📅 Is the Four-Year Crypto Cycle Dead? Institutions May Be Changing the Game

-

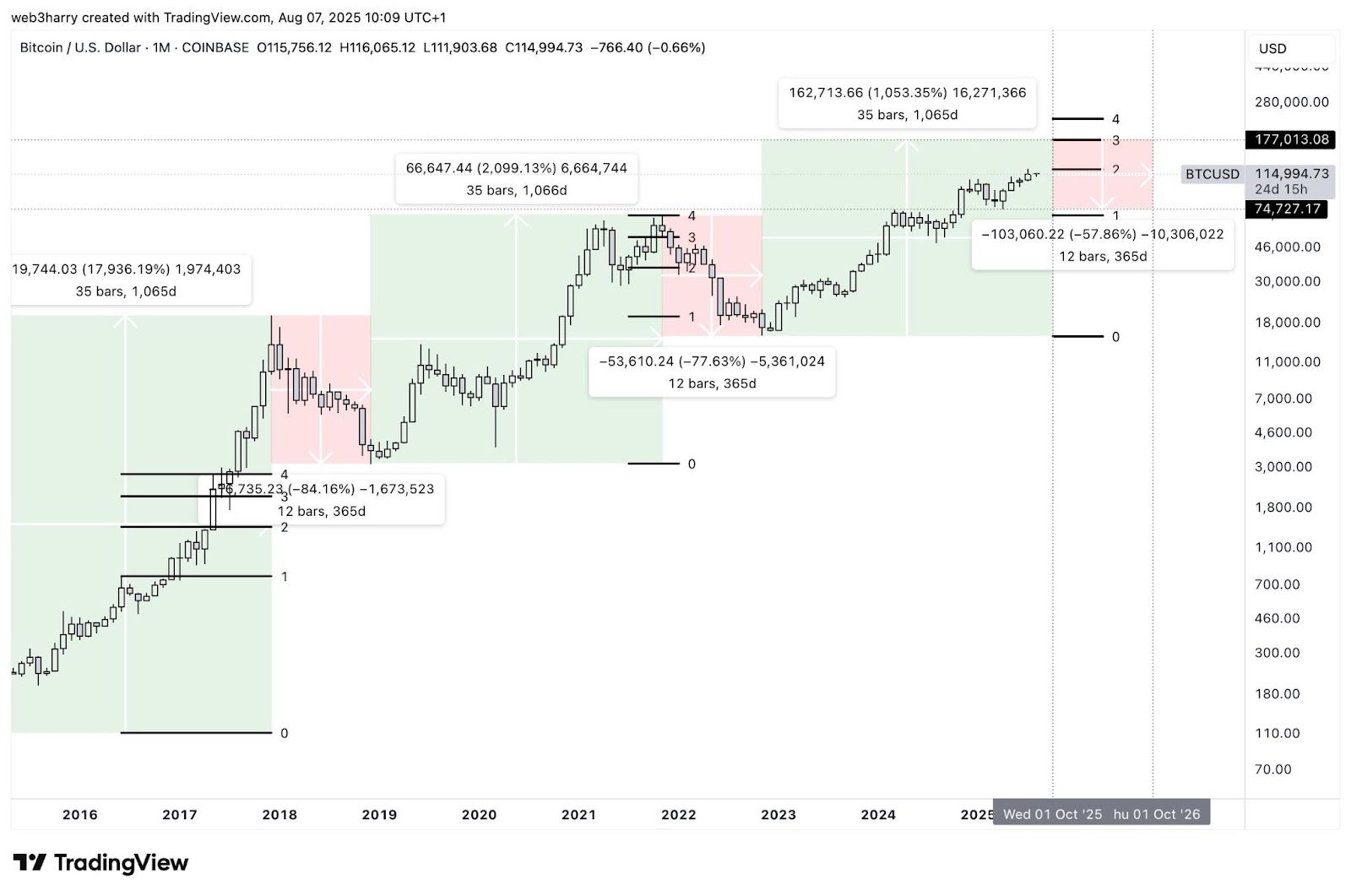

For over a decade, Bitcoin’s price action has danced to a predictable four-year rhythm — boom, bust, repeat — driven largely by the halving. But now, big voices in the industry are asking: is that cycle over?

The Case for “It’s Over”

The Case for “It’s Over”Jason Williams (author & investor): “Top 100 Bitcoin treasury companies hold almost 1 million BTC. This is why the Bitcoin 4-year cycle is over.” Matthew Hougan (CIO, Bitwise Asset Management): “It’s not officially over until we see positive returns in 2026. But I think we will… I think the 4-year cycle is over.” Pierre Rochard (CEO, The Bitcoin Bond Company): Halvings no longer matter to trading float — 95% of BTC is already mined. Now demand comes from retail spot buys, ETFs, and corporate treasuries.Their argument: Institutional capital, ETF flows, and macro factors are diluting the halving’s influence.

The Traditional Pattern

The Traditional PatternHistorically, Bitcoin peaks the year after the halving:

2013 🡆 2017 🡆 2021 🡆 (next due: 2025)Some analysts, like Harry Collins from Bluefin, still expect this — projecting a bull market top in October 2025.

The Case for “It’s Alive”

The Case for “It’s Alive”Not everyone’s buying the “cycle is dead” narrative:

CRYPTO₿IRB (715K followers on X): ETFs actually strengthen the 4-year cycle — TradFi runs on four-year presidential cycles, and ETFs boost crypto–TradFi correlation. Halvings are math, they can’t just be “cancelled.” Seamus Rocca (CEO, Xapo Bank): Institutions haven’t killed the cycles. The risk of another extended bear market is still real. ️ Middle Ground

️ Middle GroundMartin Burgherr (Sygnum Bank): The halving is still a useful reference, but not the main driver anymore. Macroeconomics, regulation, and ETF adoption now play equally big roles. Your Turn:

Your Turn:

Do you think the four-year cycle will still hold into 2025, or has institutional money rewritten Bitcoin’s script for good?