Ultimate Guide to Master: Rejection Blocks

-

How to Make Money with Rejection Blocks (ICT Concept)

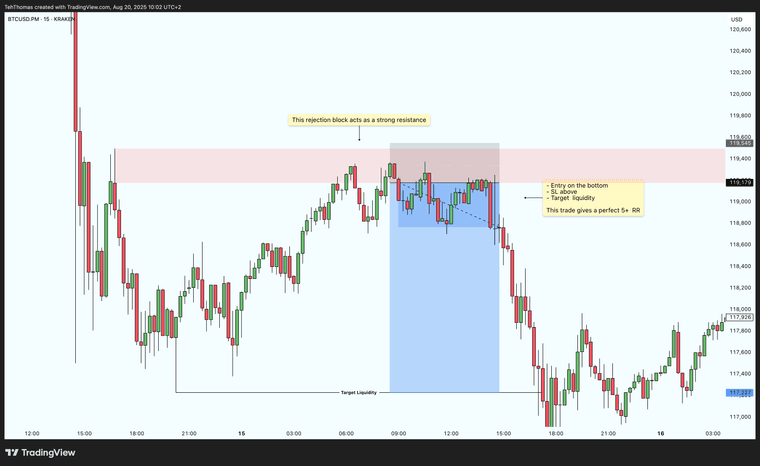

How to Make Money with Rejection Blocks (ICT Concept)Rejection Blocks (RBs) aren’t just ICT theory—they’re hidden goldmines for precision entries when used right. Here’s how you can turn them into consistent money-makers:

1. Understand the Setup

1. Understand the SetupA Rejection Block = when price tries to break beyond a candle’s high/low but fails and closes back inside.

Bullish RB → Price sweeps below, then closes higher = hidden support.

Bearish RB → Price sweeps above, then closes lower = hidden resistance.

Think of them as “footprints of failed breakouts” that leave behind juicy reaction zones.

Think of them as “footprints of failed breakouts” that leave behind juicy reaction zones. 2. Profit Blueprint: Trading RBs

2. Profit Blueprint: Trading RBsStep 1 – Mark the Level

Bullish: Mark the low of the bearish rejection candle.

Bearish: Mark the high of the bullish rejection candle.

Step 2 – Wait for Price to Return

The money isn’t made on the first touch—it’s when price comes back to retest.Step 3 – Stack Confluence

Enter only when RB aligns with:Fair Value Gaps (FVG)

Market Structure Shift (MSS)

Liquidity sweep

Higher timeframe bias (premium/discount zones)

Step 4 – Manage Risk

Stops: Just beyond the RB candle (tight risk).

Targets: Prior liquidity pools or opposite FVGs.

3. Where the Real Money Is

3. Where the Real Money IsLiquidity Sweeps → If equal highs/lows are taken, RBs often mark the reversal point.

Fake Breakouts → RBs shine after false moves out of consolidation.

Premium/Discount Zones → Align RBs with ICT’s smart money pricing for A+ setups.

4. Why Traders Love RBs

4. Why Traders Love RBsHidden support/resistance most retail misses.

Built-in liquidity grab = high probability reversals.

Tight stops, asymmetric R/R = perfect for scaling accounts.

Example Play:

Example Play:BTC sweeps a daily high → prints bearish RB → closes back inside → retests RB as resistance → high-probability short.

That’s how you catch moves others call “random wicks.”

Bottom Line

Bottom LineRejection Blocks are institutional fingerprints of failed moves. Combine them with ICT tools (FVG, MSS, liquidity) and you’ve got a roadmap for sniper entries that print money.

Pro Tip: Don’t chase them blindly. Wait for the retest + confluence. That’s where the edge is.

Pro Tip: Don’t chase them blindly. Wait for the retest + confluence. That’s where the edge is. Question for you: Do you prefer “blind” RB entries with fixed stops, or do you always wait for lower timeframe confirmation?

Question for you: Do you prefer “blind” RB entries with fixed stops, or do you always wait for lower timeframe confirmation?