Gold, Yields, and the Fed: How Monetary Policy Drives Markets

-

Few forces shape global markets more than U.S. monetary policy. The Federal Reserve’s dual mandate, maximum employment and 2% inflation is the anchor for its decisions. For traders, understanding how these objectives translate into interest rate changes is critical for positioning in gold futures and across the yield curve.

The Fed’s Dual Mandate

- Maximum Employment: Support jobs and minimize unemployment.

- Stable Prices (2% inflation target): Prevent runaway inflation or deflation.

The Fed balances these goals using interest rates:

• Raising rates: Cools demand, strengthens the dollar, lifts yield, weighs on gold.

• Cutting rates: Stimulates demand, weakens the dollar, lowers real yields, supports gold.

The tension lies in the trade-off: controlling inflation often hurts employment, while boosting employment risks higher inflation.

Gold and Monetary Policy

Gold is highly sensitive to real interest rates (nominal yields minus inflation):

• Hawkish Fed: Higher real yields, dollar strength, gold struggles.

• Dovish Fed: Lower real yields, weaker dollar, gold rallies.

However, given the recent surge in gold prices despite higher rates, traders must ask:

• Will gold continue rising as odds of rate cuts increase, and when they are eventually delivered?

• Is the traditional correlation between the dollar and gold futures prices breaking down?Gold’s rally has also been driven by geopolitical tensions and rising long term yields, reflecting rising debt burdens across the globe.

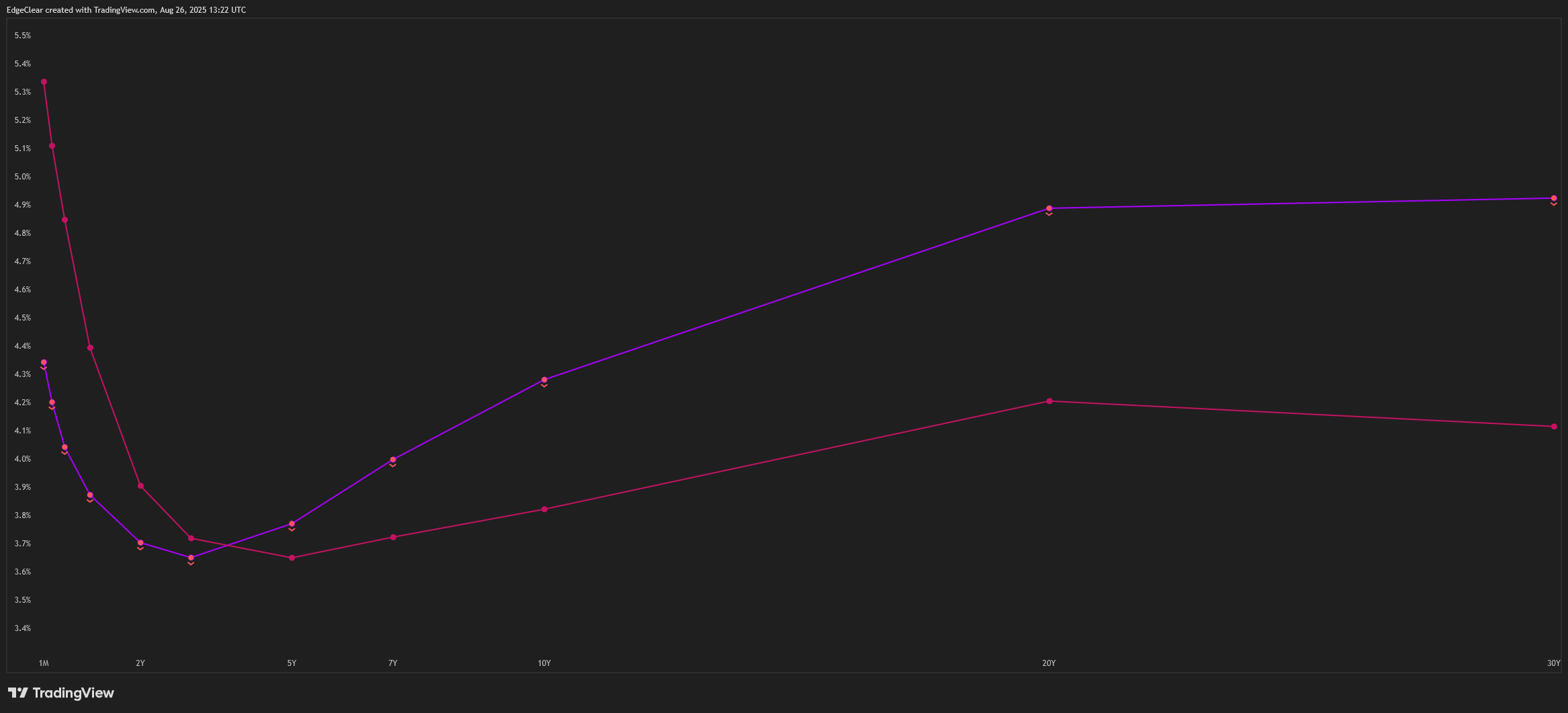

Yield Curve and Monetary Policy

The yield curve reflects expectations about growth, inflation, and Fed policy.

• Short end (1M–5Y): Anchored by Fed policy rates. If markets expect hikes/cuts, the front end moves first.

• Long end (10Y–30Y): Driven by expectations for long-term inflation, growth, and Treasury supply/demand dynamics.

Typically, investors and market participants watch for the following patterns:

• Inverted curve: Short yields > long yields, often a recession signal. See last year’s yield curve.

• Steepening curve: Usually follows Fed cuts, as front-end yields drop faster than the back end.

Two Classic Scenarios

Scenario 1: Inflation Stays High, Jobs Weaken

• Fed resists cutting, prioritizing price stability.

• Gold: Consolidates or weakens (real yields elevated).

• Yield curve: While the short end stays pinned, long end could rise on higher inflation risk and increasing debt worries, signaling stagflation risk.

Scenario 2: Inflation Stabilizes, Jobs Weaken

• Fed pivots dovish, prioritizing employment.

• Gold: Breaks higher on falling real yields.

• Yield curve: Steepens as short yields fall faster than long yields.The Policy Backdrop

Powell’s last symposium before his term ends, at the Jackson Hole appearance, Fed Chair Powell delivered a dovish pivot, highlighting rising risks to the labor market while downplaying the inflationary effects of tariffs. The reasoning behind this shift deserves its own deep dive, but for now, our focus remains squarely on how monetary policy, specifically interest rate decisions, impacts inflation, growth, supply, and demand in the U.S. economy.What’s on the Docket Until the Next Fed Meeting (September 17, 2025)

Markets will be glued to data in the coming weeks:

• Aug PCE / Core PCE (Aug 28–29) → Fed’s preferred inflation gauge.

• Aug NFP (Sep 5) → Labor market health; weak print strengthens the case for cuts.

• Aug PPI (Sep 10) → Upstream price pressures; hot numbers signal inflation risks.

• Aug CPI & Core CPI (Sep 11) → Key headline data; softer print supports dovish case.

• Fed Decision (Sep 17) → Will Powell stress inflation vigilance, or shift toward labor concerns?How the Charts Tie It Together

• Gold Futures:

o Ascending Triangle breakout above resistance towards $3,600, if Fed pivots dovish and deliver a rate cut or a bigger rate cut.

o Ascending Triangle breakdown toward $3,350 if inflation remains sticky and the Fed holds. In this scenario, gold remains in balance overall.

• Yield Curve:

o Short end reacts directly to Fed rate expectations.

o Long end reflects investor conviction on inflation, growth and increasing debt concerns.Takeaway for Traders

The Fed’s dual mandate creates a constant push and pull between inflation control and employment support. Gold and the yield curve are two of the clearest real-time mirrors of that balancing act:

• Watch short-term yields and gold to gauge how markets are pricing the Fed’s next move.

• Watch the long end of the curve to see whether investors believe inflation is truly anchored.

By linking economic data → Fed mandate → asset price response, traders gain a roadmap that works not just for this Fed meeting, but for every one that follows.In our next educational blog we will briefly explore other policy tools used by the Fed i.e., QE and QT. Quantitative Easing and Quantitative Tightening.

-

Great breakdown!

The way you connected upcoming data releases (PCE, NFP, CPI) with gold’s technical setups makes it much easier to frame potential scenarios. I agree that the Fed’s dual mandate is the key lens — short-term traders should really keep one eye on gold and the other on yields. Looking forward to your QE/QT deep dive next!

The way you connected upcoming data releases (PCE, NFP, CPI) with gold’s technical setups makes it much easier to frame potential scenarios. I agree that the Fed’s dual mandate is the key lens — short-term traders should really keep one eye on gold and the other on yields. Looking forward to your QE/QT deep dive next! -

Solid analysis, but I’d add one more angle: if debt issuance keeps accelerating, long-end yields could rise regardless of near-term inflation data. That could create a scenario where gold rallies alongside higher yields — something we’ve seen in past debt-driven cycles. Would love to hear your thoughts on how fiscal risks fit into this framework.