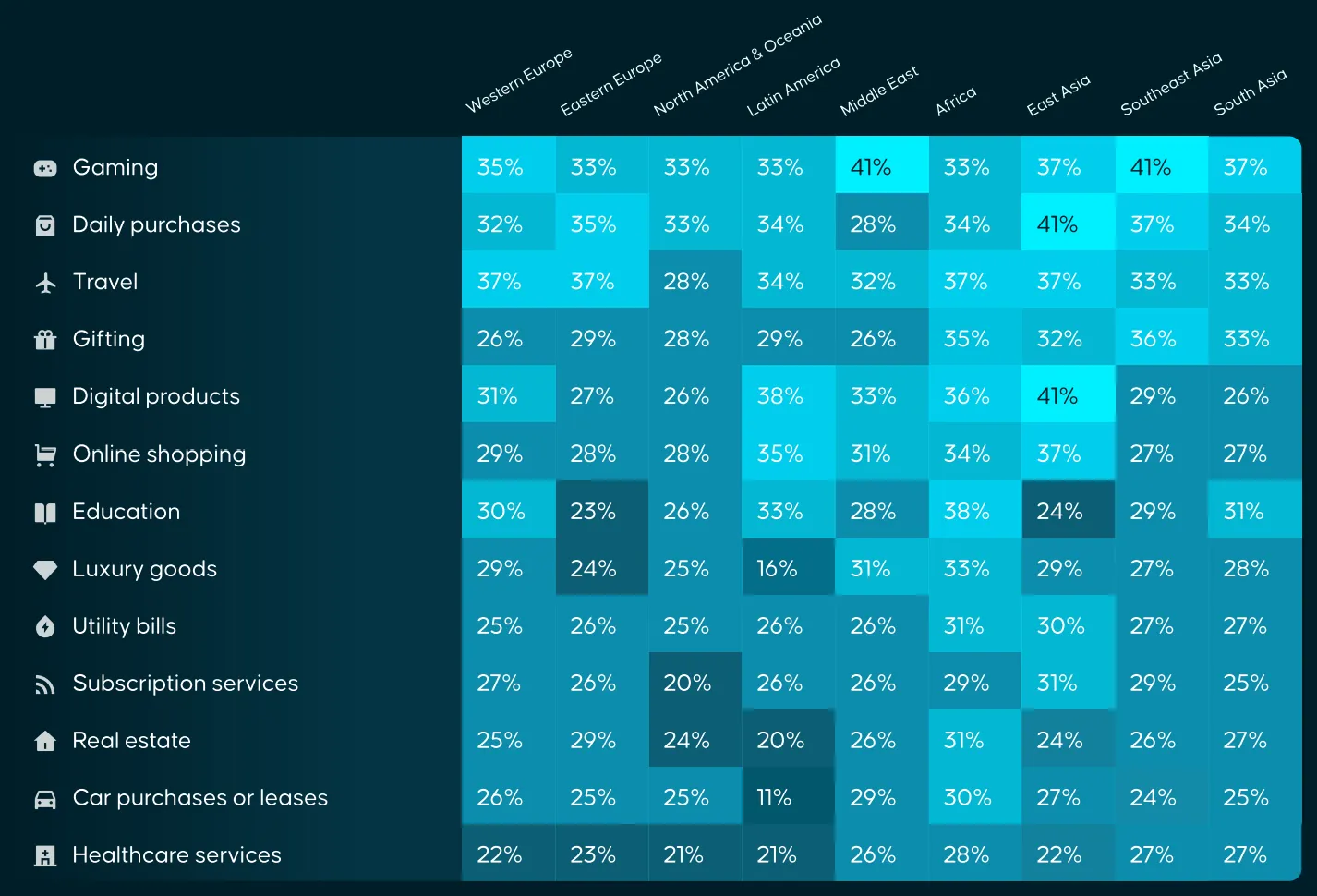

Gen Z: Daily Drivers & Gamers

Gen Z: Daily Drivers & Gamers Gen X: Big Spenders

Gen X: Big Spenders Millennials: The All-Rounders

Millennials: The All-Rounders Regional Trends

Regional Trends ️

️

️

️ ️ The Cost of AI

️ The Cost of AI Bubble or Next Dot-Com?

Bubble or Next Dot-Com?

Question to the room: Do you see this as a dot-com style bubble ready to pop… or the foundation of the next trillion-dollar wave?

Question to the room: Do you see this as a dot-com style bubble ready to pop… or the foundation of the next trillion-dollar wave?

️ The Setup

️ The Setup Police Warning

Police Warning Bigger Picture

Bigger Picture

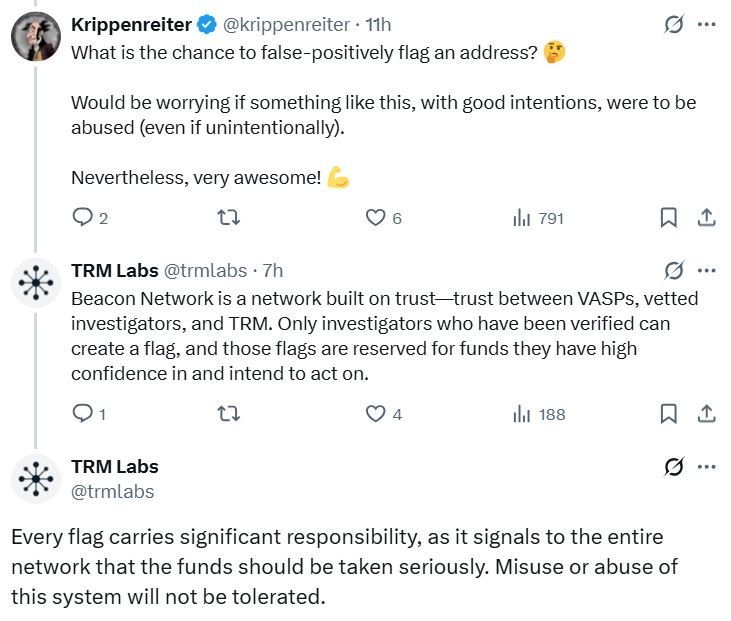

️ How Beacon Works

️ How Beacon Works Who’s in the Crosshairs?

Who’s in the Crosshairs? But What About Abuse?

But What About Abuse?

Into Interactive Content & Gaming

Into Interactive Content & Gaming The AI & Data Play

The AI & Data Play Final Take

Final Take