🚨 Bitcoin Blasts Past $117K After Powell’s Dovish Signal 🚨

-

BTC spiked 5% to $117,300 after Fed Chair Jerome Powell hinted at a September rate cut during Jackson Hole.

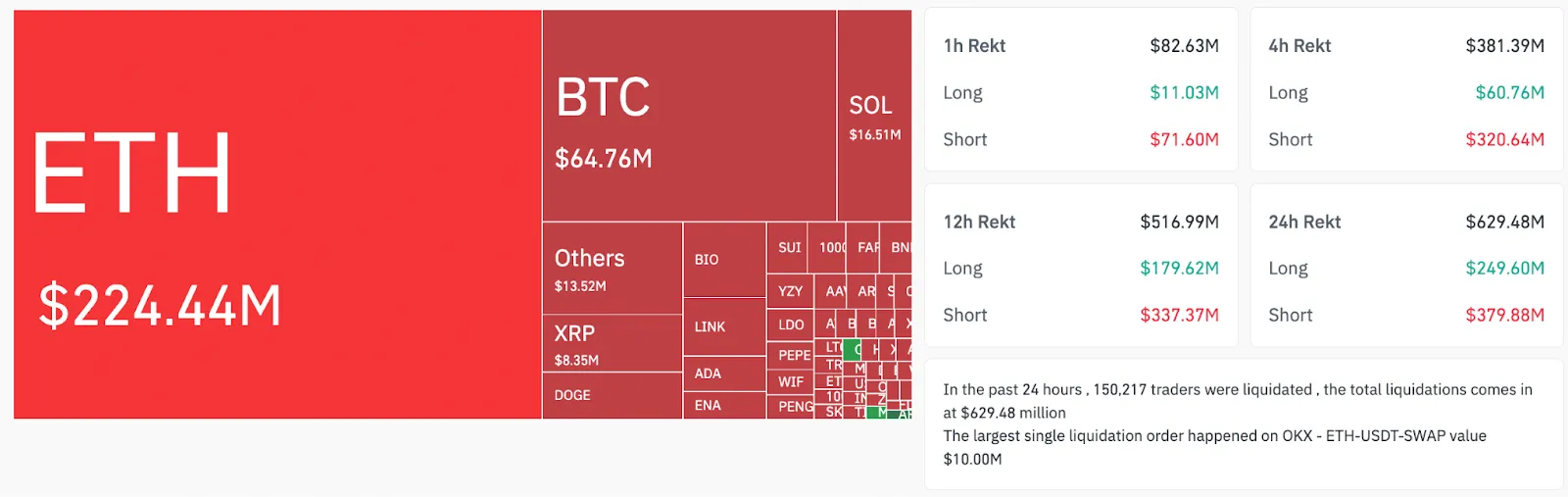

BTC spiked 5% to $117,300 after Fed Chair Jerome Powell hinted at a September rate cut during Jackson Hole. Shorts obliterated: $379.88M liquidated — including $193M in ETH shorts. Total market wipeout? $629.48M across 150K traders.

Shorts obliterated: $379.88M liquidated — including $193M in ETH shorts. Total market wipeout? $629.48M across 150K traders. Analysts: “The uptrend is back.”

Analysts: “The uptrend is back.”🟢 Why it matters

Powell’s dovish lean unlocked risk appetite. Bitcoin ate through heavy ask liquidity between $117K–$118K (CoinGlass data), flipping a brutal six-week low ($111.6K) into a clean bullish reversal.

ETH stole the spotlight with a +15% rip to $4,760, stacking ETF inflows and corporate treasuries on top of macro tailwinds.

Market Take

Market TakeMichael van de Poppe: The sweep below $112K was the perfect reload zone.

Jelle: A retrace may follow, but the “market wants higher.”

BitQuant: Still holding a $145K cycle top target.

Bitwise’s André Dragosch: Trump’s pro-crypto 401(k) move could even drive BTC → $200K this year.

Detective Note: This wasn’t just a squeeze. Liquidity clusters suggest whales dragged shorts underwater to clear the path upward. With Powell’s macro tailwind, BTC dominance dropping, and ETH ripping, the stage for late-2025 fireworks is set.

Detective Note: This wasn’t just a squeeze. Liquidity clusters suggest whales dragged shorts underwater to clear the path upward. With Powell’s macro tailwind, BTC dominance dropping, and ETH ripping, the stage for late-2025 fireworks is set.