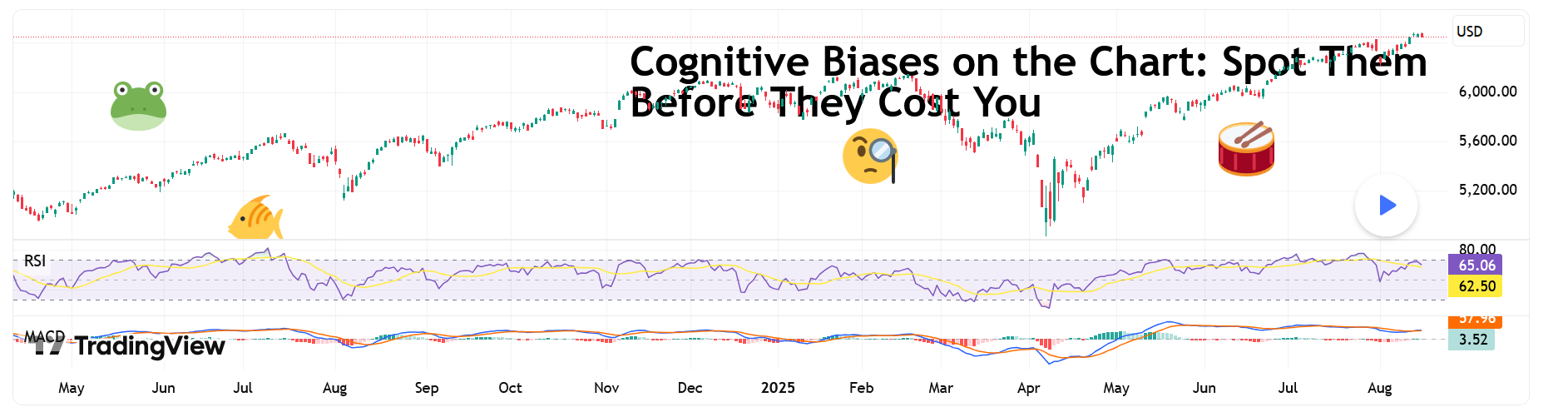

Cognitive Biases on the Chart: Spot Them Before They Cost You

-

Markets have enough enemies: central banks, unexpected earnings misses, rogue tweets from billionaires. The last thing you need is your own brain quietly kneecapping your trades.Yet, that’s exactly what happens every day — traders falling prey to cognitive biases, those sneaky mental shortcuts that can distort judgment, inflate confidence, and drain your account.

Let’s pull back the curtain on the biggest culprits.

Anchoring Bias: Marrying a Trade

Anchoring Bias: Marrying a TradeEver fall in love with a number? Traders do this all the time. Anchoring bias happens when you fixate on a past price and let it lead your present decisions.

Example: You bought C3 AI AI at $45 a pop. Now it’s under $20, and you refuse to sell because “it’ll get back to $50 and beyond.” Newsflash: the market doesn’t care about your entry. Anchoring keeps you tethered to arbitrary price points while the trend moves on without you.

How to counter it: Use hard data, not nostalgia. If the chart screams breakdown, like the recent drop in AI thanks to a sales disaster, stop waiting for a magical return to your anchor. Trade the price action, not the ghost of your buy button.

How to counter it: Use hard data, not nostalgia. If the chart screams breakdown, like the recent drop in AI thanks to a sales disaster, stop waiting for a magical return to your anchor. Trade the price action, not the ghost of your buy button. Loss Aversion: Pain > Pleasure

Loss Aversion: Pain > PleasureBehavioral economists tell us that losing $100 feels about twice as bad as winning $100 feels good. Traders know this instinctively — which is why they often let losers run and cut winners short.

Think of it: you close a trade that’s up 5% because you “don’t want to lose the gains.” Meanwhile, you let the -20% red candle sit there because “it’s only a loss if I sell.”

How to counter it: Flip the script. Place stop-losses and honor them religiously, especially in peak earnings season. Train your brain to view losses as part of the game — like paying rent to the market for playing on its field. Or tuition fee for your hands-on education.

How to counter it: Flip the script. Place stop-losses and honor them religiously, especially in peak earnings season. Train your brain to view losses as part of the game — like paying rent to the market for playing on its field. Or tuition fee for your hands-on education. Confirmation Bias: The Echo Chamber Trade

Confirmation Bias: The Echo Chamber TradeYou think Ethereum ETHUSD is going to $5,000. So, naturally, you seek out influencers, news, and even memes that validate your thesis, while conveniently ignoring that pesky Fed statement hinting at liquidity tightening.

This is confirmation bias: curating your information diet to make yourself feel smart, secure, and validated.

How to counter it: Actively hunt for disconfirming evidence. If you’re long, force yourself to read the bear case. If it rattles you, that’s a sign your conviction might be built on shaky ground. Also, Ethereum has indeed been on a pump so strong, you’d believe it’s almost unstoppable.

How to counter it: Actively hunt for disconfirming evidence. If you’re long, force yourself to read the bear case. If it rattles you, that’s a sign your conviction might be built on shaky ground. Also, Ethereum has indeed been on a pump so strong, you’d believe it’s almost unstoppable. Recency Bias: Yesterday = Forever

Recency Bias: Yesterday = ForeverMarkets swing, sometimes violently. Recency bias tricks you into believing that whatever just happened will keep happening. The GBPUSD advanced last Thursday? Must keep climbing further.

Traders caught in this loop over-leverage into recent patterns, forgetting that markets are professional curveball pitchers.

How to counter it: Zoom out. Intraday candles may trick you into seeing things that aren’t there in the long run. Daily, weekly and monthly charts often tell a different story.

How to counter it: Zoom out. Intraday candles may trick you into seeing things that aren’t there in the long run. Daily, weekly and monthly charts often tell a different story. Gambler’s Fallacy: “I’m Due” Syndrome

Gambler’s Fallacy: “I’m Due” SyndromeEvery roulette player knows this one: if red’s hit five times in a row, black must be next. Traders fall for the same illusion. If EURUSD has surged for eight straight sessions, surely it must drop… right?

Wrong. The market doesn’t know it “owes anything.” Trends can persist longer than your margin account can survive. Reminder time: John Maynard Keynes' famously said, "Markets can remain irrational longer than you can remain solvent."

How to counter it: Respect momentum. Use indicators like RSI or moving averages to spot genuine exhaustion, not just wishful thinking.

How to counter it: Respect momentum. Use indicators like RSI or moving averages to spot genuine exhaustion, not just wishful thinking. Overconfidence Bias: I’m Smarter Than Them

Overconfidence Bias: I’m Smarter Than ThemThis one’s pretty widespread. After a few wins, traders start believing they’ve cracked the code. Suddenly, leverage dials up, position sizes balloon, and risk management gets left on read.

Markets love humbling overconfident traders. That “can’t miss” setup? It misses. That oversized bet? Blown up. Overconfidence is why many promising traders don’t survive past year one.

How to counter it: Journal your trades. Cold, hard data has a way of deflating ego bubbles. And size positions consistently — the market doesn’t care if you “feel” more confident this time.

How to counter it: Journal your trades. Cold, hard data has a way of deflating ego bubbles. And size positions consistently — the market doesn’t care if you “feel” more confident this time. Herd Mentality: Everyone Can’t Be Wrong… Right?

Herd Mentality: Everyone Can’t Be Wrong… Right?If all of Reddit says “buy the dip,” surely they can’t be wrong. But if you’re hearing it from everyone, odds are the move already happened. Herd mentality gives comfort but rarely alpha.

It explains bubbles, FOMO runs, and why traders pile into a hot stock minutes before it tanks.

How to counter it: If you’re chasing a move because everyone else is, pause. Ask: what’s my actual edge here? If the answer is “none,” step away.

How to counter it: If you’re chasing a move because everyone else is, pause. Ask: what’s my actual edge here? If the answer is “none,” step away. The Meta-Bias: Thinking You Have None

The Meta-Bias: Thinking You Have NoneThe cruel twist? Once you know about these biases, you might think you’ve conquered them. But that may not be the case. Awareness helps, but biases are hardwired into human behavior.

That’s why risk management exists. Stop-losses, adequate leverage, proper diversification — they’re not just tools, they’re counter-bias survival kits.

Final Word: Outsmarting Yourself

Final Word: Outsmarting YourselfThe market isn’t your enemy (unless you view BlackRock, Ken Griffin, the hedge fund bros, and other retail traders as enemies). Anchors, overconfidence, herds, recency — these are real chart criminals draining accounts in broad daylight.

Smart traders don’t try to eliminate biases. They build guardrails to minimize the damage. Because at the end of the day, you can’t reprogram human psychology. But you can protect your portfolio from it.

Off to you: Are you tempted to “average down because it’s due” or “let it ride because I’m on fire?” Share your thoughts in the comment section!

Off to you: Are you tempted to “average down because it’s due” or “let it ride because I’m on fire?” Share your thoughts in the comment section! -

This breakdown hits hard because it exposes how most trading pain comes from the space between our ears. I’ve definitely been guilty of anchoring — holding on to a stock because “it has to come back” — only to watch capital bleed away. The gambler’s fallacy is another killer; I used to think “after three green days, red is guaranteed,” but markets don’t care about my sense of fairness. What’s worked for me lately is journaling every trade with the why behind it — sometimes reading my own reasoning later is enough to slap me out of bias-driven moves.

-

The “meta-bias” callout is so true. Once you learn about anchoring, loss aversion, confirmation bias, you start thinking you’re immune — but then you realize you’re just finding smarter ways to rationalize the same mistakes.

The only real antidote I’ve found is systematizing: fixed risk per trade, mechanical stop-losses, and deliberately checking opposing views before entry. Otherwise, you’re just another trader chasing ghosts. I’d even argue most traders don’t lose to the market — they lose to their own psychology.

The only real antidote I’ve found is systematizing: fixed risk per trade, mechanical stop-losses, and deliberately checking opposing views before entry. Otherwise, you’re just another trader chasing ghosts. I’d even argue most traders don’t lose to the market — they lose to their own psychology.