Crypto Calls in Short Format with Mihai Iacob

-

LTCUSD — The Forgotten Coin That’s Waking Up

After years in a tight range between 60–130, Litecoin quietly started building higher lows since April 2025.

The recent price action forms a bullish flag, with last week’s engulfing candle pushing again into resistance.

A break above 130 could confirm a major trend shift after 3 years of accumulation.

While it’s not the hottest coin on the market, LTC looks technically strong and ready for a move toward 300 USD.

-

BTC – The Road to 150K Begins

In my last BTC analysis, I mentioned 125K as the next target and said that as long as 112K holds, bulls have nothing to fear.

Since then, BTC continued higher and is now teasing with the ATH.From here, it’s not if we’ll make a new high — it’s how high.

After 3 months of consolidation, the breakout gives a measured target near 140K, but 150K is absolutely possible.

Trend is strong, bulls in control. Let the rocket fly!

-

Aster- Next stop 4usd?

Since its launch on major exchanges in mid-September, Aster has performed impressively — delivering a solid 5x gain to its peak around $2.5.

The subsequent correction was perfectly natural, and given the renewed optimism across the crypto market, the current symmetrical triangle consolidation looks promising.

If this pattern breaks to the upside, the next potential target for Aster could be around $4.

-

Uniswap (UNIUSDT) — Bullish Setup

After a 90% drop from 2021 highs, UNI has been consolidating around the $7 median zone. Each dip below it found strong demand, with a solid support now at $5.

As most altcoins line up for potential upside, UNI could target $14, offering a clean 1:5 risk–reward setup as long as price stays above $7.

️ Negation: Drop below $7 opens the door for another $5 retest.

️ Negation: Drop below $7 opens the door for another $5 retest.

-

Aster- Next stop 4usd?

Since its launch on major exchanges in mid-September, Aster has performed impressively — delivering a solid 5x gain to its peak around $2.5.

The subsequent correction was perfectly natural, and given the renewed optimism across the crypto market, the current symmetrical triangle consolidation looks promising.

If this pattern breaks to the upside, the next potential target for Aster could be around $4.

said in Crypto Calls in Short Format with Mihai Iacob:

Aster- Next stop 4usd?

Since its launch on major exchanges in mid-September, Aster has performed impressively — delivering a solid 5x gain to its peak around $2.5.

The subsequent correction was perfectly natural, and given the renewed optimism across the crypto market, the current symmetrical triangle consolidation looks promising.

If this pattern breaks to the upside, the next potential target for Aster could be around $4.

Right now, the spotlight is on two newly listed coins — and for good reason. Both have generated significant interest, but Aster is clearly standing out. The trading volume on its exchange is exceptionally high, which has caught the attention of many traders and investors.What makes Aster particularly interesting is that, despite being a decentralized exchange, it doesn’t publicly display individual trades — unlike HyperLiquid, which offers full transparency. This subtle difference adds an element of mystery, but it doesn’t diminish Aster’s credibility or potential. In fact, the project appears to have a solid foundation and strong growth prospects.

From a metrics standpoint, Aster has ten times more tokens in circulation than HyperLiquid, yet it still manages to maintain a higher total value locked (TVL) and a larger trading volume. That’s a strong indicator of healthy market activity and genuine demand rather than speculative hype.

Given these factors, a price range of $3 to $4 seems quite reasonable at this early stage. If the momentum continues and the fundamentals remain strong, Aster could become one of the most promising new projects in the decentralized trading ecosystem.

-

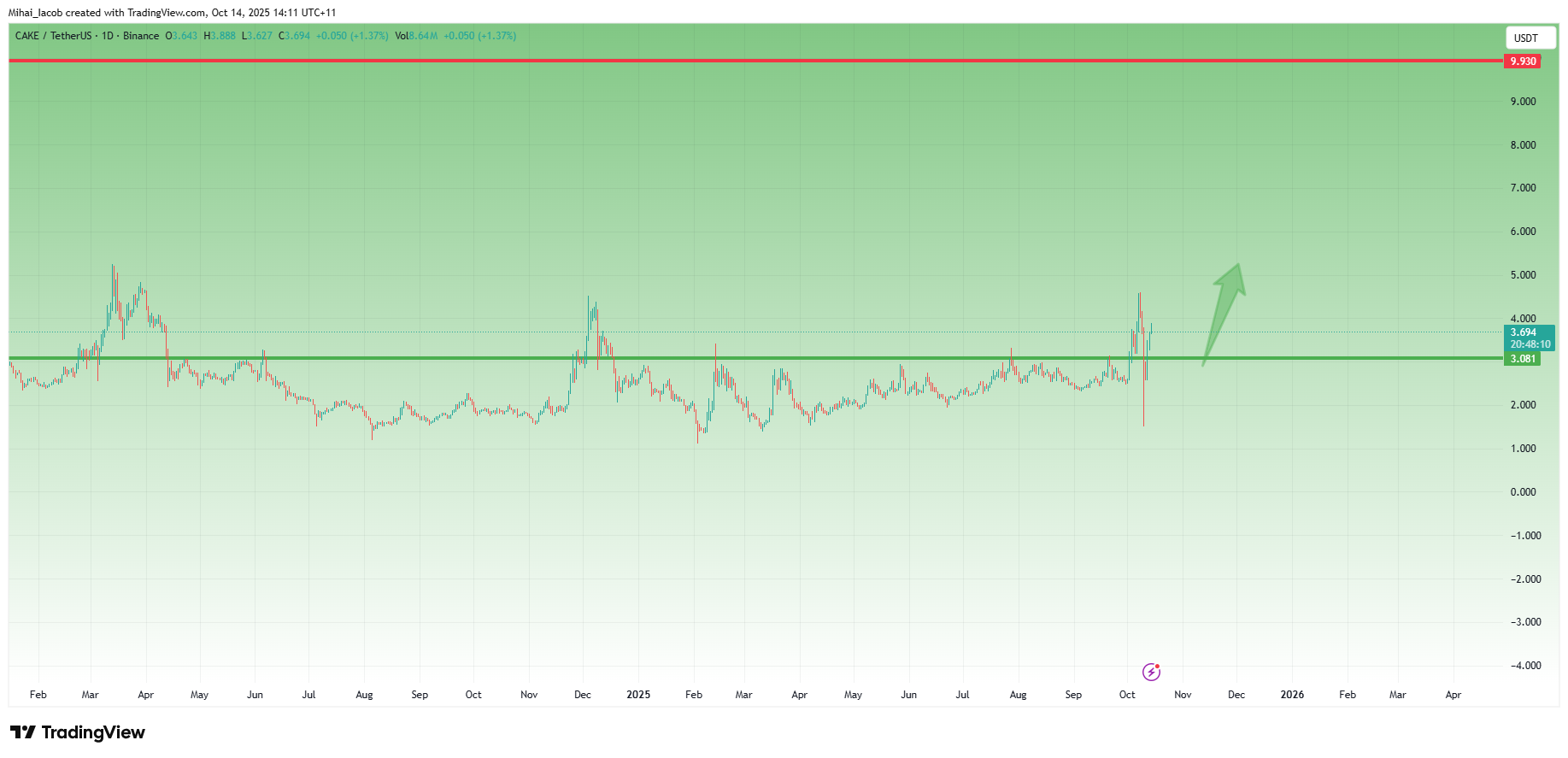

CAKE – Ready for Continuation After a Perfect Breakout Retest

CAKE broke above key $3 resistance, retested it perfectly, and is now holding strong around $3.5. As long as $3 holds, upside targets sit at $5 — and potentially $10 if momentum accelerates.

-

Solana (SOLUSDT) – Bulls Hold the Channel

Solana (SOLUSDT) – Bulls Hold the ChannelAfter the drop from 300 to under 100, Solana reversed strongly and now trades inside an ascending channel.

The 200 zone acted as perfect support, triggering a 15% bounce.As long as price stays above 215, momentum remains bullish.

Next target for buyers: 260, the channel top and November high.

Support: 200 / 215

Resistance: 260

Bias: Bullish

-

AVAX – Retest Before the Next Move Up

After breaking above the $26.60 resistance, AVAX rallied to $36.60 in a strong bullish leg.

Now, the price is pulling back to retest the broken level — a confluence support with the rising trendline from June.This area could offer a great buying opportunity, with a potential 1:4 risk/reward setup.

I’m looking to buy and target the next bullish continuation.

-

UDSUSDT – Correction Before the Next Pump

After reaching nearly $3, UDSUSDT entered a normal correction following its strong rally from the $1 support.

Now, the price is consolidating, and the $1.15 zone stands as key support.A new upward leg could start from this area, with the main target at $3 — or even higher if momentum continues.

-

BTC – Bulls Still in Control

BTC made a new ATH as expected, followed by a brief correction.

Price reversed from above 120K, and the daily candle shows strong buying pressure with a long lower wick — possibly forming a continuation Pin Bar.As long as 118K holds, the structure stays bullish and buying dips remains the plan toward 140K–150K.

-

AVAX – Retest Before the Next Move Up

After breaking above the $26.60 resistance, AVAX rallied to $36.60 in a strong bullish leg.

Now, the price is pulling back to retest the broken level — a confluence support with the rising trendline from June.This area could offer a great buying opportunity, with a potential 1:4 risk/reward setup.

I’m looking to buy and target the next bullish continuation.

-

Solana – Wait for Confirmation, Not Hope

As I mentioned in yesterday’s crypto post, I’m still bullish long-term, but we need to trade what we see, not what we wish for.

Friday’s sell-off pushed Solana below key support and the channel bottom — a bearish signal.

After the drop, price recovered to touch the $200 psychological level, but the structure remains weak.Only a clear stabilization above $200–210 would turn the short-term outlook bullish again.

Until then, it’s wiser to wait for confirmation — markets punish overconfidence.Patience first, profits later.

-

Bitcoin – Rebound or Real Recovery?

As mentioned yesterday, I’d like to stay bullish, but the overconfidence in the market keeps me cautious.

BTC bounced from key support and recovered part of the drop, yet this looks more like a technical rebound, not real buying pressure.

Only a break above 118K–120K would confirm strength.

If BTC falls back under 110K, another leg down becomes likely.Still waiting for confirmation before conviction.

-

CAKE — Bulls Still in the Game

In my previous analysis, I mentioned that CAKE could rise to 5 USD after breaking above a 1.5-year accumulation range.

The coin reached 4.5 USD, then dropped sharply during Friday’s liquidation — but unlike many others, it quickly recovered above support, showing strong bulls.As long as 3 USD holds, the outlook remains bullish, with 5 USD still the medium-term target.

Plan: Buy dips near 3 USD.

-

LINK – Back in the Game

Chainlink briefly lost the 18.50 support and dropped below $10, but quickly recovered, reclaiming that key zone and re-entering the bullish flag from late August.

No clear buy signal yet — but a break above 21.50 could confirm a new leg toward $30.

Let the market confirm it.

-

ETH: Looking strong

Despite the crypto crash, ETH has moved very technically.

The break below $4,300 sent it down to $3,500, but a rebound above $3,850 pushed the price back to the $4,300 resistance.After another pullback, ETH found support again at $3,850 and quickly bounced to $4,100.

The chart now shows an ascending triangle with resistance at $4,300 — a breakout could send ETH toward $4,900–$5,000.I’m looking to buy dips below $4,000, with a 1:3–1:4 risk-reward setup.

-

Chainlink briefly lost the 18.50 support and dropped below $10, but quickly recovered, reclaiming that key zone and re-entering the bullish flag from late August.

No clear buy signal yet — but a break above 21.50 could confirm a new leg toward $30.

Let the market confirm it.

-

First target → ATH retest.

Extended target → $4+ on this leg up.

As long as $2.70 holds, the setup remains constructive.

#XRP #Crypto #Trading #Altcoins

#XRP #Crypto #Trading #Altcoins