Tether Mirrors Central Bank Gold Buying Trends

-

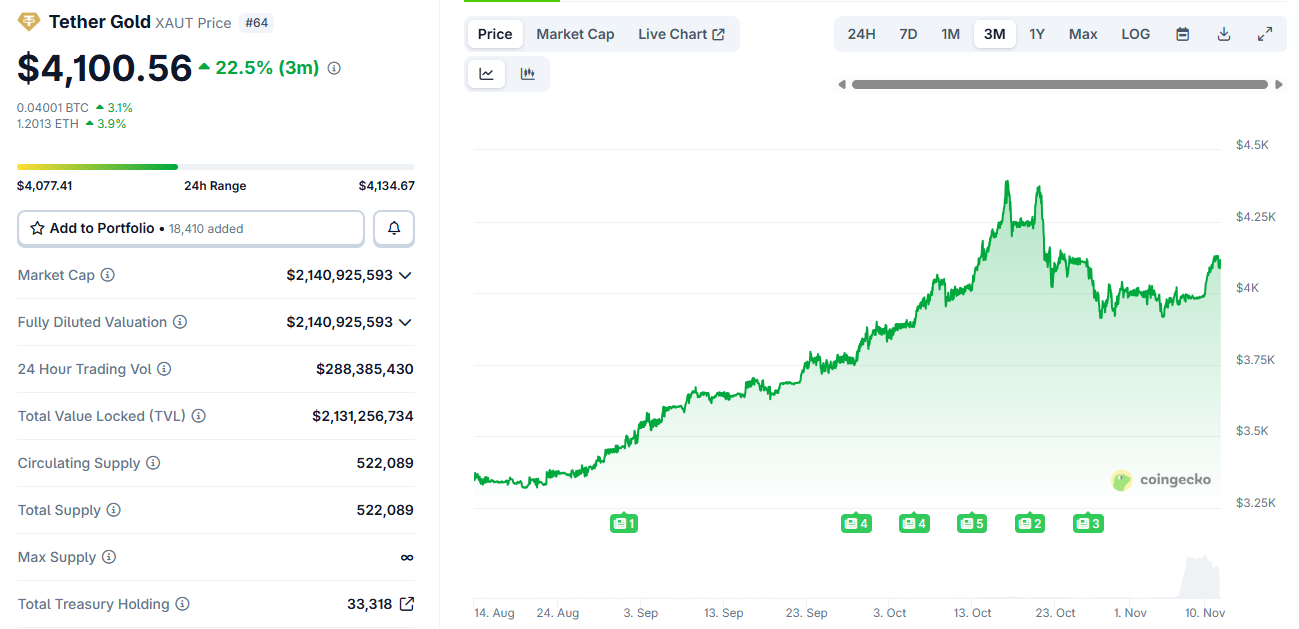

Tether’s move comes as central banks purchased over 1,000 tonnes of gold in 2024, the second-highest annual total on record, largely from emerging economies seeking protection from dollar-linked volatility.

While the addition of HSBC veterans strengthens Tether’s institutional gold management, critics emphasize the need for transparent audits and reserve disclosure to avoid scrutiny similar to past stablecoin reserve controversies.

Tether’s strategy hints at a future where private entities hold diversified, multi-asset reserves rivaling the reserves of national central banks.

-

It’s a strategic hedge — aligning with macro behavior strengthens XAUT’s position.