BTC, ETH, SOL Supply at Loss Is Misleading Without Context

-

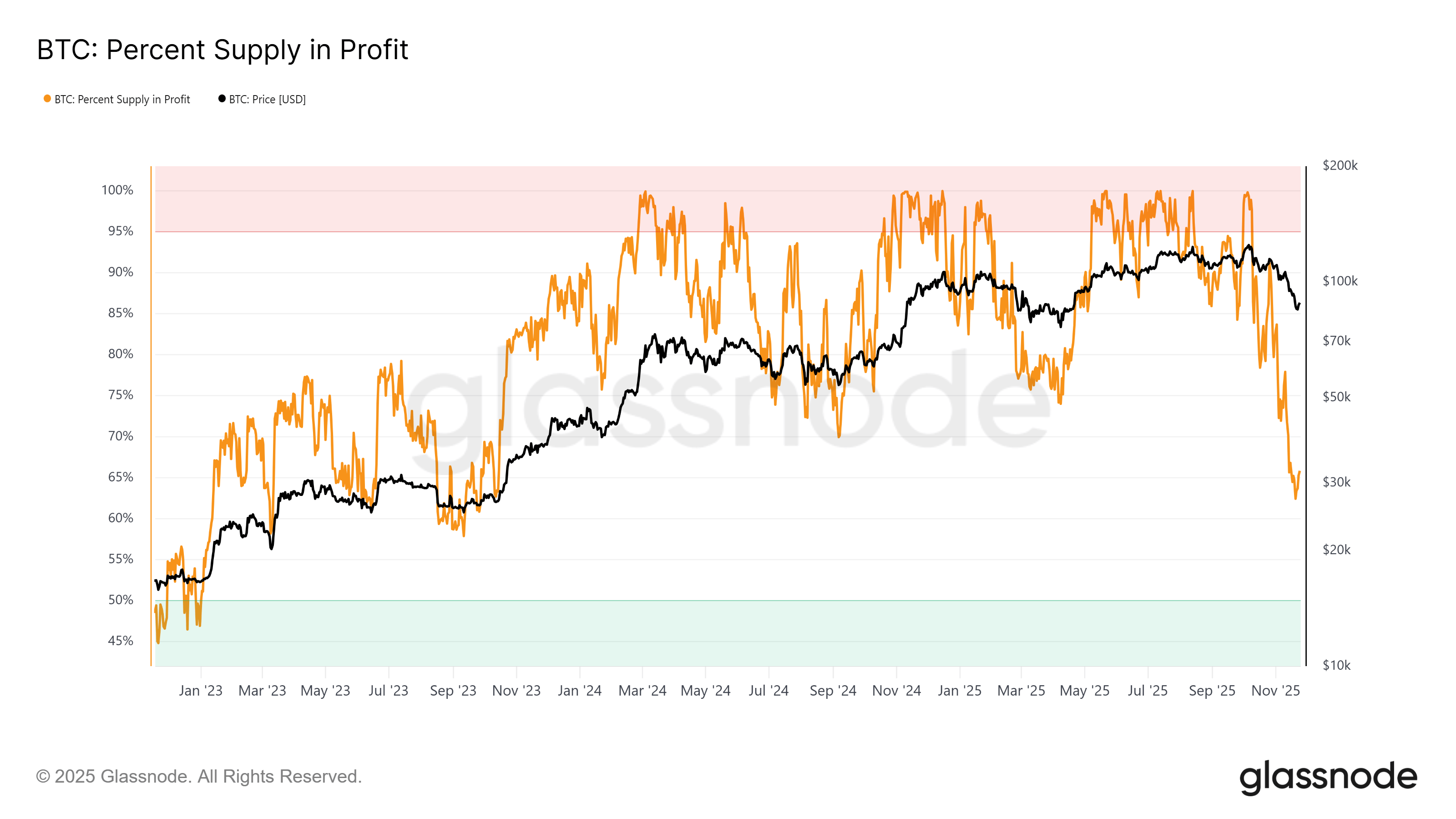

Recent Glassnode data shows BTC, ETH, and SOL hitting record levels of supply held at a loss — but the headline numbers hide the real story.

Across all three networks, locked supply, institutional holdings, and permanently lost coins drastically reduce the actual liquid supply that could respond to loss-driven selling.

For Bitcoin alone, up to 33% of all BTC is effectively non-liquid, thanks to ETF treasuries, corporate reserves, and 3–3.8M BTC lost forever. Loss metrics look extreme on charts, but true sell pressure is far more restrained. -

Supply-at-loss stats always need proper context to make sense.

-

Market structure and long-term holders distort those metrics.