📊 ARK Invest Adds Another $15.6M in BitMine — Total Stake Now $300M+

-

Cathie Wood’s ARK Invest just doubled down on its bet that Ethereum treasuries and crypto stocks are the next big frontier.

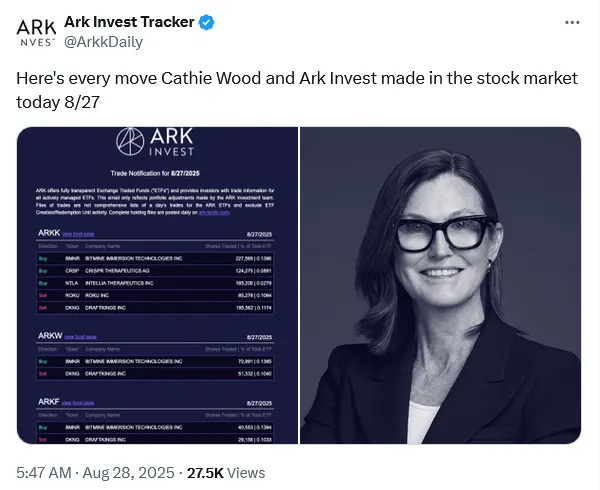

On Wednesday, ARK bought $15.6M worth of BitMine Immersion Technologies (BMNR) shares across three ETFs:

🟠 ARK Innovation ETF (ARKK): 227,569 shares

ARK Next Gen Internet ETF (ARKW): 70,991 shares

ARK Next Gen Internet ETF (ARKW): 70,991 shares🟢 ARK Fintech Innovation ETF (ARKF): 40,553 shares

(Source: Ark Invest Tracker)

ARK’s Crypto-Heavy Portfolio Moves

ARK’s Crypto-Heavy Portfolio MovesBitMine: Now over $300M invested (nearly half the size of ARK’s Coinbase stake).

Coinbase (COIN): ~$676M still held, even after trimming 5,721 shares last week.

Other recent buys:

$21.2M in Bullish stock

$16.2M in Robinhood

$19.2M in Block (after a long selling stretch)

ARK is clearly stacking crypto-adjacent equities at scale.

ARK is clearly stacking crypto-adjacent equities at scale.🟣 Why BitMine? A Proxy for ETH

BitMine’s ETH holdings: recently hit $7.5B.

ARK sees BMNR not just as a mining stock, but essentially an ETH treasury play.

This fits ARK’s thesis on disruptive tech: crypto, AI, and finance convergence.

Stock Action

Stock ActionBMNR closed Wednesday at $46.03 (–8%).

Dropped another –2.22% after hours to $45.01.

Still up a mind-blowing +490% YTD.

Q2 financials:

Q2 financials:Revenue: $2.05M (+67.5% YoY)

Net profit margin: +43%

The Take

The TakeCathie Wood is leaning hard into crypto equities, and BitMine is quickly becoming one of ARK’s biggest conviction bets — second only to Coinbase.

Translation: ARK isn’t just bullish on crypto — it’s doubling down on Ethereum as the backbone of corporate treasuries.

-

This move by ARK is telling. Cathie isn’t just treating BMNR like a mining stock — she’s treating it as an Ethereum treasury proxy. $7.5B in ETH on the balance sheet means BitMine is basically functioning like a public ETH ETF before the SEC even thought about approving one. Add in the fact that ARK already has half a billion in Coinbase, plus positions in Robinhood, Block, and Bullish… and the picture is clear: they’re building a crypto-equities index within their ETFs. If TradFi institutions follow this playbook, ETH treasuries could become a mainstream corporate strategy sooner than most expect.

-

BMNR up nearly +500% YTD and still getting ARK inflows says a lot about conviction. What stands out is how ARK is framing Ethereum not just as a network, but as financial infrastructure. Coinbase gives them exchange exposure, BMNR gives them ETH treasury exposure, Robinhood/Block give them fintech rails. It’s a layered bet that crypto isn’t just an asset class — it’s the backbone of the next financial system. The dip in BMNR’s share price this week might just be ARK’s version of “buy the blood.” If they’re right, Ethereum could end up being the balance-sheet asset of choice for corporates, the way BTC is for nation-states and ETFs.