Liquidity Regimes and Derivatives Shape the Market

-

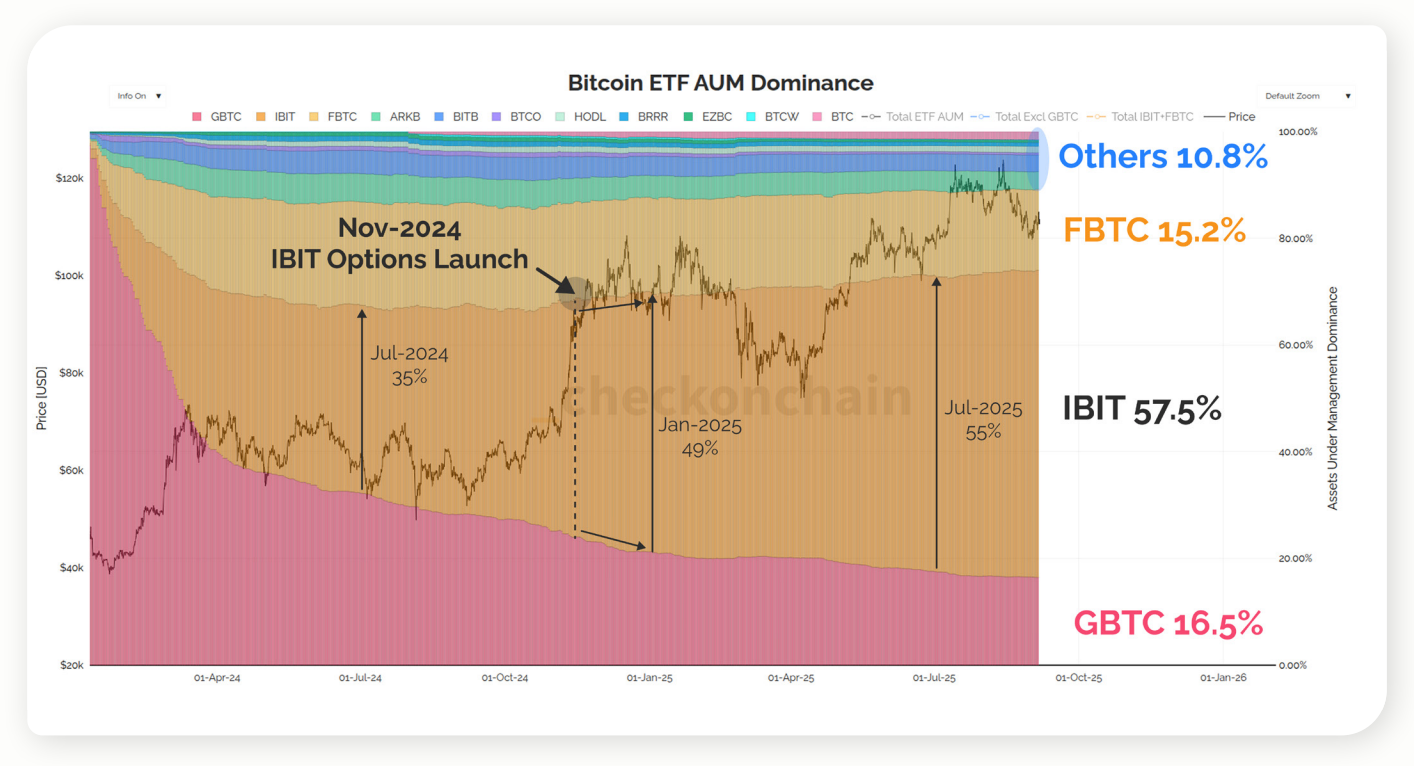

The U.S. dominates global Bitcoin ETF flows, with options markets like BlackRock’s IBIT now driving price dynamics more than the halving cycle. Sovereign wealth funds and pension inflows add concentration risks, but proof-of-work security mitigates systemic threats.

Analysts argue that 2026 strategies should focus on liquidity, custody, and derivatives, not cycles. Bitcoin’s evolution into a market-responsive, ETF-anchored asset marks a fundamental shift for institutions and investors alike.

-

Derivatives are now acting as the key driver of short-term liquidity shifts across crypto markets.