UNI Burn and Fee Activation Explained

Hero Portfolio

3

Posts

3

Posters

9

Views

-

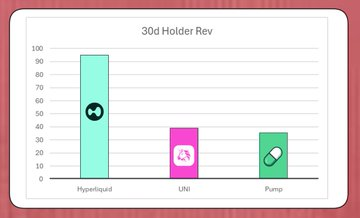

The UNIfication proposal calls for a retroactive burn of 100M UNI from the treasury and fee activation on Uniswap v2 and v3 pools. Fees collected will fund token burns, making UNI a deflationary asset.

Liquidity providers will continue earning rewards, while aggregator hooks allow Uniswap v4 to collect fees from external liquidity. Investors see this as a potential catalyst for long-term price appreciation.

-

Token burns + fee switch = perfect storm for long-term value.