🤖 Google Gemini in Crypto Trading – Friend, Not Fortune Teller

-

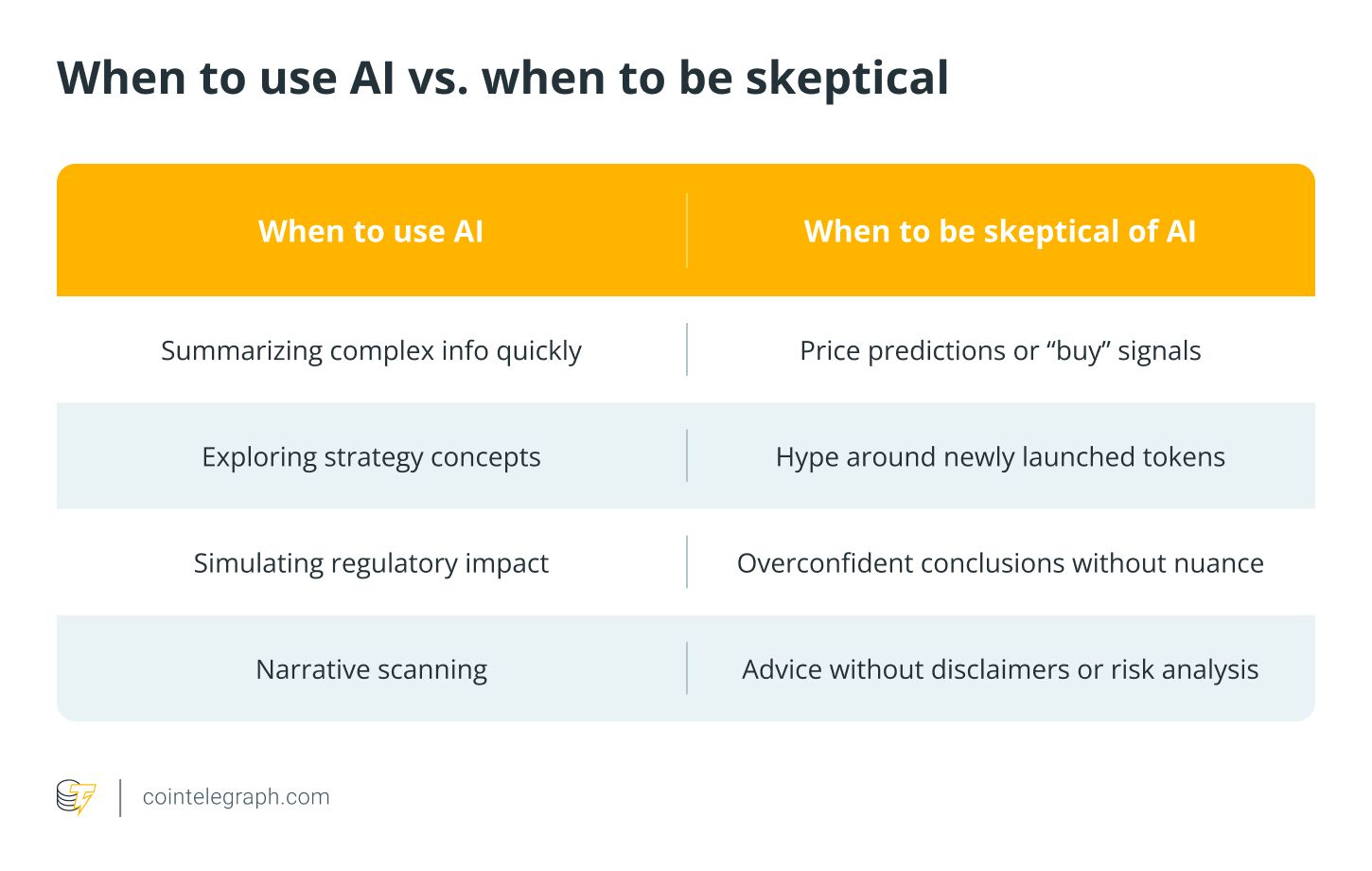

AI is everywhere in crypto these days — but how useful is Google Gemini (Flash 2.5) when it comes to trading? Here are the key takeaways:

1. Research, Not Signals

1. Research, Not SignalsGemini is great at summarizing project fundamentals (think whitepapers in plain English).

But it’s not a trading signal generator. It won’t tell you “buy/sell” — and shouldn’t.

️ 2. Info Can Be Outdated

️ 2. Info Can Be OutdatedExample: It claimed Pi Coin’s mainnet was delayed — but in reality, it launched in Feb 2025.

AI outputs can lag behind real events → always cross-check with live data tools.

🧠 3. Good for Reflection

You can use Gemini to analyze past trades → what signals you missed, how timing could improve.

Helps spot biases and rethink strategies — but it won’t replace your judgment.

4. No Real-Time Data

4. No Real-Time DataGemini Flash 2.5 doesn’t pull live feeds.

Pair it with TradingView, Nansen, CoinGecko, DefiLlama for updated charts + on-chain stats.

5. Limitations to Remember

5. Limitations to RememberNo live price prediction.

Doesn’t connect to wallets or exchanges.

Won’t map your portfolio risk unless you feed it the context.

Bottom line: Gemini =

Bottom line: Gemini =  smart research sidekick.

smart research sidekick.

TradingView + on-chain dashboards = ️ real-time weapons.

️ real-time weapons.

Your judgment = 🧠 the final call. Question for the room: Do you see AI like Gemini as a long-term trading edge, or just a fancy assistant that still needs a lot of hand-holding?

Question for the room: Do you see AI like Gemini as a long-term trading edge, or just a fancy assistant that still needs a lot of hand-holding? -

Really solid breakdown. I think the biggest misconception people have is expecting AI tools like Gemini (or even ChatGPT) to act like alpha generators. They’re not designed to tell you “buy this alt now” — and if they ever did, it’d be dangerous because the data they’re trained on is always lagging behind reality. What they are good at is the grunt work: digesting whitepapers, summarizing tokenomics, mapping out ecosystem relationships, and even analyzing historical setups.

That’s powerful because 90% of traders never actually read the fundamentals before aping into a coin. With Gemini, you can strip down a 40-page doc into 5 bullet points in minutes. But yes — you still need TradingView for charts, Nansen/DefiLlama for live flows, and your own conviction to make the actual trade. To me, Gemini is a research accelerator, not an oracle.

-

I see AI as part of the “trading stack,” not a standalone edge. Think of it like this: back in the day, Bloomberg terminals gave you a huge advantage because you had faster data. Today, data is everywhere — the edge comes from how you process it. That’s where Gemini fits. It can help filter the noise, summarize market chatter, or even point out blind spots in your past trades.

The limitations are real though. Outdated info (like the Pi Coin example), no live feeds, and zero direct portfolio integration mean it’s not a plug-and-play solution. But if you combine Gemini with tools like TradingView, CoinGecko, and on-chain analytics, you essentially create your own AI-powered research desk. For me, the traders who learn to use AI as an assistant — rather than depend on it — will be the ones who get the long-term edge.