Whale Selling Creates a Short-Term Discount — and a Long-Term Opportunity

-

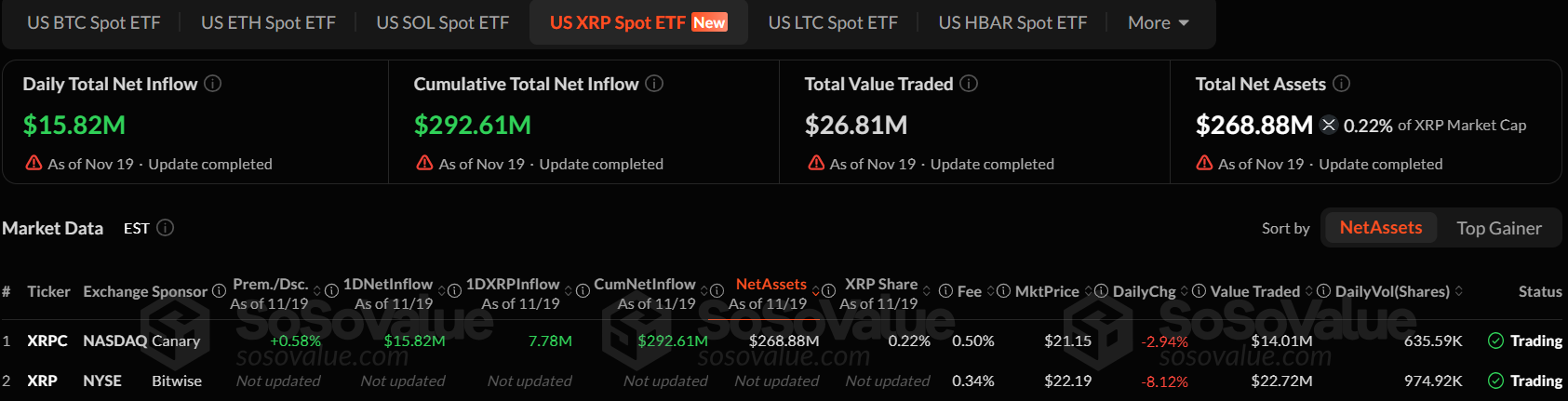

Recent data shows XRP whales dumped 200M XRP in 48 hours around the ETF launch. This kind of forced sell pressure creates short-term price weakness — but historically, whale-driven dips are some of the best entries for long-term gains.

Analysts suggest the real ETF-driven institutional flows won’t show up until 2026, meaning:

2024–2025 = accumulation opportunity

2026 = potential breakout phase

Current dips = discounted entries ahead of institutional demand

For traders thinking long-term, whale capitulation + ETF inflows + depressed price = a powerful money-making trifecta.

-

Whale sell-offs look scary, but they often create the best long-term entries.

-

ETF flows have transformed other assets — XRP might be next in line.