💰 How to Make Money with BTCS’ ETH “Bividend”

-

If you’re holding shares of BTCS Inc. (Nasdaq: BTCS), there’s a unique way to earn free Ethereum (ETH) — and it’s the first time a public company has ever done this.

Here’s how you can profit:

- Understand the “Bividend”

BTCS is paying a one-time ETH dividend of $0.05 per share on Sept. 26, 2025.

They’re calling it a “Bividend” (blockchain dividend).

So if you own 1,000 shares, you’ll get $50 worth of ETH straight into your wallet.

- Hold for the Loyalty Payment

If you hold your shares until Jan. 26, 2026, you’ll also qualify for a $0.35 per share loyalty payment in ETH.

Officers, directors, and employees of BTCS don’t get this perk — it’s strictly for retail shareholders.

1,000 shares = another $350 in ETH.

- Stack ETH Passively

Combined, the $0.40 per share payout is one of the most creative ways to earn crypto exposure without buying ETH directly.

For 1,000 shares: $400 in ETH total.

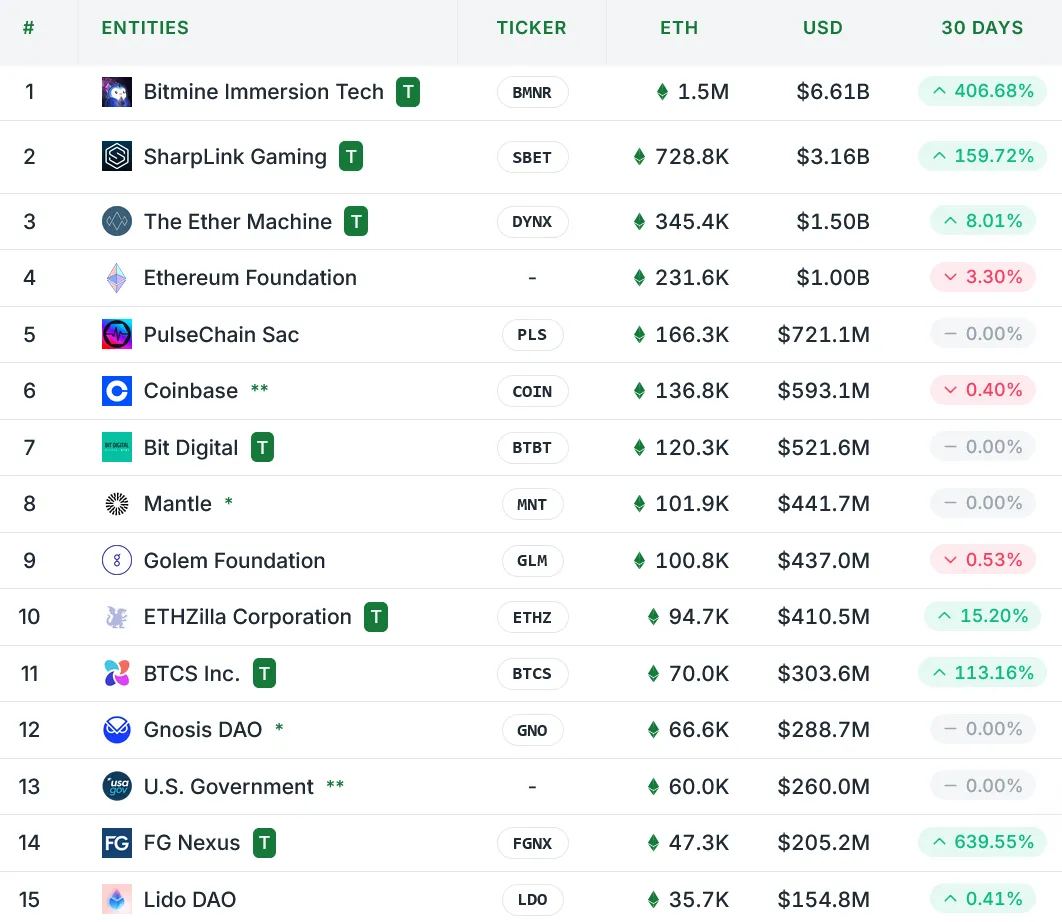

At 70,000 ETH already in its treasury, BTCS is pushing to become a top 10 ETH-holding company.

- Why BTCS Is Doing This

To reward long-term shareholders.

To limit predatory short-selling (since dividends/loyalty programs discourage lending shares).

To stand out in the crowded ETH treasury race.

- Bonus: Stock Pop Potential

News of the ETH payout already pushed BTCS stock up 10.4% in a single day.

If interest keeps growing, there’s potential upside not only from the ETH payout, but also from share price momentum. Bottom Line:

Bottom Line:

Buy BTCS → Hold through Sept. 2025 → Hold again through Jan. 2026 → Collect ETH.It’s a double dip: potential stock gains + guaranteed ETH payouts.

What do you think? Would you grab BTCS shares for the ETH “Bividend,” or is this just a flashy gimmick in the ETH treasury arms race?

What do you think? Would you grab BTCS shares for the ETH “Bividend,” or is this just a flashy gimmick in the ETH treasury arms race? -

This is honestly one of the most innovative shareholder reward strategies I’ve seen in TradFi. Instead of just stock buybacks or boring cash dividends, BTCS is directly tying its treasury strategy to Ethereum and letting shareholders benefit alongside them. The $0.40 per share in ETH might not sound massive, but the loyalty angle is smart — it discourages shorting and incentivizes people to actually hold through the long term. If more public companies follow this model, we might start seeing a genuine “ETH dividend arms race.” Imagine Apple or Tesla doing something like this. 🤯

-

I like the creativity, but I’m cautious. On one hand, it’s a clever way to attract attention and reward holders. On the other hand, BTCS is still a relatively small-cap stock — so if everyone piles in just for the ETH payout, the volatility could be brutal. The bigger question is: does this model actually create sustainable shareholder value, or is it just a short-term marketing stunt to pump the stock price? If ETH moons, it looks genius. If ETH stalls or drops, some might just call it gimmicky. Either way, this is a fascinating experiment at the intersection of TradFi and crypto.