🐶💸 Can You Really Make Money With a Memecoin Treasury Strategy? (The $BONK Case Study)

Airdrop and Ways to earn money

1

Posts

1

Posters

14

Views

1

Watching

-

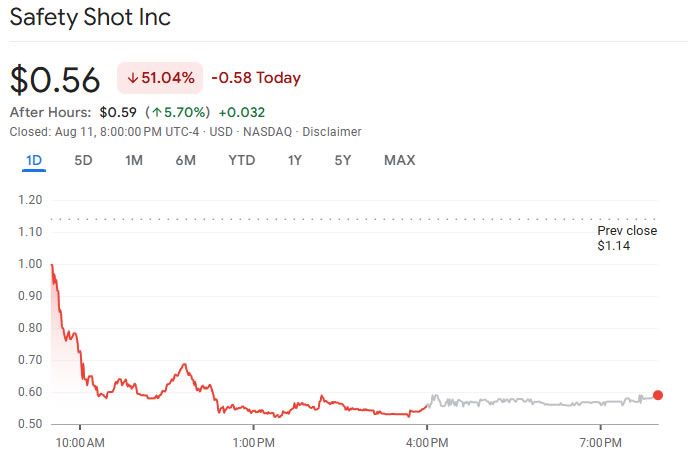

When Nasdaq-listed Safety Shot — a wellness drink company — announced it was going all-in on $BONK, the market reaction was… brutal. The stock dropped 50% in a single day. But behind the selloff, there’s an important lesson in making money with high-risk crypto plays.

The Bold Move

The Bold MoveThe Plan: Buy $25M worth of Bonk (a Solana-based memecoin) as the core corporate treasury asset. The Pitch: BONK has faster, cheaper transactions than SHIB or PEPE, and DOGE’s inflation model. The Context: BONK hit peak hype in Nov 2024 but is now down 57% from its highs. The Market’s Reaction

The Market’s ReactionInvestors dumped SHOT shares from $1.18 to $0.59 after the announcement. Stock had been up 36% in the last month… until this. Memecoin market cap overall is down 25% YTD while broader crypto is up 22%. Lessons for Making (or Losing) Money in Memecoins

Lessons for Making (or Losing) Money in MemecoinsHype is not a strategy – Corporate adoption of memecoins doesn’t guarantee price gains. Timing matters – Buying 57% below ATH could be a value play… or a value trap if hype never returns. Diversification wins – Putting all treasury eggs in one volatile basket is risky (ask SHOT shareholders). Liquidity events move prices – Issuing $35M in convertible preferred shares can dilute value even before the memecoin move pays off. ️ Risk/Reward Takeaway

️ Risk/Reward TakeawayMemecoins can deliver 10x gains in bull runs — but corporate-sized bets amplify both upside and downside. If you’re thinking of playing the BONK game:

Enter during low hype, exit into euphoric spikes. Set stop-losses — memecoins can tank 50%+ in days. Don’t bet what you can’t lose — BONK is still a speculative meme asset, not a guaranteed growth engine.