💰 How You Can Make Money in the Current ETH Market

-

Ether (ETH) just broke $4,500, futures open interest hit an all-time high, and traders are buzzing. But… under the surface, the story is more complex — and that’s where opportunities may be hiding.

1. Spot Trading

1. Spot TradingETH has surged 51% in 30 days — great for short-term swing trades. However, derivatives data shows weak leveraged long demand — meaning this isn’t purely hype-driven. If you believe the rally has more legs, buying spot ETH now may still offer upside toward the $4,878 ATH. 2. Futures & Perpetuals

2. Futures & PerpetualsETH futures OI hit $60.8B, but most of that growth came from price appreciation, not more traders. Perpetual futures premiums are at a neutral 11%, not overheated — a sign there may still be room for a leveraged long play. Tip: Manage risk — if open interest surges with no price follow-through, it can precede pullbacks.🪙 3. Competing Chains Play

Big players like Stripe, Circle, Tether, and JPMorgan are building their own layer-1 chains. This competition can create swing opportunities in SOL, TRX, and other strong L1 tokens as institutional adoption spreads. 4. ETF & Institutional Flows

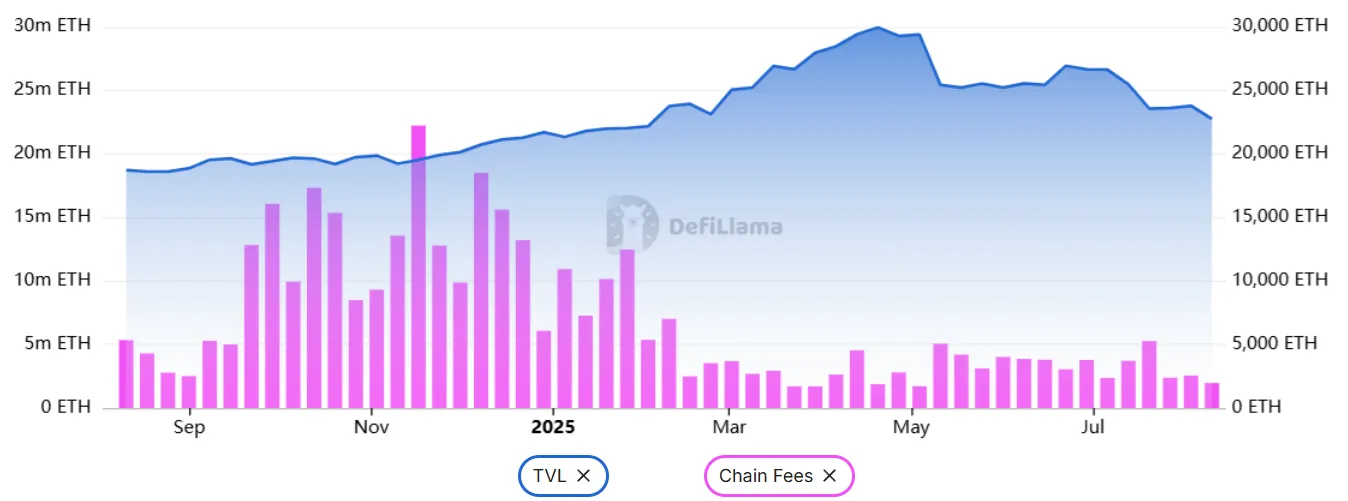

4. ETF & Institutional FlowsETH ETF inflows show institutions are buying the dip. Accumulating ETH during low onchain activity (TVL down 7% this month) could pay off if fundamentals catch up to price. ️ Bottom Line

️ Bottom LineRight now, ETH’s pump is price-led, not leverage-led — meaning if fundamentals improve (onchain activity, TVL, fees), the rally could get a second wind. On the flip side, a failure to reclaim ATH with growing competition could set up short opportunities.

#Crypto #ETH #TradingTips #DeFi #Ethereum