🕵️♂️ Case File: The Return of James Wynn — High Leverage, Higher Stakes

-

James Wynn, the trader infamous for riding — and crashing — nine-digit waves of leverage, is back in the arena. This time? A 25x ETH long.

The Setup

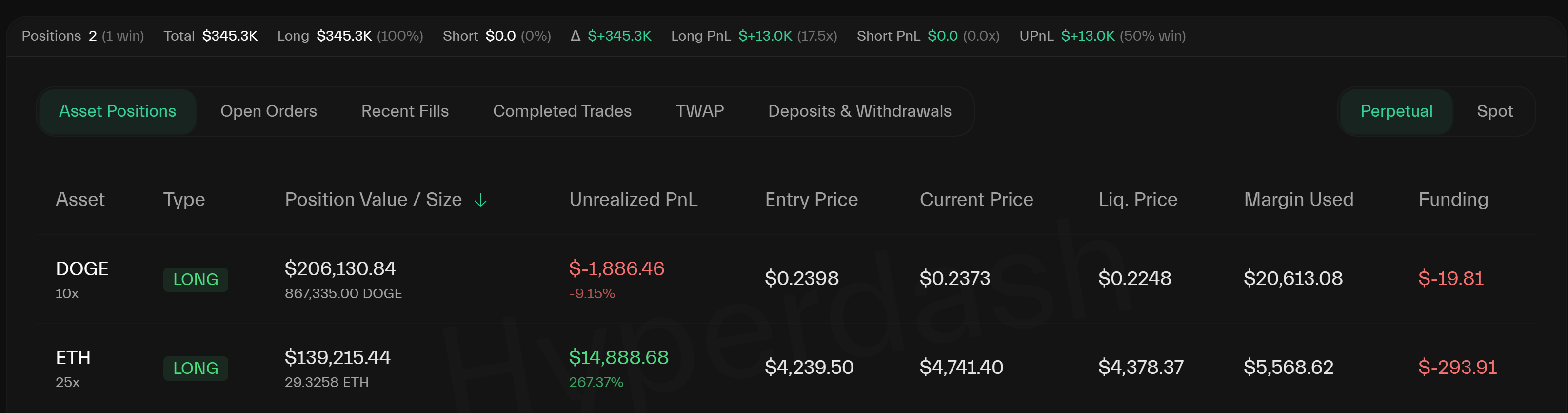

The SetupMargin: $5,568

Position: 29.3 ETH ($139,215)

Entry: $4,239

Unrealized PnL: +$14,888 (+267%)

Leverage: maxed out at 110% margin usage

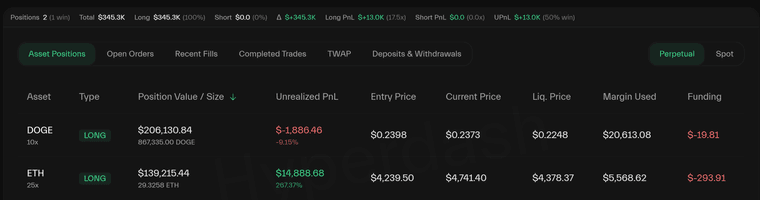

But Wynn isn’t stopping there. He’s also holding a 10x Dogecoin long worth $206K, currently bleeding ~$1,886.

All told, Wynn’s exposure is $345K on just $26.6K equity. One wrong candle, and the liquidation sirens could sing again.

The Backstory

The BackstoryMay 30: Wynn’s $100M BTC long liquidated.

June 5: Another $25M loss.

His X account vanished with a final bio update: “broke.”

July 15: He reappeared swinging — 40x BTC long, 10x PEPE long.

Now, as ETH rips past $4,860 on Powell’s dovish whisper and ETF inflows, Wynn’s gambling style is back in focus.

️ The Detective’s Question

️ The Detective’s Question

Is Wynn the quintessential degen, chasing dopamine hits on borrowed coins? Or is he the canary in the leverage mine, showing just how fragile this ETH rally could be if whales decide to squeeze?Because let’s face it — one slip, and the same “big players” he accused of hunting his stops might smell blood again.

Clue for the file: Wynn’s positions aren’t just about Wynn. With ETH treasuries swelling and ETFs pulling billions, a degen lever-longer like him could become a convenient liquidity meal in the bigger game.

Clue for the file: Wynn’s positions aren’t just about Wynn. With ETH treasuries swelling and ETFs pulling billions, a degen lever-longer like him could become a convenient liquidity meal in the bigger game.

. Either retires rich this week or disappears with another “broke” update. No in-between.

. Either retires rich this week or disappears with another “broke” update. No in-between.