Fundamentals & Catalyst

Fundamentals & Catalyst

-

Alephium is a next-generation Layer-1 blockchain combining a stateful UTXO model, sharding tech (BlockFlow), and a “Proof of Less Work” consensus, offering high TPS and energy efficiency.

-

The token ALPH powers the ecosystem: mining incentives, developer SDKs, and support for dApps built on the chain.

-

Recent news show institutional-grade partnerships and roadmap momentum such as the Phase 2 Roadmap Teaser and PrimeVault custody integration.

Why this matters => The technical stack and ecosystem signals suggest ALPH is moving beyond speculative status into infrastructure play, creating a bullish tailwind for the setup.

Technical Picture

Technical Picture

-

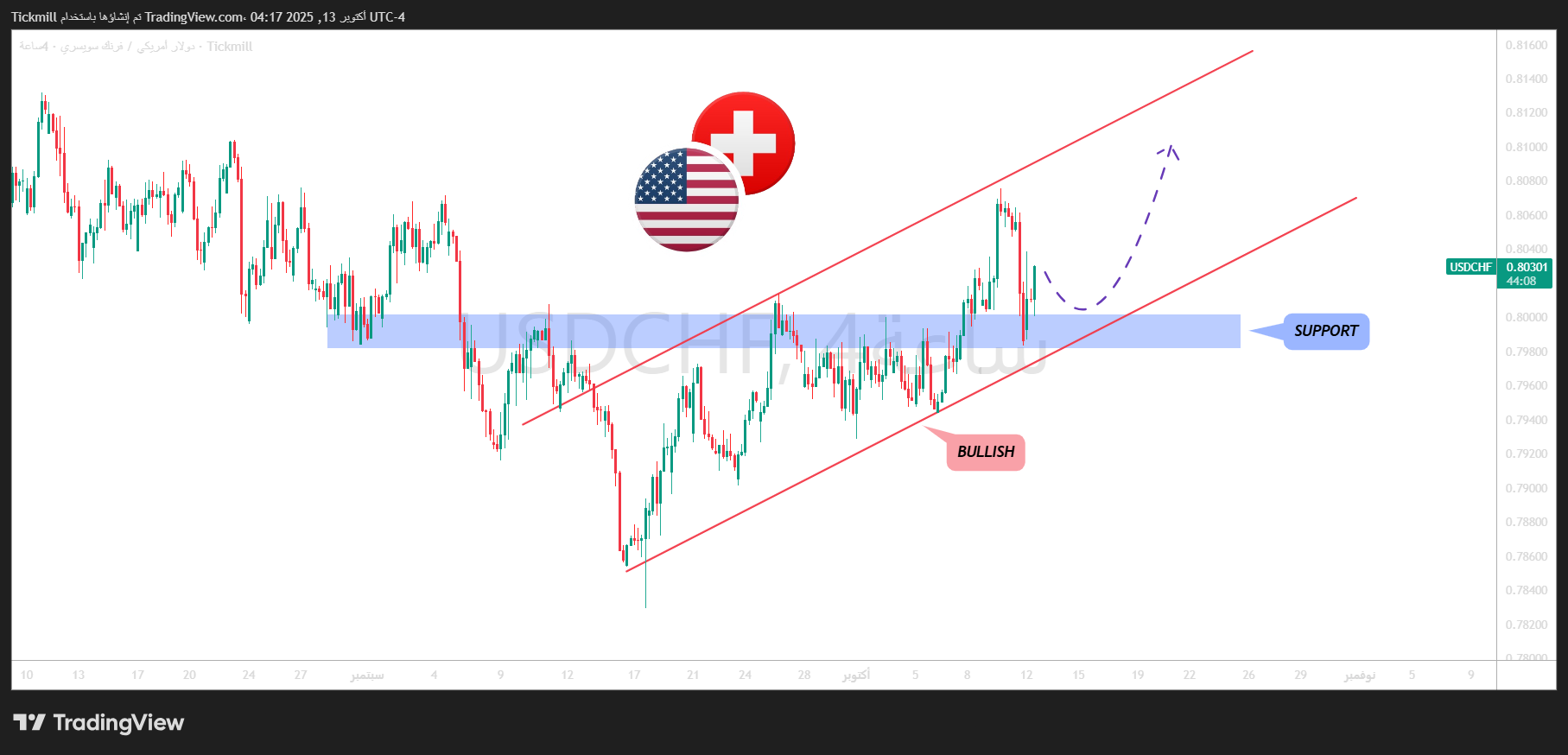

ALPH has been trading inside a clear falling wedge pattern, a classic bullish reversal structure indicating price compression ahead of a breakout.

-

Price is now sliding toward the strong round-number support at $0.10, a psychological anchor and historical inflection zone.

-

Trigger for confirmation: A clean break above the last major high (blue zone on chart) followed by a retest or sustained close above it.

-

On that breakout, the first target is significant: the next round number at $0.50, offering substantial upside.

-

Risk control: A sustained breakdown below $0.10 would invalidate the bullish reversal thesis and turn the wedge into a trap.

🧭 Trading Plan

-

Watch zone: ~$0.10 support, ideal area to look for bullish reversal signals (rejection wicks, volume pickup, retest of breakout).

-

Entry trigger: Break & hold above recent blue-zone high, with confirmation (H4/DAILY) + backing volume.

-

Targets: $0.50 as primary upside; intermediate stops could scale profits earlier.

-

Invalidation level: Close below $0.10 turns the bullish scenario off, flip to neutral/bearish until structural support reasserts.

️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

All Strategies Are Good; If Managed Properly!

All Strategies Are Good; If Managed Properly!

~Richard Nasr